Company Profile

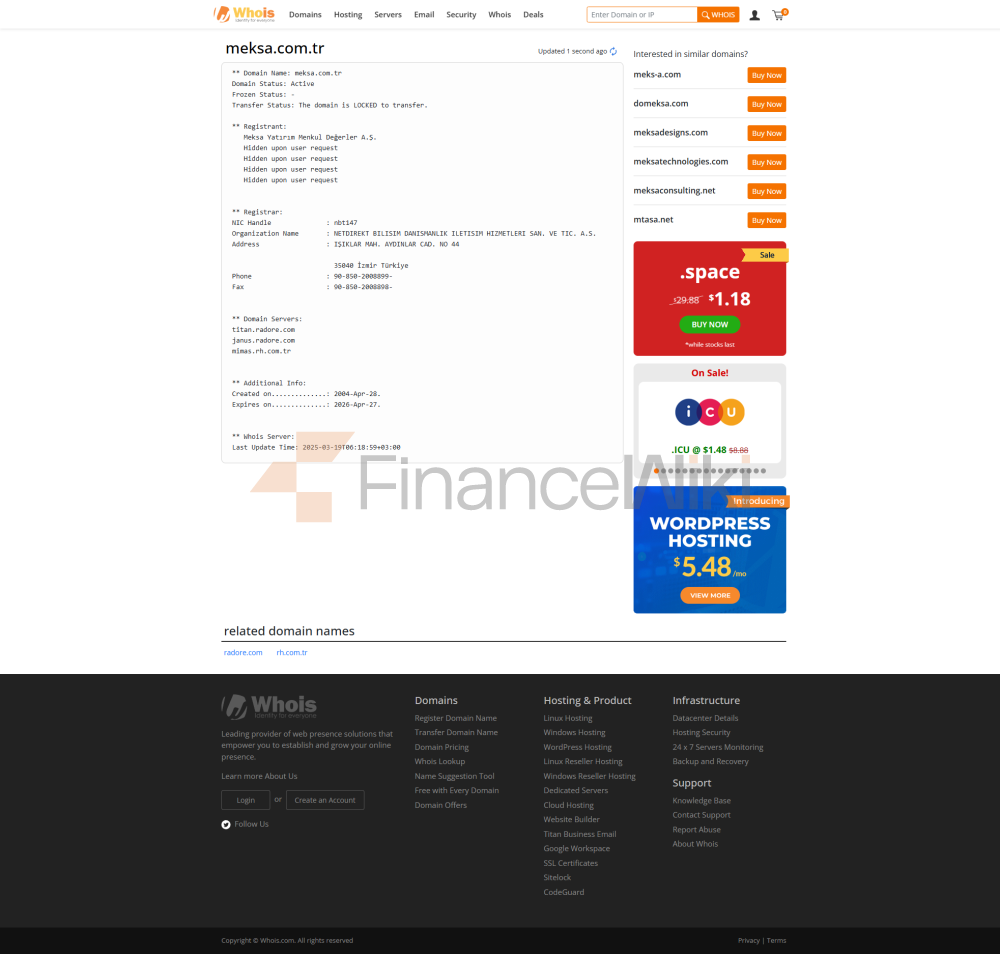

MEKSA (trade Name: Meksa Yatırım Menkul Değerler A. SZ) Is A Financial Brokerage Company Established On June 28, 1990 And Registered In Turkey. The Company Is Headquartered In The Kavacık Area Of Istanbul At:

Regulatory Information

There Is A Certain Controversy Over The Regulatory Status Of MEKSA. According To Wikifx, MEKSA Does Not Currently Have Any Valid Regulatory License, So The Regulatory Status On The Platform Is Listed As "unlicensed" And Has Received A Relatively Low Score (1.43/10). In Addition, According To Wikifx Data, MEKSA Is Registered With The Turkish Capital Markets Commission (CMA), But Its Compliance With International Regulatory Standards Remains To Be Further Verified.

Compliance Statement : MEKSA Claims To Comply With The Relevant Regulations Of The Turkish Capital Markets Commission (CMA), And Clearly States On Its Official Website: "MEKSA Yatırım Menkul Değerler A.S. Is A Legally Established Financial Company, And All Business Activities Strictly Comply With The Regulatory Requirements Of The Turkish Capital Markets Commission (CMA)."

Trading Products

MEKSA Offers A Variety Of Financial Products And Services, Mainly Including The Following Categories:

- Stock Trading : MEKSA Operates On The Istanbul Stock Exchange (BIST) And Provides Clients With Stock Trading Services In The Turkish Market.

- Foreign Exchange Trading (Forex) : MEKSA Provides Foreign Exchange Trading Services Covering Major Currency Pairs Such As EUR/USD (EUR/USD), GBP/USD (GBP/USD), Etc.

- Derivatives : The Company Offers Various Types Of Derivatives Trading, Including Options, Futures And Contracts For Difference (CFDs).

- Portfolio Management : MEKSA Provides Customized Portfolio Management Services For High Net Worth Individuals And Institutional Clients.

- Corporate Finance : MEKSA Assists Companies In Completing Financing Activities, Including Initial Public Offerings (IPOs), Bond Offerings, Etc.

Trading Software

MEKSA Does Not Provide Specific Trading Software Information On Its Official Website. However, General Financial Brokers Will Use Common Trading Platforms On The Market, Such As MetaTrader 4 (MT4), MetaTrader 5 (MT5) Or CQG, Etc. Since MEKSA Focuses On The Turkish Market, Its Trading System May Be Compatible With The Local Market Infrastructure.

Deposit And Withdrawal Methods

The Minimum Deposit Requirement For MEKSA Is 50,000 Turkish Lira (TL) . However, The Company Does Not Clearly State The Supported Deposit And Withdrawal Methods On Its Official Website, Which May Cause Certain Inconvenience To Customers. Generally, The Deposit And Withdrawal Methods Supported By Financial Brokers Include:

- Bank Transfer : Customers Complete Deposits And Withdrawals Through Bank Telegraphic Transfer.

- Credit/Debit Card : Supports Visa, MasterCard And Other International Credit Cards.

- Electronic Payment : Such As PayPal, Skrill, Neteller, Etc.

Since MEKSA Does Not Provide Detailed Information, It Is Recommended That Potential Customers Confirm The Deposit And Withdrawal Method Through Their Customer Service Channels Before Opening An Account.

Customer Support

MEKSA Provides A Variety Of Customer Support Methods:

- Telephone Support : Customers Can Contact MEKSA's Customer Support Team At The Phone Number 02166813400 .

- Fax Service : The Company Provides Multiple Fax Numbers, Including + 90 (216) 6930570, + 90 (216) 6930571, + 90 (216) 6930572 .

- Email Support : Customers Can Send Email Inquiries Through The Mailbox Destek@MEKSAfx.com .

- Online Chat : MEKSA's Official Website Supports Online Chat Function, And Customers Can Consult In Real Time Through This Channel.

- Social Media : MEKSA Has Official Accounts On Several Social Media Platforms (such As Twitter, Facebook, Instagram, YouTube And LinkedIn) Through Which Clients Can Interact With The Company.

Core Business And Services

The Core Business Of MEKSA Covers The Following Aspects:

- Investment Consulting : Provide Professional Investment Advice To Clients And Help Clients Formulate Investment Strategies.

- Brokerage Services : Provide Clients With Trade Execution Services For Stocks, Foreign Exchange And Derivatives.

- Portfolio Management : Provides Customized Portfolio Management For High Net Worth Clients And Institutional Clients.

- Derivatives Trading : Provides Trading Services For Derivatives Such As Options, Futures And CFDs.

- Corporate Finance : Assists Companies In Completing Financing Activities, Including IPOs And Bond Offerings.

- Fund Management : MEKSA Provides Fund Products To Help Clients Achieve Asset Appreciation.

Technical Infrastructure

MEKSA's Technical Infrastructure Primarily Supports Its Trading And Client Server. Since The Company Does Not Disclose Its Technical Details In Detail On Its Official Website, It Is Speculated That It May Use The Following Technologies:

- Trading System : Using Modern Trading Systems Such As Turkix Or Other Local Trading Systems.

- Data Center : MEKSA May Have A Data Center In Turkey To Ensure Low Latency And High Reliability Of Transactions.

- Cyber Security : Complies With The Cyber Security Requirements Of The Turkish Capital Markets Commission (CMA) And Uses Encryption Technology To Protect Customer Data.

Compliance And Risk Control System

MEKSA Claims To Strictly Comply With The Relevant Regulations Of The Turkish Capital Markets Committee (CMA) And Has Established A Complete Compliance And Risk Control System:

- Compliance Process : Ensure That All Trading Activities Comply With Regulatory Requirements, Including Customer Authentication (KYC), Anti-money Laundering (AML) And Counter-terrorism Financing (CFT).

- Risk Management : Adopt Advanced Risk Management Tools To Help Customers Control Trading Risks.

- Internal Control Mechanism : Establish A Strict Internal Control System To Ensure The Transparency And Compliance Of The Company's Operations.

Market Positioning And Competitive Advantage

MEKSA's Market Positioning Is Mainly Concentrated In The Turkish Market. Its Competitive Advantages Include:

- Localization Services : MEKSA Has A Deep Understanding Of The Turkish Market And Is Able To Provide Customized Localized Services To Its Customers.

- Diversified Financial Services : The Company Provides A Variety Of Financial Services To Meet The Needs Of Different Customers.

- Professional Team : MEKSA Has An Experienced Team That Is Able To Provide Professional Investment Advice And Trading Services To Its Clients.

Customer Support And Empower

MEKSA Provides Support To Clients Through Multiple Channels And Is Committed To Empowering Clients:

- Educational Resources : Provides Educational Resources Such As Market Analysis Reports, Trading Strategies And Investment Guides To Help Clients Improve Their Trading Skills.

- Tool Support : Provides Clients With Advanced Trading Tools And Technical Analysis Tools To Help Clients Make Informed Trading Decisions.

- Personalized Services : Customized Services For High Net Worth Clients And Institutional Clients, Including Dedicated Account Managers And Advanced Portfolio Management.

Social Responsibility And ESG

MEKSA Has Not Provided Details On Social Responsibility And ESG (Environmental, Social And Corporate Governance). However, As A Financial Company, MEKSA May Be Involved In The Following Activities:

- Community Support : Support The Development Of Local Communities Through Donations And Sponsorships. Environmental Protection : Promote Green Finance And Support Sustainable Development Projects.

- Social Responsibility Initiatives : Participation In Social Responsibility Projects In Areas Such As Education, Health And Culture.

Strategic Cooperation Ecology

Details Of MEKSA's Strategic Cooperation Ecology Have Not Been Made Public. However, As A Financial Company, MEKSA May Enter Into Partnerships With The Following Institutions:

- Financial Institution Group : Providing Integrated Financial Services In Cooperation With Banks, Insurance Companies And Other Financial Institution Groups.

- Technology Suppliers : Collaborate With Trading Platforms And Technology Solution Providers To Optimize The Company's Technology Infrastructure.

- Industry Association : Join The Turkish Capital Markets Committee (CMA) And Other Relevant Industry Associations To Cooperate With Other Financial Institution Groups To Promote The Development Of The Industry.

Financial Health

The Financial Health Of MEKSA Is Not Publicly Available On The Official Website. Generally Speaking, The Financial Health Of A Financial Company Can Be Measured By The Following Indicators:

- Capital Adequacy Ratio : Ensure That The Company Has Sufficient Capital To Deal With Potential Financial Risks.

- Profitability : Whether The Company Is Able To Achieve Stable Profitability.

- Liquidity Management : Whether The Company Has Sufficient Liquidity To Deal With Short-term Debt.

Future Roadmap

The Future Roadmap Of MEKSA Has Not Been Publicly Available. However, As A Financial Company, Its Future May Include The Following Development Directions:

- Business Expansion : Further Expand The Turkish Market And Expand The Customer Base.

- Technological Innovation : Introduce New Technologies To Improve The Efficiency And User Experience Of The Trading System.

- Internationalization Strategy : Explore International Market Opportunities And Expand The Global Business Map.

- ESG Investment : Increase Investment In Sustainable Development And Green Finance To Enhance The Company's Social Responsibility Image.

Risk Warning

Online Trading Involves High Risks And You May Lose All Your Invested Funds. It Is Not Suitable For All Traders Or Investors. Please Ensure That You Understand The Risks Involved And Note That The Information Contained In This Article Is For General Information Only.