Corporate Profile

Royal Trust Was Established On March 19, 2016 And Is Headquartered In Indonesia. It Is A Broker Specializing In Providing Clients With Foreign Exchange And Derivatives Trading Services. The Company Helps Traders Achieve Their Investment Goals In Global Financial Marekts Through Its Advanced Technology Platform And Professional Client Server.

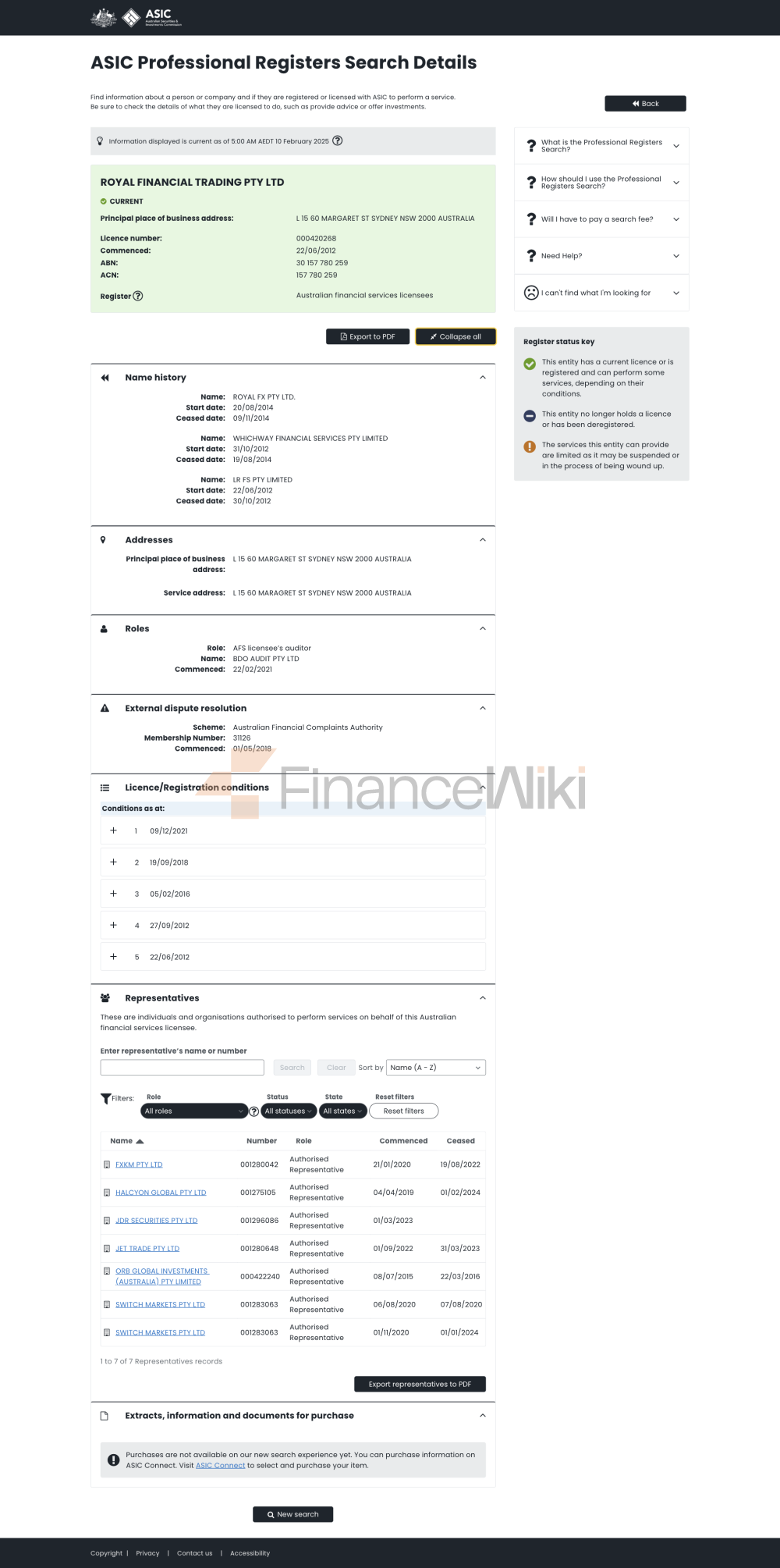

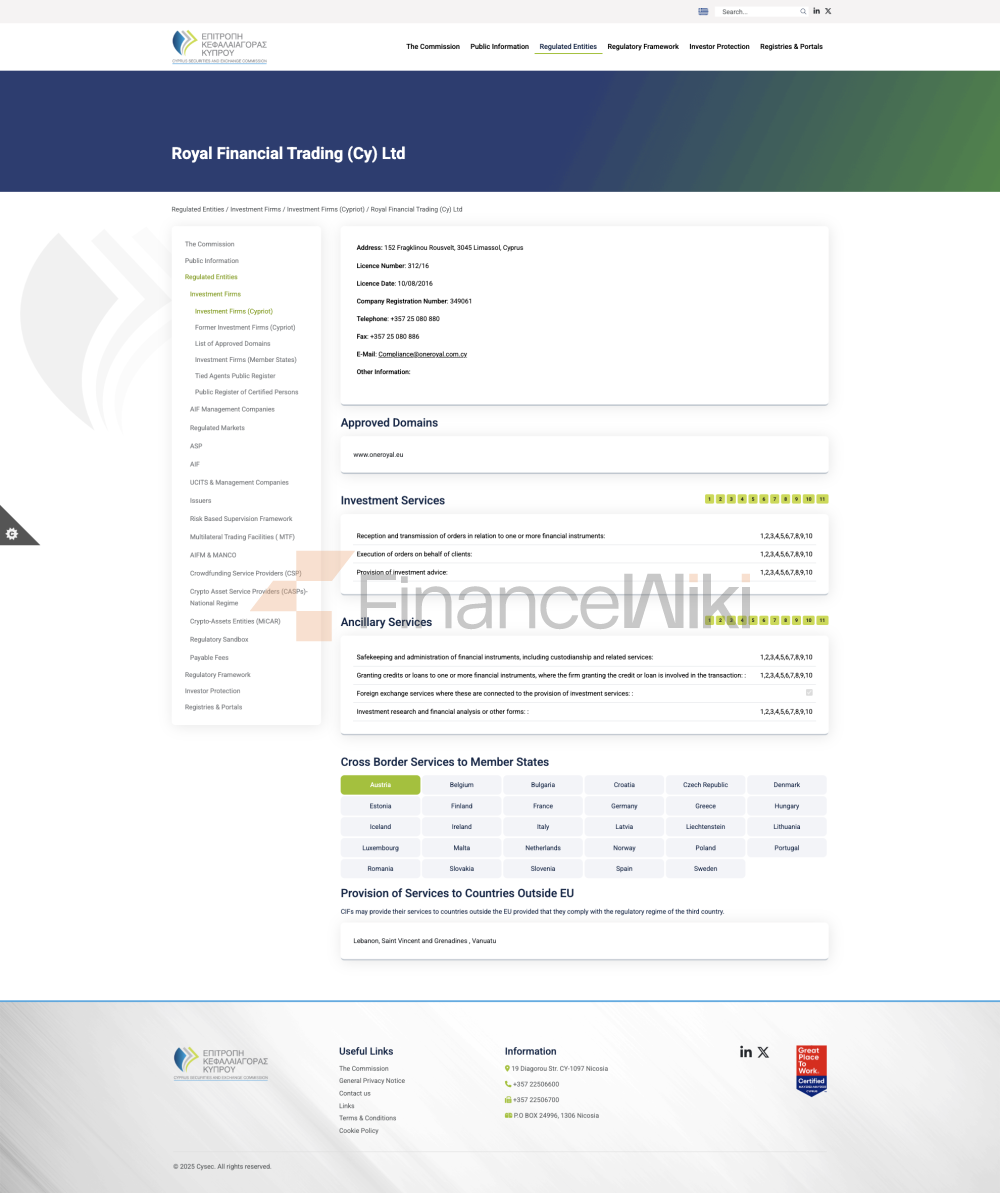

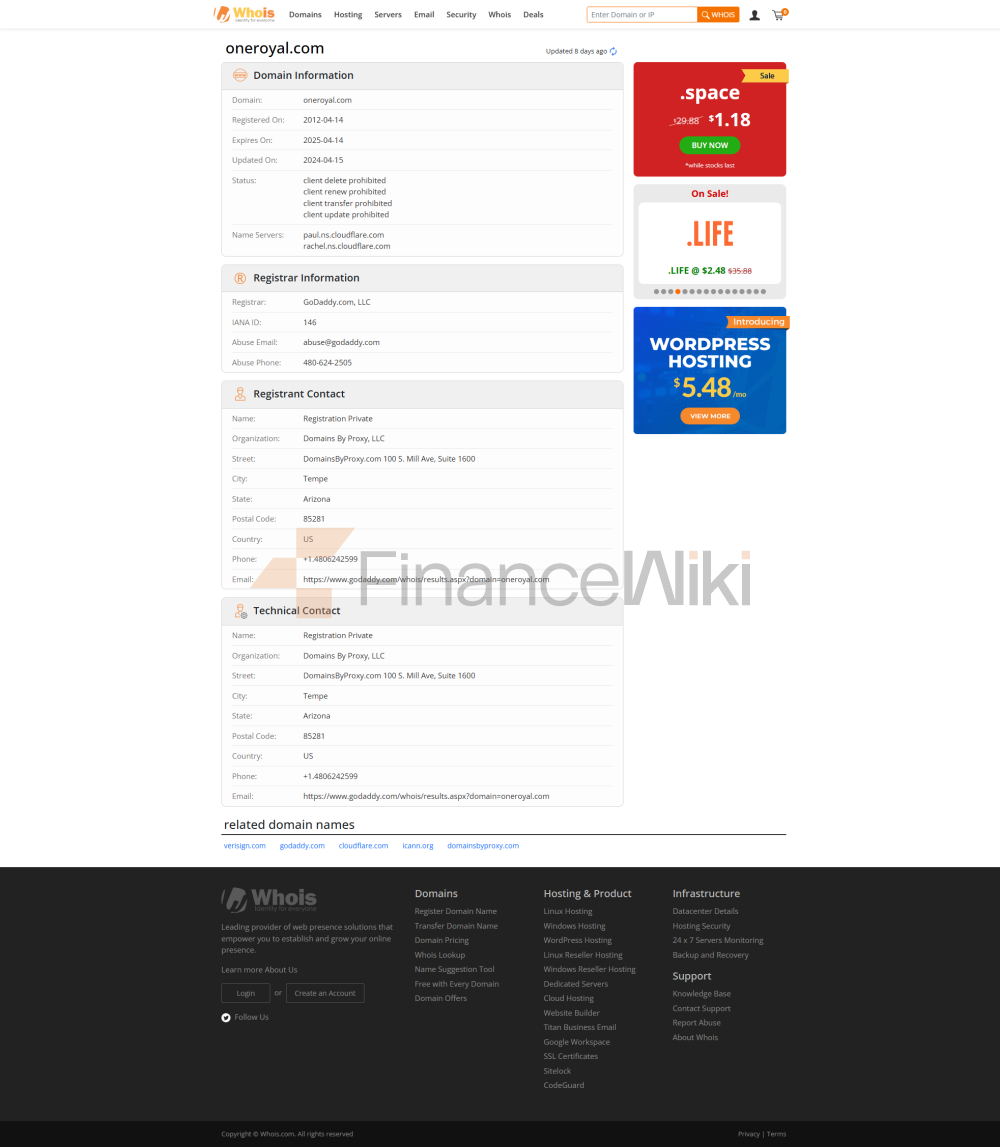

Regulatory Information

Royal Trust Is Regulated By The Indonesian Commodity Derivatives Trading Regulatory Authority (Badan Pengawas Perdagangan Berjangka Kamoditi Kementerian Perdagangan) With Regulatory License Number 922/BAPPEBTI/SI/08/2006 . This Regulatory Qualification Ensures That Royal Trust Follows Strict Financial Regulatory Standards During Its Operations, Providing Traders With A Safe And Reliable Trading Environment.

Trading Products

Royal Trust Offers A Diverse Range Of Trading Tools, Including The Following Financial Products:

- Forex: Offers Trading In Major, Minor And Rare Currency Pairs, Covering Major Currency Markets Around The World.

- London Spot Gold: Allows Traders To Participate In The London Spot Gold Market Through CFD Format, Capturing Gold Price Fluctuations.

- Crude Oil: Offers CFD Trading In Brent And WTI Crude Oil, Helping Traders Invest In The Commodity Market.

- Multilateral Tools: Covers A Wide Range Of Multilateral Currency Pairs To Meet The Diverse Needs Of Traders.

Through These Tools, Royal Trust Offers Traders A Wide Range Of Investment Options To Meet The Needs Of Different Trading Strategies.

Trading Software

Royal Trust Provides Traders With The MetaTrader 4 (MT4) Trading Platform. The Platform Supports Android, IOS And Windows Devices And Provides The Following Features:

- Advanced Charting Tools : Supports A Variety Of Technical Analysis Indicators And Graphical Objects To Help Traders Analyze The Market More Accurately.

- Multi-account Management : Allows Traders To Manage Multiple Trading Accounts Simultaneously On The Same Interface, Improving Operational Efficiency.

- Real-time Market Data : Provides Real-time Market Quotes And Deep Market Liquidity, Ensuring Traders Make Timely Decisions.

MT4's User-friendly Interface And Powerful Features Make It Ideal For Beginner Traders.

Deposit And Withdrawal Methods

Royal Trust Provides Traders With A Variety Of Deposit And Withdrawal Methods, Including The Following Options:

- Bank Transfer : Supports International Bank Transfers In Multiple Currencies. Traders Need To Operate Through The SWIFT Code Provided By The Bank.

- E-Wallet : Supports Mainstream E-wallet Services. Traders Can Quickly Complete Deposits And Withdrawals Through Platforms Such As PayPal.

Royal Trust Usually Processes Deposit Requests Within 24 Hours. The Withdrawal Processing Time Depends On The Specific Payment Method.

Customer Support

Royal Trust Provides Traders With A Comprehensive Customer Support Service That Supports Multiple Languages, Ensuring That Traders Can Quickly Solve Problems Encountered During The Trading Process. Customer Support Channels Include:

- Telephone Support : Support Phone Contact Information In Multiple Countries, Including + 62 21 3030 4129, Etc.

- Online Chat : Traders Can Communicate Directly With Customer Service Through The Online Chat Function Of The Official Website.

- Email Support : Traders Can Send An Email To Support@royalfx.co.id For Assistance.

In Addition, Royal Trust Maintains Interaction With Traders Through Social Media Platforms Such As Facebook, Instagram, TikTok And YouTube, Providing Market Updates And Trading Tips.

Core Business And Services

Royal Trust's Core Business Includes:

- Contract For Difference (CFD) Trading : Provides CFD Trading Services For Forex, London Spot Gold, Crude Oil And Multiple Currency Pairs.

- Leverage Trading : Provides Leverage Up To 1:200, Allowing Traders To Control Position Size More Flexibly.

- Demo Account : Provides A Simulated Trading Environment For Novice Traders To Help Them Become Familiar With The Platform And Trading Strategies.

Technical Infrastructure

Royal Trust Uses MT4 As Its Core Trading Platform, Which Is Known For Its Stability And Efficiency. Royal Trust Also Provides Traders With Multi-end Point Trading Capabilities. Traders Can Manage Multiple Trading Accounts Simultaneously To Improve Trading Efficiency.

Compliance And Risk Control System

Royal Trust Strictly Complies With The Regulatory Requirements Of The Indonesian Commodity Derivatives Trading Regulator To Ensure The Transparency And Security Of The Trading Process. Its Risk Control System Includes The Following:

- Leverage Control : The Maximum Leverage Ratio Is 1:200, Which Effectively Controls Trading Risks.

- Market Risk Management : Helps Traders Cope With Market Fluctuations Through Real-time Monitoring And Analysis.

- Client Funds Protection : Client Funds Are Stored In Isolation From The Company's Operating Funds To Ensure The Safety Of Funds.

Market Positioning And Competitive Advantage

Royal Trust Stands Out In The Market Through The Following Competitive Advantages:

- Regulated Operations : Has A Clear Regulatory Qualification To Ensure The Safety Of The Trading Environment.

- Diversified Trading Tools : Offers A Variety Of Instruments Such As Foreign Exchange, London Spot Gold, Crude Oil, Etc.

- Convenient Trading Experience : Improve Trading Efficiency Through The MT4 Platform And Multi-end Point Trading Capabilities.

- 24/7 Customer Support : Provide 24-hour Multilingual Customer Support To Ensure That Traders' Problems Are Resolved In A Timely Manner.

Customer Support And Empowerment

Royal Trust Helps Traders Improve Their Trading Skills By:

- Educational Resources : Provide Educational Resources Such As Market Analysis, Trading Strategies, And Risk Management Techniques.

- Demo Account : Provide A Free Demo Trading Environment For Novice Traders To Help Them Become Familiar With The Trading Process.

- Market Dynamics : Provide Traders With Real-time Market Dynamics And Analysis Through Social Media Platforms And Email Notifications.

Social Responsibility And ESG

Royal Trust Complies With Relevant Laws And Regulations In The Operation Process And Actively Fulfills Social Responsibilities, Including Supporting Financial Education And Promoting Sustainable Investment Concepts.

Strategic Cooperation Ecology

Royal Trust Has Established Long-term Cooperative Relationships With A Number Of Financial Institution Groups And Technical Service Providers To Improve Service Quality And Technical Level Through Cooperation. Its Partners Include:

- Clearing Institutions : To Ensure Efficient Clearing Of Transactions And Safety Of Funds.

- Technology Providers : To Provide Support For The Stability And Security Of The Platform.

Financial Health

Royal Trust Ensures The Company Finances Are Sound Through Strict Financial Management And Compliant Operations. Its Financial Health Is Manifested In The Following Aspects:

- Capital Adequacy Ratio : The Company Has A Sufficient Capital Base And Is Able To Cope With Market Fluctuations.

- Transparent Financial Reporting : Regular Disclosure Of Financial Position To Regulators And Traders.

Future Roadmap

Royal Trust Plans To Further Expand Its Trading Products And Services In The Future, Including:

- New Trading Tools : Introduction Of More Commodities And Index Products.

- Enhanced Technical Support : Optimized MT4 Platform Functionality To Enhance Trading Experience.

- Expanded Market Coverage : Access To More International Markets To Serve Global Traders.

Royal Trust Will Continue To Operate In Compliance And Provide Traders With A Safe, Transparent And Efficient Trading Environment.