Corporate Profile

GIB (full Name Global Intra Berjangka) Is A Regulated Financial Institution Group, Established In 2004 And Headquartered In Indonesia . As A Professional Financial Services Provider, GIB Offers A Diverse Range Of Trading Products, Instruments And Services To Investors And Traders. Its Business Covers A Wide Range Of Financial Asset Classes, Including Commodities, Foreign Exchange, Precious Metals And Stock Indices, Among Others. GIB Is Known For Its Transparent Trading Environment, Strict Compliance Management And Customer-friendly Services.

The Establishment Of GIB Marks An Important Milestone For Financial Marekt In Indonesia, Especially In The Area Of Commodities And Derivatives Trading. The Company Has Always Been Committed To Providing Clients With An Efficient And Safe Trading Experience And Maintaining Its Competitiveness In The Industry Through Continuous Technological Innovation And Risk Management Optimization.

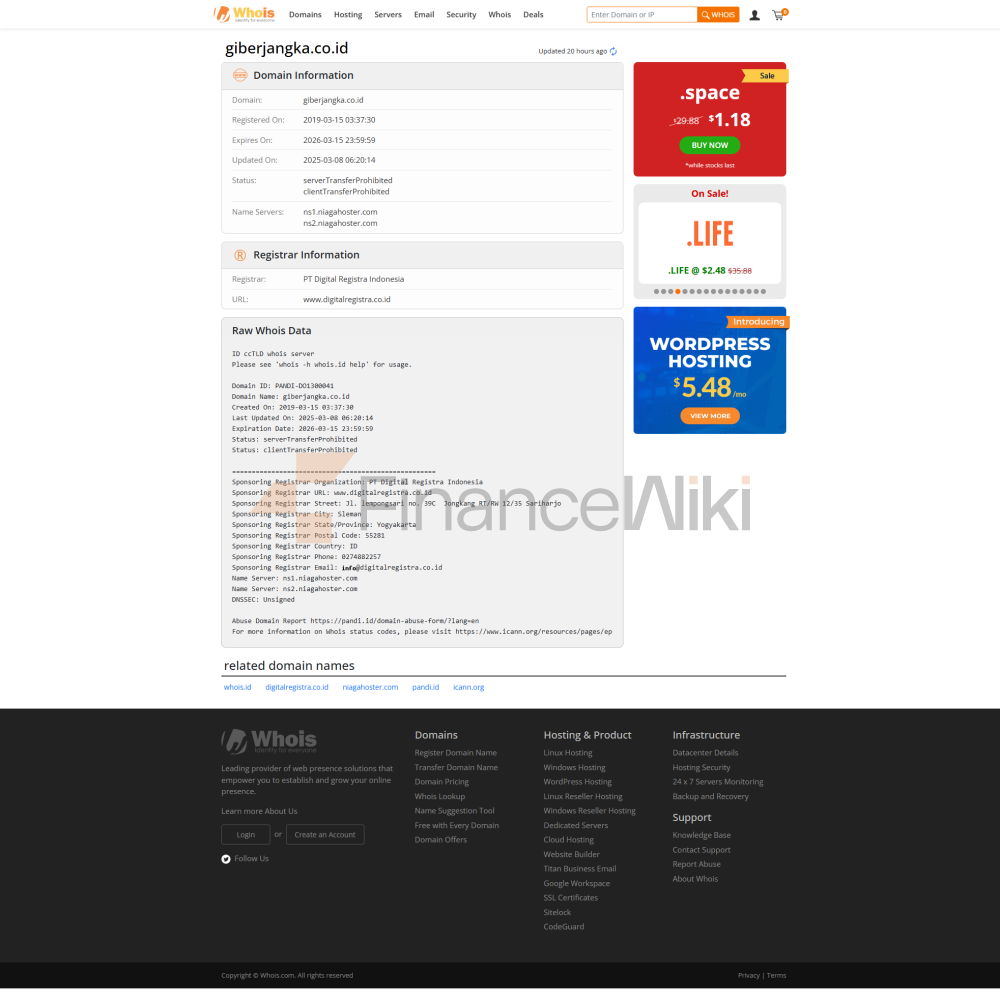

Regulatory Information

GIB Is A Highly Regulated Financial Institution Group That Operates In Compliance With The Regulatory Requirements Of Indonesia Commodity And Derivatives Exchange (ICDX) And Indonesia Financial Services Authority (BAPPEBTI) . The Following Is The Regulatory Qualification Information Of GIB:

- BAPPEBTI License Number: 587/BAPPEBTI/SI/XII/2004

- ICDX License Number: 044/SKPB/ICDX/DIR/IX/2010

These Regulators Ensure That GIB Operates Transparently, Legally, And Provides Strong Protection For Clients' Funds And Transactions. GIB's Compliance Statement Makes It Clear That The Company Strictly Complies With All Regulations Of The Regulators And Is Subject To Regular Audits And Inspections.

Trading Products

The Trading Products Offered By GIB Are Divided Into Two Categories: Multi-Contract And Bilateral Contract (Over-the-Counter, OTC) . The Following Are The Main Trading Products Of GIB:

1. Multilateral Contracts

- Mining Commodities : Covers The Extraction And Trading Of Metals, Minerals And Energy Resources, Providing Investors With The Opportunity To Participate In The Mining Industry.

- Plantation Commodities : Focuses On The Agricultural Sector, Especially The Production And Sale Of Plantation Crops Such As Palm Oil, Rubber, Tea And Coffee.

- GOFX (Global Options Forex) : This Is A Foreign Exchange Option Contract That Allows Investors To Predict And Profit From Fluctuations In Currency Exchange Rates.

2. Bilateral Contracts

- Foreign Exchange Trading (Foreign Exchange) : Offers Trading Opportunities In Multiple Currency Pairs, Where Investors Can Profit From Fluctuations In Exchange Rates.

- Gold And Silver Index : Linked To The Performance Of The Gold And Silver Markets, Investors Can Participate In Fluctuations In The Price Of Precious Metals.

- Crude Oil Index : Provides Investment Opportunities In The Crude Oil Market, Investors Can Profit From Changes In The Price Of Crude Oil.

- Index Stocks : Linked To Stock Market Indices (such As The S & P 500 Index Or The FTSE 100 Index), Investors Can Profit From The Overall Market Performance.

GIB's Trading Products Cover A Number Of Highly Liquid And Volatile Asset Classes, Providing Investors With A Diverse Range Of Investment Options.

Trading Software

GIB Provides Clients With A Set Of Powerful Trading Tools, Including:

- Demo Account : Allows Novice Traders To Learn And Practice Trading Skills In A Risk-free Environment.

- Real Trading Account : Includes Regular Account And Mini Account To Meet The Needs Of Different Investors.

In Addition, GIB's Trading Platform Supports Multiple Trading Modes, Including Manual And Automated Trading. Although The Specific Platform Name Is Not Clear, Its Functions Cover Functions Such As Order Execution, Risk Management, Real-time Quotes And Data Analytics.

Deposit And Withdrawal Methods

GIB Provides Customers With An Easy Way To Deposit And Withdraw:

- Deposit : Investors Must Deposit Funds Into GIB's Designated Account (CoFTRA) Via Bank Transfer.

- Withdrawal : Customers Can Submit Withdrawal Requests Through GIB's Customer Area, And The Funds Will Be Processed Before 12:00 Western Indonesia Time And Transferred To The Customer's Registered Bank Account On The Same Day.

It Is Important To Note That Deposits And Withdrawals Must Be Made Through An Account That Is Consistent With The Bank Account Info Provided At The Time Of Account Opening.

Customer Support

GIB Provides Support To Customers Through A Number Of Channels, Including:

- Email : Customers Can Submit Questions Or Request Assistance Through The Official Email Address Provided By GIB.

- Phone : GIB's Customer Service Number Is + 62-21-397 -20818 (Evelyn), And Customers Can Speak Directly To A Customer Service Representative.

- Social Media : GIB Has Official Accounts On Platforms Such As Facebook, Twitter And LinkedIn, Through Which Customers Can Interact With GIB.

GIB's Customer Support Team Is Committed To Providing An Efficient, Professional Service, But Response Times May Vary Depending On Workload.

Core Business And Services

GIB's Core Business And Services Include:

- Commodity Trading : Provides Trading Opportunities In Mining And Plantation Commodities, Helping Investors Participate In The Volatility Of Commodity Markets.

- Forex Trading : Supports The Trading Of Multiple Currency Pairs To Meet The Needs Of Investors For Exchange Rate Fluctuations.

- Precious Metals Trading : Offers Gold And Silver Index Contracts To Help Investors Hedge The Risk Of Price Fluctuations In Precious Metals.

- Crude Oil And Stock Index Trading : Offers Investors The Opportunity To Participate In The Crude Oil And Stock Markets.

- Demo And Real Account Services : Helps Novice And Advanced Traders To Improve Their Trading Skills And Make Real Trades.

GIB Offers Its Clients A Comprehensive Trading Solution Through A Diverse Range Of Services And Tools.

Technical Infrastructure

Although The Specific Technical Infrastructure Of GIB Has Not Been Disclosed In Detail, Its Trading Platform And Systems Are Optimized To Support High-frequency Trading And Large-scale Capital Flows. GIB's Servers Are Usually Located In Data Centers With High Security And High Stability To Ensure Fast Execution Of Transactions And Secure Transmission Of Data.

In Addition, GIB May Have Adopted An AIoT (artificial Intelligence With Internet Of Things) Risk Control System For Real-time Monitoring Of Market Volatility And Trading Behavior To Reduce Operational Risk And Market Risk.

Compliance And Risk Control System

GIB's Compliance And Risk Control System Is The Key To Its Successful Operation. The Company Strictly Complies With The Regulatory Requirements Of BAPPEBTI And ICDX , And Ensures The Security And Transparency Of Transactions Through The Following Measures:

- Fund Segregation : Client Funds Are Segregated From The Company's Working Funds To Ensure The Safety Of Client Funds.

- Risk Management System : Adopts A Multi-level Risk Control Strategy, Including Market Risk, Operational Risk And Credit Risk Management.

- Transparent Trading Process : All Transaction Records Are Kept In Their Entirety, And Clients Can View The Transaction History At Any Time Through The Client Area.

GIB's Compliance Statement Makes Clear Its Commitment To Legality And Transparency.

Market Positioning And Competitive Advantage

GIB Occupies An Important Position In The Indonesian Commodities And Derivatives Trading Market. Its Competitive Advantages Include:

- Regulatory Compliance : As A Regulated Financial Institution Group, GIB Provides Investors With The Security Of Their Funds And Transactions.

- Diversified Products : Covering Multiple Asset Classes Such As Commodities, Foreign Exchange, Precious Metals And Stock Indices, To Meet The Needs Of Different Investors.

- Customer-friendly Service : Offering Demo Accounts And Real Trading Accounts To Help Customers Improve Their Trading Skills And Make Real Trades.

Despite This, GIB Still Has Some Limitations, Such As The Singularity Of Deposit And Withdrawal Methods And The Uncertainty Of Customer Support Response Times.

Customer Support And Empowerment

GIB Provides Support To Its Clients Through A Variety Of Channels And Tools, Including:

- Educational Resources : Although Details Of Educational Resources Are Not Explicitly Mentioned, GIB May Provide Training To Its Clients In Trading Knowledge And Market Analysis.

- Demo Account : Helps Novice Traders Learn Trading Skills In A Risk-free Environment.

- Customer Support Team : Provides Professional Assistance Via Phone, Email And Social Media.

The GIB Is Committed To Helping Clients Enhance Their Trading Skills And Achieve Their Investment Objectives Through These Tools And Channels.

Social Responsibility And ESG

Although The GIB Does Not Explicitly Disclose Its Specific Actions On Social Responsibility And ESG (environmental, Social And Governance), As A Regulated Financial Institution Group, These Factors May Have Been Taken Into Account In Its Operations And Decision-making Processes. In The Future, The GIB May Further Strengthen Its Commitment On Social Responsibility And ESG To Align With Industry Trends.

Strategic Collaboration Ecology

The GIB Has Not Disclosed Details Of Its Strategic Collaboration Ecology. However, As A Regulated Financial Institution Group, It May Have Entered Into Strategic Partnerships With The Indonesian Government, Other Financial Institution Groups Or Industry Organizations To Further Advance Its Business.

Financial Health

The Financial Health Of GIB Has Not Been Disclosed In Detail. However, As A Regulated Financial Institution Group, Its Financial Statements And Audit Results Should Comply With The Requirements Of The Regulator. In The Future, GIB May Provide Investors With More Detailed Financial Information To Enhance Market Confidence In Its Financial Health.

Future Roadmap

The Future Roadmap Of GIB Has Not Been Clearly Disclosed. However, Based On Its Existing Business And Regulatory Environments, It Can Be Speculated That Its Future Development Direction May Include:

- Expand The Variety Of Trading Products To Meet The Needs Of More Investors.

- Optimize The Technical Infrastructure To Improve The Speed Of Trade Execution And Customer Experience.

- Strengthen Customer Support And Educational Resources To Help Customers Better Trade.

- Drive The Expansion In The Global Market To Further Expand Its Influence.

GIB's Future Roadmap Will Depend On Market Trends, Regulatory Changes And Customer Needs, And The Company's Flexibility And Adaptability In These Areas Will Be The Key To Its Success.

With Its Diverse Trading Products, Strict Regulatory Compliance And Customer-friendly Services, GIB Has Become A Representative Institution In The Indonesian Commodities And Derivatives Trading Market. Despite Certain Limitations, Its Core Business And Services Offer Investors A Wealth Of Choices And Opportunities. In The Future, GIB Is Expected To Further Consolidate Its Position In The Industry Through Continuous Optimization And Innovation.