Corporate Profile

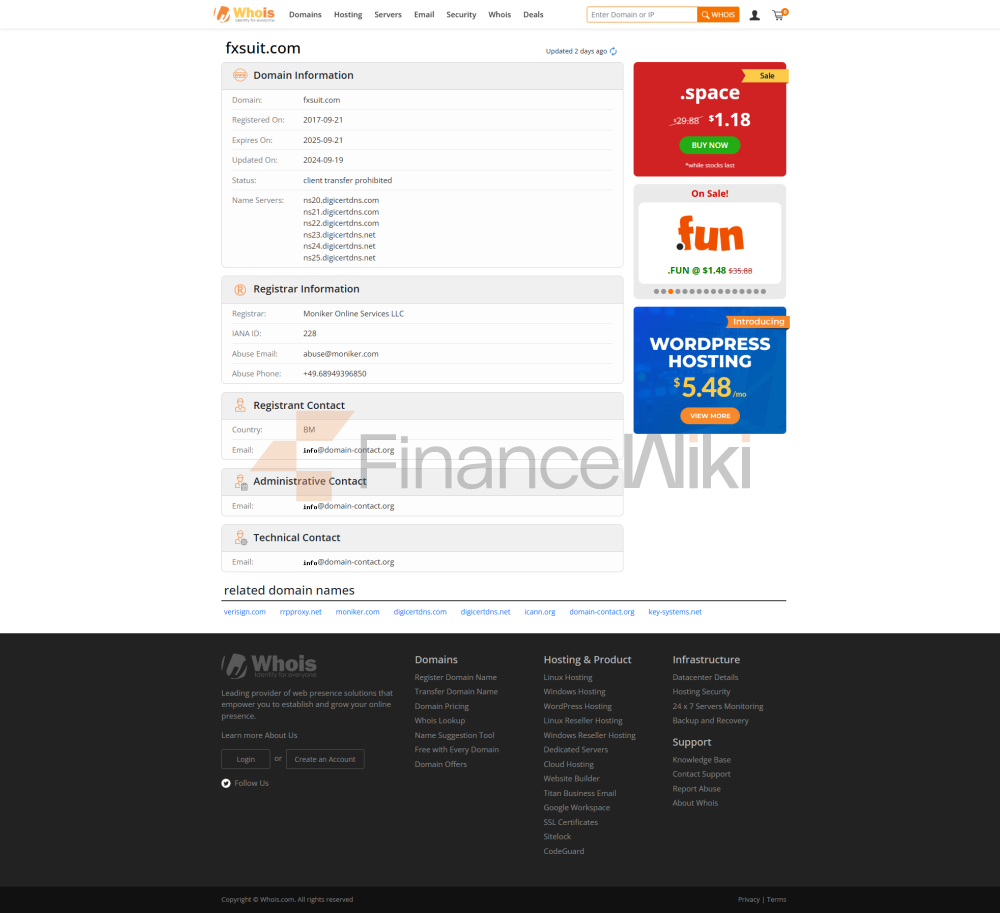

FXSuit Is A Foreign Exchange Brokerage Registered In Bermuda. The Company Name Behind It Is Salvax Limited. The Company Is Headquartered In Bermuda, A British Overseas Territory Located In The North Atlantic. FXSuit Not Only Operates Its Own Brand, But Also Owns And Manages Navitas Markets, A Brokerage Brand. It Is Worth Noting That The Government Of Bermuda Does Not Regulate Foreign Exchange Transactions In A Standardized Manner, So FXSuit's Operations Are Not Subject To Local Regulatory Rules. This Fact Can Have Important Implications For Traders' Choices, Especially When It Comes To Compliance And Risk Control.

Regulatory Information

FXSuit's Place Of Operation (Bermuda) Does Not Itself Regulate Forex Trading, Which Means That The Broker Does Not Comply With Any Regulatory Rules And Is Not Subject To Supervision By The Relevant Regulatory Authorities. This Offshore Operating Model Can Lead To Higher Risks For Traders, Especially In The Event Of Trading Disputes Or Fraudulent Incidents, Traders May Not Be Able To Complain Through Formal Channels Or Receive Financial Compensation.

Trading Products

FXSuit Offers A Wide Range Of Trading Products, Including 83 Foreign Exchange Pairs, Involving A Wide Range Of Emerging And Exotic Currencies, Such As Brazilian Real, Singapore Dollar, Norwegian Krone, Swedish Krone, Danish Krone, Hong Kong Dollar, Hungarian Forint, Polish Zloty, Czech Republic Krone, South African Rand, Mexican Peso, Turkish Lira, Russian Ruble And Chinese Yuan. In Addition, The Platform Also Supports The Trading Of Spot Metals Such As Gold, Silver, Platinum And Palladium, And Covers Contracts For Difference (CFDs) On A Wide Range Of Agricultural And Energy Commodities, Including Soybeans, Wheat, Coffee, Cocoa, Rice, Sugar Cotton, Corn, Copper, Natural Gas And Oil. FXSuit Also Offers CFD Trading On 17 Indices, Stocks, As Well As Cryptocurrencies Such As Bitcoin, Ethereum, Ripple, And Litecoin.

Trading Software

FXSuit Supports The Metatrader 4 (MT4) Platform, A Professional Tool Widely Used In The Field Of Forex And CFD Trading. MT4 Is Known For Its Rich Market Indicators, Customizable Trading Robots, And User-friendly Interface, Capable Of Meeting The Needs Of Both Professional And Novice Traders. The Platform Also Supports Automated Trading Functions And Offers A Variety Of Charting Tools And Analytical Functions To Help Traders With Technical Analysis And Market Research.

Deposit And Withdrawal Methods

FXSuit Offers A Variety Of Deposit And Withdrawal Methods, Including Credit/debit Cards Such As Visa And Mastercard, As Well As E-wallets Such As Skrill, Neteller, FasaPay And DotPay. Withdrawals Via Credit/debit Cards Will Be Charged A Fee Of €2 Per Transaction. Withdrawals Via Bank Telegraphic Transfer Are Free. Withdrawal Fees For E-wallets Are As Follows: Skrill Charges 1%, Neteller 2%, FasaPay 0.5% And DotPay Is Free. Traders Should Choose The Most Suitable Payment Method According To Their Needs.

Customer Support

FXSuit Provides Traders With A Range Of Customer Support Services, Including Trading Account Management, Order Execution, And Trading Platform Operations, Among Others. Although Specific Customer Support Channels (such As Phone, Mail, Or Online Chat) Are Not Described In Detail, Traders Can Expect To Receive Basic Technical And Trading Support.

Core Business And Services

FXSuit's Core Business Is Focused On The Areas Of Forex Trading And CFD Trading. Its Differentiating Advantage Lies In Its Wide Range Of Trading Products And Support For The MT4 Platform. However, The Broker's Offshore Operating Model And Lack Of Regulatory Scrutiny May Be Seen As Potential Disadvantages To Its Business.

Technical Infrastructure

The Technical Infrastructure Of FXSuit Is Mainly Reflected In Its Support For The MT4 Platform And The Efficiency Of Trade Execution. The Platform Is Known For Its Lightweight And User-friendly Interface, Which Is Able To Provide Traders With A Smooth Trading Experience. However, Details About Its Back-office System, Server Location And Data Security Are Not Mentioned.

Compliance And Risk Control SystemSince FXSuit's Place Of Operation (Bermuda) Does Not Regulate Foreign Exchange Trading, The Broker Is Not Subject To Any Regulatory Review Or Supervision. This Means That Traders Cannot Rely On The Protections Provided By Regulators, Such As Investor Compensation Funds Or Transaction Dispute Mediation Services. In Addition, FXSuit's Compliance Statement Does Not Mention Any Specific Risk Control Measures, Such As Capital Protection Or Trading Risk Management Systems.

Market Positioning And Competitive Advantage

FXSuit's Market Positioning Is Primarily Based On Its Wide Range Of Trading Products And Support For The MT4 Platform. Its Competitive Advantage Lies In Its Ability To Offer Traders Multiple Trading Tools And Flexible Leverage Options (up To 1:500). However, The Broker's Offshore Operating Model And Lack Of Regulatory Scrutiny May Be Seen As Its Core Weaknesses, Especially In Terms Of Risk Control And Compliance.

Customer Support And Empowerment

FXSuit Provides Traders With Basic Trading Support Services, Including Order Execution, Trading Account Management, And Trading Platform Operation. Although Specific Customer Support Channels Are Not Detailed, Traders Can Expect To Receive Basic Technical And Trading Support. In Addition, FXSuit's MT4 Platform Provides Traders With A Variety Of Tools And Features, Including Automated Trading Robots And Charting Tools, Thus Helping Traders Optimize Their Trading Strategies.

Social Responsibility And ESG

FXSuit's Public Information Does Not Mention The Company's Specific Measures On Social Responsibility And Environmental, Social And Governance (ESG). This Means That Traders Cannot Evaluate The Company's Performance In This Regard, Nor Can They Judge Whether It Meets Global Sustainability Standards.

Strategic Cooperation Ecology

FXSuit's Public Information Does Not Mention The Company's Strategic Cooperation With Other Institutions, Such As Financial Institution Group, Technology Suppliers Or Industry Associations. This Means That Traders Cannot Evaluate The Strength Of The Company's Cooperation Network And Ecosystem In This Regard.

Financial Health

FXSuit's Public Information Does Not Mention The Company's Financial Health, Including Capital Structure, Profitability, Cash Flow And Debt Levels. This Means That Traders Cannot Evaluate The Company's Robustness In This Regard, Nor Can They Judge Whether It Has The Ability To Operate For A Long Time.

Future Roadmap

FXSuit's Public Information Does Not Mention The Company's Future Development Plans And Roadmap, Such As Product Expansion, Market Entry, Technological Innovation Or Strategic Acquisitions. This Means That Traders Cannot Evaluate The Company's Growth Potential And Development Prospects In This Regard.

Key Data Annotation

- Registration Date : 2018

- Registered Capital : 5 Million USD

- Trading Product Types : Forex Pairs, Spot Metals, Agricultural Products, Energy Commodities, Indices, Stocks, Cryptocurrencies

- Trading Leverage : Up To 1:500

- Spread : EUR The Spread For The USD Currency Pair Starts At 2.5 Pips

- Trading Platform : Metatrader 4

- Deposit And Withdrawal Methods : Visa, Mastercard, Skrill, Neteller, FasaPay, DotPay

Summary

FXSuit Offers Traders A Wide Range Of Trading Options With Its Wide Range Of Trading Products And Support For The MT4 Platform. However, Its Offshore Operating Model And Lack Of Regulatory Scrutiny Can Have A Significant Impact On A Trader's Choice, Especially In Terms Of Risk Control And Compliance. Traders Should Carefully Evaluate Their Own Risk Tolerance And The Need For A Trading Environment To Decide Whether To Choose FXSuit As Their Trading Partner.