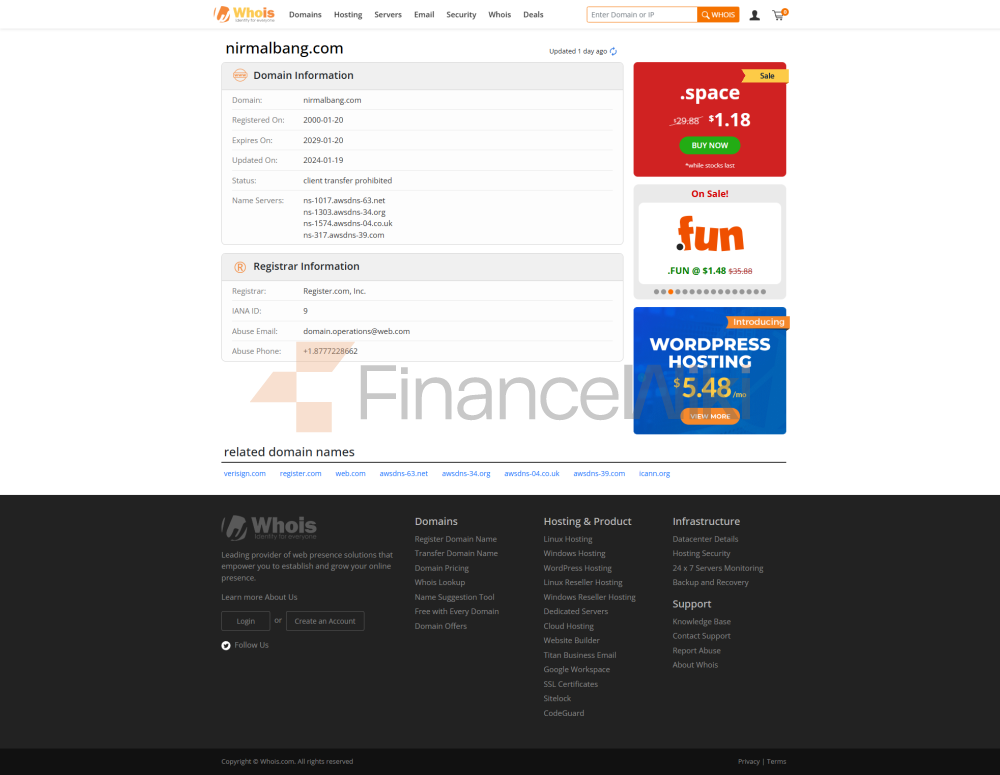

Corporate Profile

Nirmal Bang Is A Financial Services Company Headquartered In India, Established In 2000 And Headquartered In Mumbai. The Company Is Dedicated To Providing Comprehensive Financial Services To Retail And Institutional Investors, Covering Diversified Products Such As Equities, Derivatives, Foreign Exchange, Commodities, Depository Services, Security Pledge Loans, And Algorithmic Trading. Through Its Professional Platform And Team, Nirmal Bang Provides Clients With Efficient Investment Solutions That Meet The Needs Of Different Investors.

Regulatory Information

Nirmal Bang Is Not Currently Regulated By Any International Financial Regulator Such As The UK Financial Conduct Authority (FCA) Or The Australian Securities And Investments Commission (ASIC). Despite This, The Company Remains Committed To Complying With Local Financial Regulations And Standards In India To Ensure Compliance And Transparency Of Its Operations.

Trading Products

Nirmal Bang Offers A Wide Range Of Trading Instruments Covering The Following Areas:

- Trading In Stocks And Derivatives: Including Financial Instruments Such As Futures And Options.

- Forex Trading: Transactions Involving Major And Minor Currency Pairs.

- Commodity Trading: Covers Commodities Such As Gold, Silver, Crude Oil, And Agricultural Commodities.

- Institutional Brokerage Services: Provides Trade Execution Services For Mutual Funds, Insurance Companies, And Other Large Financial Institution Groups.

- Depository Services: Provides Electronic Securities Custody And Maintenance Services.

- Securities Pledged Loans: Allows Customers To Apply For Loans Against The Securities They Hold As Collateral.

Trading Software

Nirmal Bang Offers Clients A Variety Of Trading Platforms To Meet The Needs Of Different Investors:

- ODIN: A Comprehensive Trading Platform For Beginners And Professional Traders, Providing Real-time Market Data And Advanced Charting Tools.

- NET: Focuses On A Seamless Online Trading Experience, Supporting Access To Multiple Financial Marekts.

- Beyond Mobile App: A Trading Application That Supports Mobile Devices, Making It Convenient For Users To Trade Anytime, Anywhere.

- LD Rakshak: May Provide Customized Trading Solutions And Risk Management Tools.

Deposit And Withdrawal Methods

Nirmal Bang Offers A Variety Of Deposit And Withdrawal Methods To Ensure Easy Management Of Customers' Funds. Deposit And Withdrawal Are Usually Free, But The Specific Methods May Vary Depending On The Account Type.

Customer Support

Nirmal Bang Supports Customers Through Multiple Channels:

- Phone: + 91-22-6820 7000

- Email: Support@nirmalbang.com

- Live Chat: Through Its Website Or Trading Platform

- Institutional Brokerage Services: Professional Trading Support For Large Institutional Investors.

- Portfolio Management Services (PMS): Provides High-performance Portfolio Management Tools To Help Clients Achieve Their Investment Goals.

Core Business And Services

Nirmal Bang's Core Business Revolves Around Trading Services, Including Equities, Derivatives, Foreign Exchange And Commodities Trading. In Addition, The Company Offers:

Technical Infrastructure

Nirmal Bang Provides Efficient Technical Support To Clients Through Its Proprietary Trading Software And Web-based Trading Platforms. These Platforms Not Only Provide Real-time Market Data, But Also Support Sophisticated Trading Strategies That Help Traders Maintain An Edge In The Competitive Market.

Compliance And Risk Control System

Although Nirmal Bang Is Not Regulated By International Regulators, The Company Still Focuses On Risk Management, Ensuring The Security And Compliance Of Transactions Through Technical Means And Internal Processes. The Company May Utilize The AIoT Risk Control System (a Risk Management System Combining Artificial Intelligence And IoT Technology) To Monitor Trading Activities And Prevent Latent Risks.

Market Positioning And Competitive Advantage

Nirmal Bang Stands Out In The Indian Financial Services Market With Its Diverse Products And Customized Trading Platform. The Company Is Particularly Adept At Providing Professional Services To Institutional Investors And High Net Worth Individuals. At The Same Time, Its Low Commission Rates (such As 0.03% -0.05% Commission For Intraday Trading Of Stocks) Also Attract A Large Number Of Retail Traders.

Customer Support And Empowerment

Nirmal Bang Ensures That Clients Can Receive Timely Assistance And Guidance During The Trading Process Through Its Extensive Customer Support Channels And Professional Client Server Team. The Company Also Provides Market Insights And Trading Strategy Support To Clients Through Its Trading Platform And Research Reports.

Social Responsibility And ESG

Although Nirmal Bang Has Less Disclosure In Terms Of Social Responsibility, As A Financial Services Company, It May Contribute To Promoting Financial Education And Community Development. In The Future, As ESG (environmental, Social And Governance) Investments Become More Popular, Nirmal Bang May Further Strengthen Its Practices In Social Responsibility And Sustainability.

Strategic Cooperation Ecology

Nirmal Bang May Enter Into Strategic Partnerships With Multiple Financial Institution Groups, Technology Vendors, And Other Industry Players To Enhance Its Market Competitiveness And Product Innovation Capabilities. However, Specific Partner Information Has Not Been Publicly Disclosed.

Financial Health

Nirmal Bang's Financial Position Is Considered To Be Sound And Capable Of Supporting Its Continued Business Expansion And Technology Investments. However, Specific Financial Data Has Not Been Publicly Disclosed.

Future Roadmap

Nirmal Bang's Future Development Direction May Include Further Expansion Of Its Trading Products, Optimization Of Trading Platform Functions And Strengthening Its Strengths In Prime Brokerage And Portfolio Management. At The Same Time, As Digital Transformation Accelerates, The Company May Increase Its Investment In Fintech To Enhance Its Competitiveness.