Corporate Profile

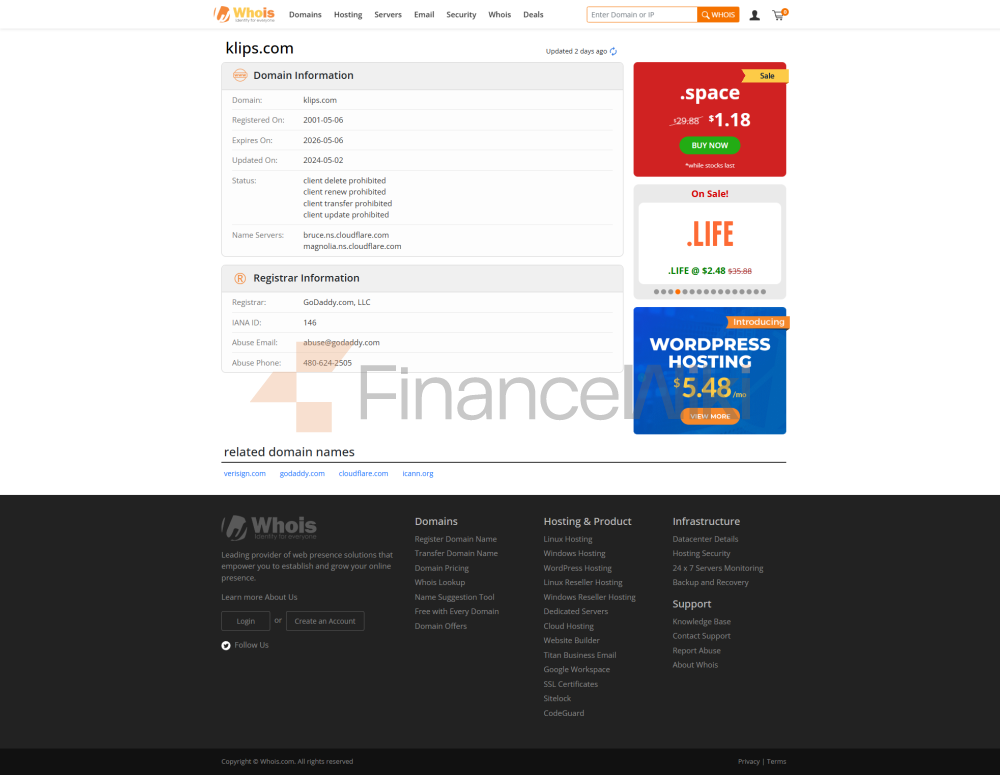

Klips Is A Regulated Financial Services Provider Established In 2014 And Headquartered In Cyprus. As An International Financial Institution Group, Klips Provides Clients With A Diverse Range Of Trading Tools And Educational Resources Through Its Mobile App . Klips' Core Business Covers Trading Services For Currencies, Commodities, Indices And Stocks And Helps Clients Improve Their Trading Skills Through Demo Accounts.

Klips' Signature Advantage Is Its No-commission Fee Model , While Offering A Variety Of Payment Methods , Including VISA, Mastercard, Maestro, SEPA And Telegraphic Transfer. Although Klips Has Certain Limitations In Terms Of Detailed Information On Trading Conditions, Its Compliance With CySEC And FSCA Ensures The Protection Of Investors' Rights And Interests.

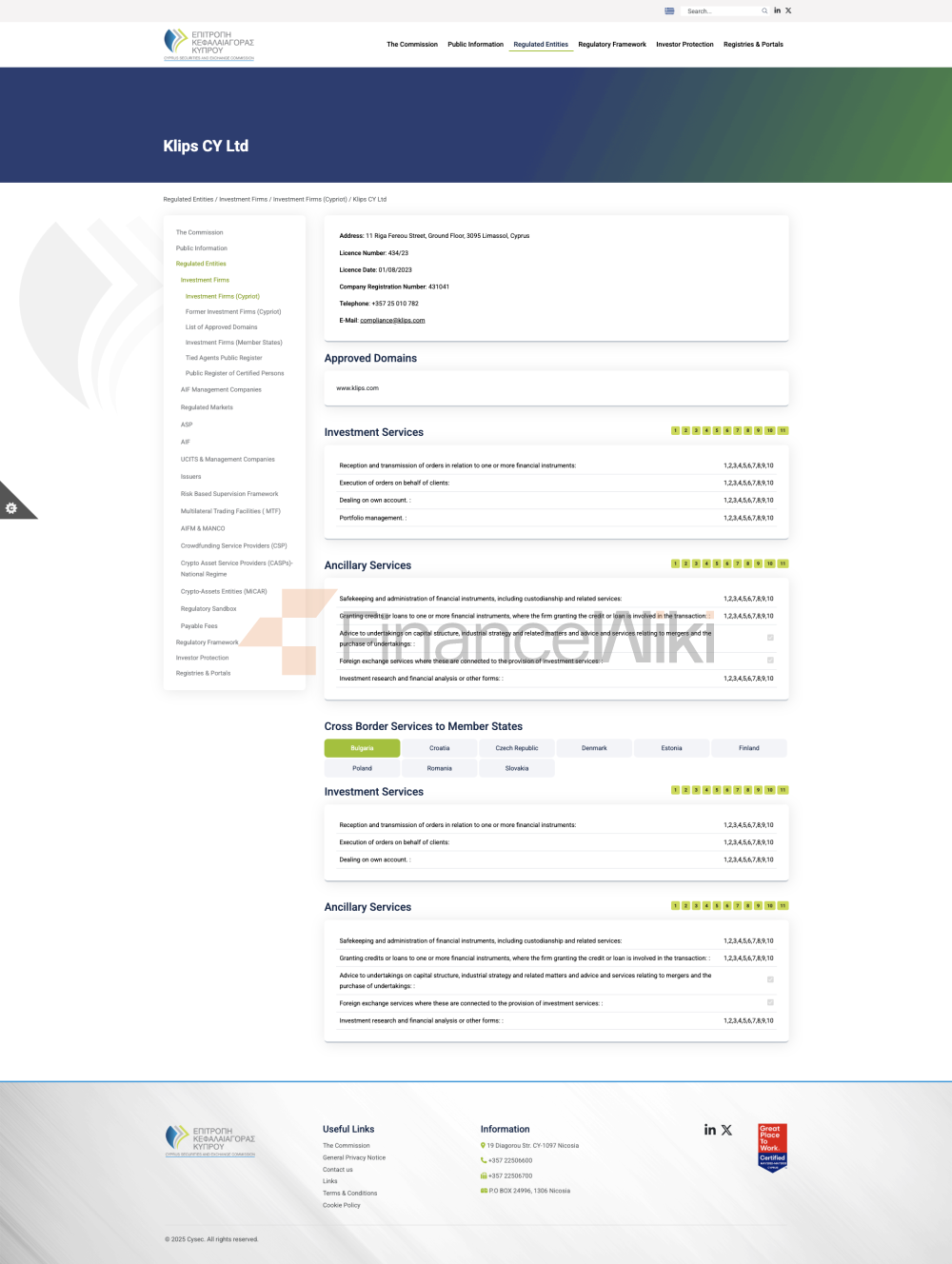

Regulatory Information

Klips Is Regulated By Cyprus Securities And Exchange Commission (CySEC) And Financial Conduct Authority (FSCA) , Which Is A Key Guarantee Of The Legitimacy And Transparency Of Its Operations. The Following Are The Regulatory Details For Klips:

Regulatory Country

Current Status

Regulatory Authority

Regulatory Entity

License Type

License Number

Cyprus

Regulated

Cyprus Securities And Exchange Commission (CySEC)

Klips CY Limited

Market Maker (MM)

434/23

South Africa

Already Regulation

Financial Conduct Authority (FSCA)

KLIPS SA (PTY) LTD

Retail Forex License

47742

Klips Ensures That Its Operations Comply With International Financial Marekt Norms Through Strict Regulatory Standards And Compliance Measures, Providing Investors With A Safe And Reliable Trading Environment.

Trading Products

Klips Offers A Diverse Range Of Financial Products, Covering The Following Asset Classes:

- Currencies: Includes Major Currency Pairs (e.g. EUR/USD, GBP/USD, Etc.) As Well As Minor And Exotic Currency Pairs, Catering To The Diverse Needs Of Different Traders.

- Commodities: Offers Trading Opportunities In Commodities Such As Brent Crude Oil, Gold And Silver, Helping Investors Hedge Against The Risk Of Economic Fluctuations.

- Indices: Covers Major Stock Market Indices Such As Dow Jones, S & P 500, Etc., Enabling Clients To Speculate On Global Economic Trends.

- Stocks: Offers Stock Trading Of Well-known Companies Such As Amazon, Enabling Investors To Directly Participate In The Performance Of Individual Stocks.

Klips' Trading Products Are Designed To Provide Clients With A Wide Range Of Market Participation Opportunities, But Currently Does Not Support Cryptocurrency Trading .

Trading Software

Klips Offers Trading Services Through Its Official Mobile App , Which Supports IOS And Android Systems . The App Provides An Intuitive User Interface And A Variety Of Trading Tools, Including Real-time Market Data, Chart Analysis And Trading Signals. Although Klips' App Is Feature-rich, Currently Does Not Support Traditional Trading Platforms Such As MT4 And MT5 , Which May Be Limited For Some Experienced Traders.

Deposit And Withdrawal Methods

Klips Offers Customers A Variety Of Convenient Deposit And Withdrawal Methods, Including:

- Credit And Debit Cards: Supports Major Payment Methods Such As VISA, Mastercard, And Maestro.

- Bank Transfer: Offers SEPA And Telegraphic Transfer Services For Customers Who Require Direct Bank Transfers.

Klips' Payment Methods Are Designed To Meet The Diverse Needs Of Customers, But Currently Does Not Support Cryptocurrency Or Other Digital Payment Methods .

Customer Support

Klips Provides Customer Support Services Through Social Media Channels , Including Platforms Such As Twitter, Facebook, Instagram, YouTube, And LinkedIn. Customers Can Connect With Klips' Support Team Through These Channels For Assistance Related To Account Management, Trading, And Technical Issues. Although Klips' Customer Support Channels Are Extensive, The Lack Of Live Chat Or Phone Support May Cause Inconvenience To Some Customers.

Core Business & Services

Klips' Core Business Includes:

- Market Making (MM) Services: As A Market Maker, Klips Provides Clients With Real-time Quotes And Liquidity Support.

- Demo Account: Offers A Free Demo Trading Account That Allows Newbies To Practice Trading Strategies In A Risk-free Environment.

- Educational Resources: Offers A Wealth Of Educational Content Through Klips Academy, Covering Topics Such As Trading Fundamentals, Advanced Strategies, And Risk Management.

- Trading Signals: Offers Free Trading Signals And Alerts To Help Clients Capture Market Opportunities In A Timely Manner.

Klips' Core Service Is Designed To Provide Customers With Comprehensive Trading Support, But Its Regional Restrictions (such As The United States, The United Kingdom And Other Countries Cannot Be Used) May Affect Some Potential Customers.

Technical Infrastructure

Klips' Technical Infrastructure Includes The Following Aspects:

- Trading Platform: Provides An Efficient And Stable Trading Environment Through Its Mobile Application, Supporting Multiple Devices And Operating Systems.

- Risk Management Tools: Provides Stop Loss And Limit Order Functions To Help Customers Effectively Control Trading Risks.

- Market Data: Provides Real-time Market Data And Analytical Tools.

Although Klips' Technical Infrastructure Is Functionally Comprehensive, The Details Of Its Trading Conditions (such As Spreads And Leverage) Are Not Yet Publicly Available, Which May Cause Distress To Some Professional Traders.

Compliance And Risk Control System

Klips Ensures The Compliance Of Its Operations And The Effectiveness Of Risk Management Through The Following Measures:

- Regulatory Compliance: Strictly Follow The Regulatory Requirements Of CySEC And FSCA To Ensure The Protection Of Investors' Rights And Interests.

- Risk Management System: Provides Stop Loss And Limit Order Functions To Help Clients Control Trading Risks.

- Client Protection Mechanism: Ensures The Safety Of Client Funds Through A Regulated Account System And Fund Separation Policy.

Market Positioning And Competitive Advantage

Klips Is Positioned In The Market As A Regulated, User-friendly Financial Services Provider . Its Core Competitive Advantages Include:

- Regulated Security: Ensures The Legitimate Rights And Interests Of Investors Through The Regulation Of CySEC And FSCA.

- Commission-free Fee Model: Provide Free Trading Services And Reduce Trading Costs For Clients.

- User-friendly Trading Platform: Enhance The Trading Experience For Clients Through An Intuitive Mobile Application Interface.

- Abundance Of Educational Resources: Provide Rich Educational Content To Help Newbies Improve Their Trading Skills.

However, Klips Also Has Obvious Competitive Disadvantages, Including Regional Restrictions , Limited Information On Trading Conditions And Lack Of MT4/5 Support , Etc.

Customer Support And Empowering

Klips Empowers Its Clients By:

- Educational Resources: Providing A Wealth Of Educational Content Through Klips Academy Covering Basic To Advanced Trading Knowledge To Help Clients Improve Their Trading Abilities.

- Demo Account: Providing A Free Demo Trading Account That Allows Clients To Practice Trading Strategies In A Risk-free Environment.

- Trading Signals: Providing Free Trading Signals And Alerts To Help Clients Capture Market Opportunities In A Timely Manner.

Although Klips' Customer Support And Empowerment Services Are Comprehensive, The Limitations Of Its Customer Support Channel (such As Lack Of Live Chat Support) May Cause Inconvenience To Some Customers.

Social Responsibility And ESG

As Of Now, Klips Has Not Clearly Stated Its Practices And Goals In Social Responsibility (SR), Environment (E), Society (S), Corporate Governance (G) In Its Official Channels. However, As A Regulated Financial Services Provider, Klips' Basic Operating Model Complies With The Norms Of International Financial Marekt, Providing A Safe Trading Environment For Investors.

Strategic Collaboration Ecosystem

Klips Has Established Partnerships With Multiple Institutions And Platforms, Including Its Regulators CySEC And FSCA, As Well As Other Financial Services Providers. These Partnerships Are Designed To Enhance Klips' Operational Efficiency And Market Presence.

Financial Health

Although Klips Does Not Disclose Its Detailed Financial Data, Its Regulated Operating Model And Market Performance Indicate That It Has Good Financial Health. Klips Ensures Its Long-term Stable Operation In The Market Through Strict Regulatory Compliance And Customer Protection Mechanisms.

Future Roadmap

Klips Plans To Continue To Expand Its Products And Services In The Future To Meet The Needs Of More Customers. These Plans Include:

- Enrichment Of Trading Products: Consider Adding Trading Services In More Asset Classes, Such As Cryptocurrencies And ETFs.

- Enhance Technology Infrastructure: Optimize The Functionality Of Its Trading Platform And Enhance The User Experience.

- Extend Market Coverage: Gradually Open Services In More Countries And Regions To Expand Its Global Reach.

Klips' Future Roadmap Aims To Further Strengthen Its Position In International Financial Marekts Through Continuous Product And Service Optimization.