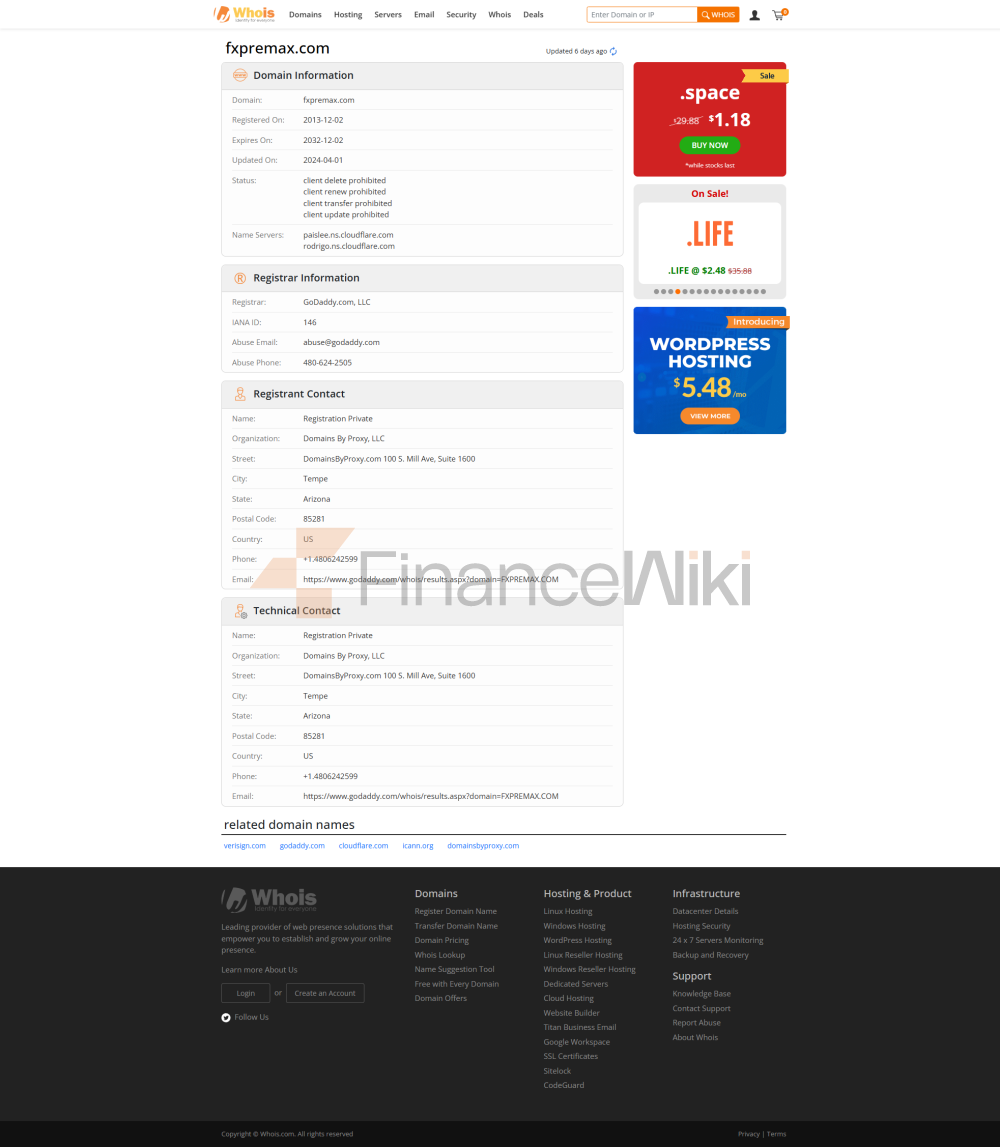

Corporate Profile

FXPremax Is A Forex Broker Owned By Premnax Capital Ltd . It Claims To Be Headquartered In London, UK, But No Specific Office Address Has Been Found. The Company Mainly Provides Trading Services For Financial Products Such As Foreign Exchange, Contracts For Difference (CFD) To Global Investors. Although The Company Does Not Provide A Detailed Establishment Time, It Is Committed To Providing Diverse Trading Tools And Account Options For Different Types Of Traders From The Services And Products It Provides.

Regulatory Information

FXPremax Does Not Currently Have Any Form Of Regulation. This Means That The Company Is Not Overseen And Regulated By Regulators During Its Operations, And Traders Should Exercise Extra Caution When Choosing The Platform. Unregulated Brokers Often Attract Traders Looking For High Leverage And Flexible Trading Conditions, But This Can Also Come With Higher Risks, Especially The Lack Of Investor Protection Mechanisms.

Trading Products

FXPremax Offers 70 Tradable Instruments , Including Contracts For Difference (CFDs) On Forex, Spot Oil, Metals And Major Indices. This Offers Traders A Wide Range Of Options To Diversify Their Investments Across Different Market Conditions.

Leverage

When It Comes To Forex Trading, FXPremax Offers Leverage Of Up To 1:1000 , Which Is The Higher Level Of Leverage In The Industry. High Leverage Can Amplify Potential Gains, But It Can Also Amplify Latent Risk. Therefore, It Is Crucial For Traders To Choose The Right Level Of Leverage, Especially For Investors With Lower Risk Tolerance.

Spreads And Commissions

FXPremax's ECN Account Offers 0 Spreads With A Commission Of 0.005% Of The Volume. These Fee Structures May Be Attractive To Investors Looking For Low-cost Trades, But Traders Still Need To Consider Other Potential Costs Such As The Impact Of Spread Fluctuations And Market Liquidity.

Trading Platform

FXPremax Offers Traders The Desktop Version Of The Trading Platform For MT4. MT4 Is One Of The Most Popular Platforms In Forex Trading And Is Known For Its Powerful Features And Wide Range Of Technical Indicators. However, Support For The Desktop Version Only May Be A Limitation For Mobile Traders.

Deposit And Withdrawal

FXPremax Supports A Variety Of Deposit And Withdrawal Methods, Including International Bank Transfers And Online Payment Methods (such As Neteller, Skrill, OKPay, UnionPay, And FasaPay). These Methods Provide A High Degree Of Convenience And Variety, Capable Of Meeting The Payment Needs Of Different Traders.

Customer Support

FXPremax Provides Customer Support Via Phone, Email, Contact Form, And Social Media Platforms Such As Facebook, Twitter, Instagram, Etc. This Multi-channel Support Method Helps Traders Solve Problems Quickly, But The Quality Of Service May Vary From Platform To Platform.

Advantages And Disadvantages

The Advantages Of FXPremax Include:

- Four Account Types Are Available : Including Micro STP, Standard Fixed, Standard STP And ECN Accounts To Meet The Needs Of Different Traders.

- Multiple Deposit And Withdrawal Methods : Supports A Variety Of Payment Methods, Providing High Flexibility.

Disadvantages Of FXPremax Include:

- Not Subject To Any Regulation : This May Increase The Risk For Investors, Especially The Lack Of Protection Mechanisms In Case Of Disputes.

- Only MT4 Desktop Version Is Supported : Mobile Traders May Not Have Access To A Convenient Trading Experience.

- Relatively High Spreads And Commissions : While ECN Accounts Offer Lower Fees, Other Accounts May Have Higher Fees.

- Does Not Accept US Clients : This Limits Its Pool Of Potential Clients.

Summary

FXPremax Offers Traders A Variety Of Trading Tools And Flexible Trading Conditions, But Lack Of Regulation May Be A Major Risk. Traders Should Fully Understand Its Advantages And Disadvantages When Choosing This Platform And Make An Informed Choice Based On Their Trading Needs And Risk Tolerance.