After Detailed Inquiry:

NPBFX Ltd., Which Claims To Have Been Established In 1996, Has Been In Business For More Than 15 Years. The Broker Has Offices On Multiple Continents,

And Offices In The UK, Belize And Russia, Acting As An Intermediary Between Clients And Liquidity Providers. NPBFX Is Registered In Saint Vincent And The Grenadines And Is Not Regulated At This Stage.

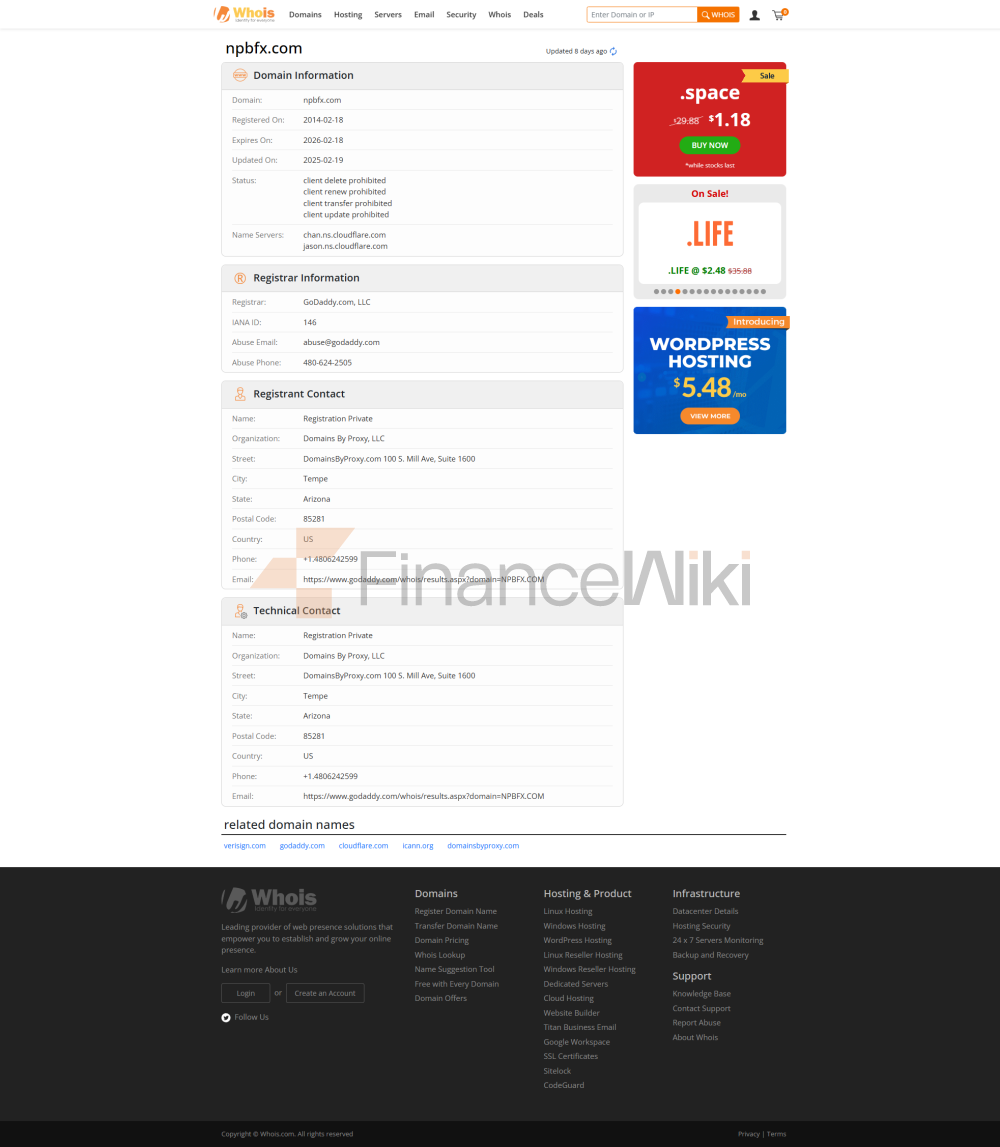

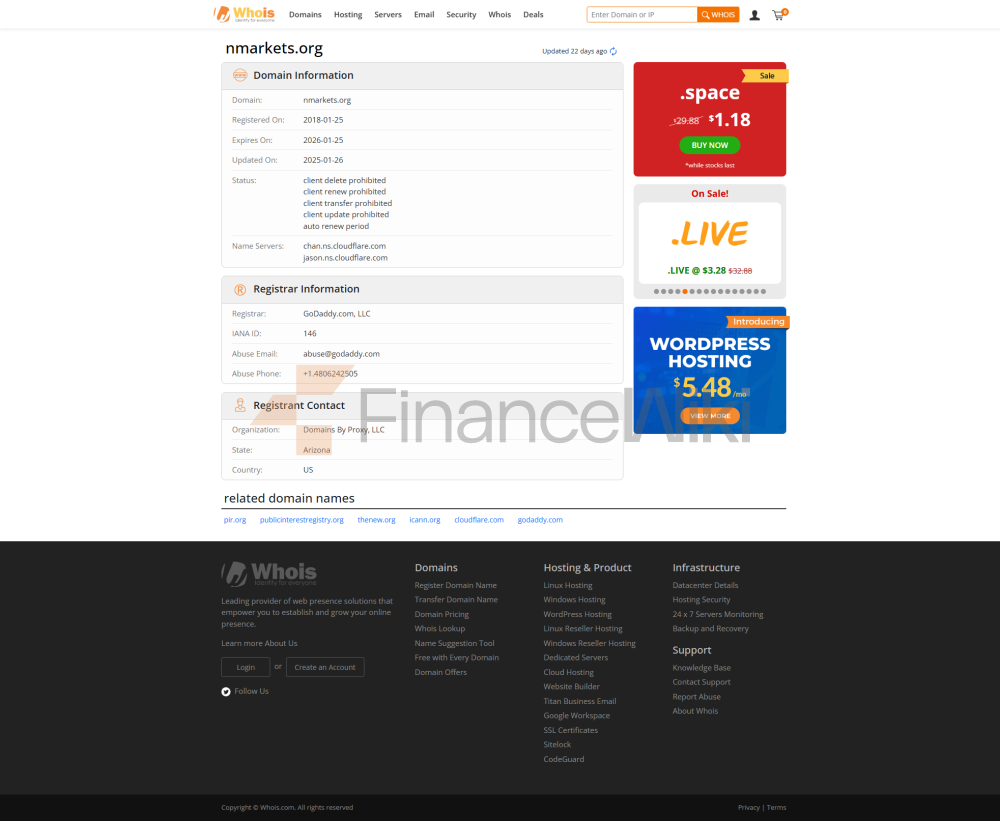

Query By Whois Domain Name The Company's Two Domain Names Were Registered On January 25, 2018 And February 18, 2014 Respectively.

NPBFX Is An Unregulated Broker. Unregulated Brokers, Such As NPBFX, Lack Oversight From Financial Regulators, Raising Concerns About The Safety Of Client Funds And The Fairness Of The Trading Environment.

Unlike Regulated Brokers That Adhere To Strict Guidelines And Offer Protections Such As Segregation Of Funds And Auditing, Unregulated Brokers May Not Adhere To These Standards. Lack Of Regulation May Lead To Higher Risks, Including Potential Fraud Or Client Loss In Capital.

Traders Considering An Unregulated Broker Should Carefully Study Its Reputation And Consider The Limited Recourse Available In The Event Of A Dispute. Many Traders Prefer The Security And Transparency Offered By A Regulated Broker.

Pros And Cons

NPBFX, Like Any Broker, Has Its Pros And Cons. Traders Should Carefully Consider These Factors NPBFX When Deciding Whether To Trade.

Pros Cons Offers A Variety Of Market Instruments, Including Currency Pairs, Gold, Silver, And Commodities. NPBFX Is An Unregulated Broker That Lacks Oversight From Financial Regulators, Which May Raise Security Concerns For Traders. Offers A Tier 3 Trading Account Option That Caters To Different Trading Preferences And Experience Levels. Educational Resources, Including Demo Accounts And Trading Strategies, Are Somewhat Limited And May Limit The Trader's Learning Experience. Supports The Popular MetaTrader 4 (MT4) Trading Platform, Which Is Known For Its Powerful Features And User-friendliness. The Level Of Customer Support May Vary, And Traders May Encounter Limitations In The Quality Of Support And Responsiveness. Offers Different Levels Of Leverage Depending On The Selected Account Type, Providing Flexibility For Different Risk Tolerances. Traders Are Choosing An Unregulated Broker (e.g. NPBFX, As It Lacks The Security Measures And Transparency Associated With Regulated Brokers. Offers Multiple Deposit And Withdrawal Methods, And Funds Management Is Convenient And Flexible. Spreads And Commissions May Vary Depending On The Type Of Trading Account, And Traders Should Carefully Review The Cost Structure Before Trading.NPBFX Offers Leveraged Trading On A Range Of Financial Marekts:

- Forex - 38 Global Currency Pairs With Dynamic Market Spreads

- Indices - Trading On 11 Major Stock Exchanges Including S & P And Dax

- Stocks And ETFs - Investing In A Long List Of Stocks Of Major International Companies

- Energy - Buying And Selling Oil In USD

- Cryptos - Trading 5 Leading Cryptocurrencies

NPBFX Offers A Total Of Three Types Of Trading Accounts: Master Account, Expert Account And VIP Account. The Basic Requirements For Opening A Basic Or Master Account Are $10/€10/500 Rubles.

NPBFX Offers Traders A Diverse Range Of Account Types To Suit Different Trading Preferences And Experience Levels. These Three-tier Trading Account Options (called Guru, Expert, And VIP) Offer Different Features And Conditions To Suit The Individual Needs Of Traders. In Addition, NPBFX Also Offers Demo Accounts For Those Who Want To Practice Their Trading Skills Without Risking Real Capital.

Master Account:

Master Account Is Designed For Traders Seeking The Highest Level Of Leverage And A Flexible Trading Environment. With Leverage Up To 1:1000, Traders Can Control Positions That Are Larger Relative To Their Capital. This Account Type Is Suitable For Traders Who Are Willing To Take On A Higher Level Of Risk And Want To Maximize Potential Returns. The Minimum Deposit Requirement For The Main Account Is $10 And Is Available To A Wide Range Of Traders. This Account Is Ideal For Those Who Enjoy Market Execution And Automated Trading With Expert Advisor.

Expert Account:

Expert Account Strikes A Balance Between Leverage And Risk. It Offers Leverage Of Up To 1:200 And Is Suitable For Traders Who Want A Reasonable Level Of Leverage But Do Not Want To Have Extreme Situations In The Main Account. The Minimum Deposit Requirement For The Expert Account Is $5,000, Which Provides More Substantial Trading Funds Than The Main Account. Traders Can Also Trade Automatically Through The Expert Advisor And Enjoy The Benefits Of Scalping And High-frequency Trading.

VIP Account:

The VIP Account Is Tailored For Experienced High Net Worth Traders Who Prioritize Risk Management And Stability. It Offers Leverage Of Up To 1:200, Similar To The Expert Account But With A Stricter Minimum Deposit Requirement Of $50,000. This Account Type Is Ideal For Those Who Enjoy Market Execution And Appreciate The Advantages Of Scalping And High-frequency Trading. VIP Account Holders Can Enjoy The Support Of Dow Jones Newsfeed And Benefit From Telephone Trading Services.

Demo Account:

NPBFX Also Offers Traders Demo Accounts As A Risk-free Environment To Practice And Test Trading Strategies. Traders Can Access Virtual Funds And Experience Real Market Conditions Without The Fear Of Losing Real Money. This Account Type Is Invaluable For Beginners Who Want To Gain Confidence And Learn Trading Secrets Before Transitioning To A Real Account.

Leverage

Trading Leverage Varies Depending On The Particular Trading Account. Maximum Leverage Level Offered For NPBFX Forex Trading Up To 1000:1. Leverage Amplifies The Returns From Favorable Movements In Currency Exchange Rates. It Is Important For Forex Traders To Understand How To Manage Leverage And Adopt Risk Management Strategies To Mitigate Forex Losses.

NPBFX Offers Different Levels Of Leverage Depending On The Type Of Trading Account. Here Is A Description Of The Leverage Provided NPBFX:

- Main Account: Leverage Up To 1:1000.

- Expert Account: Leverage Up To 1:200.

- VIP Account: Leverage Up To 1:200.

Leverage Allows Traders To Control Larger Positions With Relatively Small Amounts Of Money. In The Case Of NPBFX, Traders With A Master Account Can Get Maximum Leverage, Up To 1:1000, Which Means They Can Control Position Sizes Up To 1000 Times Their Capital Amount. Expert And VIP Account Holders Have Slightly Lower Leverage, Up To 1:200.

It Is Important To Note That While High Leverage Can Amplify Potential Profits, It Can Also Significantly Increase The Risk Of Loss. Traders Should Use Leverage Cautiously And Implement Appropriate Risk Management Strategies To Protect Their Capital. Different Account Types Offer Different Levels Of Leverage To Meet Traders' Different Risk Tolerance And Experience Levels.

Spreads And Commissions

NPBFX Does Not Charge Trading Commissions. Instead, NPBFX Makes Money Through Spreads. Spreads For Expert Accounts And VIP Accounts, The Average Spreads For Major Forex Pairs Are 1.0 Pips And 0.8 Pips Respectively. In Comparison, The Average Spreads For Major Currency Pairs (e.g. EUR/USD Currency Pairs) Offered By Standard Master Accounts Are 1.2 Pips.

Available Trading Platforms

When It Comes To Trading Platforms, NPBFX Offers Its Clients Three Trading Platforms: Metatrader 4 (mt4) As A Desktop, Web, And Mobile Device Application, Social/copy Trading Platform Zulutrade, And Automated Trading Platform Myfxbook Autotrade.

MetaTrader 4 (MT4) Is A Well-known Trading Platform, Known For Its Powerful Features And User-friendly Interface. MT4 Charts Display Buy Quotes, Which Represent The Market Price At Which An Asset Can Be Sold. Traders Can Customize Charts, Add Indicators, And Access Real-time And Historical Data For Different Timeframes. MT4 Offers One-click Trading, A Vast Library Of Indicators, Compatibility With Multiple Devices, And Support For Algorithmic Trading Via Expert Advisors (EAs). Security Measures Protect Data And Trades. In Summary, MT4 Provides Traders With A Versatile Platform To Analyze Price Movements And Execute Trades Efficiently.

Deposit Method:

- Credit Card: NPBFX May Accept Deposits Via Credit Card. Traders Can Use Major Credit Cards To Fund Their Trading Accounts, Making It A Convenient And Widely Used Payment Method.

- E-wallets: E-wallets, Such As Paypal, Skrill, Or Neteller, Are Generally Accepted By Brokers, Such As NPBFX. These Digital Payment Methods Provide Fast, Secure Transactions To Deposit Funds Into Trading Accounts.

- Inter-bank Transfers (swift): NPBFX Can Facilitate Deposits Via Inter-bank Transfers Using The Swift System. This Method Is Suitable For Larger Deposits And International Transactions, Making It Accessible To Traders Around The World.

Withdrawal Methods:

Withdrawals From NPBFX Accounts Are Usually Processed Through The Same Method As Deposits. Here Is How Withdrawals Are Generally Processed:

- Credit Card: Profits And Remaining Balances Can Be Withdrawn Back To The Credit Card Used For The Deposit. This Is A Common Practice For Traders Who Deposit Funds Via Credit Card.

- E-Wallet: For Traders Who Deposit Using An E-wallet, Withdrawals Are Usually Processed To The Same Wallet Account. This Provides A Convenient And Quick Way To Access Funds.

- Interbank Transfer (SWIFT): Large Withdrawals Or International Transfers Can Be Conveniently Made Via Interbank Transfer Using The SWIFT System. This Method Ensures The Safe And Efficient Transfer Of Funds To The Trader's Designated Bank Account.

It Is Important To Note That While NPBFX Does Not Charge Commissions For Deposits And Withdrawals Transactions, Certain Payment Methods May Incur Associated Fees. In Addition, The Time Required To Process Withdrawals May Vary Depending On The Method Chosen And The Processing Time Of The Broker.

NPBFX Offers Traders Several Ways To Obtain Customer Support:

- Personal Manager: After Registering For The Personal Office, Traders Receive The Contact Details Of The Personal Manager For Personalized Assistance.

- Online Advisor: The Online Chat Service Allows Traders To Ask Questions And Get Quick Answers To Frequently Asked Questions Or Request Feedback From The Personal Manager.

- Email Support: NPBFX Provides Dedicated Email Addresses For Payment-related Inquiries (client.payments @NPBFX.com) And Trade-related Questions (client.trading @NPBFX.com).

- Telephone Support: Traders Can Access 24/7 International Customer Support And Trade By Phone By Calling + 44 800 069-84-70.

These Diverse Support Channels Ensure Traders Can Get Help With All Aspects Of The Trading Experience, From General Inquiries To Specific Trade And Payment-related Questions.

Educational Resources

The Education Section On A Broker's Platform Is An Important Resource For Traders Looking To Improve Their Skills And Knowledge. It Usually Includes A Demo Account For Practice As Well As Information About Various Trading Strategies. However, The Limited Educational Content Can Be A Challenge As It May Not Cover A Wide Range Of Topics Or Cater To Different Skill Levels. To Improve This Section, Brokers Should Consider Expanding The Content To Provide Personalized Content For Different Traders, Provide Regular Updates, And Provide Live Webinars For Real-time Insights And Interaction. A Strong Education Section Benefits Traders By Providing Them With The Knowledge To Make Informed Decisions, And Brokers By Developing Traders' Abilities.

SUMMARY

NPBFX Is An Unregulated Broker, Which May Raise Concerns About The Safety And Fairness Of Client Funds. They Offer A Variety Of Market Instruments, Including Currency Pairs, Gold, Silver, And Commodities. Traders Can Choose From Three Account Types: Master, Expert, And VIP, As Well As A Demo Account For Practice.

NPBFX Offers Different Leverage Levels Depending On The Selected Account Type And Discloses Details About Spreads And Commissions. They Support Multiple Deposit And Withdrawal Methods.

This Broker Uses The MetaTrader 4 Platform, Which Is Known For Its Functionality And User-friendliness. Client Support Is Available Through A Personal Manager, Online Advisor, Email And Phone.

The Education Section Includes Demo Accounts And Trading Strategy Information, Although It May Be Limited. Traders Should Exercise Caution Due To Lack Of Regulation.