🏢 Company Overview

Carrick Just Capital Markets Ltd (hereinafter referred to as CJC MARKETS) was originally a foreign exchange and CFD trading platform registered in New Zealand, and previously held registration information in Saint Vincent and the Grenadines (SVG). The company initially provided global trading services through cjcmarkets.com, covering Asia, Oceania, Africa, and other regions. Founded in 2012, the company has historically operated in Australia, New Zealand, Canada, Nigeria and other countries.

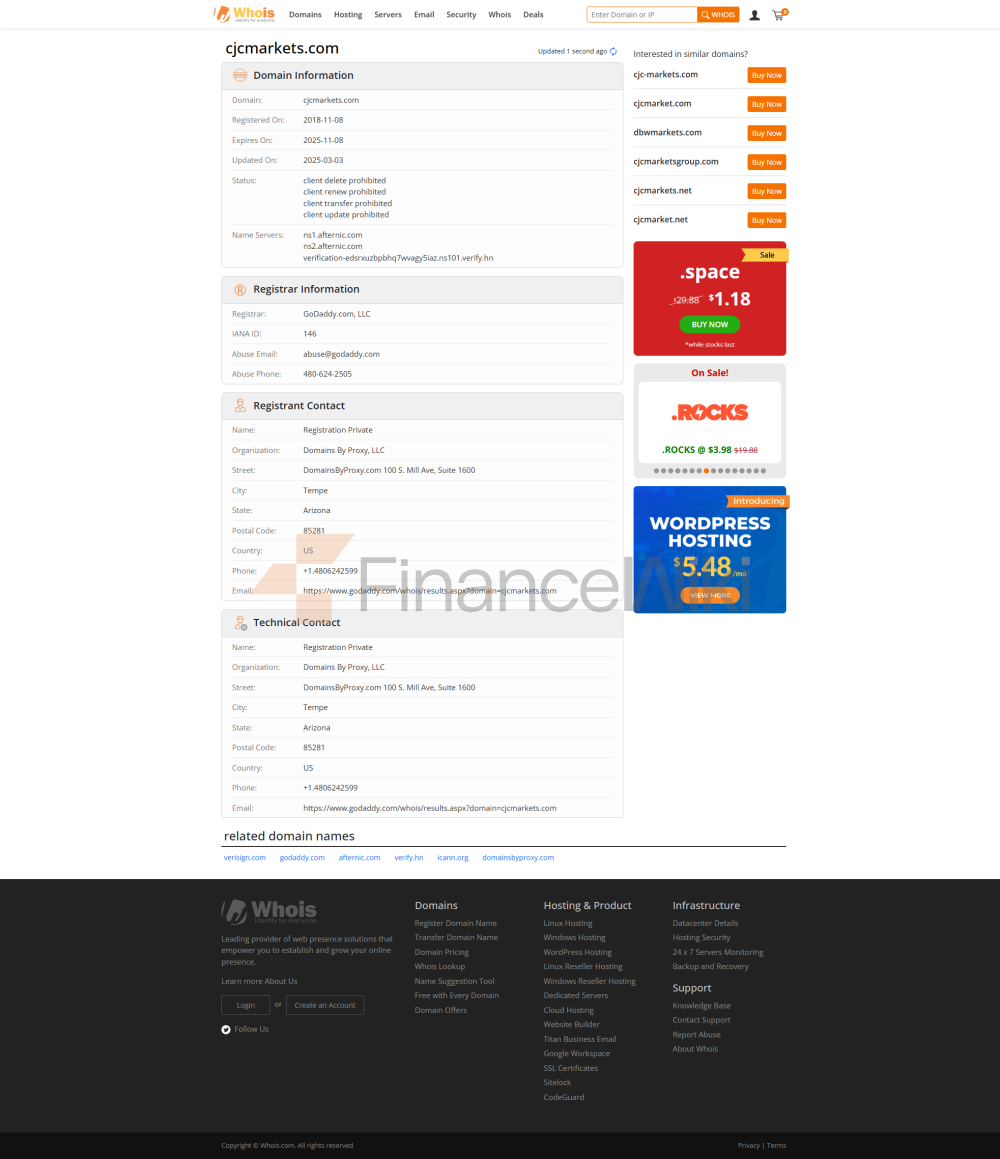

According to the latest verification in 2025, CJC Markets has completely ceased operation, its original official website domain name (cjcmarkets.com / cjcmarketsglobal.com) is now on sale or invalid, and the global platform function has been taken offline.

🧱 Basic information

Full name of the company: Carrick Just Capital Markets Limited

Date of Establishment: 2012

Country of Registration: New Zealand (Auckland)

English Headquarters Address: Auckland, New Zealand (defunct)

Company nature: Private Entity

Parent Company: Carrick Just Capital Markets LtdSubsidiary

: Registered subsidiary in Nigeria (liquidated)

Business Status: Terminated, the original official website domain name shows "Selling".

🏷️ company classification

Enterprise type: foreign exchange and contract for difference (CFD) trading platformBusiness

model: retail traders, customer groups who have used the NDD model

: retail users, IB agents, and some institutional accounts

🌍 Market segment

Business area: many places around the world (terminated)

Key areas: New Zealand, Nigeria, Australia, Southeast Asia, the Middle East, etcService

status: All websites have been offline, business has been terminated, and the Nigerian branch has been forced to liquidate

💼 Service content

CJC Markets used to provide the following services (now discontinued):

Retail Forex

TradingCFD Trading: Including Stocks, Indices, Precious Metals, Crude Oil

Multi Account Management System (PAMM, MAM)

Automated Trading (EA Supported)

Educational Content and IB Partnership Program

🛡️ Regulatory information

At present, there is no valid regulatory status, and the original claimed license information is as follows (most of which have been denied or cancelled by the regulator):

New Zealand FMA

Type: Derivatives Issuer License Status

: No valid disclosure, not on the FMA's current licensing list

Regulatoryeffective time: It was around 2017, and it is no longer available

Australia ASIC

Claim Regulatory Number: AFSL 001282580 / 517661

Status: ASIC Official Website Unable to Confirm; Multiple regulatory inquiry platforms warn of "suspicious cloning licenses"

in Saint Vincent and the Grenadines FSA

Registration Number: 25455-IBC-2019

Status: FSA does not regulate Forex/CFDs, only registration

Regulatory Effective Date: 2019

Nigeria Corporate Affairs Commission (CAC)

Status: In May 2025, the company was ruled by the Federal High Court of Nigeria to be an illegal financial entity and has ordered the mandatory deregistration of its

company registration

💱 Trading Products

The main trading varieties originally offered by the platform (all are no longer available):

Forex: Major/Minor/Exotic Currency

PairsCFDs on Stocks and Indices

Commodities: Gold, Silver, Crude Oil

Crypto assets: such as BTC, ETH (in CFD form)

💻 Trading Software

Platform: MetaTrader 4 (MT4)

Support Functions: EA Automated Trading, Charting Tools, Multi-Device Access

Platform Status: MT4 server is currently unable to connect, cannot open an account or log in

💳 deposit and withdrawal methods

Deposit method: wire transfer (wire transfer) is the main channel

withdrawal method: wire transfer

current status: there is no official service channel, the user's account funds cannot be withdrawn, and a large number of complaints are concentrated in the freezing

of funds

☎️ customer support

Customer service channels: Telephone, email, online form, Facebook, LinkedInSupport

language: Chinese, English, Korean, Persian, Vietnamese,

etc.Current status: All customer service has been suspended, contact information is not availableUser

feedback: Some customers said that customer service disappeared, account was banned, account frozen, and communication was

interrupted

🔐 compliance and risk control system

It has claimed that there is

alack of transparency and risk protection measures

such as the adoption of a No Dealing Desk (NDD) model, failure to disclose third-party audits, segregated accounts for customer funds, and compliance risk control policies

>

🖥️ technical infrastructure

Relying on the MT4 platform, there is no self-developed system,

no public back-end clearing structure or custody mechanism disclosure

,and there is no accessible system or terminal

📈 Market Positioning & Competitive Advantage

Historically, it has been marketed with the following advantages:

Multi-language support, international customer service team,

ECN/STP trading mode

,multiple account types and low spreads

At present, there is no actual business development, the so-called advantages are invalid, and user feedback is mostly focused on withdrawal difficulties and account freezing

💬 Customer Support & Enablement

Educational

Courses, Webinars, IB Rebate ProgramsAll

current customer education and support programs have been terminated, and there has

been no update

on social media for a long time

🌱 Social Responsibility and ESG

No record of ESG or CSR content disclosure or public welfare activities

🤝 Strategic Cooperation Ecology

There is no clear cooperative institution, bank or financial partner to disclose

thatit has claimed to have representative offices or branches in many countries, but most of them are IB cooperative agency channels

💰 Financial health

No annual report, Financial statements, capital information disclosure,

and a number of third-party review websites have been marked as "risk institutions" or "lost contact platforms",

and there are no external credit ratings

🚧 future roadmap

The official website and all platforms have been terminated

,and there is no public development plan or new business layout

, and there is no sign of resumption, rectification or restart

;

✅ Summary of conclusions

As of June 2025, CJC MARKETS has completely ceased operations, the regulatory status of various countries has lapsed, domain names have been put up for sale, and Nigeria has been forcibly deregistered by the courts. Its platform functions, customer service channels, and user funds cannot be recovered, and it is recommended that users carry out asset recovery operations through the legal or payment system appeal mechanism as soon as possible.