Corporate Profile

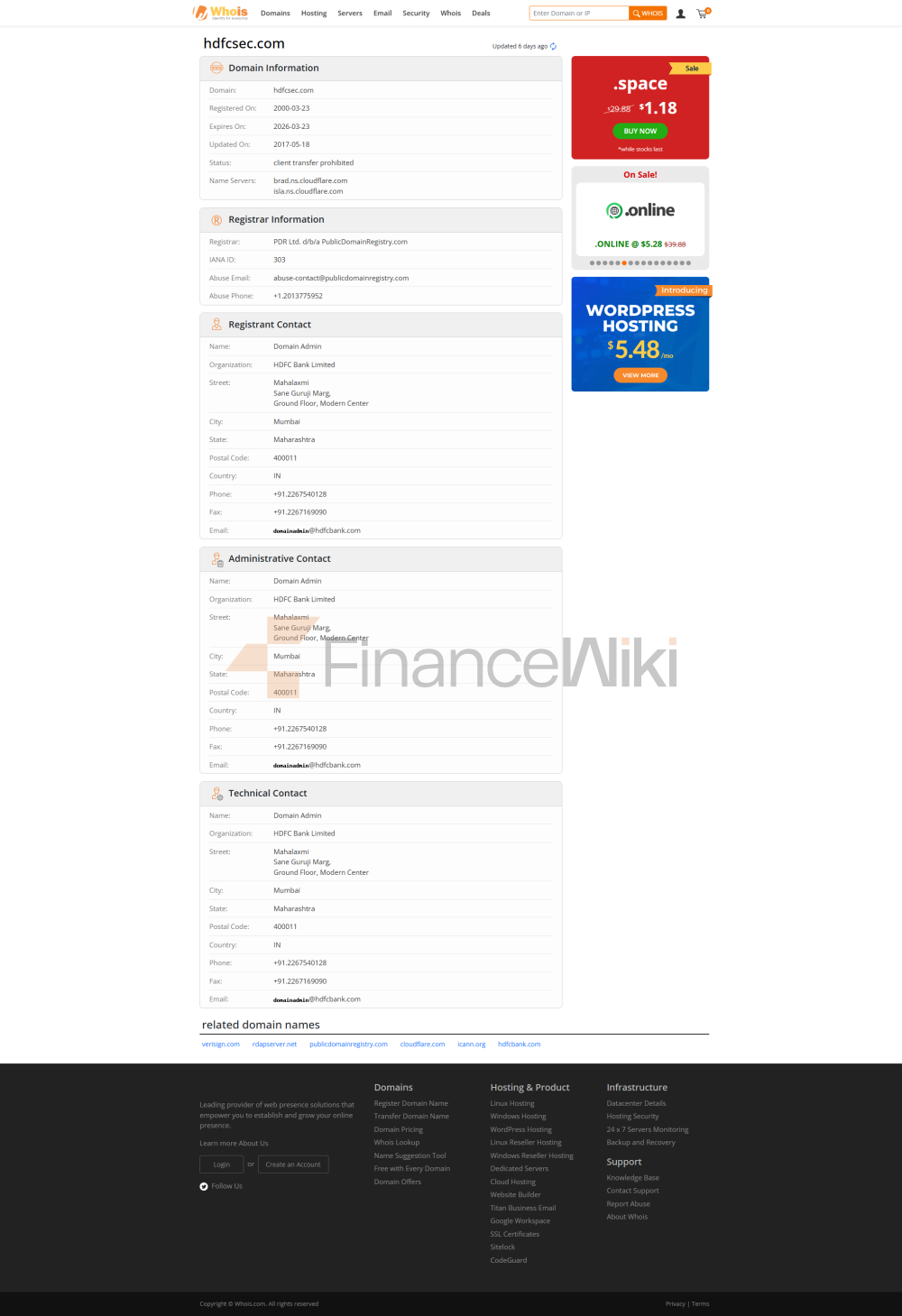

HDFC Securities Ltd. Is One Of The Leading Stock Brokerage Companies In India And A Subsidiary Of HDFC Bank, A Well-known Private Bank In India. The Company Was Established In 2000 And Is Headquartered In Mumbai, India. As A Leading Financial Services Provider, HDFC Securities Occupies An Important Position In The Indian Securities Market, Providing A Wide Range Of Financial Products And Services To Individual And Institutional Investors.

HDFC Securities Ltd. 'core Business Covers Equity Trading, Derivatives, Mutual Funds, Fixed Income Products, Insurance And Other Financial Services. As Of 2023 , The Company Has Served Millions Of Investors Through Its Professional Team, Advanced Technology Platform And Extensive Distribution Network.

Regulatory Information

HDFC Securities Ltd. Is A Securities Broker Registered With The Securities Supervision Commission Of India (SEBI) And Holds A Multi-class License (MCX ) Issued By SEBI. The Company Strictly Complies With The Laws And Regulations Of The Indian Securities Market To Ensure Compliance Of Its Business Activities. Currently, HDFC Securities Ltd. Has A Normal Regulatory Status With A License Valid Period As Of 2024 .

Trading Products

HDFC Securities Ltd. Offers Investors A Diverse Range Of Financial Instruments, Including:

- Stock Trading : Investors Can Trade Listed Stocks On The NSE And BSE Markets In India.

- Derivatives : Offers Futures And Options (F & O) Trading, Covering Stock Indices And Individual Stocks.

- Mutual Funds : Offers A Wide Range Of Open-ended And Closed-end Mutual Fund Products, Covering Equity, Hybrid And Bond Funds.

- Fixed Income Products : Includes Government Bonds, Corporate Bonds, And Other Fixed Income Securities.

- Insurance Products : Works With Insurance Companies To Provide Life Insurance And Health Insurance Products.

- Other Financial Services : Includes Foreign Exchange Trading And Structured Products.

Trading Software

HDFC Securities Ltd. Provides Investors With Industry-standard Trading Software, Including:

- PC-side Trading Platform : Supports Real-time Trading Of Stocks And Derivatives, With Features Such As Chart Analysis, Order Management, And Market Depth.

- Mobile App (HDFC Securities Mobile App) : Allows Users To Trade Stocks And Derivatives, Create Personalized Market Watch Lists, Invest In Mutual Funds, And More Via Mobile Devices. The App Is Available For Download On Both The Google Play Store And The Apple App Store .

HDFC Securities' Trading System Is Designed To Focus On User Experience, With A Multilingual Interface And Multiple Order Types (such As Market Orders, Limit Orders, Etc.).

Deposit And Withdrawal Methods

HDFC Securities Ltd. Provides Convenient Deposit And Withdrawal Methods, Including:

- Bank Transfer : Investors Can Deposit Funds Through Online Banking Or Real-time Over-the-counter Transfer.

- Cheque/Cash Deposit : Cash Or Cheque Deposit At A Company-designated Bank Outlet.

- Transfer To Securities Account : Funds Can Be Transferred Directly From An Investor's Bank Account To A Securities Account.

Customer Support

HDFC Securities Ltd. Offers A Variety Of Customer Support Channels To Ensure That Investors Can Quickly Access Help, Including:

- Online Support : Submit Inquiries Through The "Help Center" On The Company's Official Website Or The "Help" Module Within The Mobile App.

- Social Media Support : Connect With The Company's Customer Service Team On Platforms Such As Facebook, Twitter, WhatsApp, Etc.

- Email Support : Investors Can Submit Inquiries Via Email (complianceofficer@hdfcsec.com).

- Telephone Support : Call The Company's Customer Service Hotline For Professional Advice And Trading Guidance.

- Offline Services : Get Face-to-face Service At Branches In Mumbai And Other Major Cities.

Core Business And Services

As A Leading Securities Brokerage Firm In India, HDFC Securities Ltd.'s Core Businesses Include Stockbroking, Mutual Fund Management, Wealth Management, And Corporate Finance. The Company Serves Retail Investors, High Net Worth Individuals, Institutional Investors And Corporate Clients. HDFC Securities Ltd. Has Built Strong Distribution Capabilities Through Its Parent Company's Network Of Banks (HDFC Bank) And Extensive Branch Network. As Of 2023, The Company Manages Client Assets Of More Than $50 Billion.

Technical Infrastructure

HDFC Securities Ltd. Uses Advanced Technical Infrastructure To Ensure The Stability And Security Of The Trading System. The Company Uses Enterprise-class IT Platforms Provided By IBM And Oracle, And Has A Professional IT Team For Technical Support And System Maintenance.

In Addition, HDFC Securities Ltd. Has A Highly Available Trading System That Supports 24/7 Trading Services. The Company Also Regularly Performs System Upgrades To Adapt To Changes In The Market And The Needs Of Investors.

Compliance And Risk Control System

HDFC Securities Ltd. Is Equipped With A Comprehensive Compliance And Risk Control System To Ensure That Its Business Activities Comply With Legal And Regulatory Requirements. The Company's Risk Management System Covers Market Risk, Operational Risk And Credit Risk, And Uses Advanced Algorithms And Models For Threat And Risk Assessment And Monitoring.

HDFC Securities Ltd. Has Also Established An Independent Risk Management Department Responsible For Identifying, Assessing And Mitigating Various Types Of Risks. The Company's Compliance Statement Clearly States That Its Business Activities Strictly Comply With The Regulatory Requirements Of The Securities Supervision Commission Of India (SEBI).

Market Positioning And Competitive Advantage

HDFC Securities Ltd. With A Significant Market Position In The Indian Securities Market, Competitive Advantages Include:

- Strong Parent Company Support : As A Subsidiary Of HDFC Bank, HDFC Securities Ltd. Is Able To Take Full Advantage Of The Parent Company's Advantages In Terms Of Customer Base And Brand Influence.

- Extensive Distribution Network : The Company Has Numerous Branches And ATM Outlets In India, Providing Convenient Services To Customers.

- Advanced Technology Platform : Attracting Technology-driven Investors By Providing A Stable And Secure Trading System.

- Diversified Financial Products : Covering Stocks, Derivatives, Mutual Funds And Other Products To Meet The Needs Of Different Investors.

Customer Support And Empowerment

HDFC Securities Ltd. Emphasizes Client Empowerment And Helps Investors Make Informed Decisions Through Regular Investor Education Events, Market Analysis Reports And Risk Management Tools. The Company Also Provides Exclusive Wealth Management Services For High Net Worth Clients, Including Customized Investment Solutions And Tax Planning.

Social Responsibility And ESG

HDFC Securities Ltd. Actively Performs Social Responsibility And Participates In Public Welfare Projects In The Fields Of Education, Health And Environmental Protection. The Company Also Focuses On Environmental, Social And Corporate Governance (ESG) Factors And Takes Into Account Sustainability Indicators In Investment Decisions.

Strategic Cooperation Ecology

HDFC Securities Ltd. Has Established Strategic Partnerships With Several Financial Institution Groups, Technology And Consulting Service Providers To Enhance Its Business Capabilities. For Example, The Company Collaborates With Well-known Technology Companies To Develop Next-generation Trading Systems And Artificial Intelligence-driven Risk Management Tools.

Financial Health

As Of 2023 , HDFC Securities Ltd.'s Financial Position Is Healthy, With Net Profit Increasing By 15% Compared To The Same Period Last Year. The Company Has Stable Cash Flow And High Capital Adequacy Ratio, Which Is Able To Support The Continued Growth Of Its Business.

Future Roadmap

HDFC Securities Ltd. It Plans To Continue Expanding Its Market Share In The Coming Years, Especially In Digital Transformation And Wealth Management. The Company Plans To Further Invest In Artificial Intelligence, Big Data And Blockchain Technology To Enhance Its Service Capabilities And Customer Experience.

In Addition, HDFC Securities Ltd. Also Plans To Strengthen Its Business Expansion In South Asia And The Middle East Markets, Seeking More Cross-border Cooperation And Investment Opportunities.