What Is FarallonFX?

FarallonFX, Has Been A Trailblazer In The Field Of Financial Technology Since Its Inception In 2015. FarallonFX Offers A Diverse Range Of Trading Instruments, Including Real Stocks, Commodity CFDs, Forex And ETF CFDs. Their Trading Platform Is A Symbol Of Innovation And Is Available For Mobile Applications For IOS And Android Devices. In Addition, FarallonFX Prioritizes The Safety And Security Of Users' Funds In A Number Of Ways. However, It Is Not Regulated.

Advantages And Disadvantages

Advantages

- Accessibility: FarallonFX Offers Mobile Apps For IOS And Android Devices, Providing Traders With Easy Access To Global Financial Marekts Anytime, Anywhere.

- Diversified Trading Tools: FarallonFX Offers Over 950 Trading Instruments Including Real Stocks, Commodity CFDs, Forex And ETF CFDs, Providing Traders With A Wealth Of Opportunities To Diversify Their Portfolios.

- Strong Security Measures: The Company Employs Multiple Safeguards Such As SSL Technology, Anti-Money Laundering Protocols, Funds Security Initiatives, And KYC Procedures To Protect Users' Funds And Personal Information.

Disadvantages

- Unregulated Status: Despite Efforts To Ensure Security And Compliance, FarallonFX Remains Unregulated, Which May Pose A Risk To Traders As There Is No Oversight From A Regulator.

- Limited Customer Support: While FarallonFX Provides Customer Support Via Phone, Email, And Online Messaging, Availability May Be Limited To Certain Times (24/5), Which May Be Less Convenient For Traders Who Need Immediate Assistance.

- Scam Risk: The Company Acknowledges The Existence Of Scams In The Trading Industry And Advises Users To Carefully Review The Available Information, Pointing Out The Latent Risks That May Exist When Trading On An Unregulated Platform.

Is FarallonFX Secure Or Scam?

FarallonFX Employs Various Protection Measures, Such As The Anti-Money Laundering Protocol, Funds Security Initiatives, And Strict KYC (Know Your Customer) Procedures. The Company Emphasizes The Adoption Of SSL (Secure Sockets Layer) Technology Similar To The Banking Industry To Enhance Funds Protection. This Security Infrastructure Operates Seamlessly In The Background, Automatically Monitoring Access And Enhancing Security Vigilance.

However, The Lack Of Effective Regulation Poses A Significant Risk To Investors Who Trade With FarallonFX. Without Oversight From The Government Or Financial Institution Group, The Platform Has No Accountability, Potentially Exposing Investors To The Risk Of Fraudulent Activity.

The Lack Of Regulatory Scrutiny Means That The Personnel Who Regulate The Platform May Exploit Loopholes To Misappropriate Funds With Impunity, Exposing Investors To The Risk Of Large Losses. In Addition, The Lack Of Regulatory Oversight Increases The Risk Of Sudden Disappearance Or Bankruptcy Without Prior Notice, Leaving Investors With Limited Relief.

Market Tools

FarallonFX Offers A Diverse Range Of Trading Tools, Totaling Over 950, Catering To A Variety Of Investment Preferences.

- Real Stocks: FarallonFX Offers A Selection Of Various Real Stocks Available In The Global Market. This Includes Stocks From Major Indices Such As S & P 500, Dow Jones Industries Average Index, Nasdaq, FTSE 100, Etc. Traders Can Invest In Individual Companies In Different Industries And Sectors.

- Commodity CFDs (Contracts For Difference): Traders Can Speculate On Price Fluctuations Of Various Commodities Without Owning Actual Assets. Commodity CFDs Offered By FarallonFX Include Gold, Silver, Crude Oil, Natural Gas, Copper, Agricultural Commodities, Etc. These Commodities Represent Tangible Commodities Of Value That Are Traded In The Global Market.

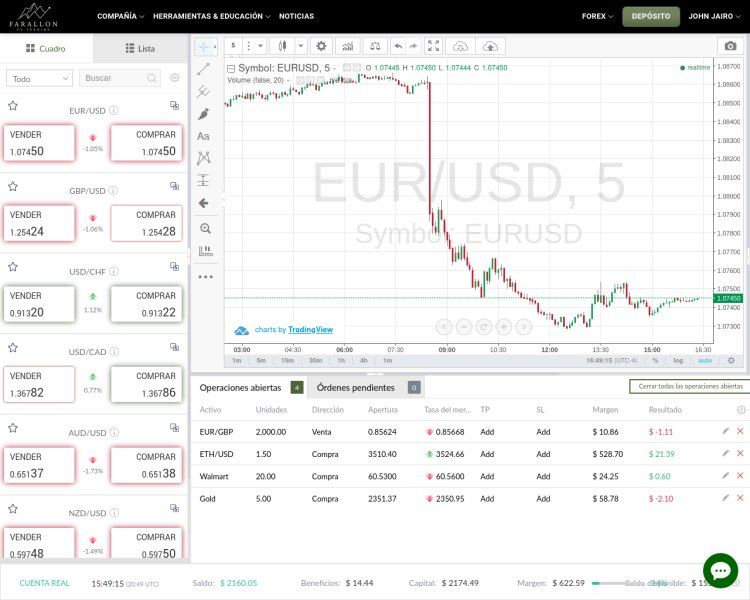

- Forex: Forex Trading Involves The Buying And Selling Of Currency Pairs On The Foreign Exchange Market. FarallonFX Offers A Wide Selection Of Currency Pairs, Including Major Currency Pairs Such As EUR/USD, GBP/USD, USD/JPY, As Well As Minor Currency Pairs And Foreign Currency Pairs. Forex Trading Allows Investors To Take Advantage Of Exchange Rate Fluctuations Between Different Currencies.

- ETF CFD (Exchange Traded Fund Contracts For Difference): FarallonFX Offers ETF CFDs That Allow Traders To Speculate On Price Fluctuations In ETFs. ETFs Are Investment Funds That Trade On Bourse And Typically Track The Performance Of A Particular Index, Commodity, Industry Or Asset Class. By Trading ETF CFDs, Investors Can Gain Access To A Diverse Portfolio Of Assets Without Directly Owning The Underlying Securities.

How Do I Open An Account?

To Open A FarallonFX Account, Follow These Steps:

- Visit The Website: Go To The FarallonFX Website.

- Go To The Registration Page: Find And Click The "Register Now" Button To Go To The Registration Page.

- Fill In The Registration Form: Provide Personal Details Including Full Name, Last Name, Email Address And Password.

- Confirm Password: Re-enter The Password To Confirm Accuracy.

- Select A Country, Enter A Phone Number, Select A Currency

- Accept The Terms And Conditions: Read And Accept The Terms And Conditions Of FarallonFX.

- Complete Registration: Submit The Registration Form To Create Your Account.

- Confirmation Of Account Creation: After Successful Registration, You Will Receive A Confirmation Email Or Notification From FarallonFX.

- Enter The Trading Platform: Use Your Login Credentials To Enter The Trading Platform And Start Trading.

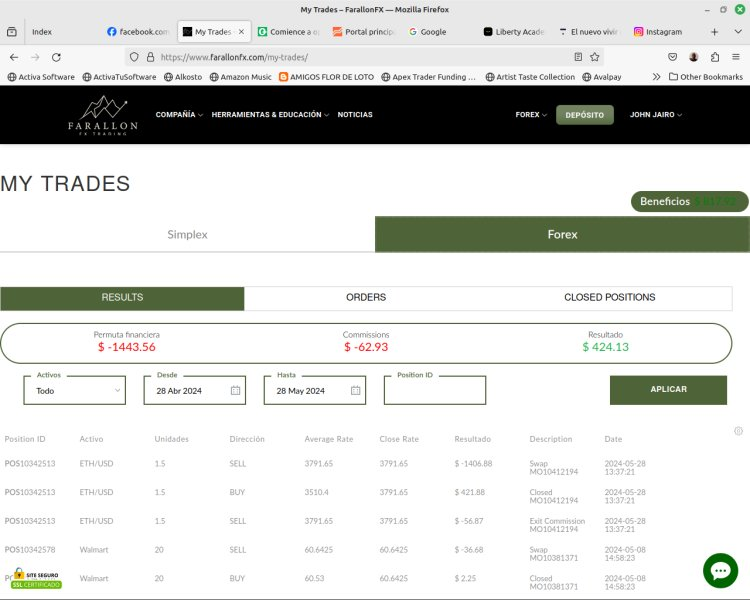

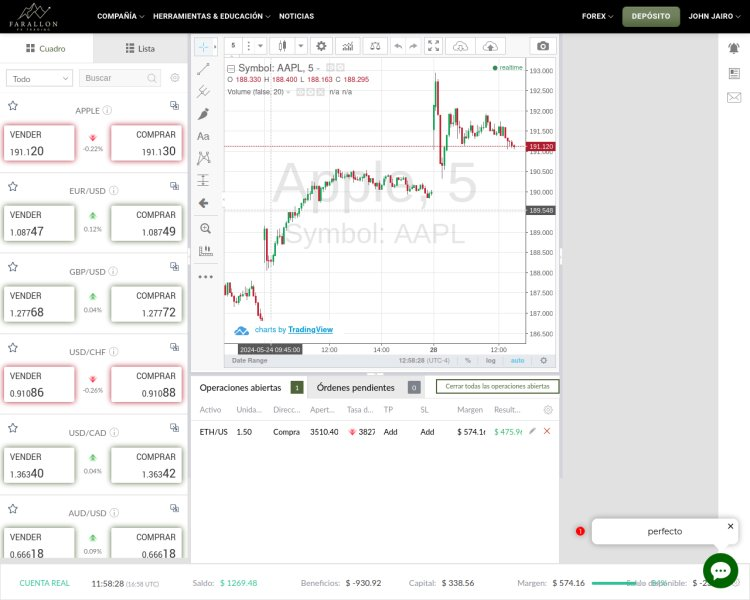

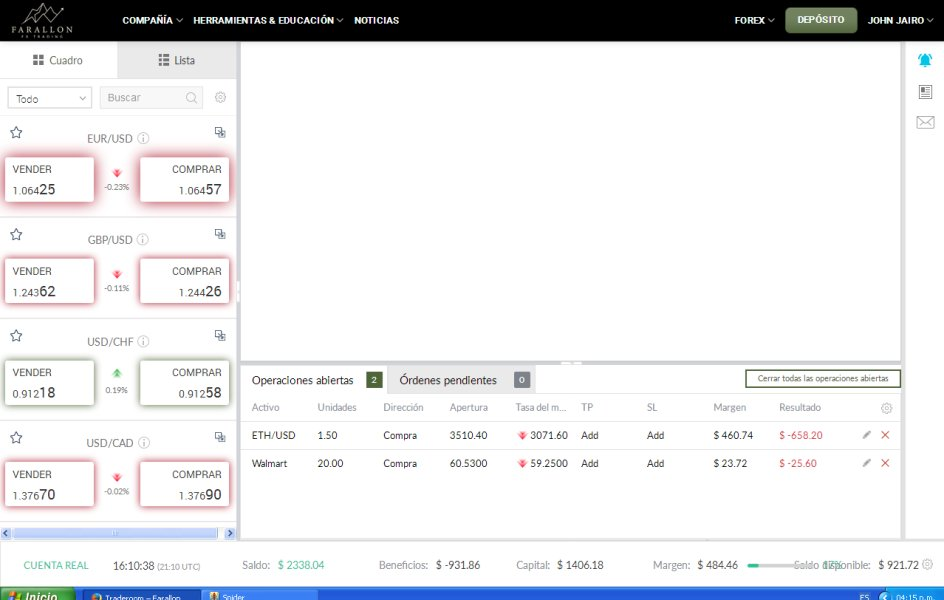

Trading Platform

FarallonFX Provides A Powerful And User-friendly Trading Platform Designed To Provide An Easy-to-access, Fast And Free Route To Global Financial Marekts. At The Heart Of The FarallonFX Trading Experience Is Its Powerful Mobile Apps For IOS And Android Devices. These Mobile Apps Enable Traders To Stay Connected To The Market And Execute Trades Anytime, Anywhere, Ensuring Flexibility And Convenience When Managing Their Portfolios.

FarallonFX's Mobile Trading Apps Are Equipped With A Comprehensive Set Of Features That Support Convenient Mobile Trading. Users Have Access To Real-time Market Data, Including Live Quotes, Charts And News Updates, Enabling Them To Make Informed Trading Decisions Quickly. The Intuitive Interface Of The App Makes It Easy To Navigate And Execute Trades With Just A Few Taps, Making It Ideal For Both Novice And Experienced Traders.

In Addition, FarallonFX's Mobile App Offers Multiple Trading Features To Suit Different Investment Strategies. From Buying And Selling Stocks, Commodities, Forex And ETFs, To Managing Positions, Setting Alerts And Monitoring Account Activity, Traders Can Get All The Tools They Need From Their Mobile Devices To Participate Effectively In Financial Marekt.

Deposits And Withdrawals

FarallonFX Offers Several Convenient Ways To Deposit And Withdraw Money From Your Account. You Can Deposit Using Credit, Debit Or Telegraphic Transfer Methods. The Minimum Amount Required For Withdrawals Is 50 Units Of The Base Currency Of Your Account, Including USD, GBP Or EUR. However, For Bank Transfers, The Minimum Amount Accepted Is Higher At 500 Units Of The Base Currency Of Your Account. Bank Transfers Typically Take About 3 To 5 Business Days To Process.

To Initiate A Withdrawal Via Bank Transfer, You Need To Contact The Client Server Department At FarallonFX For Instructions. This Ensures A Smooth Transaction And Provides You With Any Necessary Guidance Needed To Complete The Transaction.

Client Server

Customers Can Contact The Client Server Department Using The Information Provided Below:

24 Hours A Day, 5 Days A Week

Telephone: + 44 (20) 80890817

Email: Info@farallonfx.com

In Addition, FarallonFX Provides A Frequently Asked Questions (FAQ) Section On Its Website To Help Customers Answer Frequently Asked Questions And Provide Relevant Information.

CONCLUSION

In Conclusion, FarallonFX Has Some Influence In The Fintech Space, Providing A Comprehensive And User-friendly Trading Platform. With Over One Million Registered Users Worldwide, The Platform Provides Traders With Convenient Access And Diverse Trading Tools, Enabling Them To Conveniently Participate In Global Financial Marekts.

Although FarallonFX Is Unregulated, It Ensures The Safety And Compliance Of Its Users Through Strict Risk Control Measures And Compliance Across Multiple Jurisdictions. However, Traders Should Exercise Caution And Be Aware Of The Risks Of Trading On An Unregulated Platform, Including Potential Scams And Limited Oversight By Regulators.

Inducement Fraud

Inducement Fraud