Company Profile

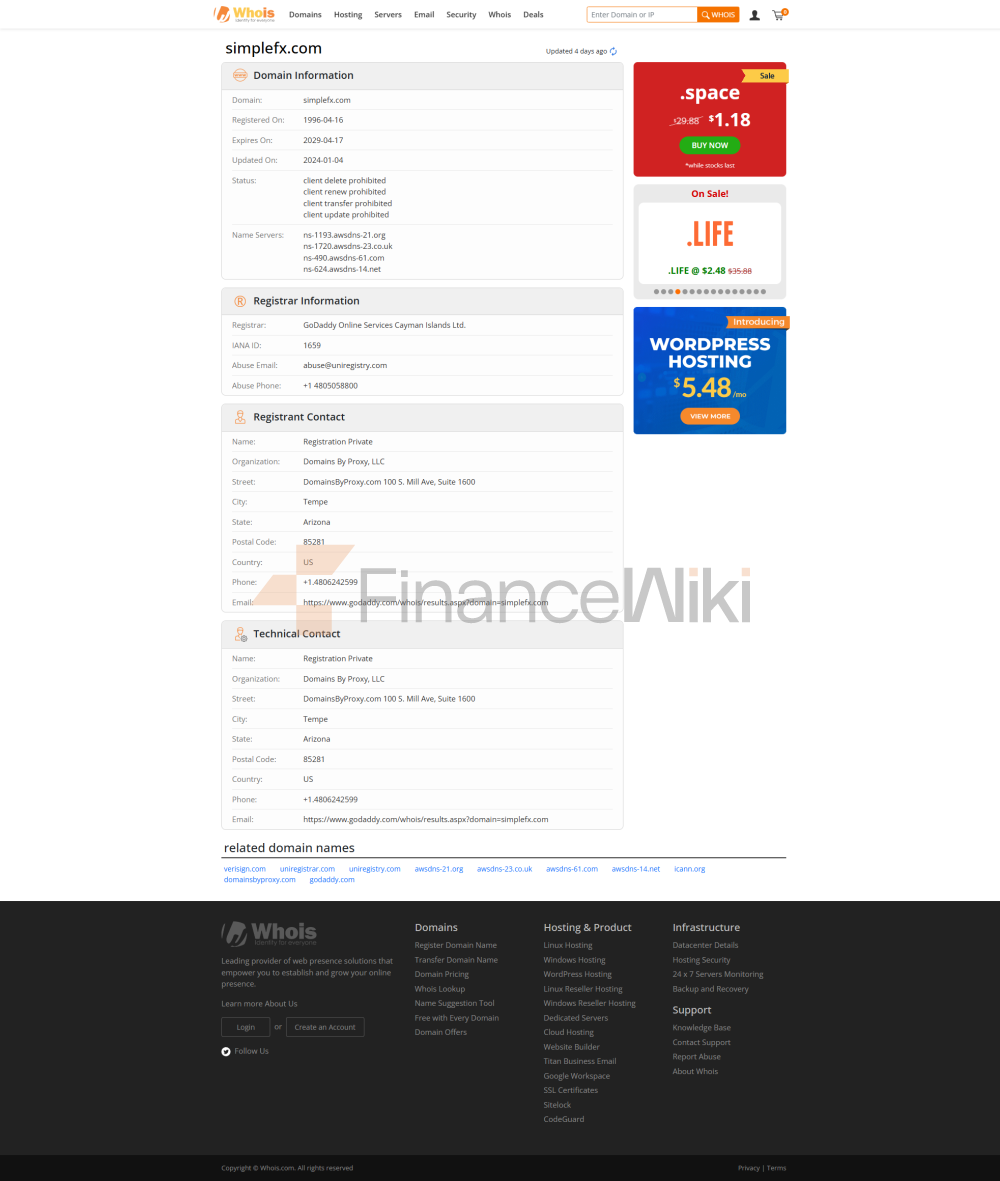

Full Name Of Company : SimpleFX Limited Established : 2014 Headquarters Location : Saint Vincent And The Grenadines Registered Capital : Undisclosed Corporate Structure : Single Account Model, Supports Multiple Trading Instruments Equity Structure : Undisclosed

SimpleFX Is A CFD Broker That Specializes In Providing Competitive Trading Fees And Leveraged Trading Services With No Minimum Deposit Requirements. Since Its Inception In 2014, The Company Has Offered Traders A Wide Range Of Financial Instruments, Including Forex, Cryptocurrencies, Indices, Commodities And Stocks, Among Others, Through One Account. SimpleFX's Goal Is To Provide Traders With A Flexible, Efficient And Transparent Trading Environment.

Regulatory Information

Regulatory License : No Valid Regulatory License Compliance Statement : SimpleFX Is Not Currently Directly Regulated By Any Financial Regulator, So Its Operating Model And Trading Services May Not Fully Comply With Financial Regulations In Certain Countries. Regional Restrictions : SimpleFX Does Not Accept Clients From The United States, But Is Open To Traders From Other Regions.

Due To The Lack Of A Valid Regulatory License, SimpleFX's Trading Services May Face Higher Risks. Traders Should Carefully Evaluate Their Operating Model And Compliance, And Understand The Associated Risks.

Trading Products

Tradable Tools :

- Forex (60 Currency Pairs, Including EUR/USD, Etc.)

- Indices (e.g. Major Stock Indices Such As FTSE 100)

- Stocks (several Well-known Stocks)

- Commodities (e.g. Crude Oil, Precious Metals)

- Cryptocurrencies (e.g. BTC And XRP)

Leverage : SimpleFX Offers Leverage Up To 1:1000 It Is Suitable For Different Types Of Trading Instruments. Spread :

- EUR/USD Spread Approximately 0.9 Pips

- Gold (XAU/USD) Spread Approximately 0.17 Pips

- FTSE 100 Index Spread Approximately 1.3 Pips

SimpleFX's Trading Fees Are Competitive, Especially In Terms Of Spreads, Which Are At A Lower Level Compared To Similar Brokers. However, The Use Of Leverage Can Lead To Greater Risk And Traders Should Exercise Caution.

Trading Software

Supported Platforms :

- SFX Self-owned Platform : Supports Mobile, Desktop And Web Trading

- MT4 (Meta Trades) : Not Available

Features :

- Powerful Charting

- Flexible Customization Options

- Support For Real-time Quotes Updated By The Second

- Offers Technical Indicators And Analytical Tools

SimpleFX's Own Trading Platform Is More Comprehensive, But It Does Not Offer Industry-standard Platforms Such As MT4 And MT5, Which May Be Limited For Some Experienced Traders.

Deposit And Withdrawal Methods

Supported Deposit And Withdrawal Methods :

- Telegraphic Transfer

- Electronic Payment Systems (e.g. Neteller And Skrill)

- Bank Cards

- Cryptocurrencies (e.g. Bitcoin And Dash)

Deposit And Withdrawal Features :

- No Minimum Deposit Requirements

- No Deposit And Withdrawal Fees

- Active Accounts Can Be Accessed At Any Time

- Telegraphic Transfer Withdrawal Time Is 3-5 Working Days

- Electronic Payment Systems And Cryptocurrency Withdrawals Are Completed Within 24 Hours

Traders Should Ensure That The Deposit And Withdrawal Method Is Consistent With Their Account Currency To Avoid Unnecessary Exchange Fees.

Customer Support

Support Channels :

- Email: Support@simplefx.com And Partnership@simplefx.com

- Live Chat

- Social Media (Telegram, Twitter, Facebook, Instagram, YouTube, TikTok And LinkedIn)

- Multilingual Support (including English, Chinese, Etc.)

- Live Response

- Trading Guides And Educational Resources

- No Minimum Deposit Requirement : Traders Are Free To Choose The Initial Deposit Amount.

- Support Multiple Account Currencies : Including USD, EUR, GBP And JPY, Etc.

- Flexible Leverage Settings : Up To 1:1000, Suitable For Traders With High Risk Preferences.

- Free Demo Account : Provides A Realistic Market Environment For Practice.

- Beginner And Intermediate Traders

- Forex, Cryptocurrency And Commodities Traders

- Investors Seeking Low-cost Trading

- Margin Call : 50%

- Stop Loss Level : 30%

- Mark To Market : No Clear Information Provided

- Regional Broker, Mainly Serving Non-US Clients

- Focus On Low-cost And Flexible Trading Services

- No Minimum Deposit Required

- Low Spreads And Free Trading

- Support For Multiple Account Currencies

- Demo Accounts

- Trading Guides And Market Analysis

- Demo Accounts For Novice Practice

- Technical Indicators And Analysis Tools

- Real-time Quotes

Support Features :

SimpleFX's Customer Support Team Can Be Reached Through Multiple Channels To Provide Traders With Timely Assistance And Answers.

Core Business And Services

Core Competitive Advantage :

Who It Serves :

The Core Business Of SimpleFX Is To Meet The Needs Of Different Traders By Providing Flexible And Transparent Trading Services. Its Advantages Of No Minimum Deposit And Multiple Account Currencies Make It An Ideal Choice For Some Traders.

Technical Infrastructure

Trading Platform : SimpleFX Self-owned Platform That Supports Multi-device Trading. Server Stability : SimpleFX's Servers Remain Stable Under Normal Conditions, But No Redundant Backup Information Is Provided. Security : SimpleFX Provides SSL Encryption To Ensure The Security Of Customer Data.

SimpleFX's Technical Infrastructure Is Capable Of Supporting Its Core Trading Services, But Its Platform Features Are Relatively Limited And Does Not Support Industry Standard MT4 And MT5.

Compliance And Risk Control

Compliance : SimpleFX Is Not Currently Directly Regulated By Any Financial Regulator. Risk Management :

SimpleFX's Risk Management System Is Relatively Simple, Mainly Through Margin Call And Stop Loss Level To Control Trading Risk.

Market Positioning And Competitive Advantage

Market Positioning :

Competitive Advantage :

SimpleFX Offers Low Cost And Flexibility A Strong Competitive Advantage, But A Lack Of Regulation Could Have A Negative Impact On Its Long-term Development.

Customer Support And Empowerment

Educational Resources :

Trading Tools :

SimpleFX's Customer Support And Empowerment Services Help Novice Traders Get Started Quickly, But The Range Of Resources Is Relatively Limited.

Social Responsibility And ESG

Social Responsibility : Does Not Provide Clear Information ESG Manifesto : Does Not Provide

SimpleFX Has Less Public Information On Social Responsibility And ESG, Which May Indicate That It Is Less Invested In This Area.

Strategic Cooperation Ecology

Partners : Undisclosed Industry Awards : Undisclosed

The Strategic Cooperation Ecosystem Of SimpleFX Is Not Yet Clear, And There Is A Lack Of Public Information On Major Strategic Partnerships Or Industry Awards.

Financial Health

Financial Status : Undisclosed Funding Rounds : Undisclosed

The Financial Health Of SimpleFX Is Not Publicly Available, And Investors And Traders Should Carefully Evaluate Its Long-term Operating Capabilities.

Future Roadmap

Development Plan : Undisclosed Innovation Direction : Undisclosed

The Future Roadmap Of SimpleFX Has Not Been Disclosed, But Its Core Business And Market Positioning May Remain Stable In The Future.

Inducement Fraud

Inducement Fraud