Corporate Profile

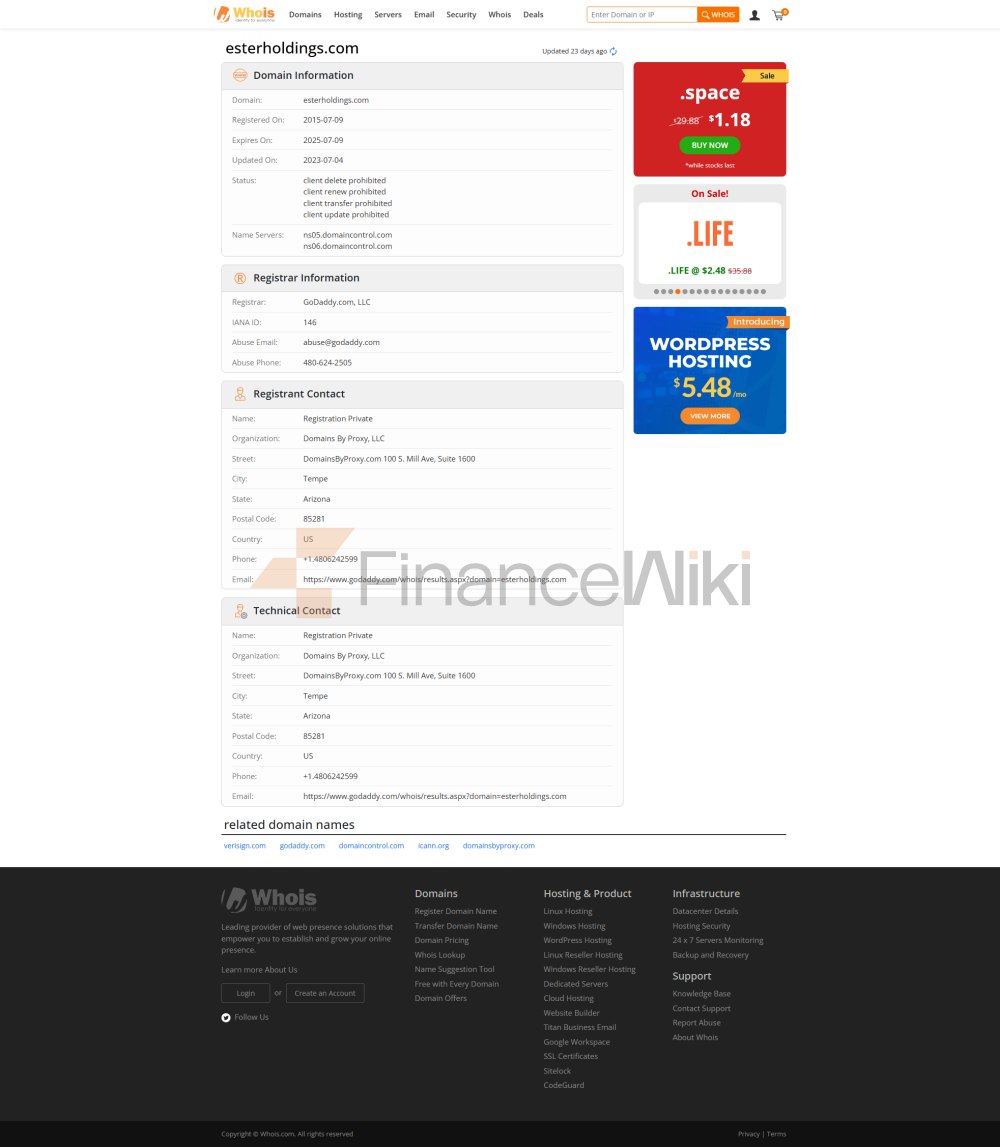

Founded In 2015 And Headquartered In Vanuatu, Ester Is An Unregulated Foreign Exchange Broker. The Company Provides Trading Services For A Variety Of Financial Products Through Its Official Website, Including Foreign Exchange, Spot Metals, Stock Indices, Commodities And Cryptocurrencies. Ester Serves Mainly Retail Traders. It Provides MT4 Trading Platform, Supports Windows And Mac OS Operating Systems, And Is Suitable For Beginners.

Regulatory Information

Ester Is Not Currently Effectively Regulated By Financial Regulators In Any Country Or Region, Which Is An Important Risk Warning For Investors. Unregulated Brokers May Have Greater Uncertainties Regarding The Safety Of Funds, Transparency And Dispute Resolution. Therefore, Investors Should Fully Understand The Relevant Risks Before Choosing Ester For Trading.

Trading Products

Ester Offers Trading Services For A Variety Of Financial Products, Mainly Including:

- Forex : Offers Trading Of Major Currency Pairs And Emerging Market Currency Pairs.

- Spot Metals : Includes Trading Of Precious Metals Such As Gold And Silver.

- Stock Indices : Offers Trading Of Major Global Stock Indices.

- Commodities : Including Trading Of Energy Commodities Such As Crude Oil And Natural Gas.

- Cryptocurrencies : Offers Trading Of Major Cryptocurrencies Such As Bitcoin And Ethereum.

Trading Software

Ester Mainly Uses MetaTrader 4 (MT4) As Its Trading Platform. MT4 Is A Powerful Tool That Supports Technical Analysis, Trading Strategy Development And Automated Trading. In Addition, Ester Also Offers Demo Accounts To Help Novice Traders Become Familiar With The Trading Platform And Trading Strategies.

Deposit And Withdrawal Methods

Ester's Deposit And Withdrawal Methods Are Special And Only Support Cryptocurrency Payments. The Following Are The Specific Deposit And Withdrawal Methods:

- Deposit : Ester Accepts Deposits In Cryptocurrencies Such As Bitcoin (BTC) And Litecoin (LTC). There Are No Fees Charged During The Deposit Process, But The Blockchain Network May Charge Certain Transaction Fees.

- Withdrawal : Ester Offers Cryptocurrency Withdrawal Services With Withdrawal Fees Of $30 (Bitcoin) And $60 (Litecoin), And Processing Time Of A Few Minutes To 3 Banking Days.

Customer Support

Ester Provides Email Support. Customers Can Contact Their Support Team At The Following Email Address:

- Support@esterholdings.com

- Finance@esterholdings.com

- Marketing@esterholdings.com

Currently, Ester Does Not Provide Telephone Support Or Other Instant Messaging Tools, Which Limits The Convenience Of Customer Support To Some Extent.

Core Business And Services

Ester's Core Business Is To Provide Online Trading Services For Foreign Exchange And Other Financial Products. The Company Has Attracted Some Traders By Offering A Variety Of Trading Products And No-fee Deposits. In Addition, Ester Also Offers Leverage Trading Capabilities Up To 1:1000, Which Further Amplifies The Potential Gains And Risks For Traders.

Technical Infrastructure

Ester's Technical Infrastructure Mainly Relies On The MT4 Platform. MT4 Is A Trading Platform Widely Used In The Foreign Exchange Industry With High Stability And Reliability. The MT4 Platform Provided By Ester Supports A Variety Of Technical Indicators And Trading Tools, Capable Of Meeting The Needs Of Different Traders.

Compliance And Risk Control System

Since Ester Is Not Currently Regulated By Any Regulatory Body, The Transparency Of Its Compliance And Risk Control System Is Relatively Low. Investors Should Pay Particular Attention To The Company's Money Management And Risk Management Measures When Choosing Ester For Trading.

Market Positioning And Competitive Advantage

Ester In Terms Of Market Positioning, To Provide A Diverse Range Of Trading Products And No-fee Deposits As A Competitive Advantage. In Addition, The Company Also Offers Demo Accounts To Help Novice Traders Become Familiar With The Trading Platform And Trading Strategies. However, The Disadvantage Of Being Unregulated May Limit Ester's Competitiveness In The International Market.

Customer Support And Empowerment

The Customer Support Provided By Ester Is Relatively Limited And Only Conducted By Email. Despite This, Ester Still Provides Traders With A Wealth Of Educational Resources Through Its Official Website And Trading Platform To Help Traders Improve Their Trading Skills And Market Analysis Capabilities.

Social Responsibility And ESG

Currently, Ester Does Not Disclose Relevant Information On Its Official Website To Explain The Company's Practices And Commitments In Social Responsibility And Environmental, Social And Corporate Governance (ESG). Therefore, This Part Of The Information Is Not Available For The Time Being.

Strategic Cooperation Ecology

Ester Does Not Mention Any Information About Strategic Cooperation Or Partners On Its Official Website. Therefore, It Is Currently Impossible To Give A Detailed Description Of Its Strategic Cooperation Ecology.

Financial Health

Due To The Fact That Ester Is Not Regulated, The Transparency Of Its Financial Reporting And Funding Position Is Low. Investors Should Be Vigilant About Its Financial Health When Choosing Ester For Trading.

Future Roadmap

Ester Has Not Made Public A Detailed Future Roadmap On Its Official Website. Therefore, It Is Currently Impossible To Give A Specific Description Of Its Future Plans And Development Direction.

In Conclusion, Ester, As An Unregulated Broker, Offers A Diverse Range Of Trading Products And Tools, Which Attracts Some Traders. However, The Disadvantage Of Being Unregulated May Adversely Affect The Safety And Trust Of Investors' Funds. Therefore, When Choosing Ester To Trade, Investors Should Fully Understand The Relevant Risks And Make Informed Decisions Based On Their Own Needs And Risk Tolerance.