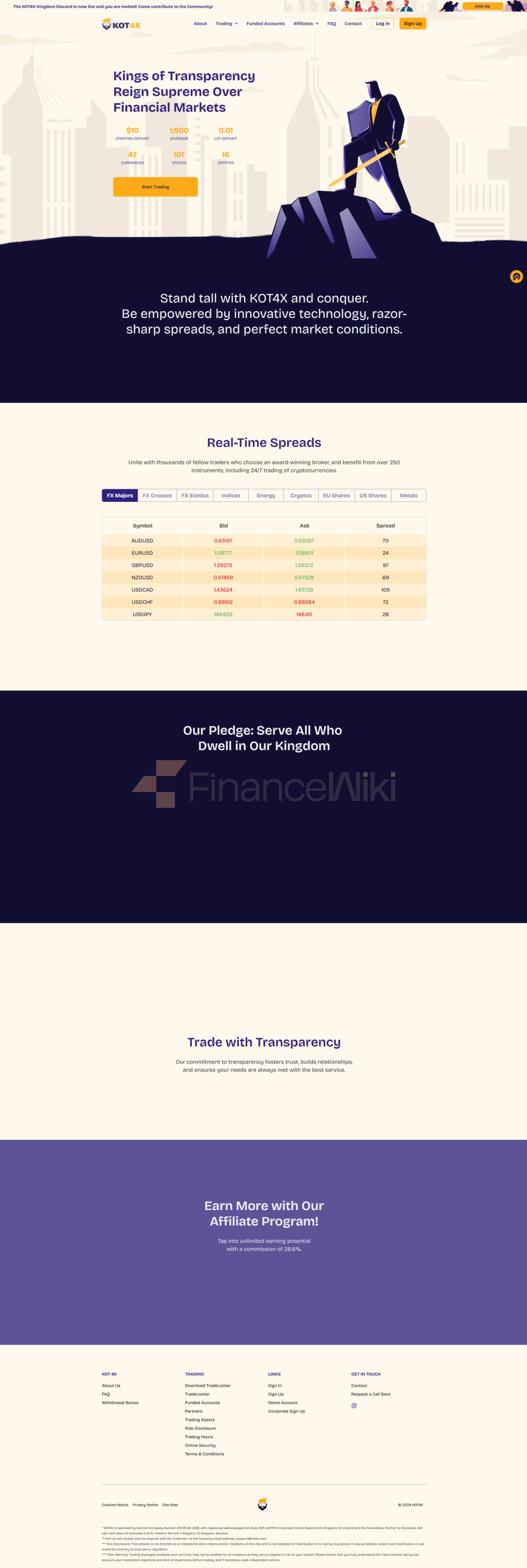

Corporate Profile

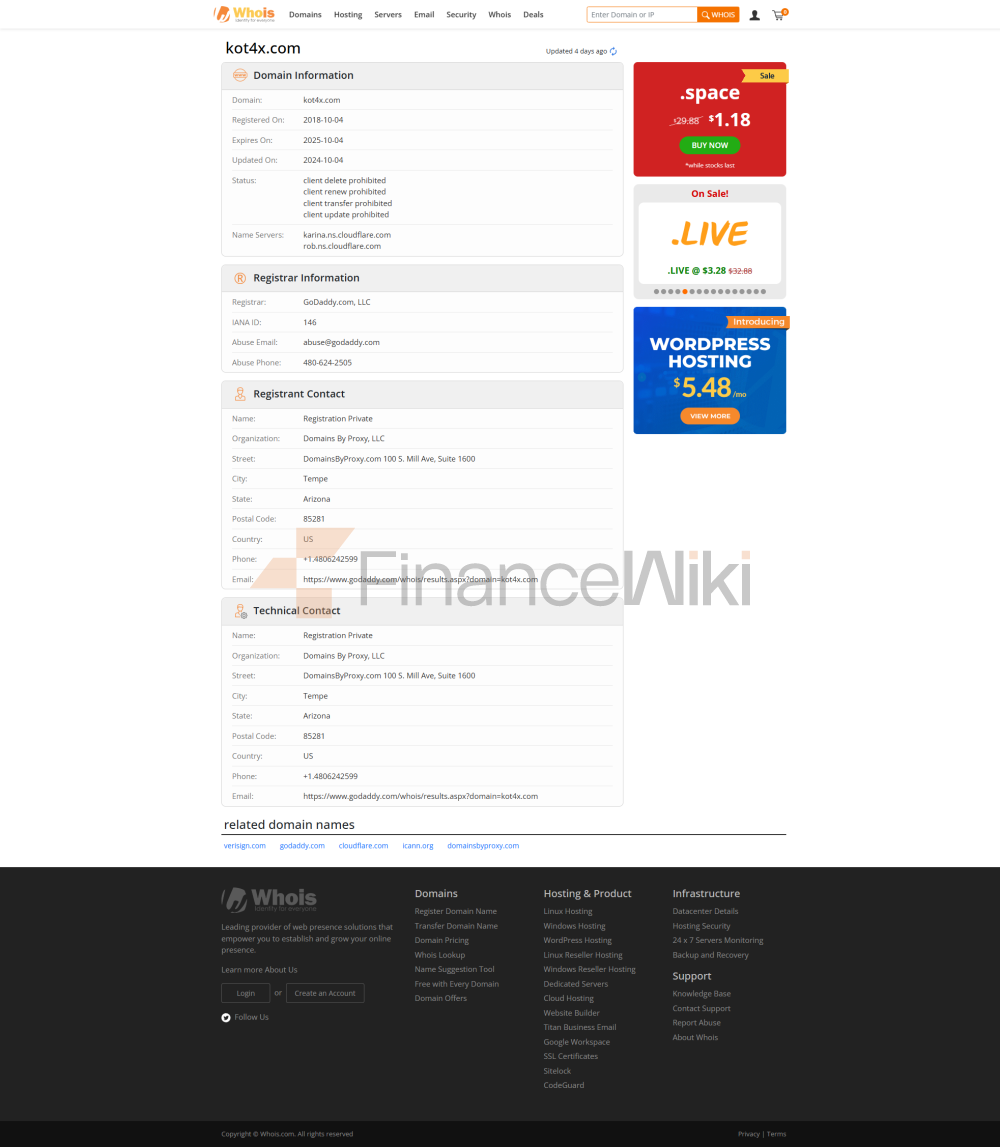

KOT4X Is An Online Forex Broker Registered In Saint Vincent And The Grenadines. It Was Established In 2020 And Has Been Established For 3 Years So Far . The Company Specializes In Providing Global Traders With Trading Services On A Wide Range Of Financial Instruments, Including Forex Pairs, Commodities, Stocks, Cryptocurrencies, And Indices. KOT4X Offers Multiple Account Types, Each With Different Spreads, Commissions, And Minimum Deposit Requirements, With Maximum Leverage Up To 1:500 . The Company Supports Multiple Deposit And Withdrawal Methods, Including Cryptocurrencies And Credit/debit Cards, And Does Not Charge Any Deposit Or Withdrawal Fees, Providing Traders With Cost-effective Options.

Regulatory Information

KOT4X Currently Has No Effective Supervision , Which Means That Its Operations Are Not Supervised By Financial Regulators In Any Country Or Region. Investors Should Pay Special Attention To Latent Risks When Choosing This Platform And Evaluate The Credibility And Stability Of The Company By Themselves.

Trading Products

KOT4X Offers 250 + Trading Tools Covering The Following Categories:

- Forex Pairs : 55 Currency Pairs Are Available, And Traders Can Explore Different Currency Combinations And Execute Multiple Trading Strategies.

- Stocks : Offers 104 Stocks, Covering Stocks From Different Markets.

- Cryptocurrencies : Offers 31 Cryptocurrencies, Including Bitcoin, Ethereum, Litecoin, And More.

- Indices : Offers 8 Indices, Covering Popular Stock Indices Around The World.

Although The Selection Of Commodities Is Limited And Fixed Income Instruments Such As Bonds Or Treasury Securities Are Not Offered, The Overall Range Of Trading Instruments Is Still Relatively Broad, Able To Meet The Needs Of Different Traders.

Trading Software

The Main Trading Platform For KOT4X Is MetaTrader 4 (MT4) , Which Is Widely Popular Due To Its Industry Standard Status. The Advantages Of MT4 Include An Easy-to-use Interface, Rich Charting Tools And Indicators, Automated Trading Capabilities, And More. However, The Disadvantages Of MT4 Are That It Can Take Up A Lot Of Resources On Older Devices And Does Not Have A Web Or Mobile-based Version Of The Platform.

Deposit And Withdrawal Methods

KOT4X Supports The Following Deposit And Withdrawal Methods:

- Cryptocurrencies : Accepts Mainstream Cryptocurrencies Such As Bitcoin, Ethereum, Ripple, As Well As Stablecoins Such As USDT And USDC.

- Credit/Debit Cards : Accepts Credit/debit Card Deposits Through Third-party Providers.

- No Withdrawal Fees : The Company Does Not Charge Any Deposit Or Withdrawal Fees, But Cryptocurrency Deposits May Involve Blockchain Network Fees.

Customer Support

KOT4X Offers A Variety Of Customer Support Channels, Including Call Back, Ticket Submission, Instagram Account, And FAQ. Although There Is No Live Chat Feature, The Support Team Is Usually Able To Respond Quickly To Inquiries. However, The Limited Details On The Website Relating To The Company And Its Regulations May Cause Some Distress To Novice Traders.

Core Business And Services

KOT4X's Main Business Area Is Forex And Contracts For Difference (CFD) Trading, Serving Retail Traders. The Company's Technology Platform Is MT4, And Its Risk Management System Includes Negative Balance Protection To Prevent Traders From Losing More Than Their Account Balance.

Technical Infrastructure

KOT4X's Technical Infrastructure Is Based On The MT4 Platform, Which Is Considered An Industry Standard Tool. Although The Platform Is Powerful, The Lack Of Mobile Trading Capabilities May Pose Limitations For Some Traders.

Compliance And Risk Control System

KOT4X's Compliance And Risk Control System Includes Negative Balance Protection, But The Company Lacks Effective Supervision, Which Means That Traders Need To Bear Certain Risks. In Addition, KOT4X's Leverage Policy Allows Leverage Of Up To 1:500, Which Increases Trading Flexibility While Also Bringing Higher Risks.

Market Positioning And Competitive Advantage

KOT4X's Market Positioning Is To Provide A Flexible Trading Environment For Experienced Traders. Its Competitive Advantages Include:

- Wide Range Of Trading Tools : Offers More Than 250 Instruments, Including Currency Pairs, Stocks, Cryptocurrencies, And Indices.

- High Leverage : Up To 1:500 Leverage, Providing Traders With Greater Market Exposure.

- Multiple Payment Methods : Supports Multiple Cryptocurrencies And Traditional Payment Methods.

- No Withdrawal Fees : The Company Does Not Charge Any Fees When It Comes To Deposits And Withdrawals.

However, KOT4X's Disadvantages Lie In Its Lack Of Educational Resources, The Uncertainty That The Stp Trading Model May Increase The Spread, And The Limited Information On The Website.

Customer Support & Empowerment

KOT4X's Customer Support Channels Include Call Back, Ticket Submission, Instagram, And FAQ. While The Support Team Is Usually Able To Respond Quickly, The Lack Of Live Chat Capabilities And Educational Resources Can Pose Challenges For Novice Traders.

Social Responsibility And ESG

KOT4X's Official Website Does Not Mention An Explicit Social Responsibility Program Or ESG Policy, Which May Have Some Impact On Its Long-term Image.

Strategic Cooperation Ecology

KOT4X Does Not Explicitly Mention Any Significant Strategic Cooperation Or Industry Association Membership, Which May Reflect Its Limited Influence In The Global Market.

Financial Health

KOT4X Does Not Disclose Its Financial Status. Investors Should Carefully Evaluate Its Financial Health.

Future Roadmap

The Future Roadmap Of KOT4X Is Not Explicitly Mentioned. Investors Should Continue To Pay Attention To Its Official Website For The Latest Developments.

Notes

Since KOT4X Currently Has No Effective Supervision , Traders Should Pay Special Attention To Latent Risks When Choosing The Platform And Evaluate The Credibility And Stability Of The Company By Themselves. In Addition, Traders Should Ensure That They Have Sufficient Knowledge Of Risk Management Techniques, Especially When Using High Leverage, To Avoid Potential Losses.

Overall, KOT4X Provides A Flexible Trading Environment For Traders, But Its Lack Of Regulatory And Educational Resources May Pose Challenges For Novice Traders.