Corporate Profile

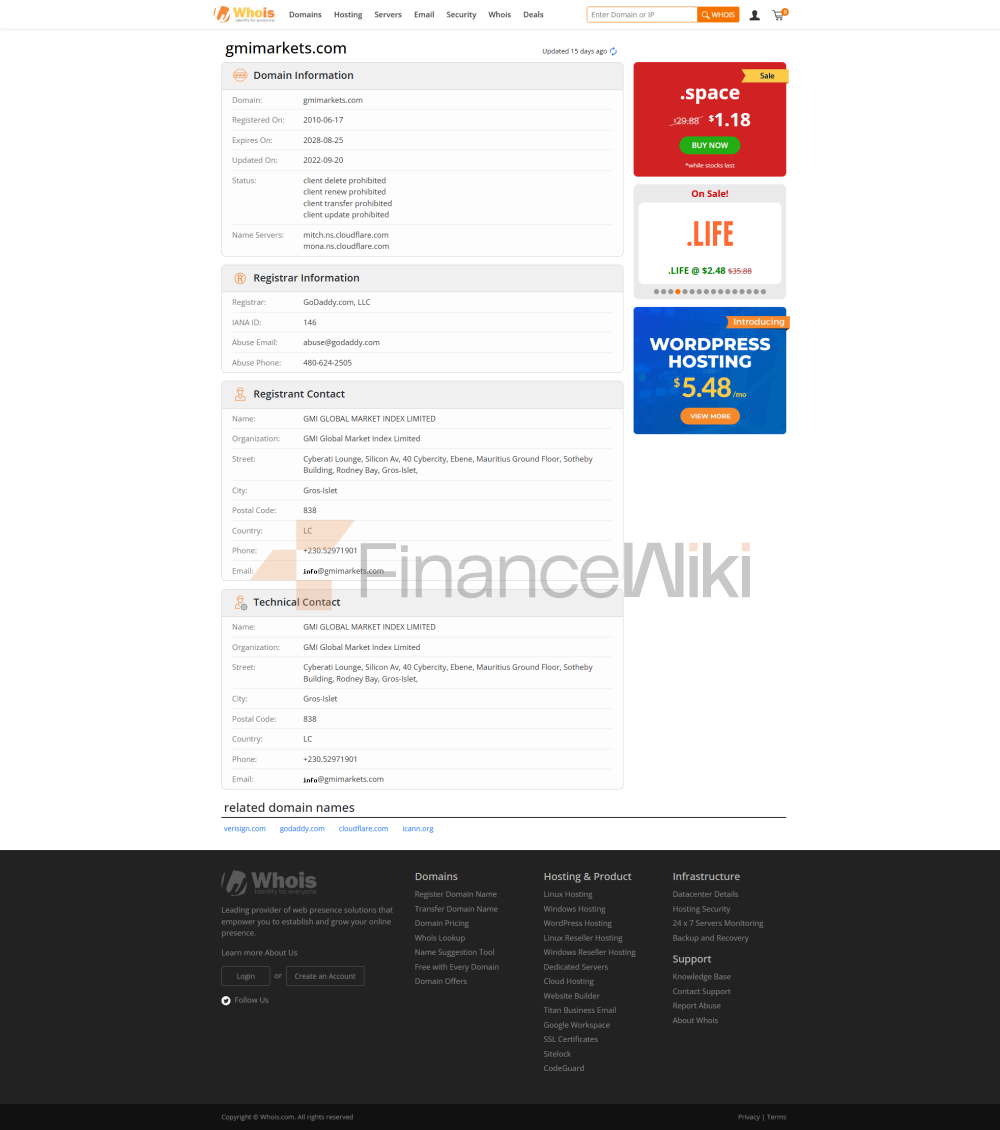

GMI Markets (full Name: Global Market Index Limited) Is A Forex CFD Broker Headquartered In Eben, Mauritius, Established On August 28, 2018. As An Institution Providing Trading Services On A Global Scale, GMI Markets Has Subsidiaries In Saint Lucia, Saint Vincent And The Grenadines And Is Registered In Multiple Jurisdictions To Meet The Regulatory Requirements And Customer Needs Of Different Markets.

The Company's Official Website Domain Name Was First Registered On June 17, 2010, Demonstrating Its Long-term Commitment To Providing Trading Services To Global Investors. As Of 2023Q3, GMI Markets' Revenue Was Approximately $120 Million, Indicating Its Solid Development In The Industry.

Regulatory Information

GMI Markets Is A Highly Regulated Broker That Holds A License Issued By The Financial Conduct Authority (FCA) And The Financial Commission Of Mauritius (FSC) With License Number 677530 . In Addition, Its Subsidiaries Are Also Regulated By The Vanuatu Financial Services Commission (VFSC) . The Presence Of These Regulators Ensures That The Company's Operations Comply With International Financial Standards, Providing Investors With A High Level Of Security.

GMI Markets Commits To Strict Compliance With All Applicable Laws And Regulations And Ensures Transparency And Compliance Of Its Operations Through Regular Audits And Compliance Reviews.

Trading Products

GMI Markets Offers Investors A Diverse Range Of Trading Products Covering The Following Main Categories:

- Forex: Offers More Than 40 Major Currency Pairs , Including EUR/USD, GBP/USD And USD/JPY, Among Others.

- Precious Metals: Trading CFDs On Precious Metals Such As Gold And Silver, Without Holding Physical Objects To Participate In The Transaction.

- Energy: CFDs Covering Energy Commodities Such As Crude Oil And Natural Gas, Allowing Investors To Participate In The Energy Market Without Directly Holding Physical Objects.

- Indices: Providing Trading Opportunities On Market Indices Such As Wall Street Indices, Hong Kong's Hang Seng Index, And Others, Enabling Investors To Track Overall Market Performance.

- Cryptocurrencies: Trading CFDs On Cryptocurrencies Such As Bitcoin And Ethereum, Providing Investors With Access To Emerging Asset Classes.

These Products Not Only Provide Investors With Access To Different Financial Marekts, But Also Help Them Manage Risk By Diversifying Their Portfolios.

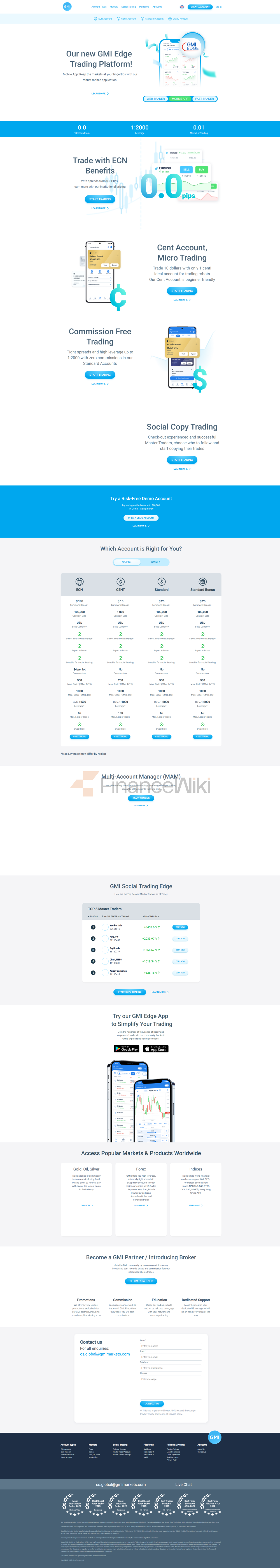

Trading Platform

GMI Markets Offers Investors Two Main Trading Platforms: MT4 And The Self-developed GMI EDGE .

MT4 Is One Of The Most Popular Trading Platforms In The World, Known For Its Powerful Charting Tools, Technical Analysis Capabilities And High Degree Of Customization. The Platform Supports Web, Mobile Devices (iOS And Android) And PC/Mac End Point, Making It Easy For Investors To Trade Anytime, Anywhere.

The Self-developed GMI EDGE Platform Further Optimizes The Trading Experience, Providing Easy Deposit And Withdrawal Operations And An Intuitive Trading Interface. The Platform Is Also Compatible With Multiple Devices, Ensuring That Investors Can Use It Easily.

Deposit And Withdrawal Methods

GMI Markets Supports A Variety Of Deposit And Withdrawal Methods, Including:

- E-wallets: NETELLER, Skrill, Etc.

- Bank Transfers: Some Countries Support Direct Bank Transfers.

There Is No Fee For Deposits And A Fee Of 4% For Withdrawals . The Minimum Deposit And Withdrawal Amount Is $10 .

For Withdrawals Under $1000 , GMI Markets Promises To Process Immediately. For Withdrawals Between $1000 And $19999 , The Review Needs To Be Completed Within 24 Hours. For Withdrawals Over $20000 , It May Take 4 Working Days .

Customer Support

GMI Markets Provides Multilingual Customer Support Services, Including English And Chinese . Investors Can Contact The Customer Support Team At:

- Telephone Support: + 86 400 606 3399.

- Email Support: Cs@gmimarkets.com.

- Online Chat: Communicate Directly With The Support Team Via The Official Website.

Despite The Rich Support Channels, GMI Markets Has Not Clearly Marked The Specific Working Hours Of The Client Server, And May Not Be Able To Respond Quickly To Customer Questions During Some Periods.

Core Business And Services

GMI Markets' Core Business Is To Provide CFD Trading Services For Individual And Institutional Investors. Its Service Targets Include:

- Retail Traders: Provide Flexible Trading Tools And A Variety Of Account Options.

- Institutional Clients: Meet Their Specific Trading And Money Management Needs Through Customized Services.

The Company Ensures The Transparency And Security Of All Transactions Through A Powerful Technical Platform And Compliance System.

Technical Infrastructure

GMI Markets' Technical Infrastructure Is Based On The World's Leading MT4 Platform And The Self-developed GMI EDGE Trading Platform. Combined With Advanced Server Technology And Data Processing Capabilities, It Ensures Smooth Trading And Low Latency. In Addition, The Company Also Provides:

- Real-time Market Data: Provide Traders With The Latest Market Dynamics And Price Movements.

- Technical Analysis Tools: Includes A Variety Of Chart Types And Indicators To Help Traders Conduct Market Analysis.

- Risk Management Tools: Such As Stop Loss And Take Profit Functions To Help Investors Control Trading Risks.

These Technical Functions Enable GMI Markets To Meet The Diverse Needs Of Traders Of Different Levels.

Compliance And Risk Control System

GMI Markets Adheres To Strict Compliance And Risk Control Standards To Ensure That Its Operations Comply With Regulatory Requirements And Protect The Safety Of Investor Funds. The Company's Risk Control System Includes:

- Client Funds Isolation: To Ensure That Client Funds Are Completely Separated From The Company's Operating Funds, So As To Avoid The Company's Risk Affecting The Safety Of Client Funds.

- Risk Management Tools: Such As Leverage Limits And Stop Loss Measures To Help Investors Control Risks.

- Periodic Audits: Periodic Reviews Of The Company's Operations And Financial Condition By A Third-party Auditor To Ensure Compliance.

The Company's Compliance Statement Emphasizes That It Always Puts The Interests Of Its Clients First And Provides Investors With A Safe And Reliable Trading Environment Through Transparent Operations And High Standards Of Risk Control Measures.

Market Positioning And Competitive Advantage

GMI Markets' Market Positioning Is To Provide Diversified, Transparent And Secure Trading Services. Its Competitive Advantage Is Mainly Reflected In The Following Aspects:

- Diverse Trading Products: Covering Multiple Markets Such As Forex, Precious Metals, Energy, Indices And Cryptocurrencies.

- High Leverage And Low Spreads: The Maximum Leverage Is 1:2000 And The Minimum Spread Is 0.0 Pip , Attracting Investors Seeking High Returns.

- Flexible Trading Accounts: Offers Multiple Account Types, Including ECN, CENT And Standard Accounts, To Meet Different Trading Needs.

- Multi-device Compatibility: Supports Web, Mobile And Desktop End Points, Making It Convenient For Investors To Trade Anytime, Anywhere.

These Advantages Have Given GMI Markets An Important Position In The Global Trading Market.

Customer Support And Empowerment

GMI Markets Not Only Provides Trading Services, But Also Empowers Clients In A Number Of Ways:

- Educational Resources: Provides Trading Guides, Market Analysis And Skills Training To Help New Traders Improve Their Abilities.

- Demo Account: Provides A Free Simulated Trading Environment For Newbies To Practice And Test Trading Strategies.

- Real-time Support: Answers To Customers' Questions Through Multiple Channels To Ensure A Smooth Trading Process.

These Services Make GMI Markets An All-round Trading Partner For Investors.

Social Responsibility And ESG

GMI Markets Takes An Active Approach In Fulfilling Its Social Responsibility, Including:

- Support Financial Education: Increase Public Understanding Of Financial Marekt By Providing Educational Resources.

- Sustainability: Focus On Efficient Use Of Resources In Operations And Reduce Environmental Impact.

- Fair Treatment Of Clients: Ensure That All Investors Have A Fair Opportunity In The Trading Process.

Although There Is Currently Limited Specific Information On Its ESG Practices, The Company Has Indicated That It Will Gradually Increase Its Investment In This Area.

Strategic Cooperation Ecosystem

GMI Markets Has Established Strategic Partnerships With Several Well-known Institutions, Including:

- Payment Processor: Collaborates With NETELLER, Skrill, And Others To Ensure Fast Deposit And Withdrawal Services.

- Technology Partner: Establishes Long-term Partnerships With The Technical Enablers Of The MT4 Platform To Optimize The Trading Experience.

- Financial Institution Group: Collaborates With Multiple Banks To Ensure The Safety And Transparency Of Funds.

These Collaborations Enable GMI Markets To Maintain A High Level Of Service In Technology, Payments, And Treasury Management.

Financial Health

As Of 2023Q3, GMI Markets' Financial Position Is Sound, With Core Metrics Including:

- Revenue: Approximately $120 Million .

- Capital Base: The Company's Registered Capital Is $5 Million , Providing Sufficient Financial Support For Operations.

These Data Indicate That GMI Markets Has A High Degree Of Financial Health And Is Able To Provide Long-lasting And Stable Trading Services To Investors.

Future Roadmap

GMI Markets Plans To Continue To Expand Its Service Scope In The Future, Including:

- Adding Trading Varieties: Introducing More Emerging Asset Classes, Such As More Cryptocurrencies And Commodities.

- Optimizing Trading Platforms: Further Improving The Functionality Of MT4 And GMI EDGE To Enhance The User Experience.

- Enhancing Customer Support: Improving Customer Satisfaction By Introducing More Language Support And Reducing Response Time.

- Fulfilling Social Responsibility: Further Strengthening Investment In Financial Education, Sustainability And Arm's Length Transactions.

These Plans Will Enable GMI Markets To Continue To Remain Competitive In The Industry In The Future And Provide Better Services To Investors.