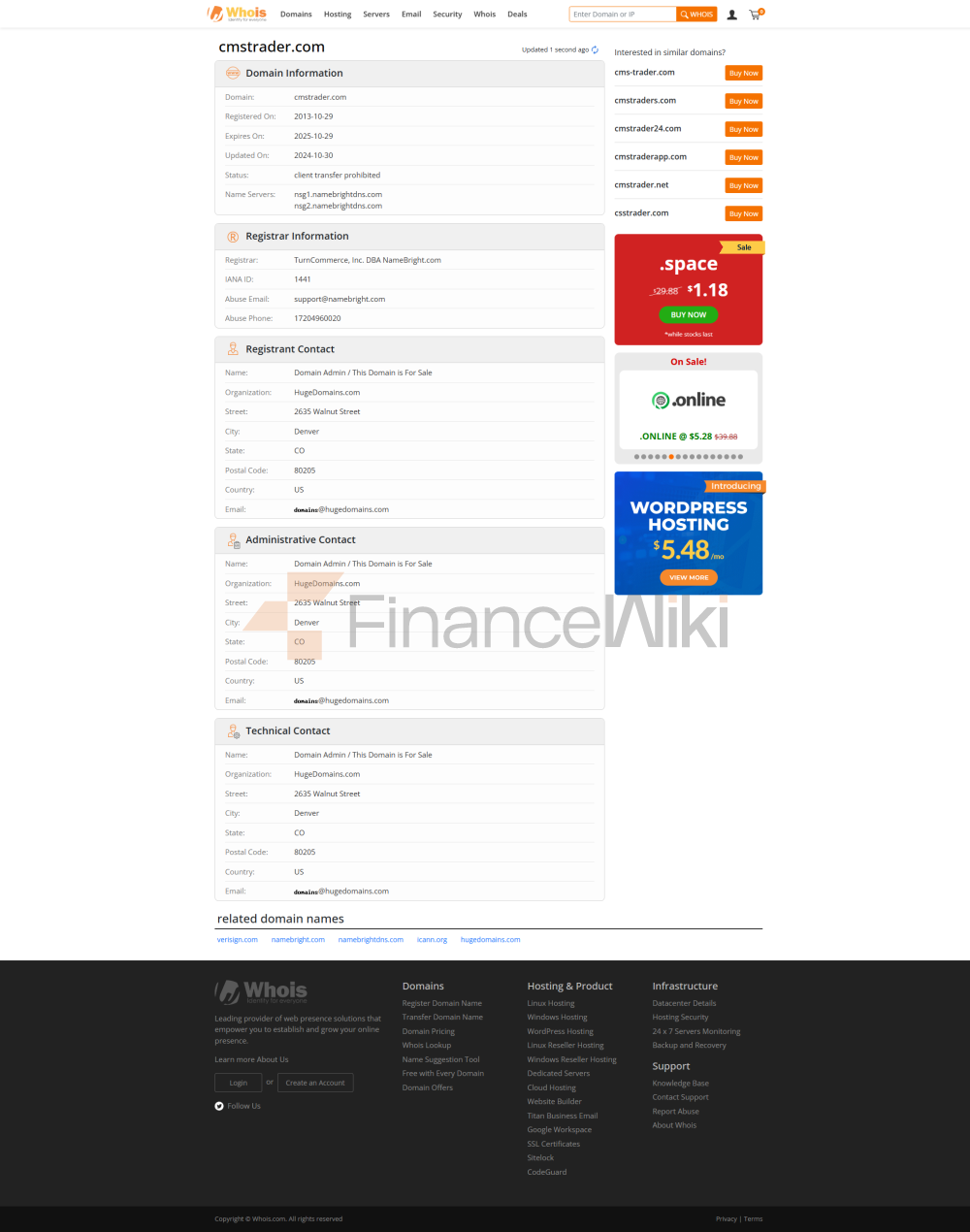

The CMSTrader Website Shows That The Domain Name Is Being Sold And The Company Appears To Have Gone Out Of Business. Therefore We Can Only Gather Some Relevant Information For Reference Only.

General Information And Regulations

CMSTrader Is A Forex And CFD Broker Founded In 2013 And Headquartered In London, UK. It Is Currently Not Subject To Any Effective Regulation.

Market Tools

CMSTrader Offers Investors A Range Of Trading Assets, Including Currency Pairs, Commodities, Indices, CFDs On Stocks, And Precious Metals.

Minimum Deposit

CMSTrader Offers Investors Three Different Trading Accounts: Mini Account (minimum Deposit Of $500), Silver Account (minimum Deposit Of $10,000), And Gold Account (minimum Deposit Of $50,000). CMSTrader Requires $as A Starting Point, Which Is Obviously Higher Than Most Brokers, As They Only Require Traders To Start Trading 100 Dollars- 200 Dollars.

CMSTrader LeverageTrading Leverage Varies Depending On The Trading Account. The Maximum Trading Leverage For Mini Account Is 1:200, And For Silver And Gold Accounts Is 1:400. Since Leverage Can Amplify Profits And Losses, Choosing The Right Amount Is A Key Risk Decision For Traders.

Spreads And Commissions

CMSTrader Mini Account For Eurusd 3 Pips, Well Above The Industry Standard. Most Legitimate Brokers Offer A Normal Spread Between 1.1 Pips And 1.5 Pips.

Trading Platform

Unlike Most Other Dealers, CMSTrader Offers Traders Not The Most Popular Mt4 Trading Platform On The Market Today, But A Sirix Trading Platform Compatible With Desktop, Web And Mobile Devices.

Deposit And Withdrawal

CMSTrader Welcomes A Variety Of Deposit And Withdrawal Methods, Mainly Telegraphic Transfer, Credit/debit Cards (visa, Mastercard, Maestro), And CMSTrader MasterCard. Popular Payment Methods Such As Skrill, Neteller, And Fasapay Cannot Be Used. The Minimum Amount For Deposit And Withdrawal Is $100, And The Maximum Amount Is $10,000.

Pros And Cons

CMSTrader Advantages Include:

1. Islamic Accounts Are Available

CMSTrader Disadvantages Include:

1. No Rules

2. High Minimum Deposit Requirements

3. High Spreads And No Competition

4. Non-MT4 Trading Platforms

5. Limited Payment Options