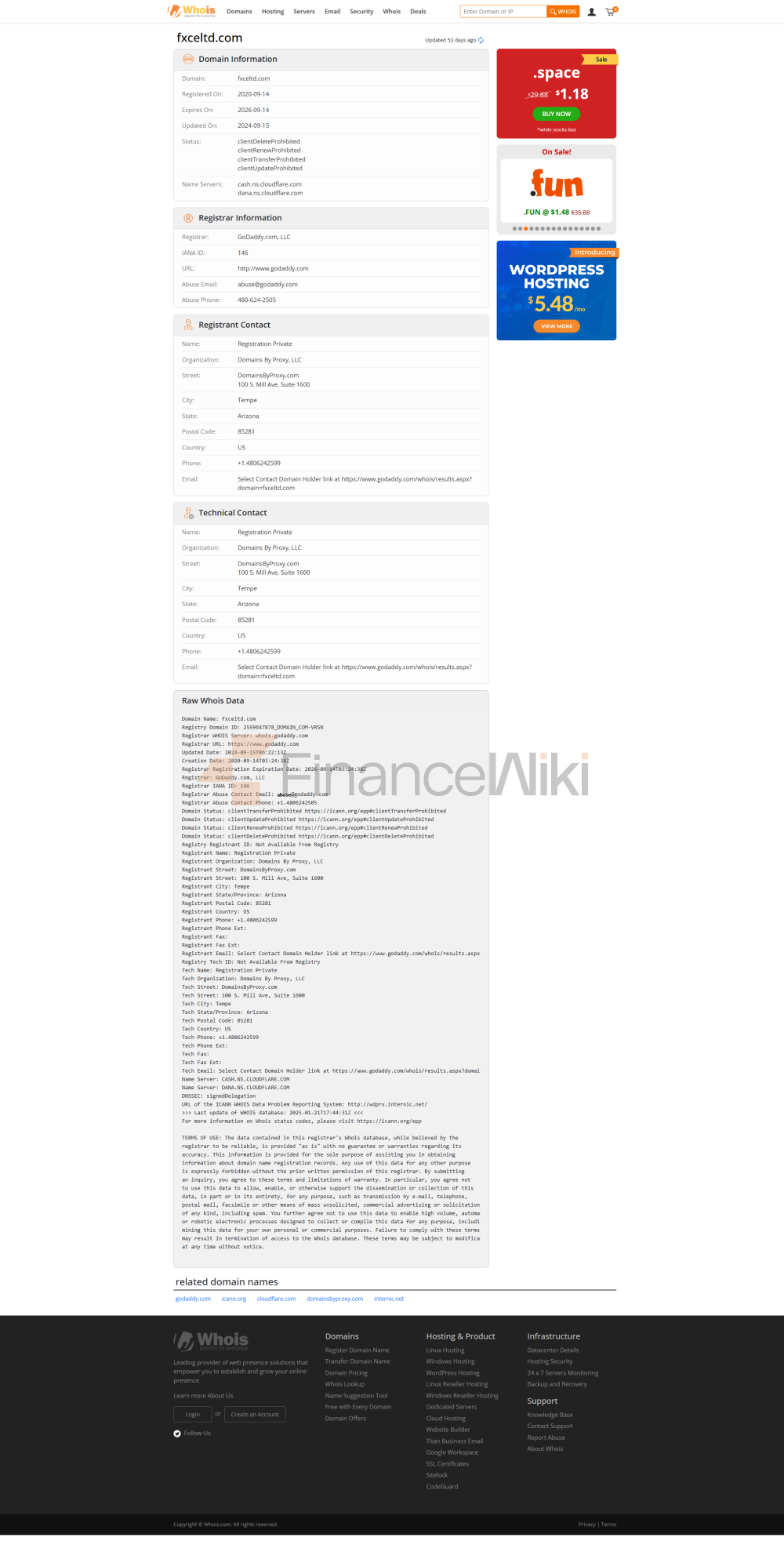

Verified: The FXCE Company Domain Name Was Registered In 2020 And Is Located In Saint Vincent And The Grenadines. It Is An Online Trading Broker. The Company Is Currently Not Effectively Regulated.

Note: FXCE As An, Unregulated Broker Means That The Client's Investment May Not Be Adequately Protected. Due To The Lack Of A Regulator To Hold The Company Accountable, The Lack Of Supervision Increases The Risk Of Potential Financial Losses.

If You Invest In An Unregulated Broker, There Is A Good Chance That They Will Run Away With Your Hard-earned Money Without Any Recourse. Therefore, Investors Must Be Extremely Cautious And Remind Everyone To Stay Away From These Unregulated As Much As Possible When Choosing A Trader.

According To The Company's Official Website:

The Company Claims To Be Regulated By The Labuan Financial Services Authority Of Malaysia, But After Verification, There Is No Relevant Regulatory Information On The Company.

By Offering About 300 + Assets, Including Foreign Exchange, Indices And Cryptocurrencies, FXCE Offers Attractive Trading Conditions. Through Its Four Account Forms And High Leverage Options, It Appeals To A Wide Range Of Traders.

FXCE Limited Is Not Entirely Legal To Trade In Foreign Exchange. Although Registered With The LL18960 License Under The Labuan Financial Services Authority (LFSA) In Malaysia, The License Type Is A General Business Registration And Does Not Authorize Forex Or Financial Services Activities.

FXCE Offers A Diverse Range Of Financial Instruments. These Are Suitable For Traders Seeking Global Financial Marekt Exposure As They Include Over 60 Currency Pairs, Commodities, Indices, Equity CFDs, Precious Metals And Cryptocurrencies.

Advantages

Wide Selection Of Financial Instruments

High Leverage Up To 1:1000

No Deposit/withdrawal Restrictions

Advanced Trading Platform (MT4/MT5)

Disadvantages

No Effective Supervision

Offshore Registration Is Risky

Ordinary Business Registration Is Not Applicable To Foreign Exchange

Account Type

FXCE Four Main Types Of Accounts Are Provided, Catering To Different Trading Needs And Levels Of Experience. Although Islamic Accounts Are Not Mentioned, A Hands-on Demo Account Is Provided.

Demo Account: Spread 0.01, Maximum Leverage 1:1000, Minimum Deposit 0 Dollars, Maximum Deposit Unlimited, Coverage Ratio 50%, Strong Flat Ratio 30%, Commission 0 Dollars, Suitable For Beginners To Practice Trading.

Sub Account: From 1.0 Pip Spread, Maximum Leverage 1:1000, Minimum Deposit Of 10 Dollars, Maximum Deposit Of $5,000, 50% Post-guarantee Ratio, 30% Strong Balance Ratio, Commission $0, Suitable For Novice Traders With Small Investment.

Standard Account: From 1.0 Pip Spread, Maximum Leverage Of 1:500, Minimum Deposit Of $50, Maximum Deposit Unlimited, 50% Post-guarantee Ratio, 30% Strong Balance Ratio, Commission $0, Suitable For Intermediate Traders.

ECN Account: From 0.0 Pip Spread, Maximum Leverage 1:500, Minimum Deposit 50 Dollars, Maximum Deposit Unlimited, 50% Post-insurance Ratio, 30% Strong Tie Ratio, Commission 7 Dollars, Suitable For Experienced Traders Who Need Tighter Spreads And Lower Latency.

Leverage

Depending On The Account Type, FXCE Offers Leverage Up To 1:1000.

FXCE Fees

Especially With ECN Accounts Offering Spreads From 0.0 Pips And Low Commission Rates, FXCE's Fees Are Cheap Compared To Industry Standards. For Traders, The Lack Of Inactive Fees And Low Deposit And Withdrawal Fees Add To Its Appeal.

Trading Platform

MetaTrader 4/5, Available Devices: IOS, Android, Windows, Mac, Suitable For Advanced Technical Traders, Automated Trading

Deposit And Withdrawal

FXCE Does Not Charge Any Deposit Or Withdrawal Fees, Making Transactions Inexpensive For Its Users. The Minimum Deposit Amount Is 10 Dollars, And Withdrawals Are Processed Securely Through 9 Pay Payment Gateways Or Traditional Banking Methods.