Corporate Profile

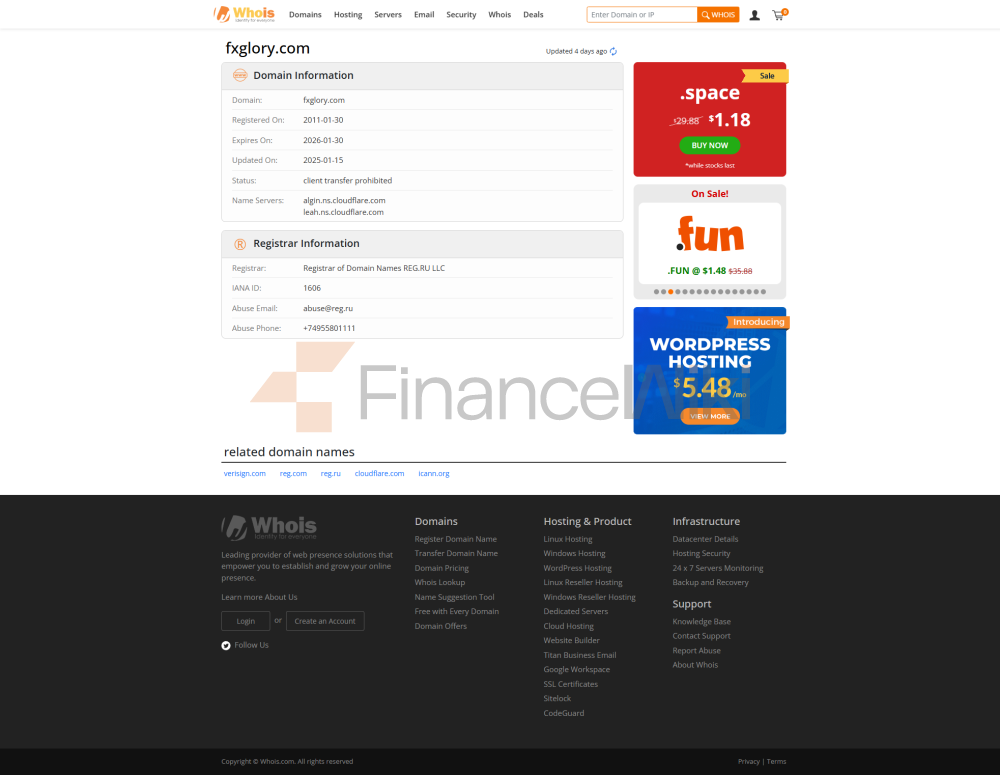

FXGlory Is An Online Financial Broker Founded In 2010 And Headquartered In Saint Vincent And The Grenadines . The Registered Capital Of The Company Is Unknown , And Its Core Business Is To Provide Global Traders With Trading Services For Financial Products Such As Foreign Exchange (Forex), Precious Metals (including Gold, Silver, Platinum And Palladium), And Crude Oil. FXGlory Provides Traders With A Diverse Range Of Trading Tools And High-leverage Trading Options Through The MT4 And MT5 Trading Platforms, With Leverage Up To 1:3000 .

As A Broker Focused On Serving Global Traders, FXGlory Is Committed To Providing A Convenient Trading Experience And A Variety Of Flexible Deposit And Withdrawal Methods. However, As An Unlicensed Offshore Broker, Traders Need To Fully Consider The Relevant Risks When Choosing.

Regulatory Information

FXGlory Is Currently Not Authorized Or Regulated By Any Authoritative Financial Regulator . According To Publicly Available Information, The Company Is Not Registered Or Licensed With A Financial Regulator In Any Country Or Region. This Unregulated Status May Lead To Uncertainty About The Security, Transparency And Dispute Resolution Mechanism Of Client Funds. Although FXGlory Claims To Offer Security Measures Such As Segregation Of Client Funds, SSL Encryption, Advanced Risk Management, Regular Audits, And Transparency, The Lack Of Independent Verification By Regulators Casts Doubt On The Credibility Of These Claims.

When Choosing FXGlory, Traders Need To Be Fully Aware Of The Risks That Unregulated Can Pose, Including Potential Fund Security Issues, Lack Of Transparency, And The Inability To Rely On Regulators For Protection.

Trading Products

FXGlory Offers The Following Trading Products:

- Currency Pairs : Includes Major Currency Pairs (e.g. EUR/USD, USD/JPY), Minor Currency Pairs (e.g. GBP/USD, USD/CAD), And Exotic Currency Pairs (e.g. AUD/JPY).

- Precious Metals : Supports Trading In Gold (XAU/USD), Silver (XAG/USD), Platinum (XPT/USD), And Palladium (XPD/USD).

- Crude Oil : Offers Trading On Price Fluctuations Of WTI Crude Oil And Brent Crude.

FXGlory's Trading Products Cover Forex, Precious Metals And Energy Markets, But Excludes Other Asset Classes Such As Indices, Stocks, Cryptocurrencies.

Trading Software

FXGlory Offers The Following Trading Platforms:

- MetaTrader 4 (MT4) : Available For Windows, Android, IOS And WebTrader, For Beginners And Intermediate Traders.

- MetaTrader 5 (MT5) : Available For Windows, Android, IOS And WebTrader, Suitable For Complex Trading Strategies And Advanced Traders.

MT4 And MT5 Are Widely Used Trading Platforms Around The World, Supporting Real-time Quotes, Technical Analysis, Multiple Chart Types And Order Types. In Addition, FXGlory Also Provides One-click Trading Capabilities To Help Traders Execute Trades Faster.

Deposit And Withdrawal Methods

FXGlory Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Credit Card : Visa, MasterCard, American Express.

- Cryptocurrencies : Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP).

- E-wallets : Perfect Money, Skrill, NETELLER, PayPal.

- Bank Transfer : Telegraphic Transfer (Wire Transfer), WebMoney.

Minimum Deposit Required :

- MT4 Account: $1 (standard Account).

- MT5 Account: $100 (Standard Account).

Deposit And Withdrawal Fee :

- Deposit: No Fee .

- Withdrawal: Depends On The Payment Method (specific Fees Need To Refer To The Information Of The Payment Provider).

Traders Need To Note That FXGlory Requires The Withdrawal Method To Be Consistent With The Deposit Method To Comply With The Requirements Of Anti-money Laundering Regulations. Withdrawal Processing Takes 1 To 10 Business Days , Depending On The Payment Method.

Customer Support

FXGlory Provides 24/7 Multi-channel Customer Support Services, Including:

- Live Chat : Communicate With The Support Team In Real Time.

- Phone Support : + (44) 322 473 800 (UK), + (44) 744 190 6300 (WhatsApp).

- Email : Support@fxglory.com.

- Online Form : Submit Questions Via The Website.

Pros:

- 24/7 Live Support.

- Multiple Contact Details.

Cons:

- Lack Of Comprehensive Frequently Asked Questions (FAQs).

- No Social Media Support Channels.

Overall, FXGlory's Customer Support Team Is Responsive And Professional, But More Detailed FAQ Support May Be Required When Traders Encounter Complex Issues.

Core Business And Services

FXGlory's Core Business Includes:

- Forex Trading : Provides Highly Liquid Currency Pair Trading, Including Major And Minor Currency Pairs.

- Precious Metals Trading : Provides Trading Of Various Precious Metals, Suitable For Hedging And Investment Needs.

- Crude Oil Trading : Provides Trading Of WTI Crude Oil And Brent Crude Oil, Helping Traders To Grasp The Fluctuations In The Energy Market.

In Addition, FXGlory Offers The Following Featured Services:

- Demo Account : Traders Can Practice Trading Strategies In A Risk-free Environment.

- Islamic Account (No Overnight Interest): To Meet The Needs Of Clients Who Adhere To The Principles Of Sharia Law.

Technical Infrastructure

FXGlory's Technical Infrastructure Is Based On The MT4 And MT5 Trading Platforms And Supports A Variety Of Payment Methods And Trading Tools. Its Servers Are Encrypted With SSL And Two-factor Authentication To Protect The Security Of Traders' Accounts. In Addition, FXGlory Also Offers Trading Tools Such As Economic Calendars And Margin Calculators To Help Traders Develop Trading Strategies.

Although The Technical Infrastructure Is Relatively Basic, Its High Leverage And Multi-account Type Options Still Meet The Needs Of Different Traders.

Compliance And Risk Control System

FXGlory Claims To Provide The Following Compliance And Risk Control Measures:

- Client Funds Segregation : Client Funds Are Managed Separately From The Company's Working Funds To Protect The Safety Of Client Funds.

- Security Measures : Includes SSL Encryption, Two-factor Authentication, Penetration Testing And Real-time Monitoring.

- Risk Management : Provides Margin Calculators And Some Risk Management Tools To Help Traders Control Risk.

However, As FXGlory Is Not Authorized Or Regulated By Any Financial Regulator, The Implementation And Effectiveness Of These Measures Cannot Be Independently Verified.

Market Positioning And Competitive Advantage

The Market Positioning Of FXGlory Is Mainly:

- Beginner Friendly : Offers A Low Threshold Minimum Deposit Requirement ($1), Suitable For Traders With Limited Funds.

- High Leverage Trading : Maximum Leverage Up To 1:3000, Suitable For Traders With Higher Risk Tolerance.

- Multi-account Options : Offers Standard Accounts, Premium Accounts, VIP Accounts And CIP Accounts To Meet The Needs Of Different Traders.

Competitive Advantages Include:

- Zero Commission Trading : No Commission Is Charged For Forex Trading On All Account Types.

- Diversified Payment Methods : Supports Multiple Credit Card, E-wallet, And Cryptocurrency Deposit And Withdrawal Methods.

- 24/7 Customer Support : Helping Traders At All Times.

Disadvantages Include:

- Unregulated Operations : Lack Of Regulation Can Lead To Funding Security And Transparency Issues.

- High Spreads : Spreads On Standard Accounts Start At 2 Pips And Are Higher Than The Industry Average.

- Limited Trading Products : Other Asset Classes Such As Indices, Stocks, And Cryptocurrencies Are Not Offered.

Customer Support & Empowerment

FXGlory Supports Its Traders By:

- Educational Resources : Provides A Knowledge Base And Glossary Covering Topics Such As Fundamental Analysis, Technical Analysis, Risk Management, And More.

- Trading Tools : Includes An Economic Calendar, Margin Calculator, And One-click Trading Functionality.

- Customer Support : 24/7 Multi-channel Support To Help Traders Solve Problems.

However, FXGlory's Educational Resources Are Relatively Limited, And The Lack Of In-depth Educational Videos Or Interactive Courses May Not Fully Meet The Educational Needs Of Advanced Traders.

Social Responsibility And ESG

FXGlory Does Not Explicitly Mention Social Responsibility Or ESG (environmental, Social, And Governance) Commitments In Its Public Information. As An Offshore Broker, Its Social Responsibility Initiatives May Be Limited.

Strategic Partnership Ecology

FXGlory Does Not Publicly Disclose Its Strategic Partnership. Its Main Competitiveness Comes From Its Multi-account Options, Highly Leveraged Trading And Convenient Deposit And Withdrawal Methods, Rather Than Strategic Partners.

Financial Health

FXGlory's Financial Health Is Not Publicly Disclosed. As An Unlicensed Offshore Broker, Its Financial Position And Capital Reserves Cannot Be Independently Verified. Traders Need To Be Aware Of The Lack Of Financial Transparency When Choosing.

Future Roadmap

FXGlory Has Not Yet Made Public Its Future Roadmap, Including Product Expansion, Market Expansion Or Technology Upgrades. Its Future Development Will Mainly Depend On The Performance Of Its Core Business And Market Competitiveness.

Risk Warning

Online Trading Involves Significant Risks, And You May Lose All Your Investment Capital. FXGlory, As An Unlicensed Offshore Broker, May Be Riskier. Traders Need To Fully Consider The Latent Risks Brought By Unregulated When Choosing, And Ensure That Their Trading Strategies Are In Line With Their Risk Tolerance.