Corporate Profile

PAXOS Is A US-based Cryptocurrency Platform Founded In 2015. The Company Focuses On Providing Diverse Financial Solutions, Covering Areas Such As Cryptocurrency Brokerage Services, Securities Settlement, Payment Services, Asset Tokenization Infrastructure, And Commodity Settlement. PAXOS Aims To Provide Users With A Secure And Efficient Digital Asset Management And Trading Environment Through Technological Innovation And Compliance Operations.

Regulatory Information

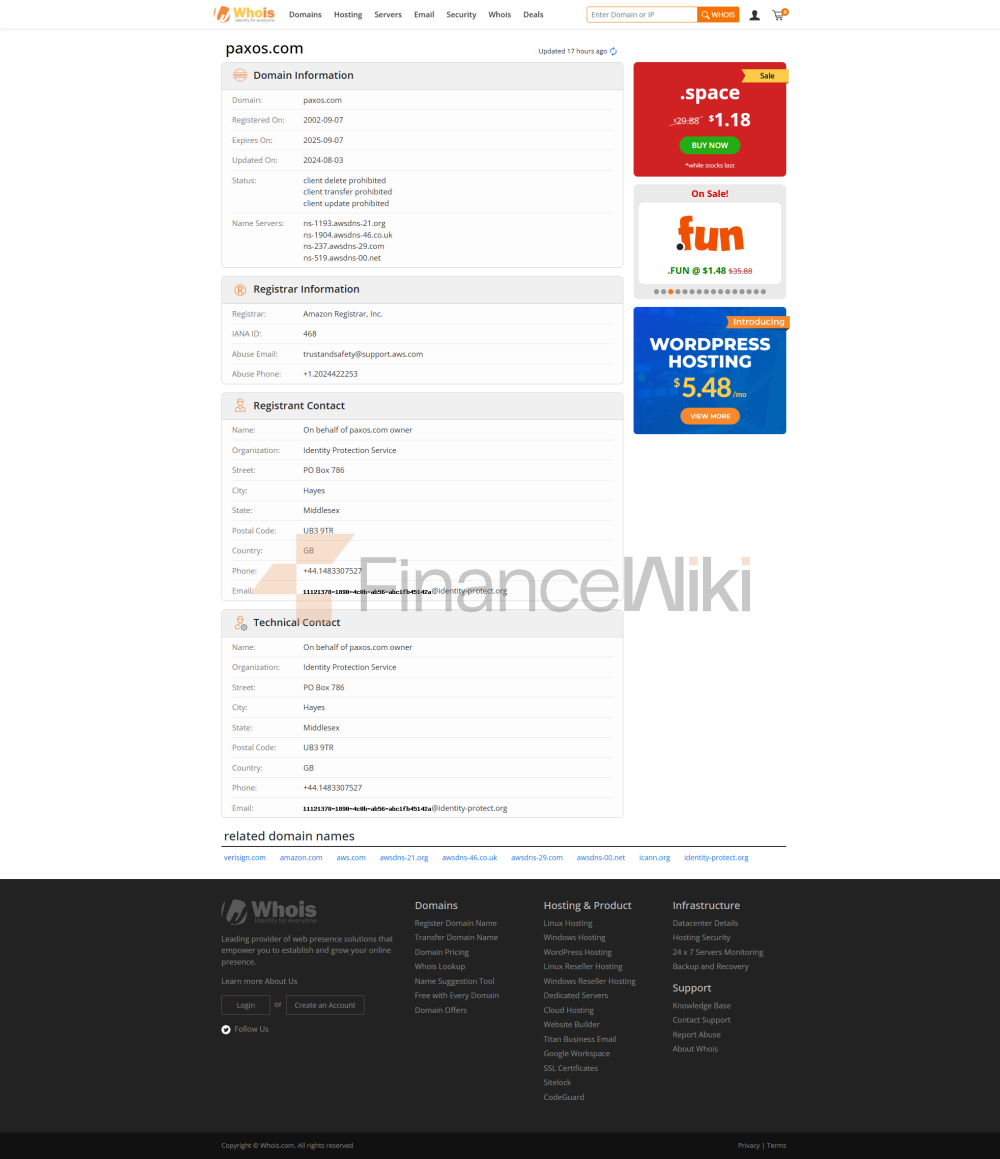

PAXOS Holds A Trust Company License (NYDFS License: 0002533) Issued By The New York State Department Of Financial Services (NYDFS) As A Recognition Of Its Operational Compliance. This License Allows PAXOS To Provide Users With Regulated Financial Services, Including Cryptocurrency Trading And Custody Services. In Addition, PAXOS Is Certified To Multiple International Financial Standards, Ensuring That Its Operations Comply With Industry Best Practices.

Trading Products

PAXOS Provides Users With A Variety Of Cryptocurrency And Stablecoin Trading Services. The Main Products Include:

- Cryptocurrencies : Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) And Other Mainstream Cryptocurrencies.

- Stablecoins : PAXOS Has Issued A Variety Of Stablecoins Such As PYUSD (pegged To PayPal USD), PAXG (pegged To Gold) And USDP (pegged To USD) To Provide Users With Safer Trading And Payment Tools.

- Commodity Settlement : PAXOS Also Supports Tokenized Trading Of Commodities Such As Precious Metals, Providing Users With More Diversified Investment Options.

Trading Software

PAXOS Provides A Set Of Powerful Trading And Wallet Infrastructure That Supports Users To Manage Digital Assets Safely And Efficiently. Its Trading Platform Has The Following Features:

- High Security : Adopts Multi-layer Security Protocols And Cold Wallet Technology To Ensure The Security Of User Assets.

- High Performance : Supports High-frequency Trading And Large-scale Capital Flows, Meeting The Trading Needs Of Institutional And Retail Users.

- User-friendly Interface : Provides An Intuitive Operation Interface, Which Is Convenient For Users To Get Started Quickly.

Deposit And Withdrawal Methods

PAXOS Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Fiat Currency Withdrawal : Users Can Deposit And Withdraw Fiat Currencies Such As US Dollars Through Bank Transfer Or Credit/debit Card.

- Cryptocurrency Deposit And Withdrawal : Supports The Deposit And Withdrawal Of Various Cryptocurrencies Such As Bitcoin And Ethereum.

- Stablecoin Exchange : Users Can Directly Exchange Fiat Currencies For Stablecoins (such As PYUSD, USDP) Through The PAXOS Platform.

Customer Support

PAXOS Provides Users With Customer Support Through Multiple Channels To Ensure That Users Can Quickly Solve Problems They Encounter:

- Support Center : Users Can Submit Problem Requests Through PAXOS 'Support Center To Receive Technical Support And Trading Guidance.

- Media Inquiries : Members Of The Media Can Contact PAXOS Via Email ([email protected]) For Company News And Related Information.

- Complaint Handling : For Unresolved Complaints, New York State Residents Can File A Complaint Through The New York State Department Of Financial Services For Further Support.

Core Business And Services

The Core Business Of PAXOS Includes The Following Aspects:

- Cryptocurrency Brokerage Services : Allows Users To Buy, Sell And Hold Cryptocurrencies, And Supports Multiple Trading Methods.

- Securities Settlement : Provides Secure And Efficient Settlement Services For Securities Transactions In The Cryptocurrency Sector.

- Payment Services : Provides Secure Payment Solutions For Users And Businesses Through Stablecoins And Tokenized Infrastructure.

- Asset Issuance And Management : Supports The Tokenization Issuance And Management Of Assets Within The Platform, Providing Users With More Diversified Investment Options.

Technical Infrastructure

PAXOS Adopts A Series Of Advanced Technical Infrastructure To Ensure The Stability And Security Of The Platform:

- Blockchain Technology : Build A Transaction And Custody System Based On Blockchain Technology To Ensure Transaction Transparency And Immutability.

- AIoT Risk Control System : Monitor Transaction Risks In Real Time Through Artificial Intelligence And Internet Of Things Technology To Prevent Malicious Transaction Behaviors.

- High Availability Architecture : Adopts Distributed Computing And High Availability Architecture To Ensure Stable Operation Of The Platform Under High Load.

Compliance And Risk Control System

PAXOS Follows Strict Compliance And Risk Control Norms To Ensure That Its Operations Meet Regulatory Requirements:

- Compliance Statement : PAXOS Strictly Complies With The Regulatory Requirements Of The New York State Department Of Financial Services To Ensure Legal Compliance Of Its Operations.

- Risk Management System : Identify And Prevent Potential Market, Operational And Credit Risks Through Multi-dimensional Threat And Risk Assessment And Monitoring.

- Anti-Money Laundering (AML) Policy : Implement Strict Anti-money Laundering And Counter-terrorism Financing Policies To Ensure That The Source Of Funds On The Platform Is Legal And Transparent.

- Data Privacy Protection : Follow Privacy Protection Regulations Such As The European Union's General Data Protection Regulation (GDPR) To Ensure User Data Security.

Market Positioning And Competitive Advantage

The Market Positioning Of PAXOS In The Cryptocurrency Industry Is As Follows:

- Regulated Platform : As A Regulated Cryptocurrency Platform In New York State, PAXOS Has Been Recognized By The Market For Its Operational Transparency And Compliance.

- Diversified Services : Provide Multi-domain Services Such As Cryptocurrency Brokerage, Securities Settlement, Stablecoin Issuance, And Tokenization Infrastructure To Meet The Diverse Needs Of Users.

- Technological Innovation : Continuously Improve The Transaction Efficiency And Security Of The Platform Through Technologies Such As Blockchain, AIoT, Etc.

Customer Support And Empower

PAXOS Supports And Empowers Its Customers In The Following Ways:

- Educational Resources : Provide Educational Resources Such As Blogs And Monthly Newsletters To Help Users Understand The Latest Developments In The Blockchain And Cryptocurrency Industry.

- Technical Support : Provide Users With Timely Technical Support And Problem Solving Through A Support Center And Online Ticket System.

- User Experience Optimization : Continuously Improve The Functionality And Interface Of The Platform To Enhance The User Experience.

Social Responsibility And ESG

PAXOS Is Outstanding In Fulfilling Social Responsibility:

- Environmentally Friendly : Adopt Energy-efficient Blockchain Technology And Cloud Computing Infrastructure To Reduce The Burden On The Environment.

- Social Good : Give Back To Society By Supporting Educational Programs And Community Development Programs.

- Transparency In Governance : Enhance Corporate Transparency And Accountability Through An Open Governance Structure And Regular Reporting.

Strategic Cooperation Ecosystem

PAXOS Has Built A Strong Industry Ecosystem By Establishing Strategic Partnerships With A Number Of Well-known Institutions:

- Technical Cooperation : Collaborate With Leading Enterprises In The Field Of Blockchain Technology And Artificial Intelligence To Promote Technological Innovation.

- Financial Cooperation : Collaborate With A Number Of Traditional Financial Institution Groups To Promote The Integration And Development Of Cryptocurrency And Traditional Finance.

- Industry Alliance : Join A Number Of International Financial Industry Associations To Participate In The Formulation And Promotion Of Industry Standards.

Financial Health

PAXOS 'financial Health Is Reflected As Follows:

- Capital Adequacy : The Registered Capital Is Sufficient To Support The Company's Continued Operation And Development.

- Income Stability : To Achieve Continuous Revenue Growth Through Diversified Services And A Stable Customer Base.

- Risk Management : Ensure The Company Finances Are Sound Through Strict Financial Management And Risk Control.

Future Roadmap

The Future Plan Of PAXOS Includes The Following Aspects:

- Product Expansion : Launch More Kinds Of Stablecoin And Cryptocurrency Trading Products To Meet Market Demand.

- Technological Innovation : Continue To Invest In The Research And Development Of Blockchain And AIoT Technology To Improve Platform Performance And Security.

- Globalization : Expand Its Business To More Countries And Regions To Promote The Global Application Of Cryptocurrency.

- Social Responsibility : Further Strengthen Investment In Environmental Protection, Social Welfare And Corporate Governance.