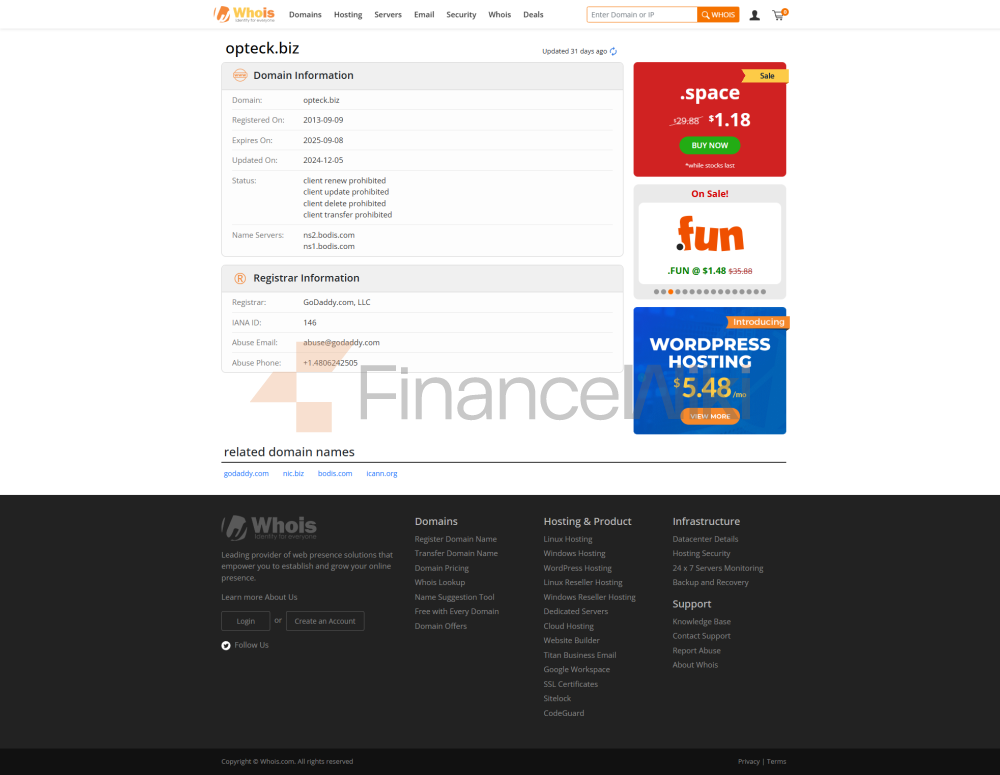

Temporarily Unable To Open Due To Domain Expiration

The URL Is As Follows: Https://www.opteck.biz/

Overview Of Opteck

Opteck Is A Trading Platform That Has Been Around For About 5 To 10 Years And Was Previously Registered Under The Supervision Of The Financial Services Commission (FSC) In Belize. However, Its Regulatory Status Has Been Revoked. In Addition, It Was Previously Associated With The Cyprus Securities And Exchange Commission (CySEC) And Was Flagged As A "suspicious Clone" Entity In Cyprus. This Status Has Raised Concerns About Its Credibility And Regulatory Compliance Within The Financial Services Industry.

Opteck's Traders Can Trade A Wide Range Of Assets, Including Forex, Indices, Commodities And Cryptocurrencies. Customer Support Is Provided Via Phone, Email And Live Chat. Payment Methods For Deposits And Withdrawals Include Telegraphic Transfers, Credit Cards And A Selected Online Payment Processor.

Is Opteck A Legitimate Or Scam?

Opteck Previously Held A Retail Foreign Exchange License For Regulation Under The Financial Services Commission (FSC) In Belize. However, The Current Status Shows That The Regulatory License Has Been Revoked.

The License Number Previously Held By Opteck Is IFSC/60/377/TS/17 And Operates Under The Entity CST Financial Services Ltd.

The Key Point To Note Here Is That The Status Indicates That Opteck Has Revoked Its Regulatory License With The Financial Services Commission Of Belize. This Means That Opteck No Longer Holds A Valid License Under The Previously Regulated Framework, Which Could Affect Its Credibility And Compliance Within The Financial Services Industry.

Opteck Operates Under The Finteractive Ltd Entity And Was Previously Associated With The Cyprus Securities And Exchange Commission (CySEC) Under License Number 238/14. However, The Current Status Shows That It Is A "suspect Clone".

This License Type Is Listed As Straight-through Processing (STP) And Is Regulated By CySEC In Cyprus. The Effective Date Of The License Is June 20, 2014. The Company Provides Compliance-related Contact Details Via Email Compliance@fxvc.eu And Operates Through The Website Www.fxvc.com/eu.

It Is Important To Note, However, That The Current Status Of "suspicious Clones" Raises Significant Concerns About Their Legality And Regulatory Compliance. This Status Suggests Issues Related To Their Operations Or Identification, And May Indicate The Presence Of Potential Fraudulent Activity Or Unauthorized Use Of Licensing Authority Details. Due To These Suspicious Circumstances, Traders And Investors Should Exercise Caution And Conduct Thorough Investigations Before Trading With Such Entities.

- Diversified Tradable Assets:

- Opteck Offers A Wide Range Of Tradable Assets, Including Various Currency Pairs, Commodities, Stocks, And Cryptocurrencies. This Diversity Provides Traders With A Wealth Of Options To Diversify Their Portfolio And Explore Different Markets Based On Their Preferences And Risk Tolerance.

2. Multiple Payment Methods:

- The Platform Supports Multiple Payment Methods For Easy Access To Funds. Traders Can Take Advantage Of Multiple Options Such As Credit/debit Cards, Telegraphic Transfers, And The Choice Of Online Payment Processors For Increased Flexibility And Convenience.

3. Various Customer Support Options:

- Opteck Offers Multiple Channels Of Customer Support, Including Phone, Email, And Online Chat. This Diverse Support Channel Ensures That Users Can Seek Help Or Resolve Issues Through Their Preferred Mode Of Communication.

4. Minimum Deposit Amount:

- Opteck Sets An Acceptable Minimum Deposit Requirement, Enabling Traders With Different Sizes Of Funds To Start Trading On The Platform. This Lowers The Barrier To Entry, Enabling Users With Different Budget Constraints To Participate In Trading Activities.

5. User-Friendly Platform:

- The Platform Features A User-friendly Interface That Simplifies Navigation And Trade Execution For Both Novice And Experienced Traders. Its Intuitive Design Is Designed To Enhance The User Experience By Providing Basic Tools And Features That Are Easily Accessible.

Cons:

- Lack Of Comprehensive Educational Resources:

- Opteck Is Inadequate In Providing Traders With Comprehensive Educational Resources. Lack Of Necessary Materials Such As Detailed Guides, Video Tutorials Or Online Seminars May Hinder The Learning Curve For New Users And May Affect Their Ability To Make Informed Trading Decisions.

2. Limited Trading Tools And Analytics:

- The Platform Lacks Powerful Trading Tools And In-depth Analytical Capabilities, Which Are Essential For Traders To Analyze The Market And Make Informed Decisions. This Limitation May Limit Users' Access To Advanced Indicators Or Comprehensive Market Analysis Tools.

3. Unregulated:

- One Notable Issue Is The Lack Of Regulatory Oversight At Opteck. The Lack Of Regulation From The Financial Institution Group May Raise Concerns About User Protection And Adherence To Industry Standards, Potentially Affecting Users' Trust And Security In The Platform.

Market Tools

Opteck Offers A Variety Of Classes Of Trading Assets To Suit Different Investment Preferences. Here Is A Specific Breakdown Of The Available Trading Assets:

1. Forex: Opteck Provides Access To Multiple Currency Pairs, Allowing Traders To Participate In Forex Trading. This Includes Major Currency Pairs Such As EUR/USD, GBP/USD, As Well As Minor And Exotic Currency Pairs. Traders Can Speculate On The Price Fluctuations Of These Currency Pairs, Taking Advantage Of The Volatility Of The Forex Market.

2. Indices: The Platform Offers The Opportunity To Trade Indices That Represent A Basket Of Stocks On A Particular Exchange. Traders Can Speculate On The Performance Of Indices Such As The S & P 500, FTSE 100, Nasdaq And So On, Thus Gaining Access To Broader Market Movements Rather Than Individual Stocks.

3. Commodities: Opteck Allows Trading Of Various Commodities Such As Gold, Silver, Crude Oil And Other Precious Metals And Energy Resources. Traders Can Speculate On The Price Fluctuations Of These Commodities, Providing Diversification To Their Trading Portfolios.

4. Cryptocurrencies: The Platform Also Allows Trading Of Cryptocurrencies Through Contracts For Difference (CFDs). Users Can Speculate On The Price Fluctuations Of Popular Cryptocurrencies Such As Bitcoin, Ethereum, Ripple Without Owning The Actual Underlying Asset. This Provides Access To The Volatile But Potentially Lucrative Cryptocurrency Market.

Account Types

At Opteck, Traders Can Choose From Two Different Accounts: Standard Accounts, Suitable For Both Beginners And Experienced Traders, Offering Leverage Of Up To 1:100, With Competitive Spreads Starting From 0.8 Pips And No Commissions; While ECN Accounts Are Designed For Experienced Traders With Lower Spreads, With $7 Commissions Per $100,000 Traded From 0.5 Pips And A Minimum Deposit Requirement Of $1,000, Potentially Appealing To Traders Seeking Better Trading Conditions And Greater Market Exposure.

Standard Account:

Opteck's Standard Account Type Provides Traders With A Balanced Set Of Features, Suitable For Both Beginners And Experienced Traders. Users Can Gain Leverage Of Up To 1:100, Which Gives Them The Potential To Significantly Enlarge Their Positions Compared To Their Initial Investment. The Account Has Competitive Spreads, Starting At 0.8 Pips, Which Can Benefit Traders By Reducing Entry And Exit Costs, Thus Maximizing Profits. One Of The Outstanding Features Is The Absence Of Commissions, Enabling Traders To Trade Without Incurring Additional Fees. The Minimum Deposit Requirement For The Standard Account Is $100, Enabling Traders Of Different Fund Sizes To Enter The Market. Withdrawals From This Account Are Free, Ensuring Smooth And Cost-effective Trading.

ECN Accounts:

Opteck's ECN Account Types Are For Experienced Traders Looking To Enhance Their Trading Conditions. Users Can Increase Their Exposure In The Market With Leverage Of Up To 1:100. ECN Accounts Offer Tighter Spreads Starting At 0.5 Pips And May Offer More Favorable Trading Conditions Compared To Standard Accounts. Unlike Standard Accounts, ECN Accounts Charge A $7 Commission For Every $100,000 Traded, Which May Affect Overall Trading Costs. To Open An ECN Account, Traders Need A Higher Minimum Deposit Amount Of $1,000, Which May Attract More Experienced Traders Or Traders With More Capital.

How Do I Open An Account?

Here Are The Steps To Open An Account With Opteck:

- Visit The Official Opteck Website: Visit The Official Opteck Website Using A Web Browser.

2. Account Registration: Look For The "Register" Or "Register" Option On The Homepage Of The Website. Click On It To Start The Account Creation Process.

3. Fill In Personal Information: Complete The Registration Form By Providing Accurate Personal Details Such As Your Full Name, Email Address, Contact Number And Residential Address.

4. Verify Identity: Authentication May Be Required By Opteck For Compliance Purposes. Follow The Prompts To Submit The Necessary Identification Documents, Such As A Government-issued ID And Proof Of Address. This Step Is Essential To Verify Your Identity And Ensure Compliance With Regulatory Standards.

5. Select Account Type: Choose The Type Of Account To Open Based On Your Trading Preferences, Risk Tolerance And Initial Investment. Opteck Offers Different Account Types That Adapt To Different Trading Needs.

6. Deposit Funds Into Account: Once Your Account Has Been Verified And Set Up, Funds Can Be Deposited Using The Available Deposit Methods Provided By Opteck. Follow The Instructions Provided By The Platform To Make An Initial Deposit And Start Trading.

Please Remember To Read All The Terms And Conditions Carefully During The Account Creation Process, As Well As Any Specific Requirements Or Steps Specified By Opteck, To Ensure A Smooth And Successful Account Opening Process.

Leverage

The Opteck Platform Offers Traders A Leverage Ratio Of Up To 1:100. Leverage Allows Traders To Scale Up The Size Of Their Position, Relative To Their Initial Investment. With A Leverage Ratio Of 1:100, Traders Can Potentially Control A Position Size That Is 100 Times Larger Than Their Deposited Funds.

Although Leverage Can Amplify Potential Profits, It Also Significantly Increases The Level Of Risk. Higher Leverage Means That Small Price Swings Can Lead To Larger Profits Or Losses. Traders Need To Exercise Caution And Effectively Implement Risk Management Strategies When Trading With Leverage. Opteck Offers This Level Of Leverage, Providing Traders With The Opportunity To Increase Market Exposure And Maximize Trading Opportunities, But Traders Must Properly Understand And Manage The Associated Risks.

Spreads And Commissions

Opteck Offers Competitive Spreads And Can Vary Depending On Market Liquidity, Volatility, And The Particular Traded Asset. While Standard Accounts Do Not Charge Commissions, Lower Spreads On ECN Accounts Are Offset By The Commission Charged Per Trade. Traders Should Consider These Factors When Choosing An Account Type, Based On Their Trading Preferences And Cost Considerations.

Trading Platform

Opteck Uses The TraderSoft Platform, Which Was Originally Designed For Binary Options Trading And Is Still In Use Despite The Move To CFD And Forex Trading. However, Due To Its Simplicity And Limited Functionality, Users Found It Inadequate On These New Products.

Interface And Information:

The Design Of The Platform Was Considered Inadequate For CFD And Forex Trading As Its Interface Was Too Minimalistic. Traders Often Need Comprehensive Tools, Charts And Market Data To Make Informed Decisions, And The TraderSoft Platform Lacks These. The Limited Information It Provides Prevents Users From Conducting In-depth Analysis And Research, Which Is Essential For These Markets.

Features:

For Contracts For Difference (CFDs) And Forex Trading, Traders Often Seek Out Advanced Features And Analytical Tools. However, TraderSoft Does Not Meet These Requirements And Offers Limited Features That May Not Meet The Diverse Needs Of Traders. The Fundamental Nature Of The Platform May Result In A Sub-optimal Trading Experience For Those Seeking More Powerful Tools.