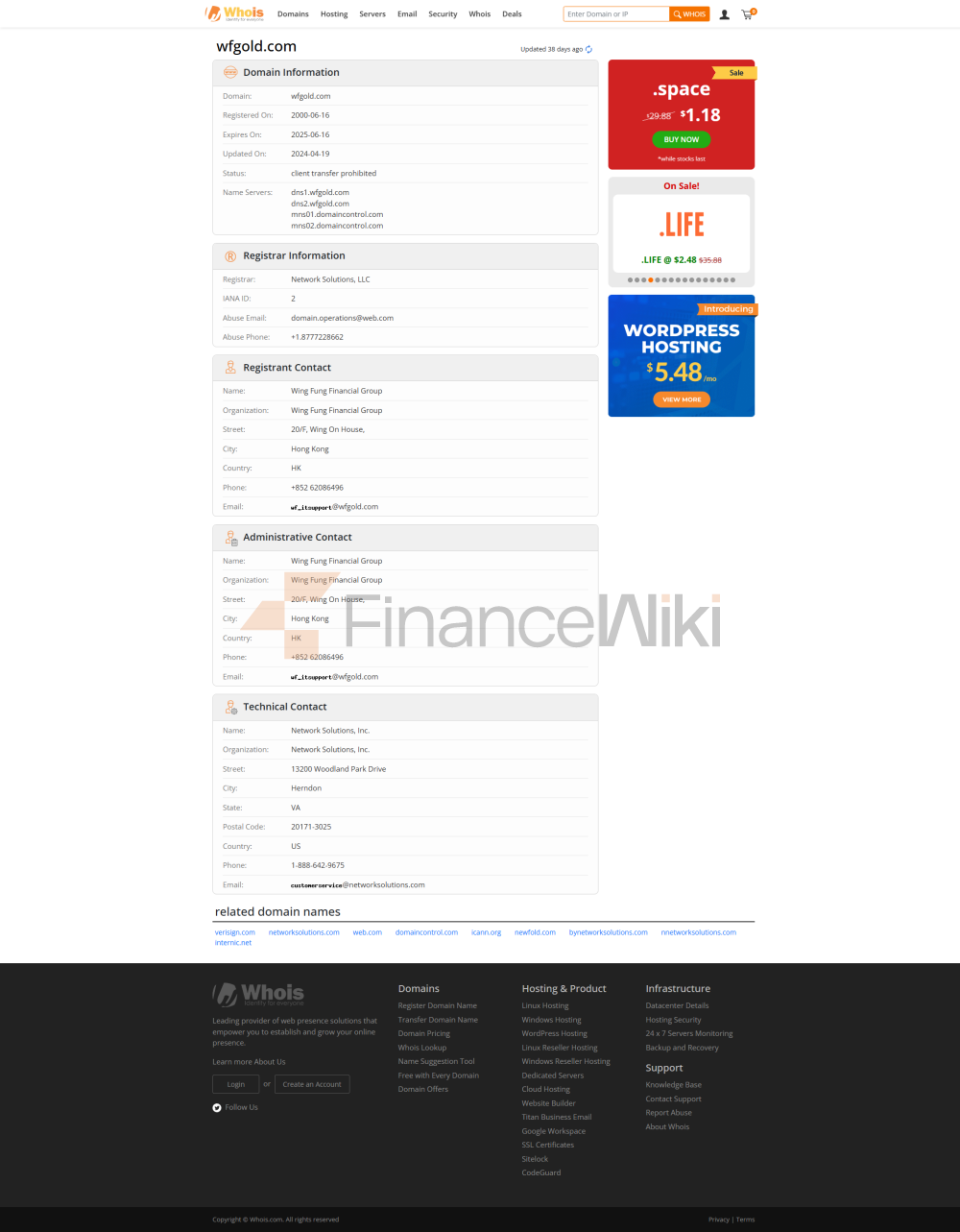

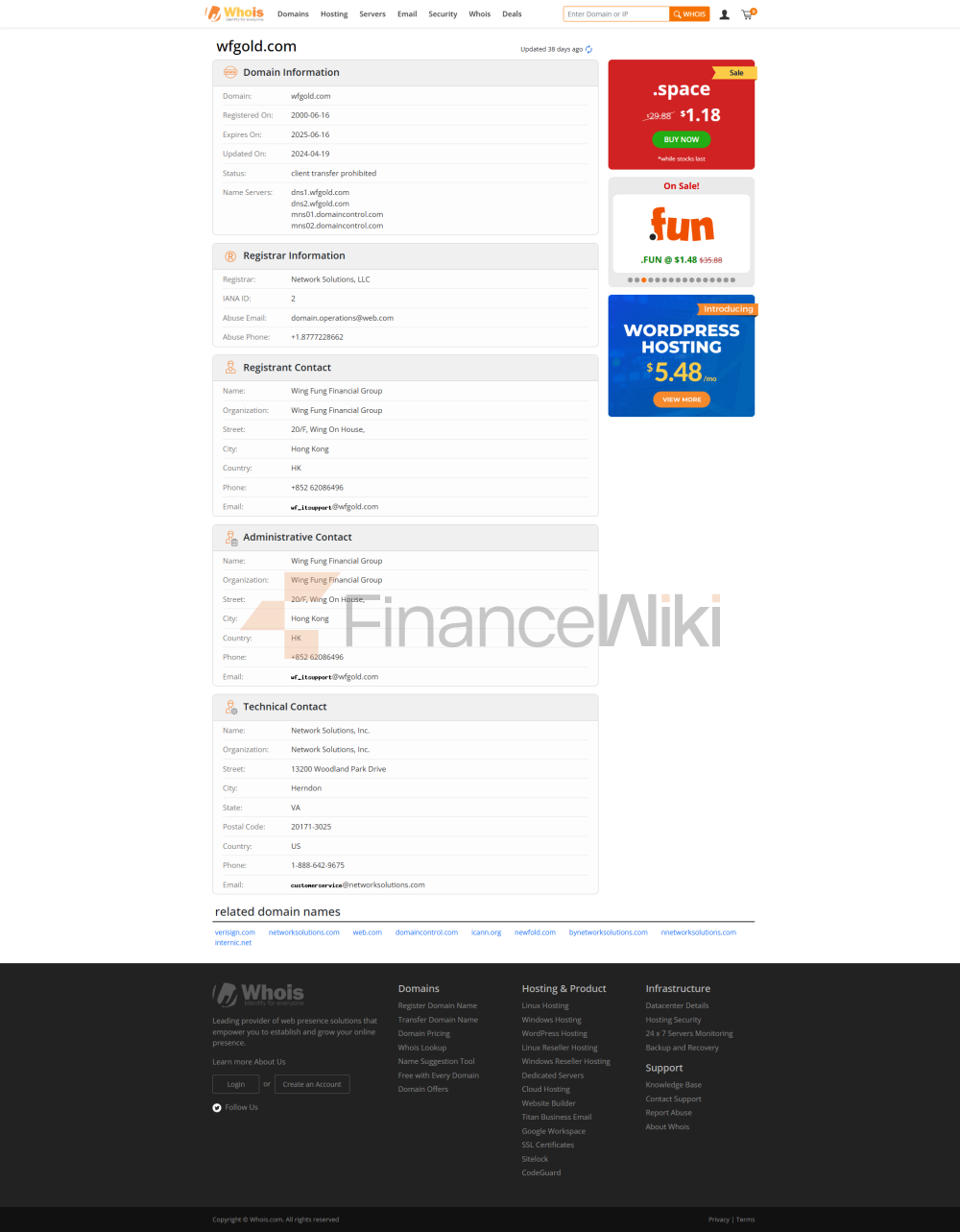

Basic Information & Regulators

Since Its Establishment In The 1980s, Wing Fung Has Developed Into A Diversified Financial Business, Including Physical Trading Of Precious Metals, Precious Metals Margin, Gold And Silver Retail, Securities, Futures, Foreign Exchange, Asset Management, Credit Services, Etc. The Members Of The Group Have Expanded To Wing Fung Financial Group, Wing Bullion Investment Co., Ltd., Wing Fung Futures Co., Ltd., Etc. Wing Fung Financial Group Is The No. 34 Clerk Of The Hong Kong Bullion And Silver Trading Market, And Enjoys The Qualification Of "Gold Bar Group", Casting The "Wing Fung" Brand 999.9 And 99 Gold Bars Recognized In Hong Kong. In Addition, Wing Has Been Appointed By The Hong Kong Gold And Silver Trading Market As The Local London Gold Market Liquidity Provider.

Security Analysis

The Hong Kong Gold And Silver Exchange Is A Regular Gold Trading Venue. Its Staff Are Established Under The Approval Of Hong Kong Laws And Have Relatively Sound Qualifications. Wing Fung Precious Metals Is An AA-level Registered Bank Member And Can Operate The Most Products.

Wing Fung Financial GroupWF Provides Customers With A Wide Range Of Products, Mainly Including Hong Kong Stocks, IPO Subscription, Global Stocks And Funds, Bonds, Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect, Hong Kong And Global Futures, Foreign Exchange, Asset Management, Credit, Wholesale Of Precious Metals, Precious Metals Margin Trading, And Retail Of Precious Metals Physical Gold.

Accounts & Fees

Investors Trading Hong Kong Stocks Can Choose Between 368 Cash Account And Margin Account. 368 Cash Account Is Charged 0.05% Of The Transaction Amount (minimum Fee Per Transaction Is HK $38). Margin Account Is Charged 0.1% Of The Transaction Amount (minimum Fee Per Transaction Is HK $38).

Trading Platform

Wing Fung Financial GroupAPP, Which Provides Users With Efficient And Diversified Financial Services, Allows Investors To Keep Abreast Of The Latest Financial Information, And Provides Trading Strategies For Gold, Stocks, Futures, And Foreign Exchange On Trading Days. The Platform Goes Directly To The Full Service Trading Platform, Including Securities, Futures, Gold And Silver Investment, Foreign Exchange, Gold And Silver Trading And Real Gold Trading. Traders Can Adjust Trading Strategies And Switch Different Investment Instruments At Any Time.

Deposit And Withdrawal

Wing Fung Financial Group Provides Traders With Three Deposit Methods.

The First One Is, Bank Deposit, Traders Need To Deposit Funds (cash, Check, Transfer Or Telegraphic Transfer) To Bank Of China (Hong Kong)/Bank Of East Asia/China Construction Bank (Asia)/DBS Bank (Hong Kong), Ocbc Wing Hang Bank Wing Fung Financial Group Precious Metals Has Opened An Account, All Checks Must Be Crossed.

The Second Way Is Through PPS. Customers Need To Open A PPS Account And Complete The Relevant Account Opening Procedures. They Can Then Use The PPS System To Transfer Funds Immediately Online Or Over The Phone To Their Securities Account With The Company (deposit Through PPS, HK $5 Will Be Charged For Each Deposit Less Than HK $5,000).

The Third Way Is The Fast Payment System (FPS). Regarding Refunds, Due To The Current Pandemic, Some Bank Outlets May Suspend Or Shorten Service Hours. Customer Withdrawal Requests Will Be Changed To Monday To Friday From 2:00 Pm To 12:00 Noon.

Account

Investors Can Choose Between 368 Cash Account And Margin Account For Buying And Selling Hong Kong Stocks. 368 Cash Account Charges 0.05% Of The Transaction Amount (minimum Fee Of HK $38 Per Transaction). Margin Account Charges 0.1% Of The Transaction Amount (minimum Fee Of HK $38 Per Transaction).

How Do I Open An Account With Wing Fung Financial Group?

Three Simple Steps To Open An Account Wing Fung:

Step 1: Fill Out The Online Application Form

Step 2: Upload Information For Our Company To Verify

Step 3: Received, SMS/Email Approval

Margin And Leverage

Wing Fung Offers A Margin Account For Buying And Selling Hong Kong Stocks With Up To 90% Margin And An Initial Margin As Low As HK $1,200. This Means That Traders Can Trade With Up To 90% Of The Value Of Their Shares On Margin, Which Can Increase The Likelihood Of Profits But May Also Increase The Likelihood Of Losses.

The Leverage Provided By Yongfeng Financial Is, Up To 1:100, Which Means That Traders Can Control Positions Up To 100 Times Their Invested Principal. However, Traders Must Be Aware Of The Risks Involved In Margin Trading And Leveraged Trading, And Should Carefully Manage Their Positions To Avoid Significant Losses.

Client Server

If Customers Have Any Questions Or Trading-related Issues, They Can Contact Yongfeng Financial Through The Following Contact Channels:

- Tel: (852) 2303 8690, 400 120 1090

- Email: Cs@wfgold.com

- Live Chat

- FAQ, Section

Or You Can Also Follow This Broker On Facebook And YouTube.