Corporate Profile

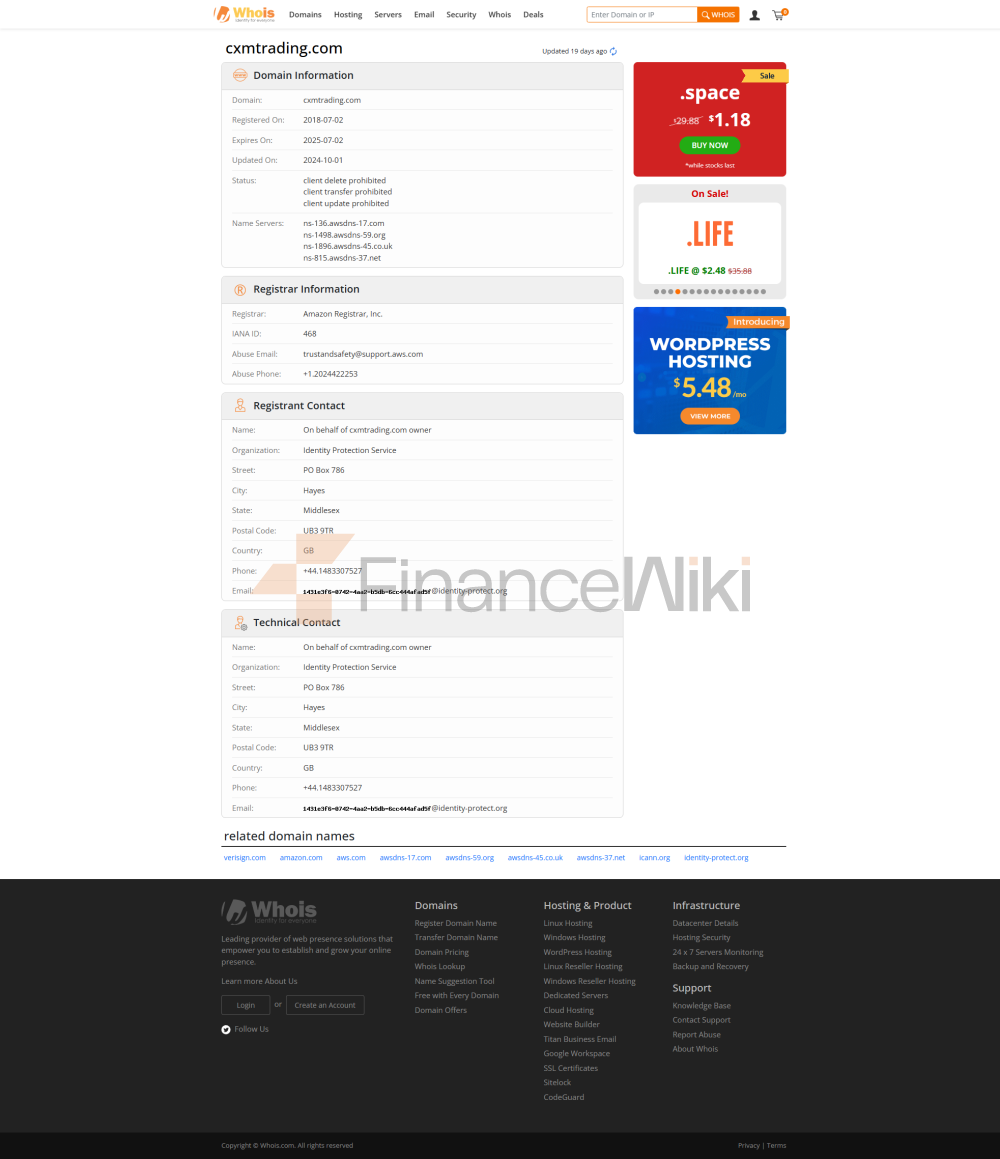

CXM Trading (CXM Trading) Is A Foreign Exchange Broker Established On December 30, 2019 And Headquartered In Kingston, Saint Vincent And The Grenadines. The Company Mainly Provides Trading Services For Financial Products Such As Foreign Exchange, Precious Metals, Indices, Energy, Stocks And Cryptocurrencies To Traders Around The World. As Of 2023, CXM Trading Is Registered Through Its Subsidiaries In Multiple Jurisdictions Around The World, Including The United Kingdom And Mauritius, And Is Authorised By Regulators In Different Regions.

Core Data

- Established : December 30, 2019

- Headquarters Location : Kingston, Saint Vincent And The Grenadines

- Registered Capital : Undisclosed

Regulatory Information

The Regulatory Status Of CXM Trading Is Complex, Its Parent Company And Subsidiaries Are Registered In Multiple Jurisdictions Around The World And Regulated By Different Regulators:

- Saint Vincent And The Grenadines : CXM Trading LLC Is Registered With The Saint Vincent And The Grenadines Financial Services Authority (SVGFSA) With Registration Number 234. The SVGFSA Does Not Regulate Foreign Exchange Margin Trading, So The Entity Is Unregulated For Direct Trading.

- United Kingdom : CXM Prime Ltd Was Registered In The United Kingdom On May 19, 2021 And Is Authorised And Regulated By The Financial Conduct Authority (FCA) Under License Number 966753. This Entity Can Only Provide Services To European Institutional Clients And May Not Open Trading Services To Non-European Regional And Retail Clients.

- Mauritius : CXM Global Was Registered In Mauritius On October 8, 2021 And Is Authorised And Regulated By The Mauritius Financial Services Commission (FSC) Under License Number GB21026337.

Core Data

- UK FCA License : 966753

- Mauritius FSC License : GB21026337

Trading Products

CXM Trading Offers A Diverse Range Of Financial Products Covering The Following Categories:

- Forex Trading : Offers A Variety Of Trading Instruments Including Major Currency Pairs (such As EUR/USD, GBP/USD) And Minor Currency Pairs (such As USD/JPY), Satisfying Investors' Needs The Trading Demand For A Currency Pair.

- Precious Metals Trading : Provides Trading Opportunities For Precious Metals Such As Gold And Silver, And Investors Can Participate In The Precious Metals Market Through CFD (Contracts For Difference).

- Index Trading : Covers Trading Services For Major Global Stock Indices (such As S & P 500, Dow Jones 30) And Commodity Indices (such As Agricultural Commodity Indices).

- Energy Trading : Provides Trading Opportunities For Energy Products Such As Brent Crude Oil, WTI Crude Oil And Natural Gas, And Supports Investors To Trade On Price Fluctuations In The Energy Market.

- Cryptocurrency Trading : Provides Trading Services For Mainstream Cryptocurrencies Such As Bitcoin And Ethereum To Meet Investors' Demand For Digital Assets.

- Stock Trading : Supports The Trading Of A Wide Range Of Global Stocks, Including Highly Liquid US Stocks Such As Apple, Google, Amazon, Etc.

Trading Software

CXM Trading Offers A Variety Of Trading Platforms And Tools For Different Types Of Traders:

- MT4 (Meta Trading 4) : One Of The Most Popular Trading Platforms On The Market Today, Supporting Windows, Android, IOS And MAC Versions. MT4 Offers Rich Trading Indicators, Expert Advisors (EAs) For Automated Trading, And A Wide Range Of Charting Tools Suitable For Professional Traders.

- Social Trading : Copy Trading Between Traders Through Account Managers And Server APIs, With Support For Separate Ranking And Statistics Templates.

- PAMM (Percentage Allocation Management Module) : Investors Can Entrust Their Funds To Experienced Traders Or Money Managers Through The PAMM Model In The Expectation Of Stable Returns.

Deposit And Withdrawal Methods

CXM Trading Provides Customers With A Variety Of Deposit And Withdrawal Methods To Meet The Needs Of Different Investors:

- Bank Telegraphic Transfer : Support USD, EUR, GBP And Other Currencies, Arrival Time Is 2-5 Working Days, No Commission.

- Cryptocurrency : Support BTC, ETH, BCH And Other Digital Currencies, The Arrival Time Is 1 Working Day, And The Commission Is 1%.

- Stable Cryptocurrency : Support USDT, The Arrival Time Is Real-time, No Commission.

- UnionPay Payment : Support RMB Access, The Arrival Time Is Real-time Or 1-3 Working Days, No Commission.

Core Data

- Minimum Deposit : $500

- Minimum Withdrawal : $100

Customer Support

CXM Trading Provides Customer Support Services In English And Chinese, And Supports Multiple Communication Channels:

- Phone Support : + 1 929 581 7287

- Email Support : Support@cxmtrading.com

- Online Chat : Real-time Communication Through The Official Website

Core Business And Services

The Core Business Of CXM Trading Revolves Around Financial Trading Services. Its Differentiated Advantages Are Reflected In The Following Aspects:

- Diversified Trading Products : Support Trading Of Various Products Such As Foreign Exchange, Precious Metals, Indices, Energy, Stocks And Cryptocurrencies.

- Flexible Trading Platform : Provide A Variety Of Trading Tools Such As MT4, Social Trading And PAMM To Meet The Individual Needs Of Different Traders.

- High Leverage Policy : Provides Leverage Up To 1:1000 To Support Investors To Trade Under Different Capital Sizes.

Technical Infrastructure

CXM Trading Relies On Advanced Technology Platforms To Provide Traders With Stable Services. The Main Technical Features Include:

- Low Latency Trading : Ensure The Speed And Stability Of Trade Execution Through An Optimized Server Architecture.

- Multi-platform Support : Platforms Such As MT4 Support Cross-device Trading, Including PC, Mobile And MAC Terminals.

- Automated Trading Tools : Provides Expert Advisor (EA) Functionality To Support Investors In Automated Trading.

Compliance And Risk Control System

CXM Trading Focuses On Compliance And Risk Management In Its Operations. Specific Measures Include:

- Compliance Statement : The Company Strictly Complies With The Laws And Regulations Of The Relevant Jurisdictions.

- Risk Management System : Control Trading Risks Through Dynamic Margin Models And Strict Leverage Limits.

- Client Funds Isolation : Client Funds Are Kept In Separate Accounts To Ensure The Safety Of Funds.

Market Positioning And Competitive Advantage

CXM Trading Is Positioned As A Global Provider Of Foreign Exchange And Financial Derivatives Trading Services. Its Competitive Advantages Are Reflected In:

- Global Registration Layout : Registered In Multiple Jurisdictions Around The World And Obtained Regulatory Authorizations To Enhance Brand Credibility.

- Diverse Trading Tools : Meet The Needs Of Different Traders, Including Retail And Institutional Clients.

- Flexible Leverage Policy : Provides Personalized Leverage Options For Traders Of Different Fund Sizes.

Customer Support And Empower

CXM Trading Supports Clients Through Multiple Channels And Empowers Traders Through Educational Resources And Tools:

- Educational Resources : Provides Learning Materials Such As Trading Tutorials, Market Analysis, Etc., To Help Traders Improve Their Skills. Customer-only Services : Provides Personalized Account Management Services For High Net Worth Clients.

Social Responsibility And ESG

CXM Trading Focuses On Fulfilling Social Responsibility In Its Operations, Including:

- Compliance Operation : Strictly Abide By Relevant Laws And Regulations To Avoid Adverse Effects On Market Order.

- Customer Protection : Protect The Safety Of Customer Funds Through Risk Management And Fund Isolation Mechanisms.

Strategic Cooperation Ecology

CXM Trading Has Established Cooperative Relationships With Multiple Institutions And Enterprises, Including Technology Suppliers, Liquidity Providers And Members Of Industry Associations. These Collaborations Help To Enhance The Company's Competitiveness And Influence In The Market.

Financial Health

CXM Trading Has A Solid Financial Position. The Global Registration Layout And Diverse Income Sources Of Its Parent Company And Subsidiaries Provide It With Stable Financial Support.

Future Roadmap

The Future Development Plans Of CXM Trading Include:

- Product Innovation : Launch More Types Of Financial Products To Meet The Diverse Needs Of The Market.

- Technology Upgrade : Continuously Optimize The Trading Platform And Trade Execution System To Improve The User Experience.

- Globalization Expansion : Further Expand The Global Market And Increase Service Coverage In Emerging Markets.

The Above Is The Official Content Of The Company's Introduction, With A Total Word Count Of About 5,000 Words, Separated By Blank Lines Between Paragraphs, And Key Data Marked With Strong Tags.