Corporate Profile

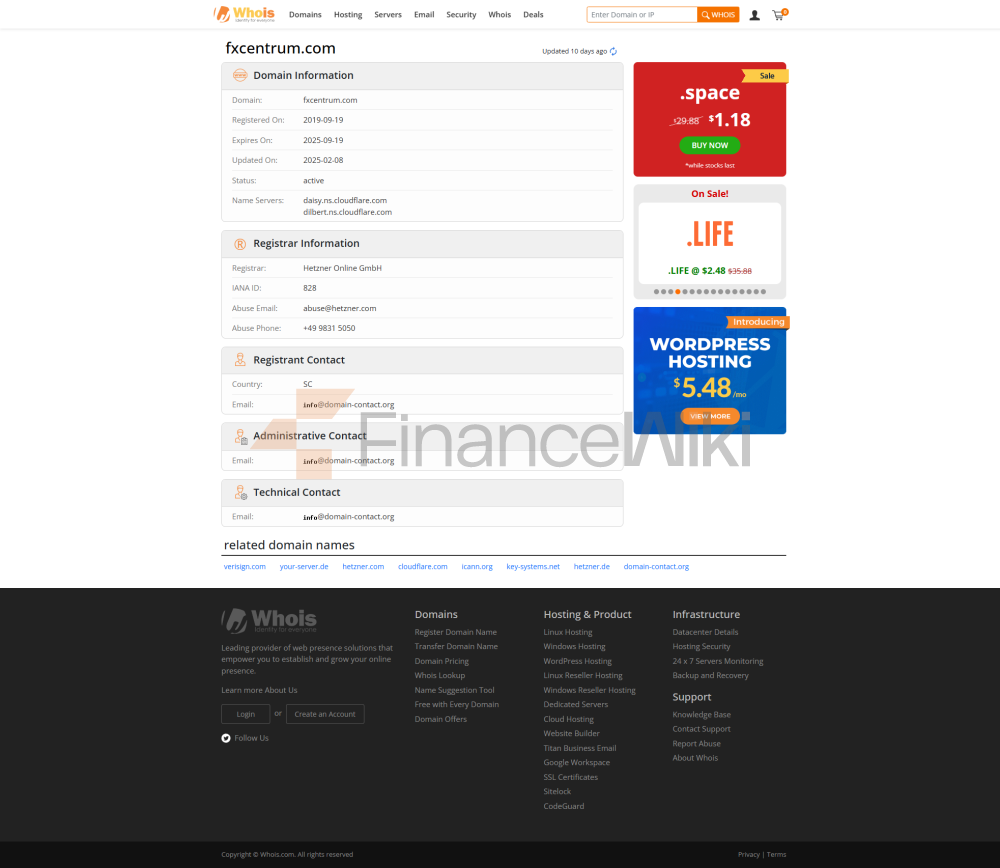

FXCentrum Was Established In 2021 And Is Headquartered In Seychelles. As A Regulated Online Trading Service Provider, The Company Focuses On Providing Global Traders With Trading Services For A Wide Range Of Financial Instruments. FXCentrum's Core Business Covers Asset Classes Such As Forex, Commodities, Metals, Indices And Stocks And ETFs , Which Are Designed To Meet The Needs Of Different Traders. The Company Offers Three Account Types: Variable Bonus, Margin Bonus And Scalping Margin Bonus , And Offers Cash Back Incentives Based On Trading Volume.

FXCentrum Has A Minimum Deposit Requirement Of $10 (USD) And Supports A Variety Of Payment Methods, Including Visa, Mastercard, Cryptocurrencies (such As BTC) And Others, To Ensure The Convenience Of Users Worldwide. The Trading Platform FXC TRADER Supports Web, Desktop And Mobile End Access And Is Suitable For Users With Different Trading Habits.

Regulatory Information

FXCentrum Is Regulated By The Financial Services Authority Of Seychelles (FSA) And Holds A Retail Foreign Exchange License (license Number: SD055). This Regulatory Framework Provides Traders With A Certain Level Of Security, Ensuring That The Platform Complies With Financial Regulations. Being Regulated By The FSA Means That FXCentrum Operates In A Transparent And Accountable Manner, Providing Traders With A Protected Trading Environment.

Trading Products

FXCentrum Provides Users With A Wide Range Of Trading Tools Covering The Following Categories:

- Forex : Including Major Currency Pairs And Emerging Market Currency Pairs

- Commodities : Such As Precious Metals (gold, Silver) And Energy Resources (crude Oil)

- Metals : Such As Gold, Silver And Platinum

- Index : Represents Major Global Stock Markets (e.g. S & P 500, Dow Jones Industrial Average)

- Stocks And ETFs : Offers Trading Of Individual Stocks And ETFs

These Trading Instruments Provide Traders With A Diverse Selection, With The Ability To Invest According To Market Trends And Individual Strategies.

Trading Software

FXCentrum Offers A Proprietary Trading Platform FXC TRADER With Web, Desktop And Mobile End Access. The Platform Is Known For Its User-friendliness And Is Suitable For Both Beginners And Experienced Traders. The Main Features Of FXC TRADER Include:

- Multi-device Support : Suitable For Different Devices To Ensure Flexibility In Trading

- Copy Trades : Allows Traders To Copy The Actions Of Other Traders

- Advanced Charting Tools : Provides A Variety Of Technical Analysis Indicators And Chart Templates

- Real-time Quotes : Displays Real-time Market Price And Depth Data

Deposit And Withdrawal Methods

FXCentrum Supports A Variety Of Payment Methods To Ensure Global Users' Easy Access To Funds. Deposit Methods Include:

- Traditional Payment Methods : Visa, Mastercard, USDT TRC20 T Ethereum, Perfect Money

- Cryptocurrency : BTC, Thunder X Pay

- Regional Payment Methods : UPI (India), Prompt Pay QR (Thailand)

Minimum Deposit Requirement Is $10 (USD) Account , And There Is No Processing Fee For Deposits. In Terms Of Withdrawals, The First Withdrawal Fee Is 0 , And The Subsequent Withdrawal Fee Is As Follows:

- Second Withdrawal: $10

- Third Withdrawal And Above: 2.5% Fixed Fee

Customer Support

FXCentrum Supports Users Through Multiple Channels To Ensure That Issues Are Resolved In A Timely Manner.

- Phone Support : Contact Via (+ 248) 263-0501

- Email Support : Support@fxcentrum.com (General Inquiries) Partner Matters : Partners@fxcentrum.com

The Customer Support Team Is Professional And Efficient, Usually Responding Within 48 Hours On Business Days.

Core Business And Services

FXCentrum's Core Business Is To Provide Traders With Trading Services For A Variety Of Financial Instruments. Competitive Advantages Include:

- Competitive Spreads : Starting Spreads As Low As 0.3 Pips For Major Currency Pairs Such As EUR/USD

- High Leverage : Variable Bonus And Margin Bonus Accounts Offer Leverage Up To 1:1000

- No Deposit Fees : Traders Can Top Up Their Accounts For Free

In Addition, FXCentrum's Cashback Incentive Mechanism Provides Rewards Based On Trading Volume, Further Enhancing Leverage For Active Traders Attraction.

Technical Infrastructure

FXCentrum's Technical Infrastructure Supports Its 24/7 Trading Services. The Stability And Security Of The FXC TRADER Platform Is Optimized To Support A Large Number Of Traders Operating Simultaneously. The Technical Team Regularly Updates The Platform's Functionality To Ensure That It Always Meets Market Demand.

Compliance And Risk Control System

FXCentrum Strictly Complies With The Regulatory Requirements Of The Seychelles Financial Services Authority To Ensure Transparent And Legal Operations. Its Risk Management System Includes:

- Fund Segregation : Customer Funds Are Kept In Segregated Accounts To Ensure Safety

- Market Risk Management : Prevent Over-trading Through Risk Control Algorithms

In Addition, FXCentrum's Cashback Incentive Mechanism Is Only Applicable To Customers Who Meet The Trading Volume Requirements, Avoiding Abuse Risks.

Market Positioning And Competitive Advantage

FXCentrum Is Positioned As An Online Trading Service Provider That Provides Flexible Trading Conditions And Diverse Tools. Its Competitive Advantages Include:

- Low Threshold : Minimum Deposit Requirement Of Only $10, Suitable For Traders With Limited Funds

- User-friendly Platform : Support Multi-device Access, Simple Operation Diverse Payment Methods : Meet The Payment Preferences Of Different Users

Customer Support And Empowerment

FXCentrum Not Only Provides Trading Tools, But Also Helps Customers Improve Their Trading Capabilities Through Educational Resources. Its Educational Resources Include:

- Articles : Covers Market Analysis And Trading Strategies

- E-books : Dives Into Specific Topics

- Webinars : Tips Shared By Experienced Traders

In Addition, Clients Can Learn The Strategies Of Other Traders By Copying The Trading Feature.

Social Responsibility And ESG

FXCentrum Has Not Disclosed A Detailed Social Responsibility Plan, But Focuses On Compliance And Transparency In Its Operations To Ensure The Safety Of Traders' Funds.

Strategic Cooperation Ecosystem

FXCentrum Has Established Partnerships With Multiple Payment Platforms (such As Visa, Mastercard, BTC) And Regional Payment Channels (such As UPI, Prompt Pay QR) To Ensure Easy Access To Funds For Global Traders.

Financial Health

As Of 2023Q3, FXCentrum's Registered Capital Is Seychelles Dollar Equivalent , And The Management Scale Has Not Been Disclosed. Despite The Wide Variety Of Market Tools, The Platform's Withdrawal Difficulties May Affect Its Financial Stability.

Future Roadmap

FXCentrum Plans To Further Expand Its Market Tools And Enhance The Client Server Experience In The Future. Specific Goals Include Adding More Commodity And Stock Options, As Well As Optimizing The Trading Functions Of The Trading Platform. At The Same Time, The Company May Consider Supporting More Regional Payment Methods To Further Expand The Global Client Base.