Corporate Profile

Axim Trade Is A Forex Broker Registered In Saint Vincent And The Grenadines, Established In 2020 . The Company Focuses On Providing Global Traders With Diversified Trading Services Covering A Wide Range Of Financial Products Such As Forex, Precious Metals, Energy Commodities, Stock Indices, Cryptocurrencies, Etc. With Its Flexible Trading Platform And Account Types, Axim Trade Is Designed To Meet The Needs Of Clients With Different Trading Styles And Experience Levels.

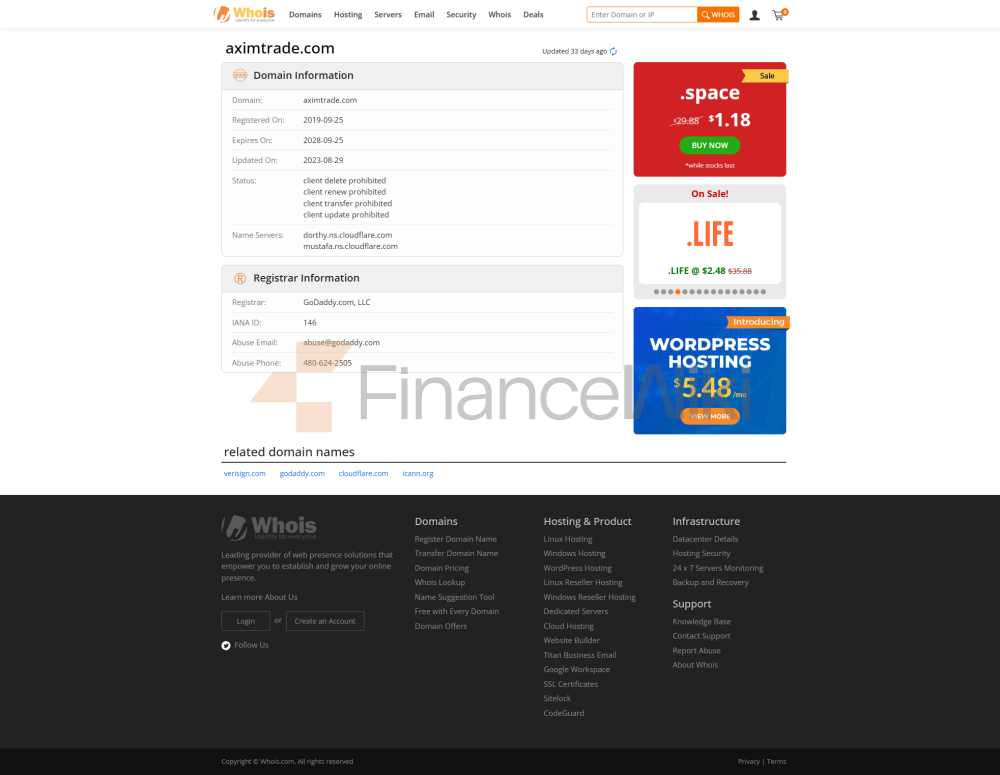

Regulatory Information

Axim Trade Is Currently Not Regulated By Any Major Financial Regulator . Although The Company Offers A Range Of Trading Tools And Services, Its Unregulated Status Can Pose A Latent Risk To Traders, Especially In Markets Such As The US And Australia. For Example, NFA (National Futures Association) Labels Axim Trade As An Unauthorized Entity, While ASIC (Australian Securities And Investments Commission) Lists It As A Suspect Clone Company. This Suggests That Traders Should Carefully Evaluate Axim Trade's Legality And Safety When Selecting It.

Trading Products

Axim Trade Offers A Diverse Range Of Trading Products, Including:

- Forex Currency Pairs : Covers Major Currency Pairs (e.g. EUR/USD, GBP/USD) As Well As Minor And Exotic Currency Pairs (e.g. USD/TRL, EUR/HUF).

- Precious Metals : Offers Spot Trading And Futures Contracts Such As Gold And Silver.

- Energy Commodities : Contracts For Difference (CFD) Trading Including Crude Oil And Natural Gas.

- Stock Indices : Supports Trading In Major Global Stock Indices (e.g. S & P 500, FTSE 100).

- Cryptocurrencies : Covers Popular Digital Currencies Such As Bitcoin (BTC) And Ethereum (ETH).

- Commodities : CFDs Including Agricultural Products Such As Wheat, Corn, Copper, And Industrial Metals.

Trading Software

Axim Trade Mainly Uses MetaTrader 4 (MT4) As Its Core Trading Platform, Which Is Popular For Its User-friendly Interface, Powerful Charting Tools And Rich Technical Indicators. In Addition, Axim Trade Also Offers A Mobile Application For IOS And Android Devices , Making It Easy For Traders To Trade Anytime, Anywhere.

Deposit And Withdrawal Methods

Axim Trade Supports A Variety Of Payment Methods, Including:

- Deposit Methods : Bank Telegraphic Transfer, Credit/debit Card, E-wallet (eg Skrill, Neteller).

- Withdrawal Methods : Bank Telegraphic Transfer, Credit/debit Card, E-wallet. Minimum Deposit Is $1 And Deposit Is Free. However, There May Be Certain Fees For Withdrawals And Payment Processors, Such As Bank Transfer Withdrawal Fees Of $35 , Credit Card Withdrawal Fees Of 3.5% , And E-wallet Withdrawal Fees Of 0.5% -3% .

Customer Support

Axim Trade Offers A Variety Of Customer Support Methods, Including:

- Live Chat : 24/5 (Monday To Friday All Day) Support. Email : Customers Can Send Emails To Designated Mailboxes.

- Phone Support : Support For Multiple Languages (including English, Spanish, Russian, And Chinese).

However, Axim Trade's Customer Support Does Not Include 24/7 Service And Lacks A Detailed Frequently Asked Questions (FAQ) Section, Which May Cause Some Trouble For Traders To Solve Their Problems.

Core Business And Services

Axim Trade's Core Business Revolves Around Foreign Exchange And CFD Trading. The Company Offers Four Account Types:

- Sub-Account : Minimum Deposit Of $1, Suitable For Beginners, With Leverage Of 1:1000.

- Standard Account : Minimum Deposit Of $1, Suitable For Moderately Experienced Traders, With Leverage Of 1:2000.

- ECN Account : Minimum Deposit Of $50, With Leverage Of 1:1000 And Tighter Spreads.

- Unlimited Account : Offers Unlimited Leverage And Personalized Trading Conditions, Suitable For Clients With High Trading Volume.

In Addition, Axim Trade Also Provides Copy Trading Service (AximSocial), Which Allows Traders To Automatically Copy The Actions Of Other Successful Traders, Thus Enabling Newcomers To Improve Trading Efficiency.

Technical Infrastructure

Axim Trade's Technical Infrastructure Is Based On The MT4 Platform And Supports Multiple Trading Platforms (including Desktop, Web And Mobile Versions). Its Technical Advantages Are:

- Fast Execution : The MT4 Platform Is Known For Its Efficient Execution Speed.

- Multilingual Support : Traders Can Choose To Use Different Language Interfaces.

- Rich Features : Including Automated Trading, Copy Trading, Economic Calendar, Etc.

Compliance And Risk Control System

Although Axim Trade Is Not Regulated By Major Regulators, It Still Manages Trading Risks Through Internal Mechanisms, Including:

- Leverage Limit : Although Maximum Unlimited Leverage Is Provided, Traders Are Advised To Use It Reasonably According To Their Risk Tolerance.

- Margin Call : When The Account Equity Falls Below A Certain Level, The System Will Automatically Trigger A Margin Call Or Position Squaring.

- Spread Management : Ensure That Traders Get A Fair Transaction Price Through Transparent Spread Quotes On The MT4 Platform.

Market Positioning And Competitive Advantage

Axim Trade's Market Positioning Is Mainly Aimed At Highly Leveraged Traders And Clients Seeking Low-cost Trades . Its Competitive Advantage Is:

- Low Minimum Deposit : Start Trading With Only $1.

- Diversified Trading Products : Covers Forex, Precious Metals, Energy, Stock Indices, Cryptocurrencies And Commodities.

- Flexible Leverage Options : From 1:1000 To Unlimited Leverage To Meet Different Trading Needs.

However, Its Unregulated Status And Limited Educational Resources (such As Lack Of Demo Accounts And Detailed Trading Tutorials) May Pose A Disadvantage To Some Traders.

Customer Support And Empowerment

In Addition To Basic Customer Support Services, Axim Trade Also Offers Limited Educational Resources, Including:

- Economic Calendar : Helps Traders Track Important Economic Events And Data Releases.

- Seminars : Provides Educational Resources On Trading Strategies And Market Analysis.

However, Axim Trade Has Relatively Limited Customer Support And Educational Resources Compared To Regulated Brokers, Which Can Pose A Certain Barrier For Novice Traders.

Social Responsibility And ESG

In Terms Of Social Responsibility And Environmental, Social And Corporate Governance (ESG), Axim Trade Did Not Provide Detailed Information. At Present, Its Main Focus Is Still The Optimization Of Trading Services And Market Expansion.

Strategic Cooperation Ecology

Axim Trade Has Not Disclosed Its Major Strategic Cooperation Information. The Company's Market Expansion And Product Development Are Mainly Based On Internal Resources And Platform Optimization.

Financial Health

Due To The Fact That Axim Trade Is Not Regulated, Its Financial Transparency Is Relatively Low. However, The Company Has Attracted Part Of The Trader Community By Offering Flexible Trading Conditions And Low Deposit Thresholds.

Future Roadmap

Future Development Directions For Axim Trade May Include:

- Regulatory Compliance : Explore Applying For Licenses In Regulated Jurisdictions (e.g. Seychelles, Malta) To Enhance Legality And Trust.

- Product Expansion : Adding More Trading Instruments (such As Individual Stocks And Commodity Futures).

- Customer Education : Providing More Educational Resources And Demo Accounts To Help Novice Traders Improve Their Skills.

In Conclusion, Axim Trade Offers Traders Certain Trading Options Through Its Flexible Trading Conditions And Diverse Product Line. However, Its Unregulated Status And Limited Customer Support May Pose Risks To Some Traders. When Choosing To Partner With Axim Trade, Traders Should Comprehensively Evaluate Their Strengths And Weaknesses And Make Decisions Based On Their Own Needs And Risk Tolerance.