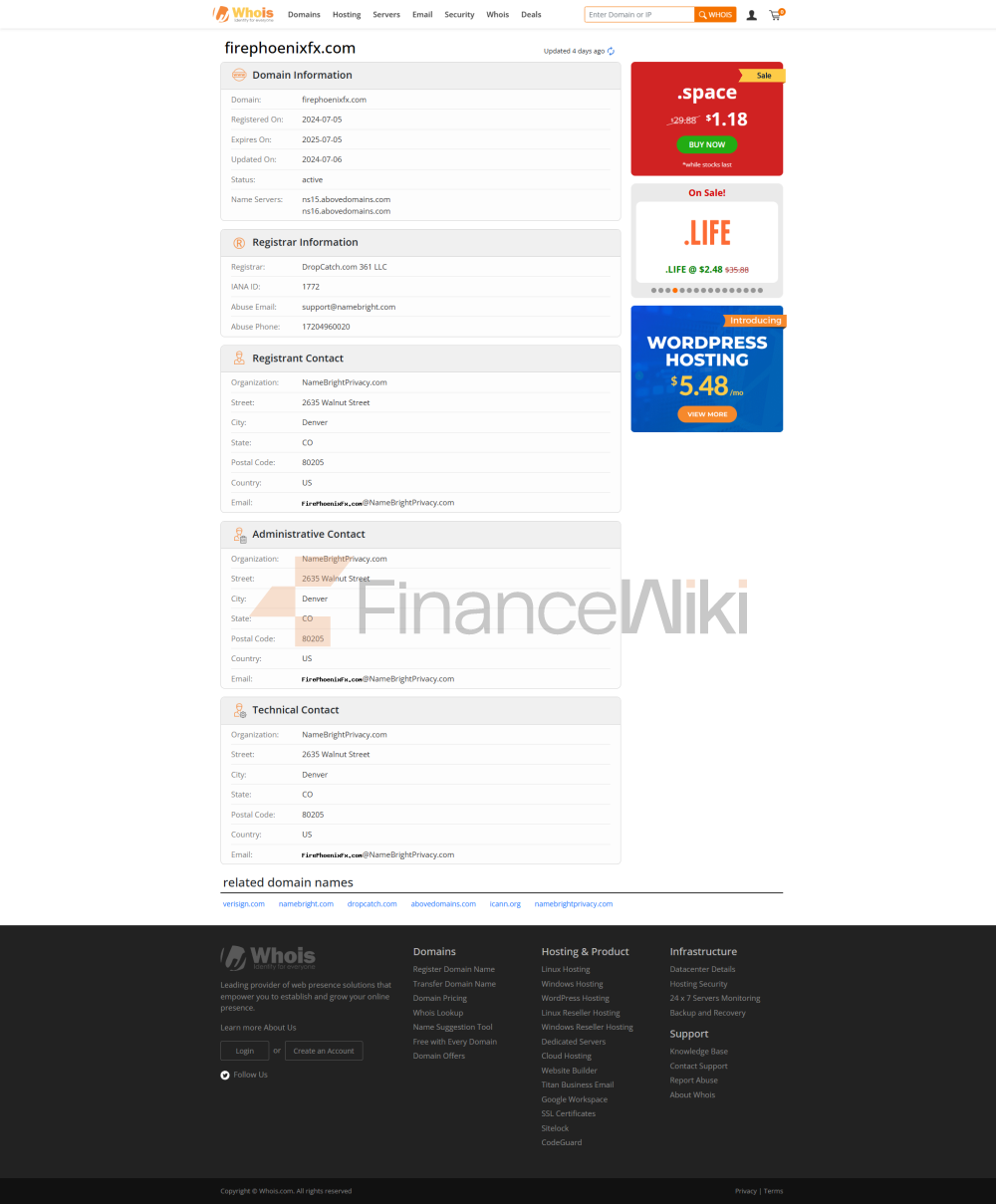

FIRE PHOENIX's Official Website Cannot Be Opened Temporarily Due To Unknown Reasons, So We Can Only Collect Some Relevant Information For Reference Only

Overview

FIRE PHOENIX Is An Unregulated Broker Based In China That Provides Traders With A Range Of Financial Instruments, Including Forex, Stocks, Commodities, And Cryptocurrencies. Although It Has Competitive Forex Pair Spreads From 0 Pips And Offers The Popular Metatrader 4 Trading Platform, It Is Deficient In Several Key Aspects. The Lack Of Regulatory Oversight Has Raised Concerns About Investor Protection. In Addition, FIRE PHOENIX Lacks The Necessary Educational Resources, Limiting Traders' Opportunities For Learning And Growth. Its Customer Support Is Limited To Email Correspondence, Which Can Create Difficulties For Users Seeking Timely Assistance. In Addition, Some Users Have Reported That FIRE PHOENIX Has Called Into Question The Reliability And Trustworthiness Of Brokers Due To Potential Scams, Urging Traders To Exercise Extra Caution And Explore Regulated Alternatives.

Regulatory Information

FIRE PHOENIX Appears To Be An Unregulated Broker, Meaning It May Not Be Regulated By Financial Regulators. Investing In Unregulated Brokers Carries Significant Risks, As They May Lack The Necessary Safeguards To Protect The Interests Of Investors. Before Considering Any Financial Trading With FIRE PHOENIX Or Any Similar Entity, It Is Essential To Conduct Thorough Research And Due Diligence To Ensure The Safety And Legality Of Your Investment. In Addition, It Is Recommended To Work With A Regulated And Reputable Financial Institution Group To Minimize Latent Risk.

Pros And Cons

FIRE PHOENIX, As An Unregulated Broker, Has Both Advantages And Disadvantages For Potential Traders. While It Offers A Wide Range Of Market Tools And Flexible Account Types That Allow Traders To Access A Variety Of Financial Marekts And Customize Their Trading Experience, It Lacks The Necessary Educational Resources And May Hinder Traders' Skill Development. The Commission-based Pricing Structure Of CFD Trading Provides Transparency, But Limited Customer Support Options And The Lack Of A Dedicated Education Program Have Raised Concerns. In Addition, The Potential Scam Activity Reported By Some Users Has Cast A Shadow Over People. The Reputation Of FIRE PHOENIX. Traders Should Approach This Broker With Caution, Conduct Thorough Research, And Consider Other Options Under Regulatory Oversight.

Market Instruments

Forex (Forex): Currency Pairs Used For Trading In The Forex Market, E.g. EUR/USD, GBP/JPY, Etc.

Stocks: Shares Of Publicly Traded Companies From Various Stock Exchanges (e.g. NYSE, NASDAQ, Or Other Stock Exchanges).

Commodities: Tradable Commodities Such As Gold, Oil, Silver, Agricultural Products, Etc.

Indices: Market Indices Such As The S & P 500, Nasdaq Composite, Dow Jones, Which Represent The Performance Of A Group Of Stocks.

Cryptocurrencies: Digital Currencies Such As Bitcoin (BTC), Ethereum (ETH), Etc.

Bonds: Fixed Income Securities Issued By Governments Or Corporations.

Options And Futures: Derivative Contracts That Allow Traders To Speculate On Price Movements.

CFD (Contracts For Difference): Derivatives That Reflect The Movement Of Their Price Without Owning The Various Underlying Assets.

ETF (Exchange Traded Fund): Investment Funds That Track The Performance Of The Underlying Index Or Asset Class.

Precious Metals: Metals Such As Gold, Silver, Platinum And Palladium Used For Trading And Investing.

Account Types

FIRE PHOENIX Offers A Range Of Flexible Account Types Designed To Meet The Different Needs And Preferences Of Traders. The Following Is A Description Of Its Account Type Based On The Information Provided:

Integrated Account:

FIRE PHOENIX Offers Integrated Accounts Designed To Meet The Needs Of Traders Seeking A Comprehensive Trading Experience. This Account Type Allows Traders Access To A Wide Range Of Financial Instruments, Including CFDs That Can Be Traded 24/7. The Unique And Proprietary Integrated Index FIRE PHOENIX Offered Simulates Real Market Movements, Providing Traders With A Dynamic Trading Environment.

Financial Account:

For Traders Specializing In Forex, Commodities And Cryptocurrencies, Financial Accounts Are Ideal. This Account Type Offers The Flexibility To Trade These Asset Classes At Both Standard And Microtrade Sizes. It Also Offers Traders The Option To Take Advantage Of High Leverage, Which Can Amplify Trading Positions And Potential Profits. Financial Accounts Are Suitable For Traders Seeking Exposure To A Variety Of Financial Marekts.

Financial STP Accounts:

FIRE PHOENIX Offers Financial Stp Accounts To Traders Who Want To Trade With Precision. This Account Type Allows Traders To Focus On Specific Currency Pairs And Markets, Providing Opportunities For Specialization. It Also Caters To Those Who Prioritize Smaller Spreads, Making It Suitable For Traders Who Aim To Optimize Their Trading Strategies And Take Advantage Of Narrower Bid-ask Spreads. Financial Stp Accounts Are Adapted To Traders With Different Trading Styles And Preferences.

In Summary, FIRE PHOENIX's Account Types Offer Traders Flexible, Comprehensive Options, Whether They Prefer A Diversified Trading Experience, Focus On A Specific Financial Marekt, Or Prioritize Trading Precision. Traders Can Choose The Type Of Account That Aligns With Their Trading Objectives And Strategies To Get The Most Out Of Their Trading Journey.

Leverage

FIRE PHOENIX Offers Traders Leverage Options That Can Significantly Enhance Their Trading Capabilities In Forex And Index CFD Trading.

Forex Trading Leverage (up To 1:500): For Forex Trading, FIRE PHOENIX Offers Leverage Of Up To 1:500. Leverage Essentially Allows Traders To Control A Larger Position Size With A Relatively Small Amount Of Money. In Practice, If Traders Choose A Leverage Ratio Of 1:500, They Can Trade A Position Size 500 Times Larger Than Their Initial Investment. While This Can Amplify Potential Profits, It Is Worth Noting That It Also Increases The Risk Of Significant Losses. Traders Should Exercise Caution When Using High Leverage In Forex Trading And Have A Clear Risk Management Strategy In Place.

Leverage For Index CFD Trading (up To 1:100): When It Comes To Index CFD Trading, FIRE PHOENIX Offers Leverage Of Up To 1:100. This Means That Traders Can Control Position Sizes That Are 100 Times Larger Than Their Initial Capital. While Leverage For Index CFD Trading Is Not As High As For Forex, It Still Allows Traders To Take Larger Positions Than With Equity Funds Alone. As With Forex Trading, Traders Must Understand The Risks Associated With Leverage And Manage Their Positions Accordingly.

Leverage Is A Double-edged Sword In Trading. While It Can Amplify Potential Gains, It Also Increases The Risk Of Potential Losses. Traders Should Fully Understand The Risks And Benefits Of Using Leverage And Should Employ Risk Management Techniques Such As Setting Stop-loss Orders, Using Appropriate Position Sizes, And Developing Clear Trading Strategies To Protect Their Capital When Trading With Leverage. When Financial Marekt Utilizes Leverage, It Is Essential To Exercise Caution And Trade Responsibly.

Spreads And Commissions

Spreads On Forex Pairs (starting From 0 Pips): FIRE PHOENIX Advertises Competitive Spreads On Certain Forex Pairs, Starting From 0 Pips. Spreads Represent The Difference Between The Buy (sell) Price And The Sell (buy) Price Of A Currency Pair. When Spreads Are As Low As 0 Pips, This Means That Traders Are Likely To Trade With Very Small Bid-ask Spreads. This Is Advantageous For Traders, As A Smaller Spread Can Reduce The Cost Of Entering And Leaving Positions In The Forex Market. However, It Is Worth Noting That Spreads May Vary Depending On Market Conditions And The Particular Currency Pair Being Traded.

CFD Trading Commission: In The Case Of CFD Trading, FIRE PHOENIX Charges A Commission On Each Trade, Rather Than Relying On Larger Spreads. This Commission-based Pricing Structure Is Transparent And Cost-effective For Traders, Especially When Trading Assets Such As Indices, Commodities Or Individual Stocks. By Charging Commissions Separately, Traders Can Gain A Clearer Picture Of The Costs Associated With Their CFD Trading. Commission Fees May Vary Depending On The Specific CFDs Being Traded And The Size Of The Trade.

Traders Can Choose The Pricing Model That Best Suits Their Trading Style And Preferences. Traders Must Consider Spreads And Commissions When Evaluating The Overall Cost Of Their Trades And Be Aware Of Any Potential Fees Associated With Their Trading Activities.

Deposit And Withdrawal

Deposit Options:Traders With FIRE PHOENIX Have Access To A Variety Of Deposit Methods, Making It Convenient To Fund Their Trading Accounts. Available Options Typically Include:

Bank Telegraphic Transfer: Traders Can Initiate Deposits Through A Traditional Bank Telegraphic Transfer. This Method Allows For The Safe And Direct Transfer Of Funds From Their Bank Account To Their FIRE PHOENIX Trading Account. Bank Telegraphic Transfer Is A Reliable Way To Transfer Large Amounts Of Money Into A Trading Account.

Electronic Wallets (e.g. Neteller): FIRE PHOENIX Supports Popular Electronic Wallets (e.g. Neteller) To Deposit Funds. Electronic Wallets Provide A Quick And Efficient Way To Fund Accounts As They Are Often Associated With A User's Bank Account Or Credit Card. This Option Is Known For Its Speed And Ease Of Use.

Cryptocurrency: FIRE PHOENIX Goes A Step Further And Allows Cryptocurrency Deposits. Traders Can Fund Their Accounts Using Digital Currencies Such As Bitcoin (btc) Or Ethereum (eth). This Method Is Usually Favored By Those Who Like The Anonymity And Speed Of Cryptocurrency Transactions.

Withdrawal Options:

When It Comes To Withdrawing Funds, FIRE PHOENIX Ensures That The Process Is Simple And Hassle-free. Traders Can Usually Make Withdrawals Using The Same Method As Deposits. In Addition, The Information Provided Mentions That There Are No Fees For Withdrawals. Here Is How Withdrawals Typically Work:

Bank Telegraphic Transfer: Traders Can Opt For Bank Telegraphic Transfer To Withdraw Funds From Their Account FIRE PHOENIX Account. This Method Ensures That Funds Are Safely Transferred Back To Their Bank Account.

Electronic Wallets (e.g. Neteller): Electronic Wallets Like Neteller Can Also Be Used To Withdraw Funds. This Option Offers Speed And Convenience, Making It A Popular Choice For Traders.

Cryptocurrency: Similar To Deposits, It Is Possible To Withdraw Funds In Cryptocurrency If Traders Initially Deposit Using This Method. This Is Especially Attractive For Those Who Like To Maintain Financial Activity Within The Digital Asset Space.

The Distinguishing Feature Here Is That FIRE PHOENIX Generally Does Not Charge Fees For Deposits Or Withdrawals. This Policy Enhances The Attractiveness Of Brokers, As Traders Can Manage Their Funds Without Having To Worry About Additional Fees. However, Traders Are Advised To Verify The Specific Terms And Conditions Associated With Deposits And Withdrawals By: FIRE PHOENIX, As The Policy May Change Over Time Or Depending On Individual Circumstances.

Trading Platform

FIRE PHOENIX Offers Traders A Variety Of Trading Platforms, Including The Popular Metatrader 4 (mt4) Platform For Desktop And Mobile Trading. MT4 Is Known For Its Powerful Charting Tools, A Wide Range Of Technical Indicators, And Automated Trading Features Implemented Through Expert Advisors (EAS). The Platform Provides Real-time Market Data And An Intuitive Interface That Ensures Traders Can Analyze The Market Efficiently And Execute Trades Easily. In Addition, FIRE PHOENIX Provides A Web-based Phoenix Trading Platform That Provides Traders With Flexible Tools And Accessibility Options To Suit Their Trading Preferences And Needs.

Customer Support

Customer Support FIRE PHOENIX Seems To Have Limited Capabilities And Lack Of Professionalism Given That They Only Provide Email Addresses (firephoenixltd@gmail.com) As Contact Details. This Limited Contact Information May Not Be Sufficient To Meet The Needs Of Traders Who Need Timely Assistance, Especially In Emergency Situations. The Lack Of Alternative Contact Channels Such As Telephone Support Or Live Chat May Hinder Effective Communication And Support To Users. In Addition, The Lack Of Detailed Contact Information Or A Dedicated Customer Support Portal Can Raise Concerns About The Accessibility And Reliability Of Their Client Server, Thus Making It Possible For Traders To Have Frustrating Experiences When Seeking Assistance Or Resolving Issues.