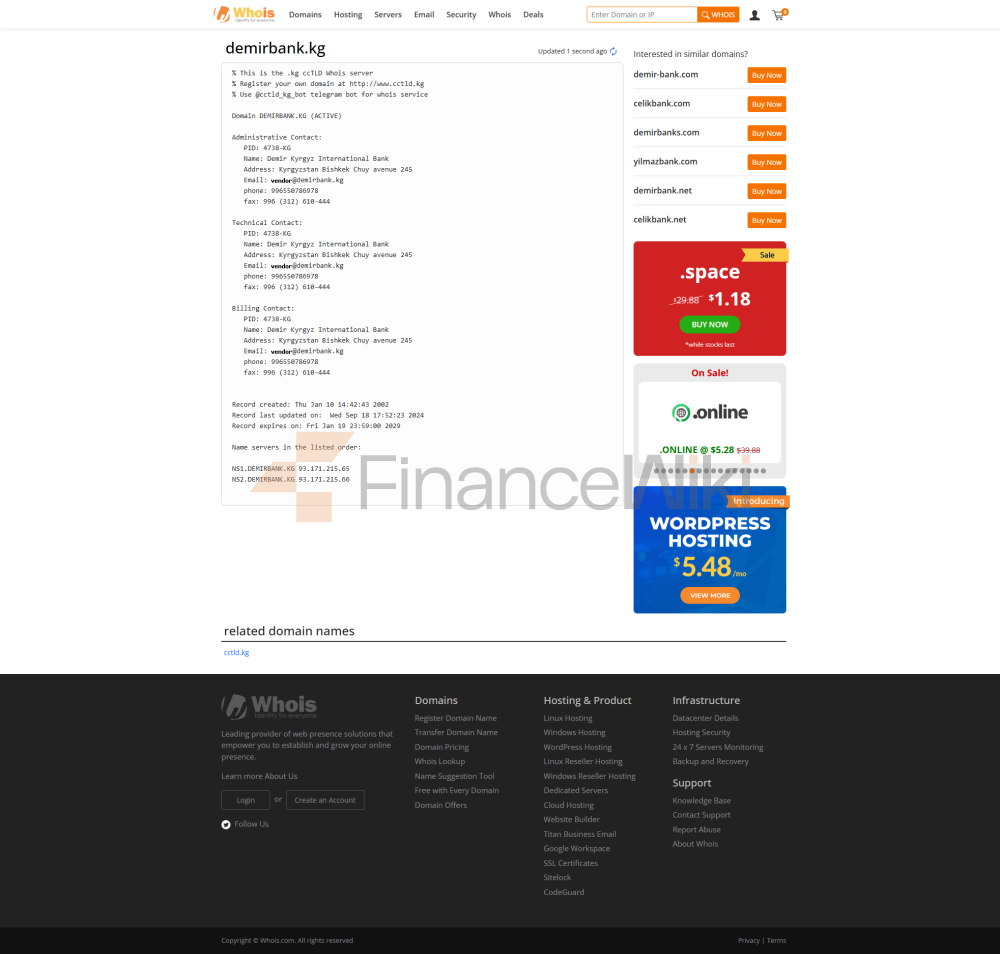

name and background<

span style="font-family: sans-serif; color: black" > full name: Demir Kyrgyz International Bank Closed Joint Stock Company

was established on May 2, 1997, and the official opening ceremony was held on May 28, 1997, attended by the president and shareholder representatives.

Headquarters location: 245 Chui Avenue, Bishkek, KyrgyzstanShareholder

Background: Demirbank is a joint venture bank with 100% authorized capital consisting of foreign investment, and the main shareholder is HCBG Holding B.V., a financial holding company registered in Amsterdam, the Netherlands, controlled by Halit Cingillioglu, which has a presence in Turkey, the Netherlands, Germany, Kazakhstan and Kyrgyzstan have 30 years of operational experience in the financial sector. The bank is not publicly listed, adopts a closed joint-stock company structure, and emphasizes international standards and market-oriented operation.

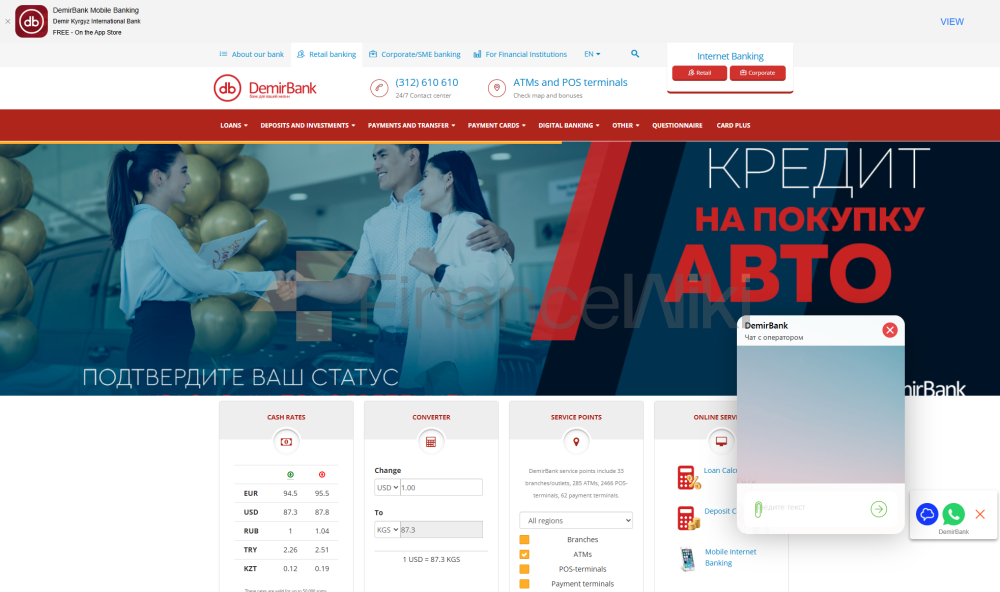

Scope of Services

coverage area: Demirbank mainly serves the whole country of Kyrgyzstan, covering major cities such as Bishkek, Osh, Calabarta, Jalalabad, etc., and has no overseas branches, but supports cross-border financial services through international payment systems (such as Visa, MasterCard) and cooperation with international financial institutions.

Number of offline branches: As of 2023, the bank has 33 branches and outlets located in major cities in Kyrgyzstan, focusing on the breadth and depth of service coverage.

ATM distribution: The bank operates 215 ATMs and 2,452 POS terminals, covering major cities and commercial locations across the country, and 17 payment terminals, supporting 24/7 self-service. ATMs are divided into two types: cash withdrawal and deposit, which is convenient for customers to operate.

services & products

Demirbank provides comprehensive financial services to individuals, small and medium-sized enterprises (SMEs), large enterprises and financial institutions, including product lines including:

Corporate Banking: provides investment loans, working capital loans, trade finance, bank guarantees and cash management services to businesses. The FastPay.kg platform supports real-time payments and account management for businesses.

SME services: Customized loans, overdrafts and factoring services, as well as mortgage development in partnership with construction companies to support SME development.

e-banking: 7/24 online services, including account management, transfers, bill payments and loan applications, through the Demirbank mobile app and internet banking platform.

payment service: supports one-click payment through virtual POS terminals and FastPay.kg services, has connected more than 50 major businesses in Kyrgyzstan, serving more than 10,000 users. In 2013, the service of payment of traffic violation fines was launched, which was the first in Kyrgyzstan.

> personal banking: Savings accounts, fixed deposits, consumer loans (from 18.99% p.a., up to 200,000 som), credit and debit cards (Visa, MasterCard supported), installment cards (the first of its kind in Kyrgyzstan) and foreign exchange services. Featured products include card-not-present payment (via QR code) and installment cards with a 63-day interest-free period.

Demirbank is known for its innovations in the field of cashless payments and mortgage lending, with a growing customer base and an ever-expanding range of services every year.

regulatory and compliance

regulator: Demirbank is regulated by the National Bank of Kyrgyzstan (NBKR), holds a banking license issued on 2 May 1997 and is subject to the Kyrgyz Banking Act and international financial standards (such as the Basel Accord).

Deposit Insurance Program: The bank participates in the Kyrgyz Agency for Deposit Protection, which insures customer deposits, the exact amount of which is not disclosed.

Recent Compliance Record: Demirbank has a strong compliance track record with no major breaches recorded. It strictly enforces Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations, undergoes regular international audits, and is recognized as the "Best Bank in Kyrgyzstan" by institutions such as Euromoney, Global Finance and the Asian Development Bank.

digital service experience<

span style="font-family: sans-serif; color: black" > app and online banking: Demirbank offers a mobile app and internet banking platform with a rating of around 4.2 out of 5 stars on Google Play and the App Store, and has been praised for its convenience and innovative features such as QR code payments.

core functionality:

real-time transfers: domestic and international transfers via mobile app, based on BI-FAST and SWIFT systems, plus QR code transfers.

Bill management: Utility bills, mobile top-ups, and insurance payments are supported.

investment tool integration: Doesn't offer stock or fund investment features, but supports deposit management and loan applications.

technology innovation:AI customer service: mobile apps integrate AI-powered chatbots, Handle frequently asked questions and account inquiries.

Open Banking API: Enables third-party developers to integrate payments and financial services and promote the open banking ecosystem.

QR code payment: Support card-not-present withdrawals, transfers, and payments through the mobile app, and scan the QR code of an ATM or merchant to complete the transaction.

PayWave technology: Launched in 2015 with Visa PayWave contactless payment card, the first of its kind in Kyrgyzstan, to improve payment efficiency and security.

>Face recognition: Support account login and transaction verification.

Demirbank plans to upgrade its corporate internet banking system from June 10, 2025 to further improve service speed and security.

customer service<

span style="font-family: sans-serif; color: black">Demirbank offers multi-channel customer service to meet the needs of individual and corporate customers:

e-mail: Handle account and product inquiries through customercare@demirbank.kg.

Live chat: Mobile apps and internet banking platforms provide live chat capabilities to quickly respond to customer questions.

Branch services: 33 branches offer face-to-face consultations, and some support 24/7 self-service.

> customer hotline +996 312 610 610 with 24/7 support.

security measures

Demirbank uses multi-layered security measures to protect customers' assets and data:

Anti-Money Laundering & Anti-Fraud: Strictly comply with NBKR's AML/CFT requirements, monitor suspicious transactions, and conduct regular risk assessments.

transaction security: Enterprise customers reduce the risk of unauthorized transactions through a FastPay.kg multi-level authorization mechanism.

Physical security: Branches and ATMs are equipped with surveillance systems and security personnel to prevent theft and fraud.

> cybersecurity: Online transactions are protected using SSL encryption and multi-factor authentication, including facial recognition and SMS verification, and customer data is encrypted and anonymized to ensure privacy.

featured services and differentiation

Demirbank is unique among the banking industry in Kyrgyzstan thanks to its international background and innovative capabilities:

Cashless payment leader: With 215 ATMs and 2,452 POS terminals, it won the "Best Cashless Payment Bank" award several times in 2018-2020.

installment card pioneering: Kyrgyzstan's first installment card was launched in 2002, offering a 63-day interest-free period to enhance customer payment flexibility.

Mortgage innovation: Partnering with construction companies to develop mortgages to support the real estate market.

Social Responsibility: Actively participate in the International Business Council, the American Chamber of Commerce and the Association of Banks of Kyrgyzstan, support financial education and employee training, and hold leadership training and team building activities in 2023.

International recognition: Received the "Best Bank in Kyrgyzstan" award from Euromoney, Global Finance, Asian Development Bank and other institutions in recognition of operational excellence.

> international capital background: As the first commercial bank with 100% foreign capital in Kyrgyzstan, it has been widely recognized by international financial institutions.

summary

Demirbank, as the first international commercial bank in Kyrgyzstan, occupies an important position in the domestic financial market thanks to its joint venture background, extensive payment network and leading digital capabilities. Banks meet the needs of individuals to large corporations through diversified products, solid financial performance, and customer-oriented innovation. Its contribution in the areas of cashless payments, mortgage lending and SME support further strengthened its market position. Demirbank is a trusted choice for customers looking for convenient financial services in Kyrgyzstan or to support regional development.