Corporate Profile

STAK FX Is A Cyprus-based Foreign Exchange Trading Company Established In 2022. The Company Focuses On Providing Customized Financial Services To Wealthy Individual And Institutional Clients. Its Minimum Deposit Requirement Is $100,000 . This High Threshold Reflects Its Positioning In The High-end Market. Although STAK FX Was In Its Early Days, It Quickly Obtained A Regulatory License For The Straight-through Processing (STP) Model, Demonstrating Its Efforts In Compliance And Market Access.

STAK FX's Core Business Covers The Trading Of Forex, Commodities And Contracts For Difference (CFDs), Utilizing The Popular Trading Platform MetaTrader 4 (MT4). Emphasizing The Importance Of Customer Support, The Company Offers A Variety Of Deposit And Withdrawal Methods And 24/7 Customer Service, Aiming To Provide Customers With A Seamless Trading Experience.

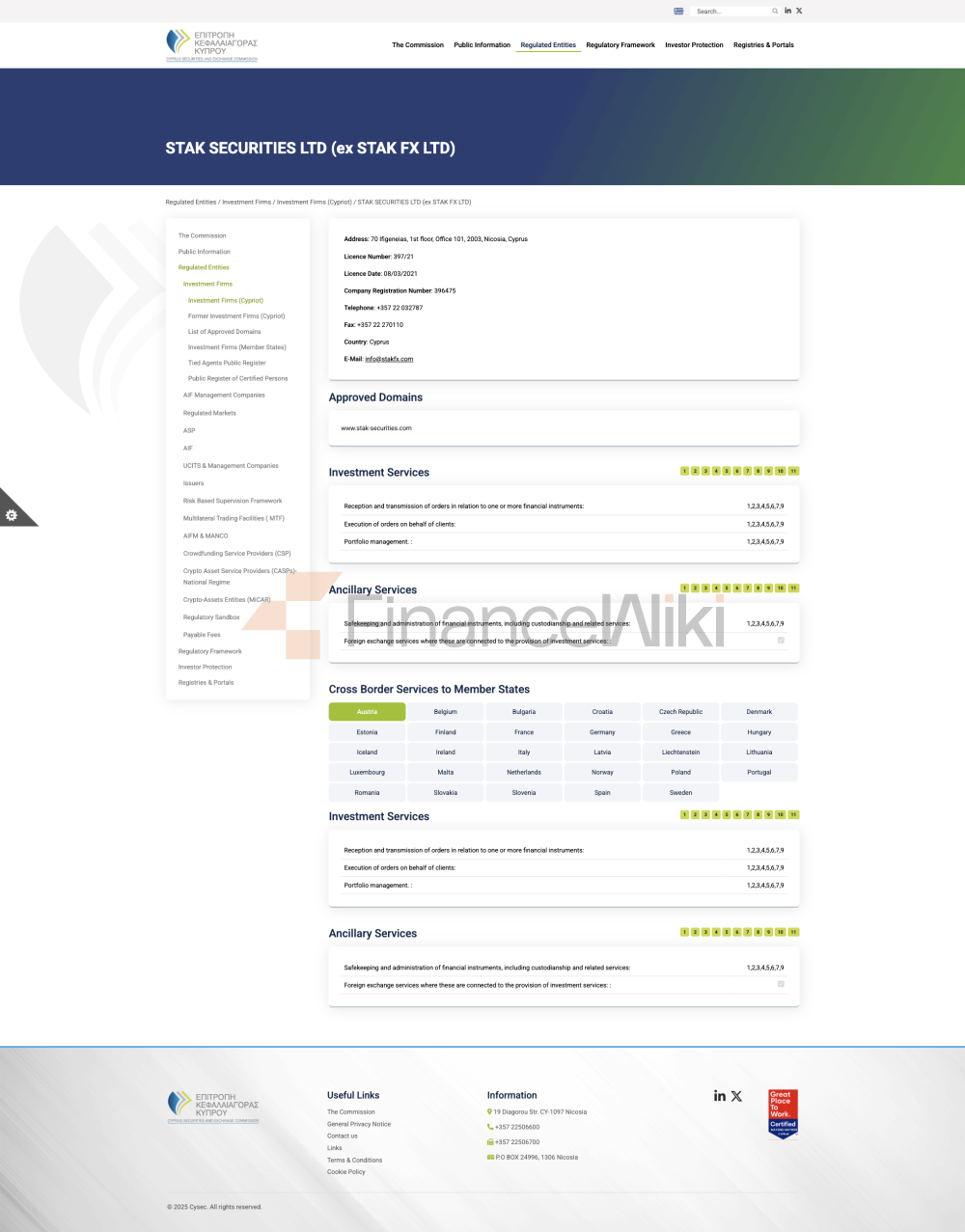

Regulatory Information

STAK FX Is Regulated By The Cyprus Securities And Exchange Commission (CySEC) And Holds An STP License With License Number 397/21 . The License Type Is Designated As "shared-free", Indicating That The Company Does Not Intervene With Traders During The Trading Process, But Instead Passes Transactions Directly To Liquidity Providers. This Model Is Designed To Increase The Transparency And Efficiency Of Trading And Reduce Potential Execution Risks.

Trading Products

STAK FX Offers A Broad Portfolio Of Products Covering The Following Asset Classes:

- Forex (Foreign Exchange) : Including Major, Minor And Exotic Currency Pairs. Traders Can Trade Multiple Currency Pairs Through STAK FX's Platform To Seize The Volatility Opportunities In The Global Foreign Exchange Market.

- Commodities : Covers Precious Metals (such As Gold And Silver) And Agricultural Products, Among Others. Traders Can Speculate On The Price Movement Of Commodities And Participate In The Supply And Demand Dynamics Of The Global Market.

- Contracts For Difference (CFDs) : Offers The Opportunity To Speculate On The Price Movements Of Stocks, Indices And Other Financial Instruments Without Having To Actually Hold The Underlying Asset.

These Diverse Offerings Enable Clients To Develop Comprehensive Trading Strategies That Respond To Changes In Different Market Environments.

Trading Software

STAK FX Has Chosen MetaTrader 4 (MT4) As Its Core Trading Platform. Known For Its User-friendly Interface And Rich Functionality, MT4 Supports A Wide Range Of Technical Analysis Tools And Chart Types For Traders Of Different Experience Levels. With MT4, Customers Can Access Real-time Market Data, Execute Orders, And Manage Transactions.

The Company Has Not Mentioned Whether It Plans To Launch Other Trading Platforms, But Its Reliance On MT4 Reflects Its Emphasis On Market Acceptance And Ease Of Operation.

Deposit And Withdrawal Methods

STAK FX Offers Flexible Deposit And Withdrawal Methods, Including:

- Credit/Debit Card : Traders Can Deposit And Withdraw Funds Through Mainstream Credit Or Debit Cards.

- Bank Transfer : For Customers Who Wish To Trade Through Traditional Banking Channels.

The Company Clearly Stipulates That The Minimum Deposit Threshold Is $100,000 , Which Reflects Its Positioning In The High-end Market. The Specific Handling Fees And Processing Times For Deposits And Withdrawals Need To Be Further Understood Through The Company's Official Website Or Customer Service.

Customer Support

STAK FX Values The Comprehensiveness Of Customer Support And Provides The Following Contact Information:

- Telephone Support : Customers Can Directly Contact The Customer Service Team By Phone + 357 22 032787 For Real-time Assistance.

- Email Support : Through The Email Address Info@stakfx.com , Customers Can Submit Questions Or Get More Information.

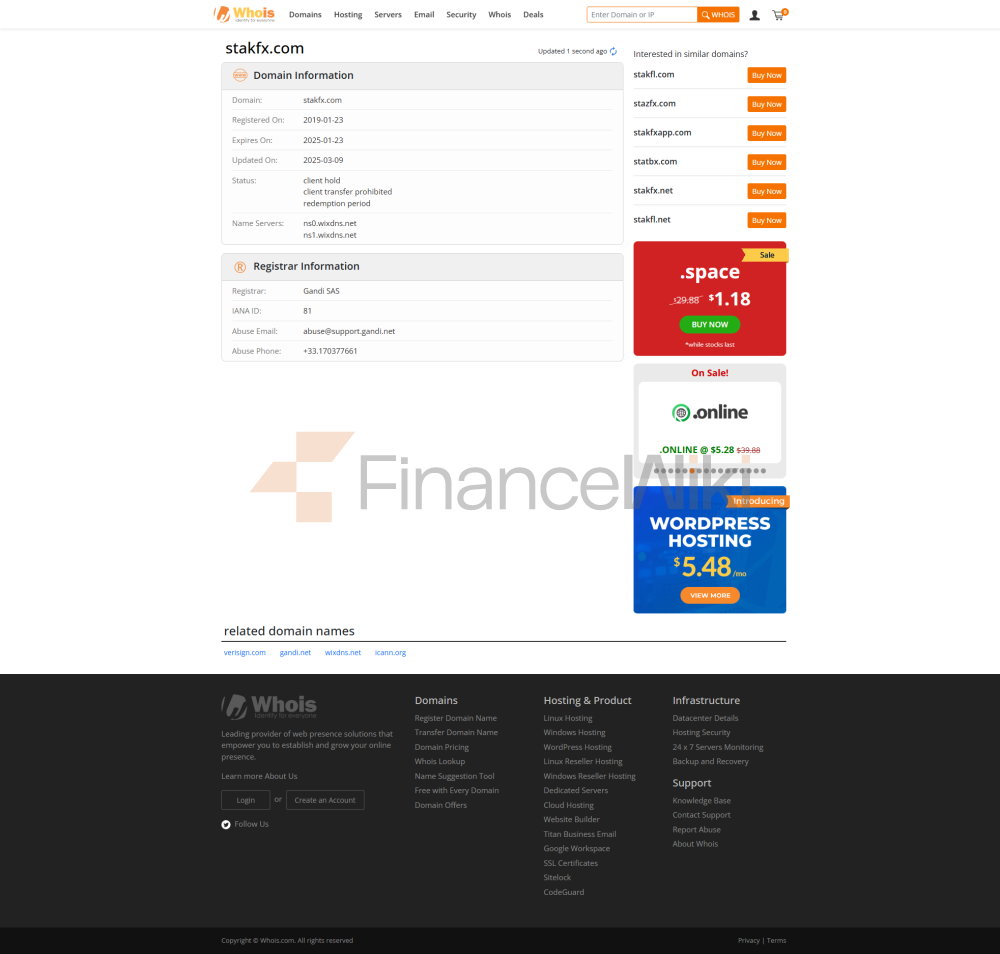

The Company Does Not Provide Detailed Service Hours Or Support Language Information, But Its Official Website Recommends Customers To Browse The Official Page Or Contact Customer Service Directly For More Detailed Trading Procedures And Fee Structures.

Core Business And Services

STAK FX's Core Business Focuses On Providing A Diverse Range Of Trading Products And Personal Account Services. Its Target Customer Group Is Wealthy Individuals And Institutions, Which Have High Demand For Customized Services And Personalized Support. The Company Made No Mention Of Providing Educational Resources Or Training Materials, A Lack That May Pose A Certain Barrier For Novice Traders.

Technical Infrastructure

STAK FX's Technical Infrastructure Is Based On The MT4 Platform, Which Is Known For Its Stability, Functionality, And Extensive Plug-in Support. While The Company Did Not Elaborate On Its Back-office System, Its Reliance On MT4 Shows The Importance It Places On Technical Reliability.

Compliance And Risk Control System

As A Company Regulated By CySEC, STAK FX Must Comply With A Series Of Compliance Requirements. Its STP-mode License Further Enhances The Transparency Of Trading And Reduces Potential Execution Risks. However, The Company Did Not Mention Specific Risk Control Measures Or Mechanisms To Protect Client Funds, And This Information Is Crucial For Traders To Develop Risk Management Strategies.

Market Positioning And Competitive Advantage

STAK FX's Market Positioning Is Mainly Aimed At The High-end Customer Group, And Its High Standard Minimum Deposit Threshold Is One Of Its Core Competitive Advantages. In Addition, Its Mature MT4 Platform And Diverse Trading Products Make It Attractive In The Market. However, The High Threshold And The Limitations Of A Single Platform May Pose Challenges For Some Traders.

Customer Support And Empowerment

STAK FX Provides Customer Support Through A Variety Of Means, Including Telephone, Email, And Online Resources. However, Its Lack Of Educational Resources And Training Materials May Limit The Growth Of Novice Traders.

Social Responsibility And ESG

Currently, STAK FX Does Not Explicitly Mention Its Initiatives In Social Responsibility And ESG (environmental, Social, Governance). Information In This Area Is Increasingly Important For Decision-making Of Modern Investors.

Strategic Cooperation Ecology

Due To The Company's Relatively Short Establishment, STAK FX's Strategic Cooperation Ecology Has Not Been Made Public. Its Main Energy Is Focused On Improving Its Own Services And Technical Infrastructure.

Financial Health

As A Newly Established Company, There Is No Publicly Available Data On The Financial Health Of STAK FX. Its High Threshold Deposit Requirements And Positioning In The High-end Market May Have A Positive Impact On Its Financial Stability.

Future Roadmap

The Future Roadmap Of STAK FX Has Not Been Clearly Announced. However, Its Continued Technological Development And Service Optimization Will Be Key To Future Development.

Summary

STAK FX Is A High-end Foreign Exchange Trading Company Located In Cyprus, Serving Affluent Clients Through A Diverse Range Of Products And Mature Trading Platforms. Although It Performs Well In Terms Of Customer Support And Technical Infrastructure, High Barriers And Lack Of Educational Resources May Pose Challenges For Some Traders. In The Future, STAK FX Needs To Further Expand Its Services And Information Transparency In Order To Attract More Client Groups.