Corporate Profile

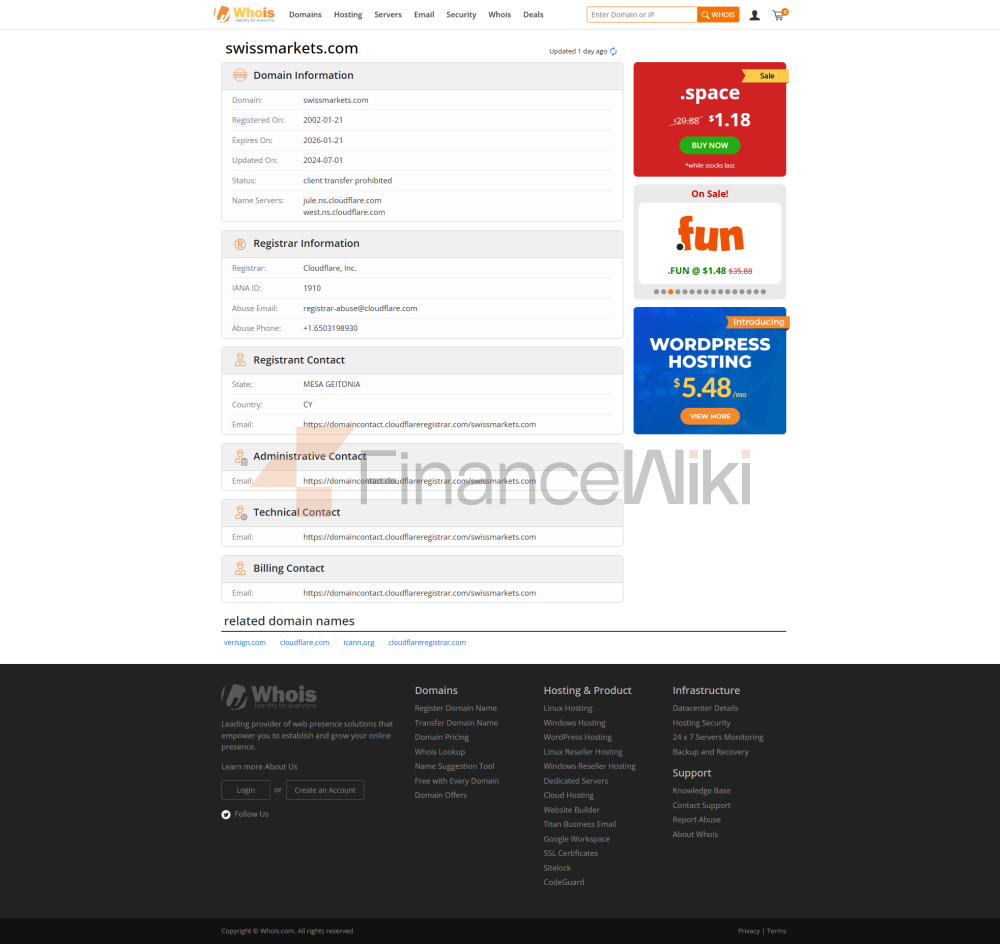

Swiss Markets (which Has Been Renamed BDS Markets) Was Established In December 2016 And Is Headquartered In Ebini, Mauritius. As A Regulated Foreign Exchange Broker, The Company Mainly Provides Investors With Trading Services For Financial Products Such As Foreign Exchange, Metals, Energy, Indices, Etc. The Company Has Strong Technical Support And A Rich Product Line, And Is Committed To Providing Customers With A Safe, Transparent And Efficient Trading Environment.Regulatory Information The Mauritian Entity Of Swiss Markets Is BDS Markets. It Is Authorized And Regulated By The Mauritius Financial Services Commission (FSC). The Authorization Date Is December 6, 2016. The License Number Is C116016172 . Meanwhile, Its Seychelles Entity, BDS Ltd, Is Regulated By The Seychelles Financial Services Authority (FSA) With License Number SD047 . These Regulators Ensure The Legality And Compliance Of The Company's Operations, Providing Strong Safeguards For Its Clients.

Trading Products Swiss Markets Offers A Diverse Range Of Trading Products Covering Asset Classes Such As Forex, Precious Metals, Energy And Indices. Specifically Include:

- Forex Pairs (e.g. EUR/USD, USD/JPY, Etc.)

- Precious Metals (e.g. XAU/USD, XAG/USD, Etc.)

- Energy (e.g. USOIL, BRENT, Etc.)

- Indices (e.g. US30, EUR100, Etc.)

These Trading Products Are Designed To Meet The Needs Of Different Investors, Especially In Volatile Market Environments.

Trading Software Swiss Markets Provides Clients With MT4 Trading Platform , Which Supports Multiple Client Sides Such As Windows, Mac, IOS, Android And Web. MT4 Is Popular For Its Powerful Features And User-friendly Interface, Supporting A Wide Range Of Technical Analysis Tools, Chart Types And Trading Strategies.

Deposit And Withdrawal Methods Swiss Markets Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Visa, Mastercard, Maestro, Postepay, Giro Pay, Sofort, EPS, IDeal, Przelewy24 And Other Credit And Debit Cards

- Skrill, Neteller

- Bank Telegraphic Transfer

These Payment Methods Provide Customers With Convenient Deposit And Withdrawal Services To Meet The Fund Management Needs Of Different Customers.

Customer Support Swiss Markets Provides Multilingual Customer Support Services In English, German, Spanish, Greek And Other Languages. Customers Can Be Contacted Via:

- Telephone : + 44 (20) 36709704 (English), + 49 3021446981 (German), + 34 (91) 0756974 (Spanish), + 357 25262934 (Greek) Email : Support@swissmarkets.com, Complaint@swissmarkets.com

- Online Contact Form

In Addition, The Company Regularly Updates The Official Website Information To Ensure That Customers Can Easily Access The Latest Developments And Services.

Core Business And Services Swiss Markets' Core Business Includes Foreign Exchange Trading, Contract For Difference (CFD) Trading And Precious Metals Trading. The Company Connects Customer Orders Directly To The Flow Pool Through The STP (Straight Through Processing) Model, Ensuring Low Latency And High Transparency Of Transactions. For Different Customer Needs, The Company Offers Two Trading Accounts:

- STP Classic Account : The Maximum Foreign Exchange Leverage Is 1:500 , The Spread Is As Low As 0.9 Points , Suitable For Customers Seeking High Liquidity

- STP Raw Account : The Maximum Foreign Exchange Leverage Is 1:200 , The Spread Is As Low As 0 Points , Suitable For Customers Seeking Low Latency And Low Spreads

In Addition, The Company Also Offers Islamic Account To Meet The Needs Of Specific Customers Religious Needs.

Technical Infrastructure Swiss Markets Uses An Advanced Technical Infrastructure To Ensure The Stability And Security Of Trading. Its Trading Servers Are Operated By BDS Swiss Markets Global Services Ltd And Support Multi-platform Access And Instant Order Execution.

Compliance And Risk Control System As A Regulated Foreign Exchange Broker, Swiss Markets Strictly Abides By Relevant Laws And Regulations To Ensure The Compliance Of Operations. The Company Adopts The AIoT Risk Control System (combined With Artificial Intelligence And Internet Of Things Technology) To Monitor Trading Behavior In Real Time To Prevent Operational Risks And Market Risks. In Addition, The Company Has Also Established A Clear System Of Isolation Of Customer Funds To Ensure The Safety Of Customer Funds.

Market Positioning And Competitive Advantage Swiss Markets Is Positioned To Provide Professional And Transparent Trading Services To Global Investors. Its Competitive Advantage Is Mainly Reflected In The Following Aspects:

- Diversified Trading Products : Covering Multiple Asset Classes To Meet The Needs Of Different Investors

- Low Latency Trading Environment : Fast Order Execution Through STP Mode

- Multilingual Support : Convenient Communication Services For Customers In Different Regions

- Operation Of Security Compliance : Strict Supervision And Risk Control System To Ensure The Safety Of Customer Funds

Customer Support And Empowerment Swiss Markets Not Only Provides Basic Customer Support Services, But Also Publishes Educational Resources Such As Market Analysis And Trading Strategies Through Its Official Website And Social Media Platforms To Help Customers Improve Their Trading Skills. In Addition, The Company Regularly Organizes Investor Education Activities To Enhance The Financial Literacy Of Its Clients.

Social Responsibility And ESG Swiss Markets Actively Fulfills Its Social Responsibility And Supports Social Welfare Projects In Mauritius And Other Regions. In Terms Of ESG (environmental, Social, Governance), The Company Is Committed To Promoting Green Finance And Sustainable Development, And Strives To Reduce The Impact Of Its Business Activities On The Environment.

Strategic Cooperation Ecology Swiss Markets Has Established Long-term Partnerships With A Number Of Well-known Financial Institution Groups, Technology Suppliers And Market Data Providers To Jointly Promote Technological Innovation And Service Upgrades. These Strategic Partnerships Further Enhance The Company's Market Competitiveness And Influence.

Financial Health As Of The Third Quarter Of 2023, Swiss Markets' Financial Position Was Sound And Its Capital Adequacy Ratio Remained At A High Level. The Company Ensured Long-term Sustainability Through Strict Financial Management And Risk Control.

Future Roadmap Swiss Markets Plans To Further Expand Its Global Presence In The Future, Especially In Expanding Its Client Base In Emerging Markets. In Addition, The Company Will Continue To Invest In Technology Infrastructure And Client Server To Enhance The Overall User Experience.