Corporate Overview

Windsor Brokers Is A Foreign Exchange Broker Incorporated In Cyprus In 1988 And Headquartered In Limassol. The Company Has Branches In Several Regions Around The World, Including Jordan, Seychelles And Kenya . As A Professional Foreign Exchange Broker, Windsor Brokers Provides Users With Comprehensive Trading Services Covering Forex, Indices, Commodities, Stocks, Energy, Bonds, ETFs And Metals .

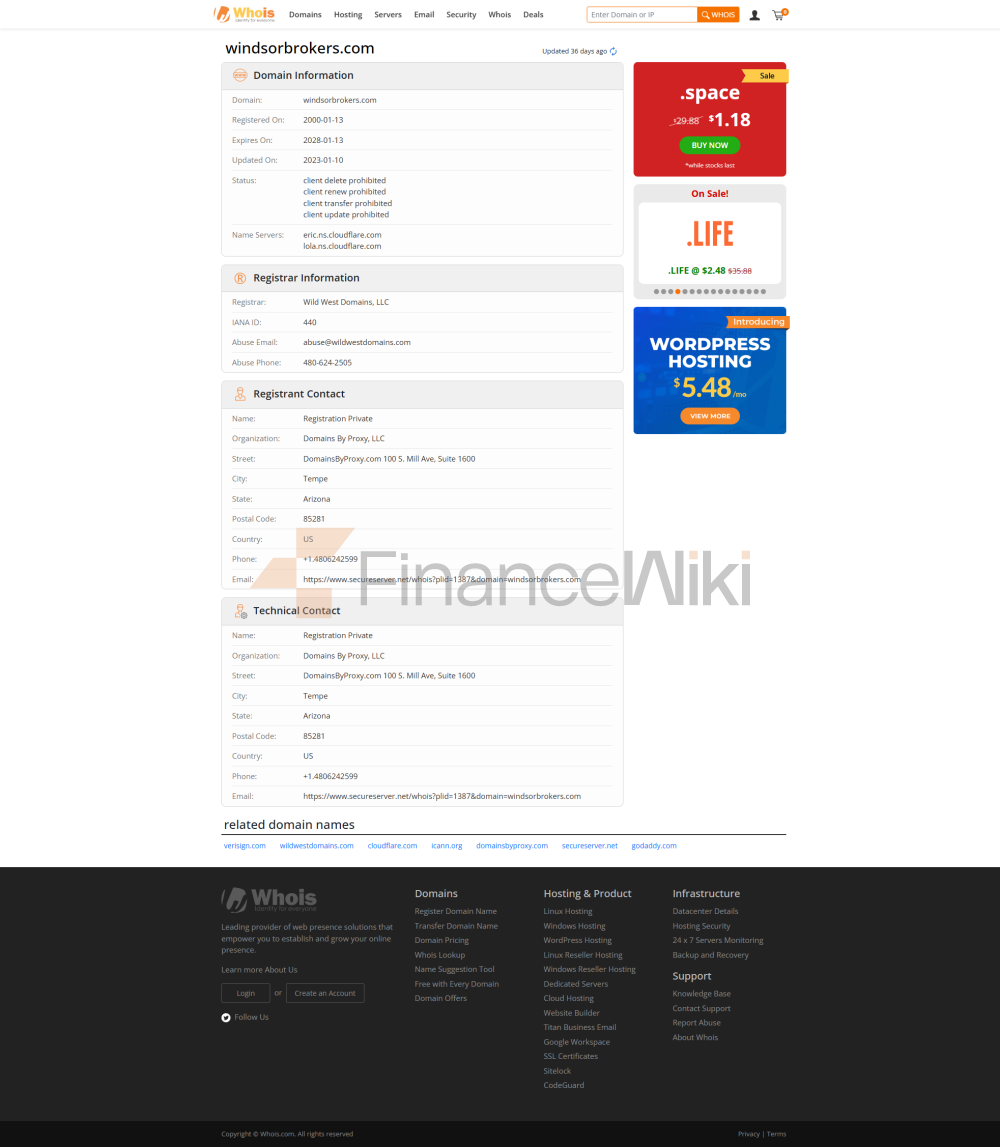

Windsor Brokers' Corporate Registration Entity Is Windsor Brokers Ltd With Company Registration Number 119081 . The Registration Of Its Official Website Domain Name Was Completed On February 1, 2022 , Marking An Important Step For The Company In Digital Transformation And Branding.

Regulatory Information

Windsor Brokers Is A Highly Regulated Broker Operating In Compliance With The Laws And Regulations Of Multiple Jurisdictions. The Following Is Its Key Regulatory Information:

- Cyprus Securities And Exchange Commission (CySEC) : Windsor Brokers Is A Brand Under The Windsor Group And Is Regulated By The Cyprus Securities And Exchange Commission.

- Seychelles Financial Services Authority (FSA) : Windsor Brokers Int'l Ltd Is Licensed By The Seychelles Financial Services Authority. The License Number Has Not Been Replaced.

- Jordanian Securities Commission (JSC) : Zydor Investment Co. Ltd. Is Regulated By The Jordanian Securities Commission.

- Kenya Capital Markets Authority (CMA) : Windsor Markets Kenya Ltd Is Licensed By The Kenya Capital Markets Authority.

Windsor Brokers Has Demonstrated Compliance And Transparency In Global Markets Through Multi-regional Regulatory Certifications.

Trading Products

Windsor Brokers Offers A Diverse Range Of Trading Products To Meet The Needs Of Different Investors. The Following Are Its Main Trading Instruments:

- Forex: Offers Trading On More Than 45 Foreign Exchange Currency Pairs, Attracting Experienced Traders With Ultra-low Spreads.

- Index: Includes Leading Global Indices Such As The S & P 500 Index (S & P 500) And The Nasdaq .

- Commodities: Offers CFD Commodities Trading Such As Coffee, Soybeans And Other Agricultural Products.

- Stocks: Offers CFD Stocks Trading From Large Global Institutions.

- Energy: Includes CFD Trading Of Energy Products Such As Crude Oil And Natural Gas .

- Bonds: Diversifies Its Portfolio With CFD Bonds.

- ETFs: Offers ETFs That Trade In The Most Liquid Markets, Such As QQQ ETF And IWM ETF .

- Metals: Offers CFD Trading In Precious Metals Such As Gold And Silver .

Windsor Brokers' Trading Products Cover A Wide Range Of Asset Classes, Providing Investors With A Wealth Of Trading Options.

Trading Platform

Windsor Brokers Offers Investors The Industry-renowned MetaTrader 4 (MT4) Trading Platform . Known For Its Powerful Trading Capabilities And Flexible Analytical Tools, The Platform Supports Multiple End Point Formats:

- MT4 Desktop End Point : Suitable For Computer-side Trading.

- MT4 Mobile End Point : Convenient For Investors To Trade Anytime, Anywhere.

- MT4 Tablet End Point : An Optimized Version For Tablet Devices.

- MT4 Web Version : No Need To Download Software, Trade Directly Through The Web.

Windsor Brokers' MT4 Platform Offers Investors An Excellent Trading Experience With Its Fast, Flexible And Powerful Performance.

Account Types

Windsor Brokers Offers Two Different Types Of Trading Accounts To Meet The Needs Of Different Traders:

-

Zero-point Trading Account:

- Suitable For: Senior Traders.

- Minimum Deposit: 1000 Dollars.

- Major Currency Pair Spreads: From Zero.

- Leverage: 1000 Times.

-

Standard Trading Account:

- Suitable For: Beginner Trader.

- Minimum Deposit: 50 Dollars.

- Spreads On Major Currency Pairs: 1 Pip.

- Leverage: 1000 Times.

The Design Of The Two Account Types Reflects Windsor Brokers' Precise Grasp Of The Needs Of Different Traders.

Deposit And Withdrawal Methods

Windsor Brokers Offers Three Deposit And Withdrawal Options To Facilitate Investors' Trading Operations:

-

Credit Card:

- If The Withdrawal Time Is 6 Months From The Date Of Deposit , The Same Credit Card Must Be Used To Withdraw.

- For More Than 6 Months, Customers Need To Provide Windsor With A Bank Statement To Transfer Funds Back To Their Bank Account.

-

Electronic Deposit:

- Supports Multiple E-wallets (e.g. Neteller, Webmoney, Skrill).

- The Same E-wallet Is Required For Deposits And Withdrawals.

-

Telegraphic Transfer:

- Users Need To Complete The Deposit Through The Bank.

- Withdrawals Need To Be Returned To The Same Bank Account.

Windsor Brokers' Deposit And Withdrawal Methods Reflect Its Strong Emphasis On The Safety Of Investors' Funds.

Customer Support

Windsor Brokers Provides Investors With Multi-channel Customer Support Services:

- Email: Support@windsorbrokers.com.

- Tel:

- Jordan: + 962 6 550 9090.

- Seychelles: + 44 1145519650.

- Kenya: + 254 205029240.

Investors Can Obtain Professional Trading Support And Advisory Services Through The Above Channels.

Compliance And Risk Control System

Windsor Brokers Places A High Priority On Compliance And Risk Management, And Has Established A Comprehensive Compliance And Risk Control System:

- Compliance Statement: Windsor Brokers Strictly Adheres To The Laws And Regulations Of Each Jurisdiction And Is Regularly Reviewed By Regulators.

- Risk Management System: Windsor Brokers Uses Advanced Risk Management Tools To Help Investors Control Trading Risks.

- Client Funds Protection: Client Funds Are Held In Separate Bank Accounts, Segregated From The Company's Operating Funds.

Windsor Brokers Compliance And Risk Control System Has Earned It The Trust Of Investors.

Market Positioning And Competitive Advantage

Windsor Brokerage Has A Unique Market Positioning In The Global Foreign Exchange Market:

- Multi-regional Supervision: Windsor Brokerage Has Been Licensed In Multiple Jurisdictions, Demonstrating Its Global Layout. Diversified Trading Varieties: Offers A Wealth Of Trading Products To Meet The Needs Of Different Investors.

- Strong Technical Support: Offers Investors An Excellent Trading Experience Through The MT4 Platform.

- Flexible Account Selection: Zero-point Trading Accounts And Standard Trading Accounts Meet The Needs Of Different Traders.

Windsor Brokers Has Become One Of The Leading Brands In The Global Foreign Exchange Market Through Its Differentiated Advantages.

Social Responsibility And ESG

Windsor Brokers Actively Fulfills Its Social Responsibility And Promotes Sustainable Development. Its Efforts In Environmental Protection, Social Responsibility And Corporate Governance (ESG) Include:

- Environmental Protection: Windsor Brokerage Supports Global Environmental Causes By Reducing Carbon Emissions And Promoting Green Energy.

- Social Responsibility: Actively Participates In Community Good Activities And Supports Education And Healthcare.

- Corporate Governance: Establishes A Transparent Corporate Governance Structure To Ensure Fairness And Transparency In Company Operations.

Windsor Brokerage's Social Responsibility And ESG Practices Have Earned It A Good Social Reputation.

Strategic Cooperation Ecology

Windsor Brokerage Has Established Strategic Partnerships With Several Well-known Institutions To Drive Business Development. These Partners Include:

- Fintech Companies: Collaborate With Leading Fintech Companies To Optimize Trading Technology.

- Industry Associations: Join Several International Financial Industry Associations To Enhance Industry Influence.

- Academic Institutions: Collaborate With Universities To Promote Financial Education And Research.

The Strategic Cooperation Ecosystem Of Windsor Brokers Has Provided A Strong Driving Force For Its Development.

Financial Health

Windsor Brokers Has Shown Solid Financial Performance In Recent Years:

- 2022: The Company's Net Profit Increased By 15% , Indicating Its Strong Performance In The Market.

- 2023: Asset Size Breaks Through $1 Billion , Showing Its Continued Improvement In Financial Health.

Windsor Brokers' Financial Soundness Provides A Solid Foundation For Its Future Development.

Future Roadmap

Windsor Brokers' Future Plans Continue To Develop In The Following Areas:

- Technological Innovation: Increase Investment In Artificial Intelligence And Big Data Technology To Optimize The Trading Experience.

- Market Expansion: Deepen Its Presence In The Asian And Middle Eastern Markets And Expand Its Global Presence.

- Client Education: Launch More Investor Education Programs To Enhance The Professionalism Of Traders.

Windsor Brokerage Has Demonstrated Its Long-term Vision In The Global Foreign Exchange Market With Its Clear Future Roadmap.

Windsor Brokerage Has Become A Trusted Foreign Exchange Broker For Global Investors With Its Professional Services, Compliance Operations And Strong Technical Capabilities.