Corporate Profile

MAKASKY Is A Foreign Exchange Brokerage Based In Malaysia. It Was Established In 2017 And Is Regulated By The Malaysian Financial Supervisory Authority (LFSA). The Company Focuses On Providing A Diverse Range Of Financial Trading Services To Traders Worldwide, Including Forex, Contracts For Difference (CFDs) And More. MAKASKY Caters To The Diverse Needs Of Traders From Novice To Professional Through Its Professional Trading Platform And Rich Range Of Financial Instruments.

Regulatory Information

As A Regulated Foreign Exchange Brokerage, MAKASKY Holds A Straight-Through Processing (STP) License Issued By The LFSA With License Number MB/16/0012. This Regulatory Framework Ensures That MAKASKY Complies With Industry Standards And Regulations, Providing A Safe, Transparent Trading Environment For Its Clients.

Trading Products

MAKASKY Offers Traders A Wealth Of Financial Instruments, Including Over 40 Currency Pairs As Well As Contracts For Difference (CFDs) Covering Indices, Commodities And Stocks. These Instruments Cover Major Currency Pairs, Minor Currency Pairs And Exotic Currency Pairs, Providing Traders With A Wide Range Of Options In Order To Build A Diversified Portfolio.

Trading Software

MAKASKY Uses MetaTrader 4 (MT4) As Its Primary Trading Software. Known For Its Powerful Features, User-friendly Interface, And Reliable Execution Capabilities, The Platform Supports Traders In Technical Analysis, Chart Analysis, As Well As The Operation Of Multiple Trading Strategies.

Deposit And Withdrawal Methods

MAKASKY Offers Customers A Variety Of Deposit And Withdrawal Methods, Including Bank Transfers And Credit/debit Cards. These Methods Ensure The Flexibility And Security Of Funds. It Is Worth Noting That MAKASKY Does Not Charge Handling Fees For Deposits And Withdrawals, But May Involve Foreign Exchange Transaction Fees From Banks.

Customer Support

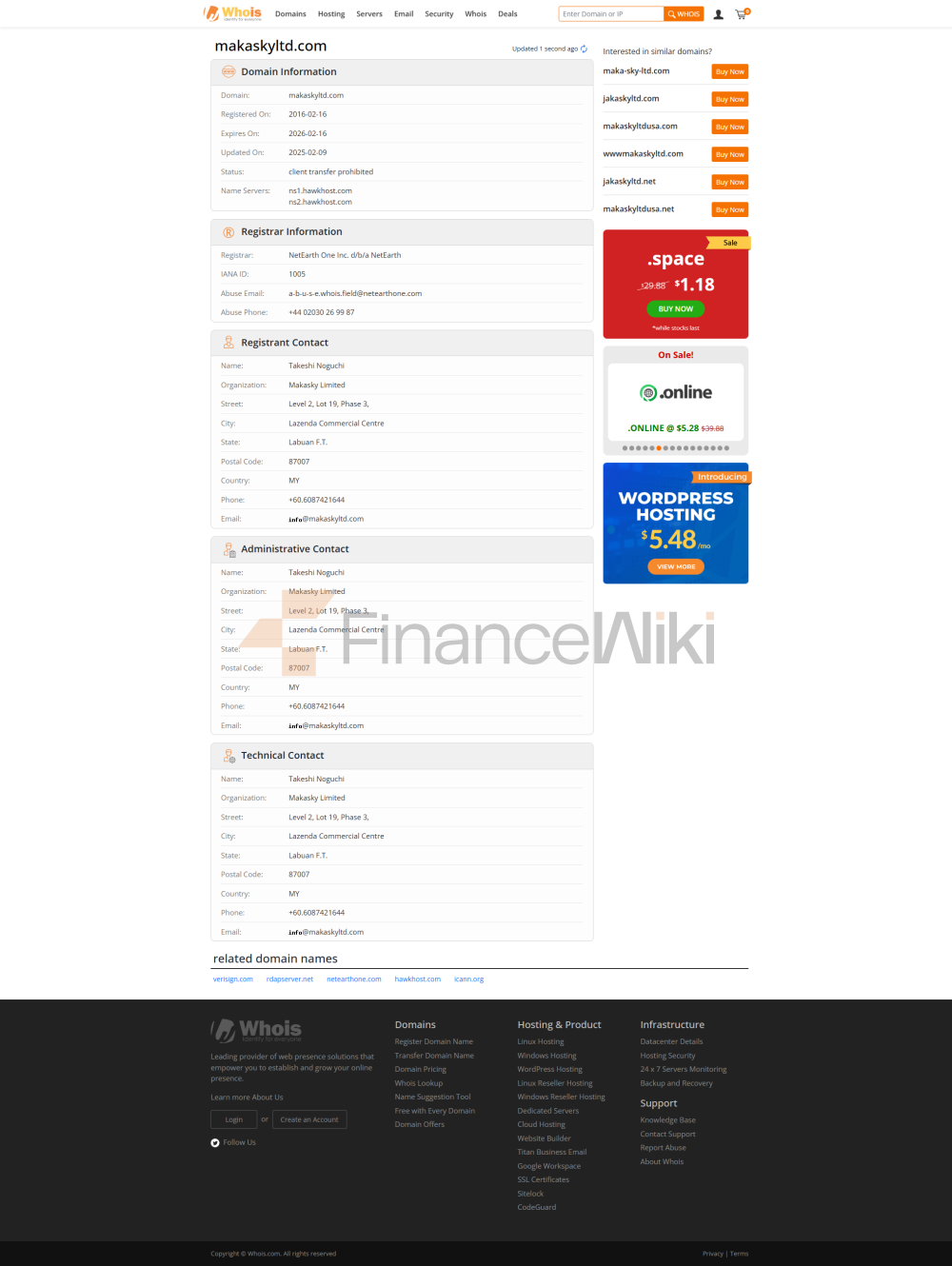

MAKASKY Provides Customer Support Through Multiple Channels, Including Telephone, Fax, And Email. Clients Can Contact The Customer Support Team On The Phone Number + 60 87 421 644 Or Submit An Enquiry Via The Email Address Info@makaskyltd.com. In Addition, MAKASKY Provides A Detailed Frequently Asked Questions (FAQ) Section To Help Traders Get Information Quickly.

Core Business & Services

MAKASKY's Core Business Is To Provide Forex And CFD Trading Services. The Company, Through Its MT4 Platform, Supports Leverage Ratios Of Up To 1:100, Enabling Traders To Control Larger Positions With Relatively Little Capital. In Addition, MAKASKY Also Offers Traders Two Options Of Demo Account And Standard Account, Respectively, To Meet The Needs Of Traders With Different Experience Levels.

TECHNOLOGY INSTRUCTION

MAKASKY Employs An Advanced Technical Infrastructure That Ensures Fast Execution Of Transactions And Stability Of The System. Through Straight-through Processing (STP) Mode, MAKASKY Is Able To Pass Customers' Orders Directly To Liquidity Providers, Reducing Transaction Delays And Slippage.

Compliance And Risk Control System

As A Regulated Financial Institution Group, MAKASKY Strictly Complies With Regulatory Requirements And Has Established A Sound Compliance And Risk Control System. Through Real-time Monitoring And Risk Management System, The Company Ensures The Compliance And Safety Of Trading Activities And Protects The Safety Of Customers' Funds.

Market Positioning And Competitive Advantage

MAKASKY Stands Out In The Industry With Its Diverse Range Of Financial Instruments, Flexible Account Types And Competitive Leverage Ratios. The Company Is Committed To Providing Clients With A Transparent, Efficient And Secure Trading Environment, Earning The Trust And Recognition Of Its Clients.

Customer Support And Empowerment

MAKASKY Provides Traders With Strong Support And Educational Resources Through A Comprehensive Frequently Asked Questions (FAQ) Section And Multiple Customer Support Channels. These Resources Help Traders Better Understand Financial Marekt And Enhance Trading Skills, Resulting In Better Investment Results.

Social Responsibility And ESG

MAKASKY Performs Well In Fulfilling Social Responsibility And Actively Participates In And Supports Community Development Projects. The Company Focuses On The Practice Of Environmental Protection, Social Responsibility And Corporate Governance (ESG) And Is Committed To Creating Long-term Value For Society.

Strategic Cooperation Ecology

MAKASKY Has Established Close Strategic Partnerships With Several Financial Institution Groups And Industry Partners To Further Expand Its Business Scope And Service Capabilities Through Resource Sharing And Collaborative Innovation. These Collaborations Not Only Enhance The Company's Market Competitiveness, But Also Provide Customers With More Quality Services And Resources.

Financial Health

As Of The Third Quarter Of 2023, MAKASKY Maintained A Good Financial Health, Demonstrating Its Robust Operational Capabilities And Risk Management Level. The Company's Financial Reporting Is Open And Transparent, Providing Investors And Customers With A Reliable Reference Of Their Financial Position.

Future Roadmap

MAKASKY Plans To Continue To Expand Its Global Business In The Future, Adding New Financial Instruments And Markets, And Further Enhancing Its Technological Infrastructure And Service Capabilities. The Company Is Committed To Providing Customers With A More Quality And Diversified Trading Experience Through Innovation And Optimization.