Corporate Profile

Tradu Is A UK-based Financial Trading Services Provider, Established In 2023, Focused On Providing Global Traders With A Diverse Range Of Financial Instruments Trading Services. The Platform Is Regulated By CySEC (Cyprus Securities And Exchange Commission) And FSA (Seychelles Financial Services Authority), Ensuring That Its Operations Meet The High Standards Of The International Financial Industry. Tradu Offers A Wide Range Of Trading Products Including Forex, Stocks, Indices, Commodities And Cryptocurrencies, And Offers Efficient Trade Execution And Competitive Spreads Through Its Own Tradu APP. As Of 2023, Tradu Supports Over 10,000 Financial Instruments, Covering Major Markets Worldwide.

Tradu Has A Registered Capital Of 5,000,000 Euros . The Core Management Team Consists Of Experienced Industry Veterans. The Enterprise Structure Adopts A Modular Design To Ensure Efficient Operation And Compliance Management. Tradu's Shareholding Structure Is Relatively Centralized. The Main Shareholder Is Stratos Group, With A Shareholding Ratio Exceeding 70% . The Platform Has No Minimum Deposit Requirements And Supports A Variety Of Payment Methods, Including Credit Cards, Debit Cards, Skrill, Neteller And Bank Telegraphic Transfers.

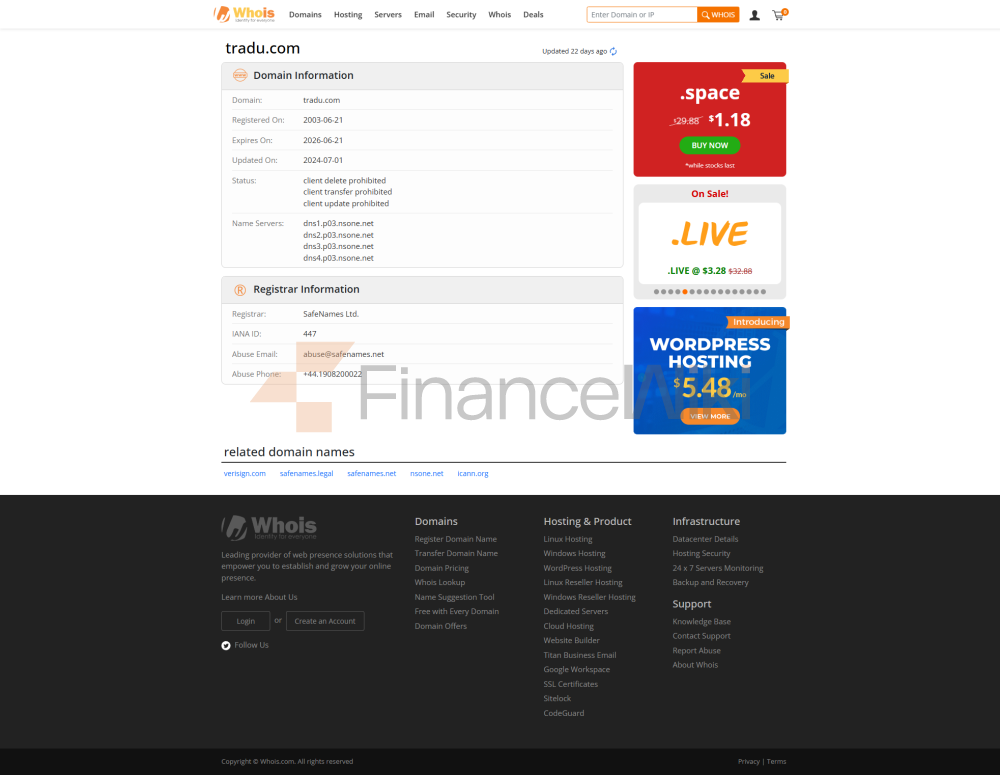

Regulatory Information

Tradu Operates In Multiple Jurisdictions And Is Subject To Strict Regulatory Frameworks. Its Core Licenses Include:

- CySEC: Tradu Holds A License Number 392/20 Authorizing It To Carry Out Market-making Activities In Cyprus.

- FSA: Tradu Has Been Granted A Retail Foreign Exchange License By The Seychelles Financial Services Authority With License Number SD147 , Which Regulates Its Offshore Operations.

- Registration: Tradu Has A Registered Record In Both The UK And Cyprus, But Is Not Legally Authorised In Australia.

Although Tradu Claims To Be Associated With ASIC (Australian Securities And Investments Commission), Its License Is Suspected To Be A Clone, So There Are Certain Risks To Operating In Australia. Tradu Passes Rigorous Compliance Reviews To Ensure That The Platform Operates In Compliance With Anti-Money Laundering (AML), Counter-Terrorism Financing (CFT) And Other Financial Regulatory Requirements.

Trading Products

Tradu Offers A Wealth Of Trading Options For Financial Instruments, Covering The Following Main Categories: