Naito Securities Information

Naito Securities Is A Well-known Japanese Brokerage Firm Involved In Stocks, Bonds, Exchange-traded Funds (ETFs), And Real Estate Investment Trusts (REITs). It Provides Information On Stock Markets From Around The World, Including Japan, China, And The United States.

Advantages And Disadvantages

Advantages

- Longer Established Company (1933)

- Offering A Wide Range Of Financial Products (from Forex To ETFs, From China To The US)

- FSA Regulated

- No Demo Accounts Available

- Overly Complex Fee Structure

Disadvantages

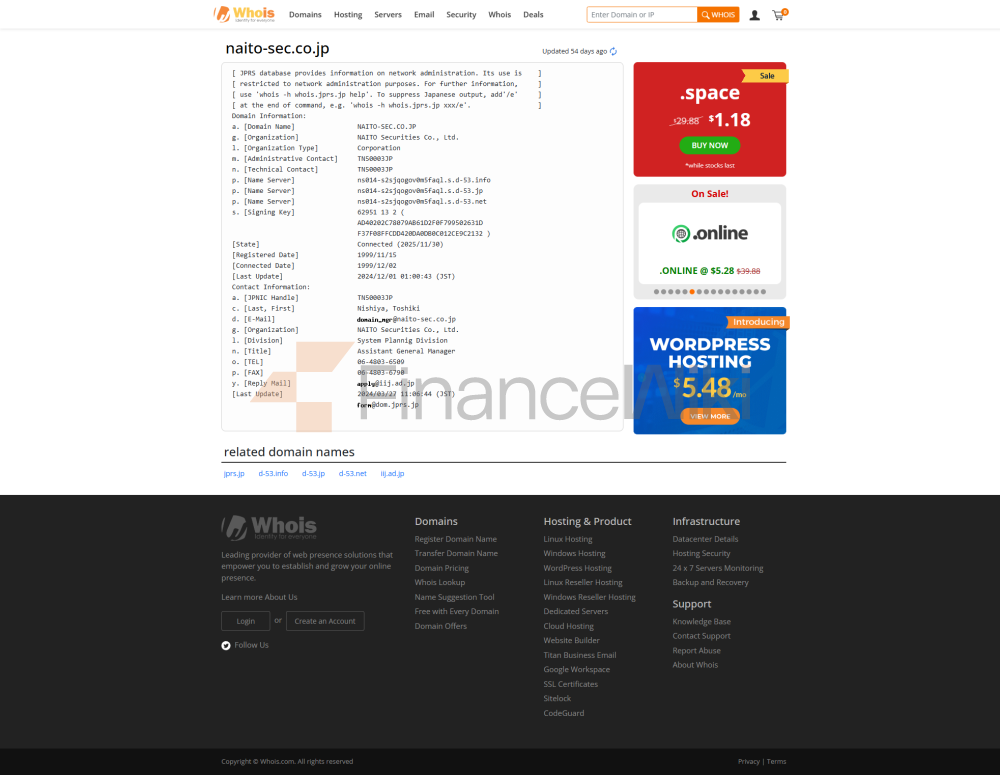

Regulatory Information

Regulatory Status: Regulated (Retail Forex License)

Regulated Agency: Japan

Licensing Agency: Naito Securities Co., Ltd.

License Number: Kinki Financial Bureau Director (Jinshang) No. 24

Effective Date: 2007-09-30

Licensing Agency Address: Nakanoshima, Kita-ku, Osaka City, Japan 3-3-23

Licensing Agency Phone Number: 06-4803-6501

Trading Products

Naito Securities Offers A Variety Of Financial Products Covering Different Markets And Types, Including Japan, China, And The United States. Assets Include Foreign Exchange And REITs.

Account TypesNaito Securities Offers 3 Types Of Accounts. It Does Not Offer Demo Accounts.

- The Fee For Over-the-counter Trading Is That The Starting Fee For Trading Less Than JPY 500,000 Is JPY 2,750. The Main Feature Is Face-to-face Consultation For Investors Looking For A Personalized, Face-to-face Service.

- The Fee For The Telephone Trading Center Is JPY 3,300 For The Transaction Volume Below JPY 500,000. The Main Feature Is Telephone Trading, Which Reduces The Fee Compared To Over-the-counter Trading. Suitable For Traders Who Prefer Telephone-based Consultation, With Lower Fees.

- The Fee For The Online Trading Is JPY 419 For The Transaction Volume Below JPY 500,000. The Main Feature Is Trading Via Computer, Smartphone Or Tablet, With Lowest Fees And 24/7 Market Order Access. Suitable For Autonomous Traders, Who Want Low Fees And Convenience.

Naito Securities Fees

The Fees Charged By Naito Securities Are Complex And Can Be Roughly Divided Into 3 Types: Commissioned Transaction Fees, Online Transaction Fees, And Over-the-counter Transaction Fees.

Entrusted Transaction Fees

Entrusted Transaction Fees For Domestic Listed Stocks Through Naito Securities' Call Center Vary According To The Contract Price. The Spot Trading Range Is JPY 2,750 To JPY 33,550, And The Margin Trading Range Is JPY 3,300 To JPY 34,100. These Fees Also Apply To ETFs And J-REITs.

Online Transaction Fee

Naito Securities' Online Transaction Fee Range Offers Two Options: Based On The Contract Price, The "per Execution Plan" Charges An Order Fee Of JPY 272 To JPY 492, While The "1-day Flat Rate Plan" Starts From JPY 178 And Increases As The Total Daily Contract Amount Increases.

Branch Transaction Fee

Naito Securities' Domestic Stock Branch Transaction Fee Range Starts From 1.265% Of The Contract Price Of JPY 1 Million, And Decreases In Percentage And Adds Additional Fixed Fees As The Amount Increases.

The Minimum Fee Is JPY 2,750, And The Zero-share Sale Is Calculated According To The Unit Share Price. The Minimum Fee Is JPY 2,750.

Trading Platform

- Self-owned Platform Available Devices Are Desktop, Mobile, Suitable For Beginners And Experienced Traders

- Online Trading, Available Devices Are Desktop, Mobile, Suitable For Investors Who Prefer Digital Trading Solutions

Deposits And Withdrawals

Naito Securities Does Not Explicitly State On Deposit And Withdrawal Options.