Yritysprofiili

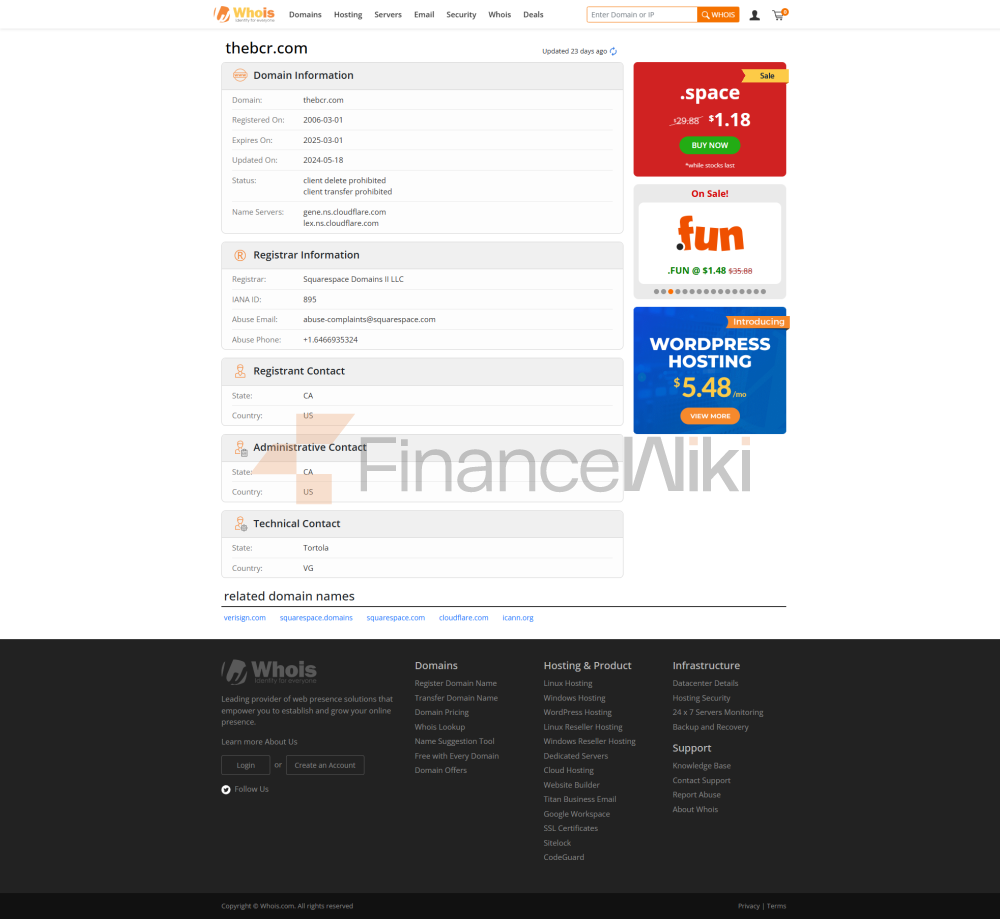

Yrityksen koko nimi : BCR Global Limited Vakiintunut : 2008 Pääkonttori Sijainti : Sydney, Australia Rekisteröity pääoma : Julkistamaton (mutta julkisen tiedon mukaan se osoittaa hyvää taloudellista kuntoa) Sääntelyyn perustuva lisenssi :

- Australian Securities and Investments Commission (ASIC) Lisenssinumero: LF002377

- Neitsytsaaret Financial Services Commission (FSC) Lisenssinumero: SIBA / L / 77 / 1762

Toimeenpaneva tausta : BCR: n johtoryhmällä on laaja kokemus rahoitusalalta, joka kattaa muun muassa kaupankäynnin, riskienhallinnan ja kehittämisen

Maailmanlaajuisena erosopimuksen (CFD) välittäjänä BCR on sitoutunut tarjoamaan asiakkailleen korkealaatuisia rahoituskaupankäyntipalveluja. Yhtiö on asiakaskeskeinen ja tarjoaa monipuolisen valikoiman rahoitustuotteita ja välineitä, muun muassa valuuttakauppaa, jalometalleja, hyödykkeitä, indeksejä, kryptovaluuttoja ja osakkeita.

Sääntelytiedot / h3 >

<<<< noudattamissitoumus : Pääomansuojamekanismi : Tuetut kaupankäyntivälineet

Kauppatuotteet

- Suurin vipuvaikutus on 1: 400.

- Käyttäjät voivat valita erilaisia vipukerrannaisia tarpeidensa mukaan väliltä 1: 20 1: 400.

Kauppaohjelmisto

Kauppajärjestelmä :

- MT4 (MetaTrader 4) : BCR tarjoaa asiakkaille MT4-kauppapaikan, joka tukee työpöytä- ja mobiilipäätelaitteita.

- Muokatut ominaisuudet : MT4-käyttöliittymä on yksinkertainen ja helppokäyttöinen, tukee yli 200: ta mukautettua indikaattoria ja asiantuntijalausuneuvojaa.

> > vahva Monikielinen tuki / Vähimmäistalletus : Talletus- ja nostomenetelmät : Nostomaksu : Monikielinen tuki : Asiakassuhteiden hallinta : Tärkeimmät liiketoiminta-alueet : > vahva > Erottuva > / p > Kauppapaikka : MT4 Tekninen etu : Talletus- ja nostomenetelmät

Asiakastuki

Ydinliiketoiminta ja -palvelut

<

Tekninen infrastruktuuri

vaatimustenmukaisuuden valvontajärjestelmä

strong > riskienhallintajärjestelmä :

- BCR ottaa käyttöön AIoT-riskienhallintajärjestelmän yhdistettynä tekoälyyn (AI) ja esineiden internetiin (IoT) -teknologian markkinoiden dynamiikan ja asiakaskauppakäyttäytymisen seuraamiseksi reaaliajassa sekä piilevien riskien tunnistamiseksi.

- Tiukka pääomasuojamekanismi sen varmistamiseksi, että asiakasrahastot pidetään erillään yrityksen työrahastoista.

- Säännölliset stressitestit, joilla arvioidaan yrityksen kykyä reagoida äärimmäisiin markkinaolosuhteisiin.

Markkina-asema ja kilpailuetu

Markkina-asema :

- BCR on sijoitettu maailman johtavaksi CFD-välittäjäksi, keskittyen tarjoamaan kauppiaille korkealaatuisia rahoitustuotteita ja -palveluita > li /

- Avoin kaupankäyntiympäristö : Ei vaatimuksia ja ei toimeksiantoja koskevia hylkäämiskäytäntöjä asiakaskauppojen oikeudenmukaisuuden varmistamiseksi.

- Monipuoliset rahoitustuotteet : Kattaa laajan valikoiman kaupankäyntivälineitä, kuten Forex, jalometallit, hyödykkeet, indeksit, kryptovaluutat ja osakkeet.

-

Vahva tekninen vahvuus : MT4-kaupankäyntialusta tukee pitkälle räätälöintiä, jotta se täyttäisi ammattimaisten kauppiaiden monimutkaiset tarpeet. - Demo Tili tarjotaan auttamaan asiakkaita perehtymään kaupankäyntiprosessiin ja alustan toimintoihin.

- Asiakkaat voivat valita erilaisia tilityyppejä tarpeidensa mukaan (kuten alfa-kerrointili, platinatili ja vakiotili) nauttiakseen eriytetyistä palveluista ja eduista.

- BCR toteuttaa aktiivisesti yhteiskunnallista vastuuta ja tukee julkisia hyvinvointihankkeita, kuten ympäristönsuojelua, koulutusta ja yhdyskuntakehitystä.

- Yritys antaa takaisin yhteiskunnalle lahjoitusten ja vapaaehtoispalvelujen kautta. >

- BCR on solminut strategisia kumppanuuksia useiden maailmanlaajuisesti tunnettujen rahoituslaitosryhmien ja teknologiayritysten kanssa edistääkseen yhdessä teknologista innovaatiota ja liiketoiminnan laajentamista.

Kilpailuetu :

Koulutusresurssit :Henkilökohtainen palvelu :

sosiaalinen vastuu ja ESG

/ strong >: Strateginen yhteistyöekologia

Strateginen yhteistyö :

Rahoitusterveys

Pääomarahasto : Vuoden 2023 kolmannesta neljänneksestä lähtien BCR: n pääomavaranto ylittää$50 miljoonaa , mikä varmistaa yhtiön toiminnan vakauden äärimmäisissä markkinaolosuhteissa. osakkeenomistajien pääoma : Vuoden 2023 kolmannesta neljänneksestä lähtien yhtiön osakkeenomistajien oma pääoma ylitti$. Tulevaisuuden etenemissuunnitelma >

Teknologian päivitys : BCR aikoo edelleen optimoida kaupankäyntialustansa ja teknologiainfrastruktuurinsa seuraavan kahden vuoden aikana lisäten transaktioiden suoritusnopeutta ja käyttökokemusta. Tuotelaajennus : Yhtiö etsii uusia rahoitustuotteita ja palveluita, kuten lisää kryptovaluuttakaupankäyntiinstrumentteja ja robo-advisor-työkaluja. Globalisaation asettelu : BCR jatkaa maailmanlaajuisen liiketoimintaverkostonsa laajentamista ja lisää läsnäoloaan Aasian, Euroopan ja Pohjois-Amerikan markkinoilla.

Yllä on BCR: n yrityksen käyttöönotto, joka perustuu julkiseen tietoon ja pyrkii tarjoamaan asiakkaille kattavan ymmärryksen.