Yritysprofiili

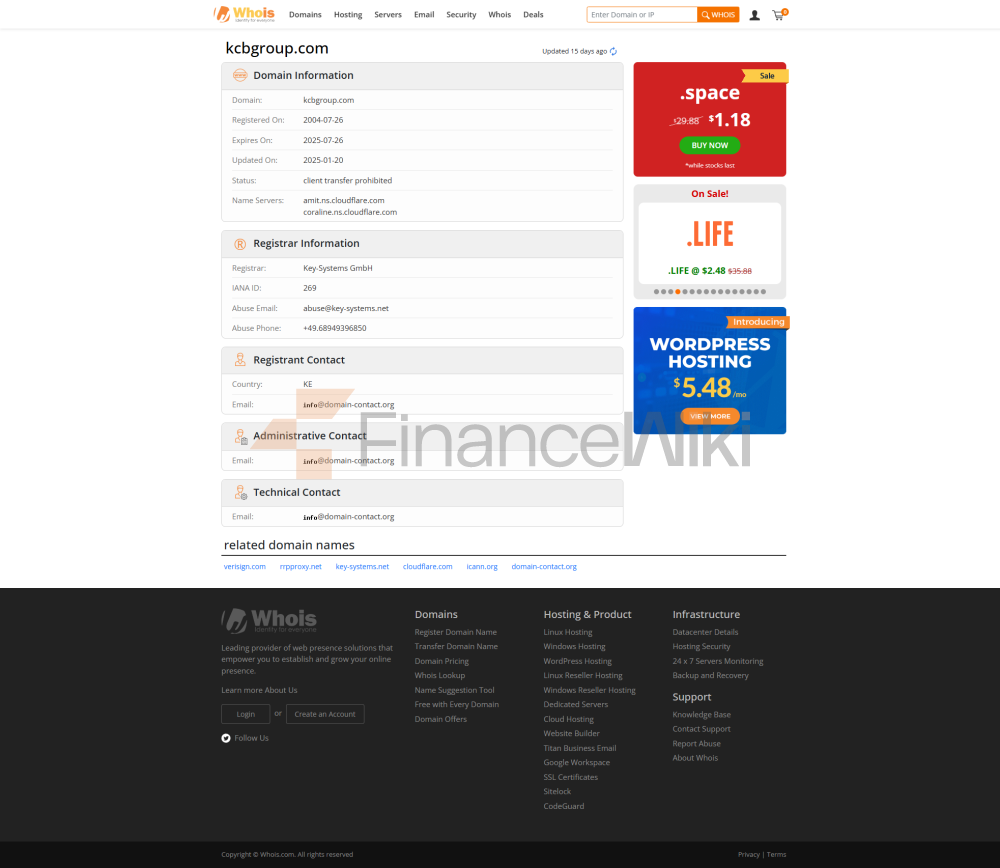

KCB Bank Kenya Limited on rahoituspalvelujen tarjoaja, jonka pääkonttori sijaitsee Nairobissa Keniassa ja jonka liikepankki on saanut Kenian kansalliselta pankkivalvontaviranomaiselta. Pankin liiketoimintamalli kattaa kirjeenvaihtajapankkitoiminnan ja tarjoaa asiakkaille monipuolisen valikoiman rahoituspalveluja laajan konttoriverkostonsa ja digitaalisten palvelujensa kautta.

KCB Bank Kenian historia juontaa juurensa vuoteen 1896, jolloin sen emokonserni KCB Group (KCB Group) perustettiin Mombasan sivuliikkeeksi State Bank of Indiaan. Monien fuusioiden ja uudelleenjärjestelyjen jälkeen KCB Groupista tuli yksi Kenian ja jopa Itä-Afrikan suurimmista rahoitusalan holdingkonserneista. KCB Groupilla on elokuussa 2021 Keniassa 201 konttoria, 397 pankkiautomaattia sekä yli 15 000 pankkiasiamiestä ja kauppiasta. Sillä on laaja liiketoimintaverkosto Itä-Afrikan alueella, muun muassa Tansaniassa, Ugandassa, Ruandassa ja muissa maissa.

Sääntelyyn liittyvät tiedot

KCB Kenya Bank Limited on Kenian keskuspankin (CBK) valvonnassa toimiluvan saanut liikepankki. Pankki on KCB Groupin tytäryhtiö Kenian vuoden 2012 rahoituslain mukaisesti, kun taas KCB Group vastaa muun kuin kaupan alan holdingyhtiönä sen pankki- ja muiden toimintojen hallinnoinnista Itä-Afrikan alueella. Pankki noudattaa Kenian keskuspankin sääntelyvaatimuksia ja varmistaa toimintansa noudattamisen.

Trading Products

KCB Kenya Bank tarjoaa erilaisia rahoitustuotteita ja -palveluita, mukaan lukien:

- Pankkikorttipalvelut : Tarjoa erilaisia pankkikorttityyppejä asiakkaiden päivittäisiin kulutustarpeisiin.

- Lainapalvelut : Tarjoa erilaisia lainatuotteita yksityis- ja yritysasiakkaille, mukaan lukien henkilökohtaiset lainat, kiinnelainat ja yrityslainat jne.

- Sijoitustuotteet : Tarjoa säästötilejä, sijoitustilejä ja muita tuotteita auttamaan asiakkaita saavuttamaan varallisuuden vahvistumisen.

-

Valuutanvaihtopalvelut : Tarjoa palveluja, kuten valuutanvaihtoa ja rajat ylittäviä rahalähetyksiä kansainvälisen kaupan asiakkaiden tarpeisiin.

Kauppaohjelmisto

KCB Kenya Bank tarjoaa käteviä kaupankäyntipalveluita digitaalisen alustan kautta, mukaan lukien verkkopankki ja mobiilipankki. Pankin mobiilipankkisovellus tukee useita toimintoja, kuten tilinhallintaa, siirtoa, maksamista jne., tarjoten asiakkaille 24 / 7 rahoituspalveluja.

Talletus- ja nostomenetelmiä

KCB Kenya Bank tukee erilaisia talletus- ja nostomenetelmiä, mukaan lukien:

- Sivukonttori Talletus ja nosto : Asiakkaat voivat tallettaa ja nostaa rahaa pankin sivukonttoreiden kautta kaikkialla Keniassa.

- Pankkiautomaatti Talletus ja nosto : Asiakkaat voivat nostaa ja nostaa käteistä pankin pankkiautomaattiverkon kautta.

-

Pankkilinja

Asiakastuki

KCB Kenia Pankki tarjoaa erilaisia asiakastukikanavia, mukaan lukien:

- Puhelintuki : Asiakkaat voivat saada neuvontaa pankin asiakaspalvelun vihjepuhelimen kautta.

- Sosiaalisen median tuki : Asiakkaat voivat olla vuorovaikutuksessa asiakaspalvelutiimin kanssa pankin sosiaalisen median alustojen kautta.

- Online-tuki : Asiakkaat voivat lähettää tiedusteluja pankin verkkosivujen ja mobiilisovelluksen kautta.

Ydinliiketoiminta ja palvelut

Kenia Pankin ydinliiketoiminta Kenia > Kenian CB > > > Vähittäispankkitoiminta : Säästö-, laina-, sijoitus- ja valuuttapalvelujen tarjoaminen yksittäisille asiakkaille.

Teknologiainfrastruktuuri

KCB Bank Kenia on ottanut käyttöön edistyneen teknologiainfrastruktuurin, joka tukee sen digitaalista muutosta ja asiakaspalvelinvaatimuksia. Pankin digitaalinen alusta perustuu pilvipalvelu- ja massadata-analytiikkateknologiaan, mikä parantaa sen toiminnan tehokkuutta ja palvelun laatua. Lisäksi pankki suorittaa riskienhallintaa ja asiakkaiden tunnistamista AIoT: n (AIoT) riskienhallintajärjestelmän kautta varmistaakseen maksutapahtumiensa turvallisuuden.

vaatimustenmukaisuuden ja riskienhallintajärjestelmä

KCB Bank Kenia noudattaa tiukasti Kenian keskuspankin sääntelyvaatimuksia ja on perustanut moitteettoman riskienhallintajärjestelmän. Pankin riskienvalvontajärjestelmä sisältää:

- AIoT-riskienhallintajärjestelmän : Reaaliaikainen tapahtumavalvonta ja asiakkaiden todentaminen tekoälyn ja esineiden Internet-tekniikoiden avulla.

- Rahanpesuntorjuntajärjestelmä : Seuraa asiakkaiden liiketoimia rahanpesun estämiseksi kansainvälisten rahanpesun vastaisten standardien mukaisesti.

- Tietoturva : Varmistaa asiakastietojen turvallisuuden salaustekniikan ja pääsyn valvonnan avulla.

Markkina-asemointi ja kilpailukykyinen etu

KCB Kenya Pankilla on johtava asema markkinaosuudessa Itä-Afrikan alueella. Sen kilpailuetuja ovat:

- Laaja konttoriverkosto : Pankilla on Kenian ja Itä-Afrikan alueen suurin yksityinen pankkiautomaattiverkosto ja eniten agenttiliikkeitä.

- Leading Digital Services : Digitaalisen muutoksen avulla pankki parantaa asiakkaidensa transaktiokokemusta ja mukavuutta.

- Monipuoliset rahoitustuotteet : Tarjoaa monipuolista valikoimaa rahoitustuotteita ja -palveluita eri asiakkaiden tarpeisiin.

Asiakastuki ja vaikutusvalta

KCB Kenya Bank tarjoaa asiakkailleen yksilöllisiä rahoituspalveluja asiakastukikanavansa ja digitaalisen alustan kautta. Pankki myös antaa asiakkaille mahdollisuuden parantaa taloudellisia tietojaan ja taitojaan koulutusohjelmien avulla, jotta he voivat hallita paremmin taloudellisia tarpeitaan.

Yhteiskuntavastuu ja ESG

KCB Kenya Bank osallistuu aktiivisesti yhteisökehityksen ja yhteiskuntavastuun ohjelmiin tukeakseen kestävää kehitystä muun muassa koulutuksen, terveyden ja ympäristönsuojelun aloilla. Pankki varmistaa myös, että sen toiminnot noudattavat kansainvälisiä kestävyysstandardeja ESG (Environmental, Social and Governance) -kehyksensä kautta.

Strategic Cooperation Ecosystem

KCB Kenya Bank ja sen emoyhtiö KCB Group ovat yhdessä rakentaneet monipuolisen strategisen yhteistyön ekosysteemin. Konserni on solminut strategisia kumppanuuksia useiden Itä-Afrikan rahoituslaitosryhmien ja muiden kuin rahoituslaitosryhmien kanssa laajentaakseen liiketoimintaverkostoaan ja palveluvalmiuksiaan.

Financial Health

Elokuun 2021 tietojen mukaan KCB Kenya Bankin asiakastalletusten koko on

Tuleva etenemissuunnitelma

KCB Kenya Bank jatkaa digitaalisen muutoksen strategiansa edistämistä teknologiansa ja asiakaspalvelimen valmiuksien parantamiseksi edelleen. Pankki aikoo myös laajentaa markkinaosuuttaan edelleen ja laajentaa liiketoiminnan kattavuutta Itä-Afrikan alueella laajentamalla agenttiverkostoaan ja digitaalista alustaa. Tulevaisuudessa KCB Kenya Bank on sitoutunut tarjoamaan asiakkaille laadukkaampia ja tehokkaampia rahoituspalveluita innovaatioiden ja kestävän kehityksen avulla.