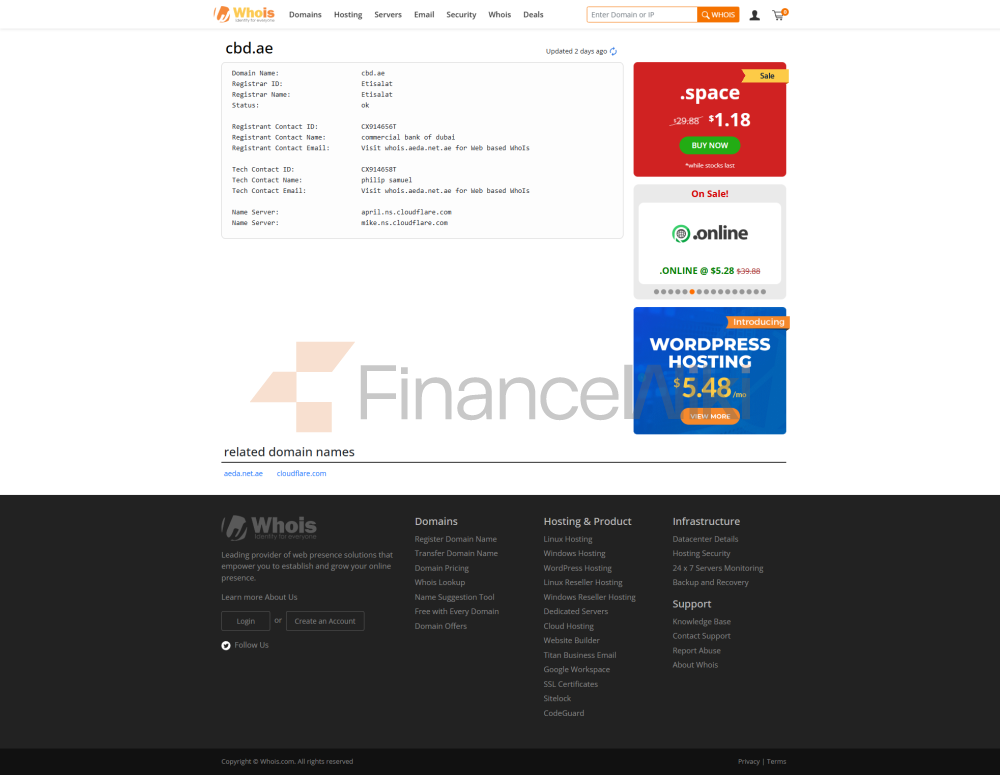

Dubai Commercial Bank (CBD) on emiraatilainen pankki- ja rahoituspalveluyritys, jonka pääkonttori on Deirassa, Dubaissa. CBD: n varat ovat yli 23 miljardia dollaria, ja se luokitellaan Arabiemiirikuntien seitsemänneksi suurimmaksi pankiksi kokonaisvarallisuudeltaan. Se näkyy myös Dubain finanssimarekt-indeksissä.

Historia

CBD perustettiin vuonna 1969 edesmenneen Rashid Bin Saeed Al Maktoumin antamalla Amirin asetuksella. Alun perin Commerzbankin, Chase Manhattan Bankin ja Kuwait Commercial Bankin yhteisyritys se kasvoi kansalliseksi julkiseksi osakeyhtiöksi vuoteen 1982 mennessä. Sen osakkeista 80% on Yhdistyneiden arabiemiirikuntien kansalaisten omistuksessa ja loput 20% Dubai Investment Corporationin (Dubain hallituksen investointiosasto) omistuksessa.

CBD tarjoaa tukku-, yritys-, vähittäis-, yritys-, pk-yritys-, yksityis- ja varakkaisiin pankkipalveluita.

FINANCIAL DATA

Vuonna 2019 Dubai Commercial Bank kirjasi nettovoittoa 1,40 miljardia dirhamia, kasvua 20,5% vuodesta 2018, ja kokonaisvarat 88,10 miljardia dirhamia. Vuoden 2019 toimintatulo oli AED 3,033 miljardia euroa, mikä merkitsee 2,8 prosentin nettokoron (NII) kasvua ja 31,2 prosentin muun liiketoiminnan tuoton kasvanut. OI (OI). Maksu- ja provisiotulot kasvoivat 21,3%, valuuttatulot kasvoivat 37,7%, sijoitustulot 179,4% ja muut tulot 53,3% verrattuna vuoteen 2018. CBD: n luokitukset Baa1 ja A- ovat Moody 's ja Fitch.