Basic Information & Regulators

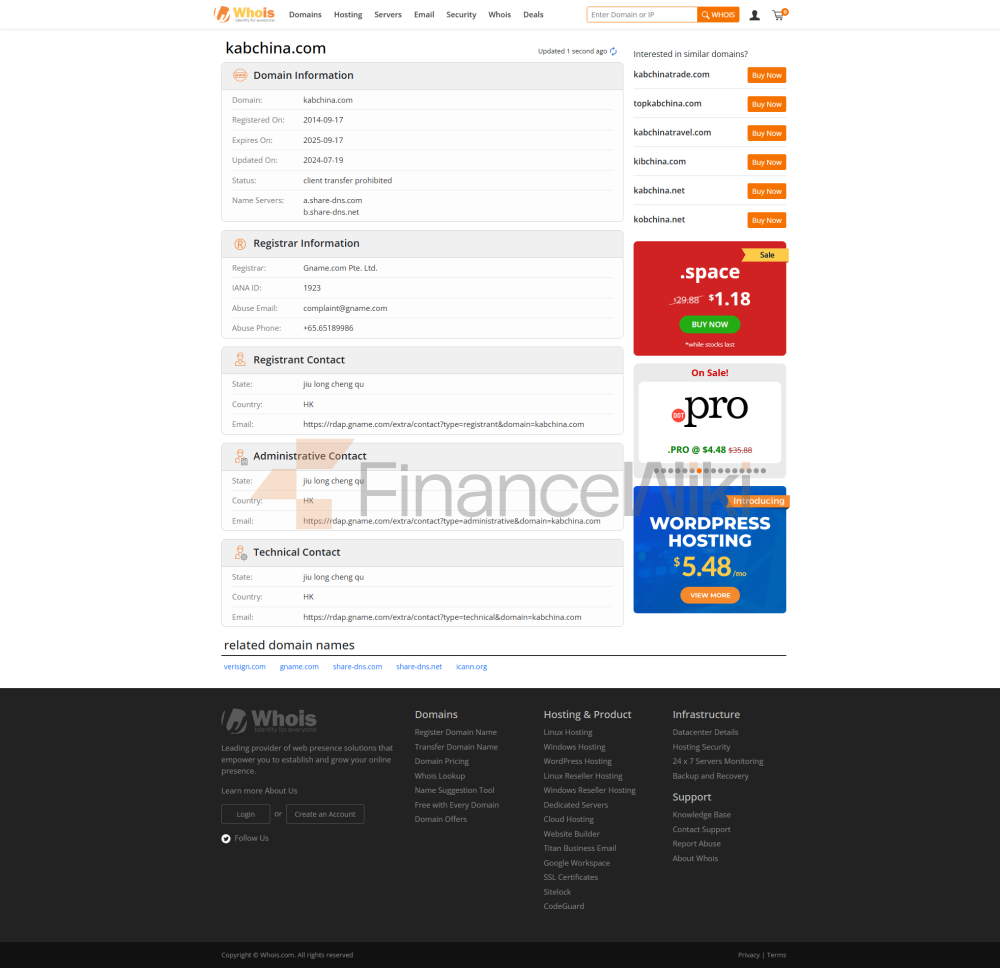

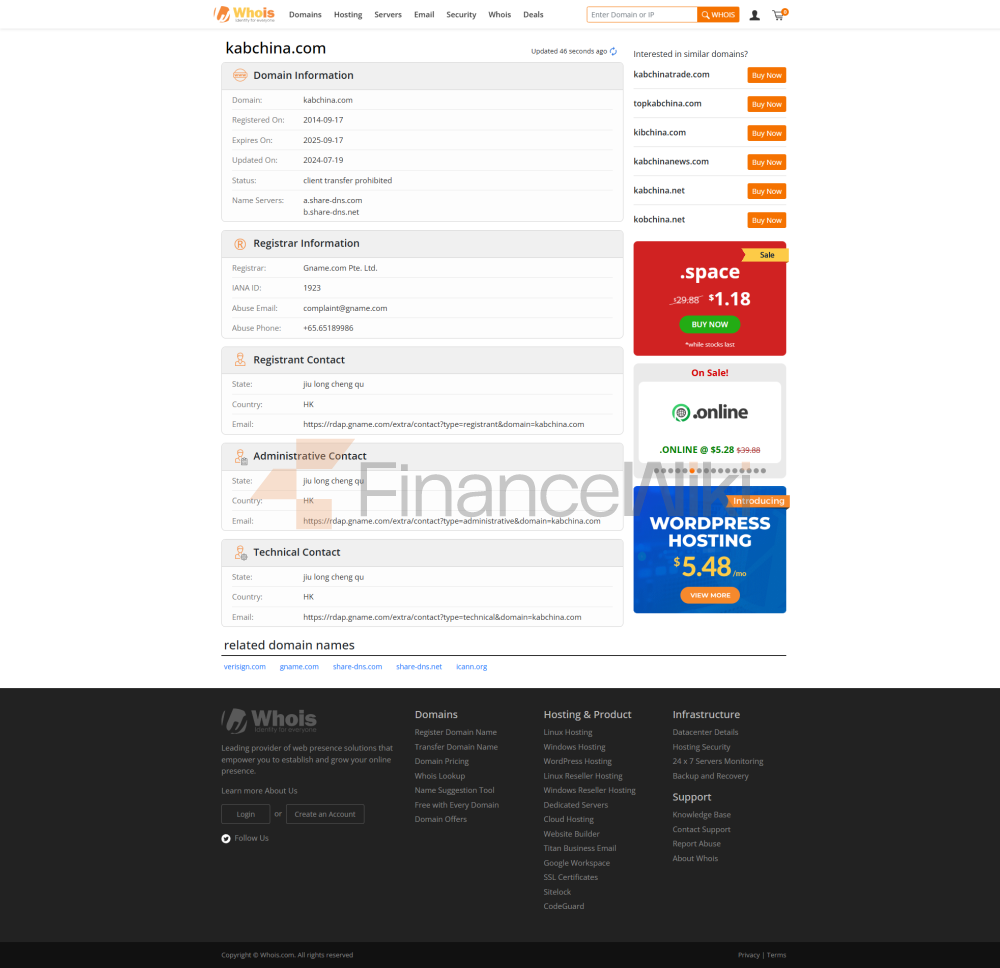

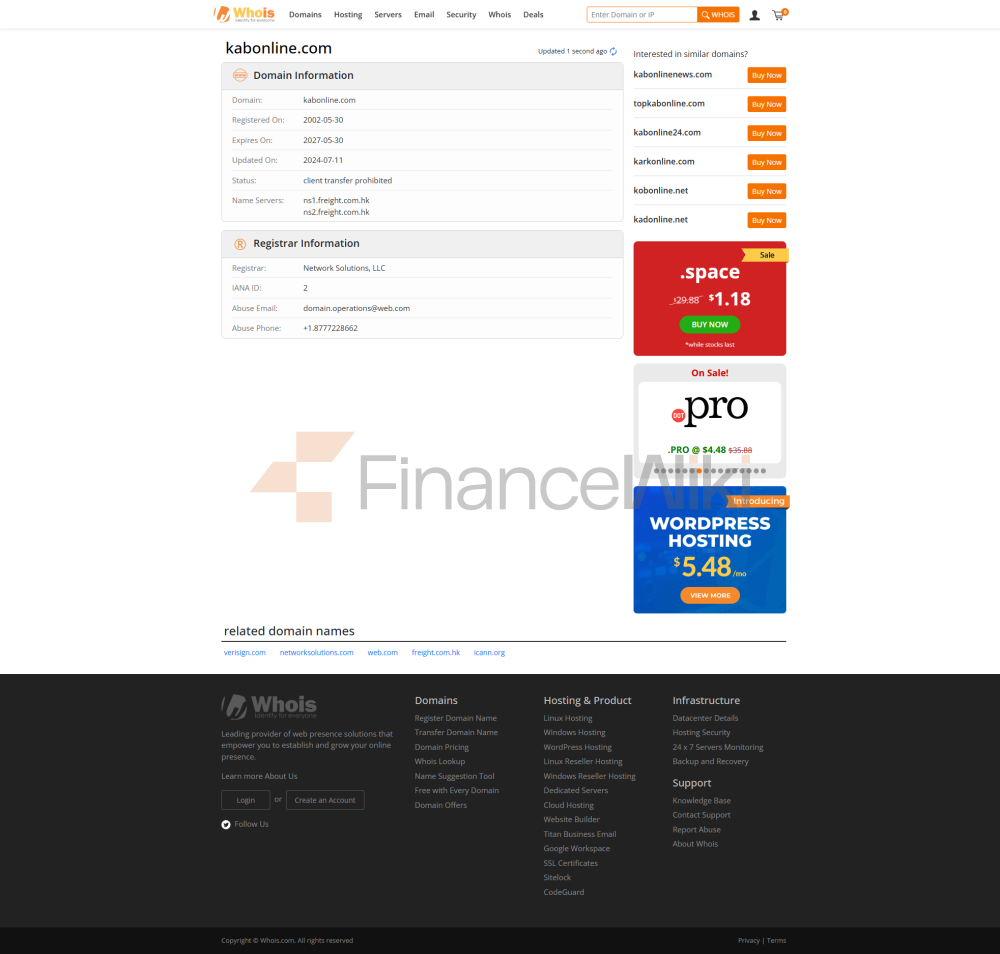

KAB perustettiin vuonna 2002. Samana vuonna KAB avasi ensimmäisen ulkomaisen rahoituslaitoskonserninsa Kuwaitiin tarjoamaan sijoitustuotteita ja niihin liittyviä palveluja asiakkaille Lähi-idässä. Nykyään KAB International Holdings Ltd on integroitunut monikansallinen rahoituskonserni, jolla on toimistoja kaikkialla Aasiassa, Euroopassa ja Lähi-idässä. KAB International Holdings Ltd tarjoaa kansainvälisiä sijoitustuotteita, -palveluita ja -ratkaisuja kumppaneilleen ja asiakkailleen maailmanlaajuisesti. KAB: n Triple A Gold and Silver Limitedillä on AA-luokan lisenssi Hongkongin kulta- ja hopeakauppaan (asetus nro: 009), ja sen tytäryhtiöllä KAB Strategy Ltd: llä on Kyproksen arvopaperi- ja pörssikomission (asetus nro: 058 / 05) myöntämä toimilupa.

Main Business

KAB tarjoaa sijoittajille laajan valikoiman sijoitustuotteita, joihin kuuluvat pääasiassa Hongkongin / Kiinan osakkeet, Kiinan listautumisanti, Kyproksen pörssiosakkeet, swap-futuurit, spot-metallit, spot-valuutat, ECN: n valuuttamarkkinat, maailmanlaajuiset futuurit, salkunhoito jne.

Account & Leverage

Vastatakseen erityyppisten sijoittajien sijoitustarpeisiin ja kaupankäyntikokemukseen KAB tarjoaa sijoittajille neljäntyyppisiä tilejä, jotka sisältävät pääasiassa Hongkongin / Kiinan osakkeen, salkunhoitotilit, MTKAB: n ja MTECN: n valuuttatilit. tilejä.

Spreads & Fees

Spot Forex Suuret valuuttaparit, kuten EUR USD, GBP USD, AUD USD jne. Spreadit ovat kaikki 5 pistettä, tavalliset Lontoon kultasopimusten spreadit 50 senttiä, mini Lontoon kultasopimusten spreadit 50 senttiä, tavalliset Lontoon hopeasopimusten spreadit 2,6 senttiä, mini Lontoon hopeasopimusten spreadit 2,6 senttiä ja nettoprovisio spot-valuutasta 40 dollaria. Hongkongin / Kiinan osakkeista perittävä komissionmaksu: Stamp Duty on 0,1% kaupankäyntivolyymistä (pyöristettynä lähimpään Yhdysvaltain dollariin), Trading Levy on 0,0027% (pyöristettynä lähimpään senttiin), Trading Fee on 0,005% (pyöristettynä lähimpään senttiin), Central Clearing Fee on 0,002% ja kaupankäyntimäärä 0,01% (pyöristettynä lähimpään senttiin, Hong Kong Clearing House veloittaa 0,002%, vähintään 3,0 HK $). Net Commission for Swap Futures on 40 dollaria (vain position avatessa).

Kauppapaikka

KAB tarjoaa kauppiaille Hongkongin / Kiinan arvopaperikauppapaikan sekä markkinoiden johtavan MTKong-kauppapaikan. Hong / China Securities Trading -kauppapaikan käyttäjät voivat käyttää ja hallita tilejään tehdäkseen verkkokauppoja turvallisesti Hongkongissa milloin tahansa. MT4 on huippuluokan alusta, joka on suunniteltu tarjoamaan kaikki tarvittavat välineet ja resurssit valuuttakaupassa, hinnanerosopimuksissa ja futuureissa käytävään kauppaan verkossa.

Talletuksesta ja nostosta

Rahastotalletuksesta: Kauppiaiden on talletettava varoja KAB: n pankkitilille. Sitä ennen varat on muunnettava vastaavaksi valuutaksi. Yleensä varat saadaan 1-3 päivässä. Sekä talletusten että nostojen käsittely kestää noin 3-4 työpäivää riippuen selvitysmenettelystä ja käyttäjän paikallisen pankin nopeudesta