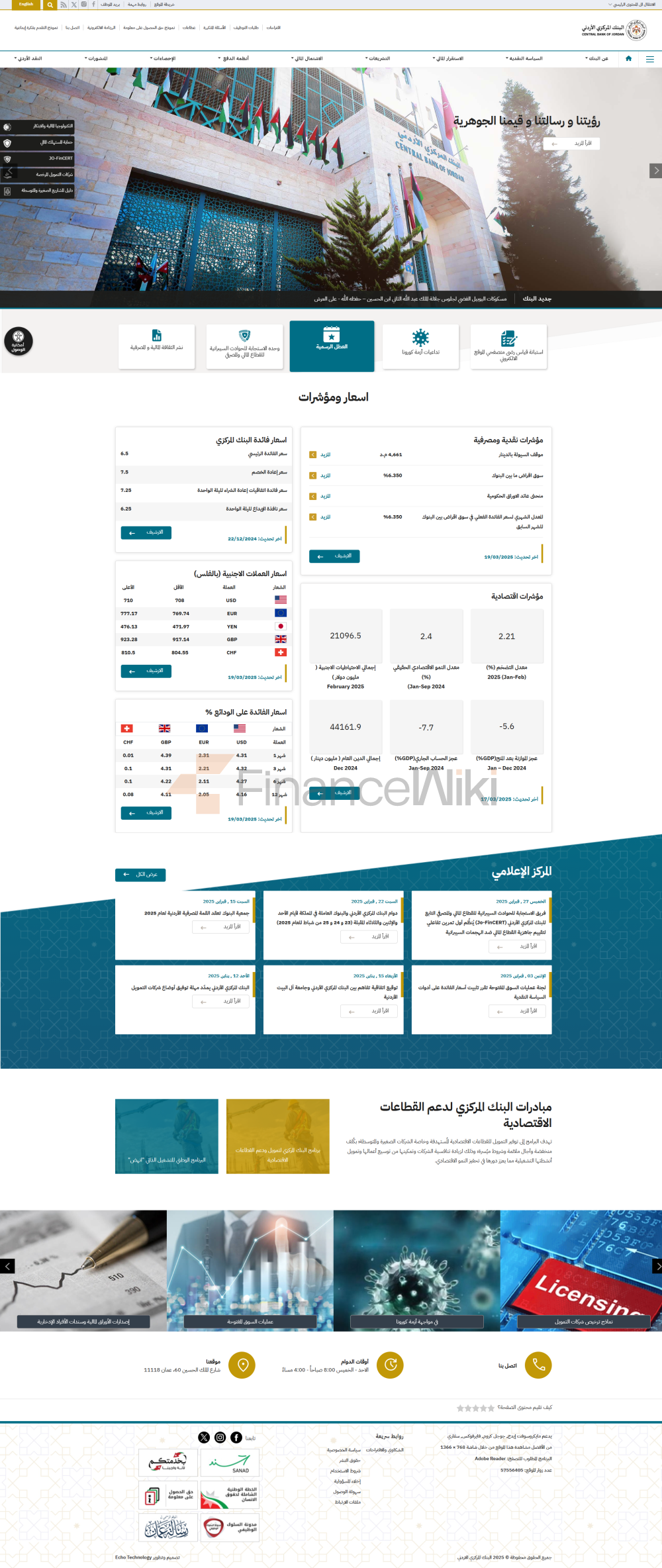

La Banque centrale de Jordanie (CBJ) est l'organe d'élaboration de la politique monétaire et l'autorité de régulation financière du Royaume hachémite de Jordanie. Sa principale responsabilité est de maintenir la stabilité monétaire, la stabilité financière, de promouvoir le développement sain du secteur financier et de soutenir la mise en œuvre des politiques économiques nationales.

Création et cadre juridique

La Banque centrale de Jordanie a été créée en 1959 en vertu de la loi sur la banque centrale de 1959 et a été modifiée à plusieurs reprises depuis. Son indépendance est garantie par la loi pour lui permettre d'exercer ses fonctions librement et sans ingérence du gouvernement.

Principales responsabilités - Élaboration de la politique monétaire : La Banque centrale est chargée de formuler et de mettre en œuvre la politique monétaire afin de maintenir la stabilité des prix et de promouvoir la croissance économique et l'emploi, tout en maintenant la stabilité du taux de change.

- Émission de devises : La Banque centrale est le seul émetteur du dinar jordanien (JOD) et est responsable de l'émission et de la circulation de devises.

- Réglementation financière : La Banque centrale supervise les banques et autres groupes d'institutions financières pour s'assurer qu'ils respectent les lois et règlements et maintiennent la stabilité du système financier.

- Réglementation du système de paiement : La Banque centrale supervise et gère les systèmes de paiement pour assurer l'efficacité et la sécurité Stabilité des systèmes de paiement.

- Gestion des changes : La Banque centrale gère les réserves de change du pays, met en œuvre des politiques de change et réglemente le marché des changes.

- Réserves d'or et d'argent : La Banque centrale de Jordanie est responsable de la gestion et de la supervision des réserves d'or et de change du pays.

- Développement financier : La Banque centrale promeut la réforme et le développement du secteur financier, notamment en encourageant l'inclusion financière et la fourniture de services financiers.

- Lutte contre le blanchiment d'argent et le financement du terrorisme : La Banque centrale participe à l'élaboration et à la mise en œuvre de politiques et de réglementations de lutte contre le blanchiment d'argent (LAB) et le financement du terrorisme (CFT) pour lutter contre les flux financiers illicites.

Références aux politiques des dernières années À condition, la Banque centrale de Jordanie a réussi à maintenir la stabilité monétaire et financière ces dernières années, même face aux incertitudes économiques mondiales. Par exemple, en 2021, elle a maintenu un taux de base relativement bas (2,5 %) pour soutenir la croissance économique. Dans le même temps, le secteur financier qu'elle réglemente a attiré les investissements directs étrangers, bien que ces investissements aient diminué en 2018.

De plus, la Banque centrale de Jordanie a réalisé des progrès dans la gestion des réserves de change et d'or. Selon les données de 2023, les réserves de change et d'or ont atteint un niveau record, ce qui indique qu'elle a réussi à accroître le coussin économique du pays et à garantir des réserves suffisantes pour répondre à la demande d'importations.

Conclusion

En tant qu'institution centrale du système financier jordanien, la Banque centrale de Jordanie joue un rôle clé dans le maintien de la stabilité monétaire et financière et la promotion du développement économique. Grâce à sa politique monétaire indépendante et à sa supervision financière, ainsi qu'à une gestion efficace des réserves de change et d'or, la Banque centrale soutient la compétitivité de la Jordanie dans l'économie mondiale et assure la résilience du système financier. Avec l'évolution de l'environnement économique au pays et à l'étranger, la Banque centrale de Jordanie continuera d'ajuster ses stratégies et politiques pour relever les nouveaux défis et saisir les opportunités.

Références aux politiques des dernières années À condition, la Banque centrale de Jordanie a réussi à maintenir la stabilité monétaire et financière ces dernières années, même face aux incertitudes économiques mondiales. Par exemple, en 2021, elle a maintenu un taux de base relativement bas (2,5 %) pour soutenir la croissance économique. Dans le même temps, le secteur financier qu'elle réglemente a attiré les investissements directs étrangers, bien que ces investissements aient diminué en 2018.

De plus, la Banque centrale de Jordanie a réalisé des progrès dans la gestion des réserves de change et d'or. Selon les données de 2023, les réserves de change et d'or ont atteint un niveau record, ce qui indique qu'elle a réussi à accroître le coussin économique du pays et à garantir des réserves suffisantes pour répondre à la demande d'importations.

Conclusion

En tant qu'institution centrale du système financier jordanien, la Banque centrale de Jordanie joue un rôle clé dans le maintien de la stabilité monétaire et financière et la promotion du développement économique. Grâce à sa politique monétaire indépendante et à sa supervision financière, ainsi qu'à une gestion efficace des réserves de change et d'or, la Banque centrale soutient la compétitivité de la Jordanie dans l'économie mondiale et assure la résilience du système financier. Avec l'évolution de l'environnement économique au pays et à l'étranger, la Banque centrale de Jordanie continuera d'ajuster ses stratégies et politiques pour relever les nouveaux défis et saisir les opportunités.