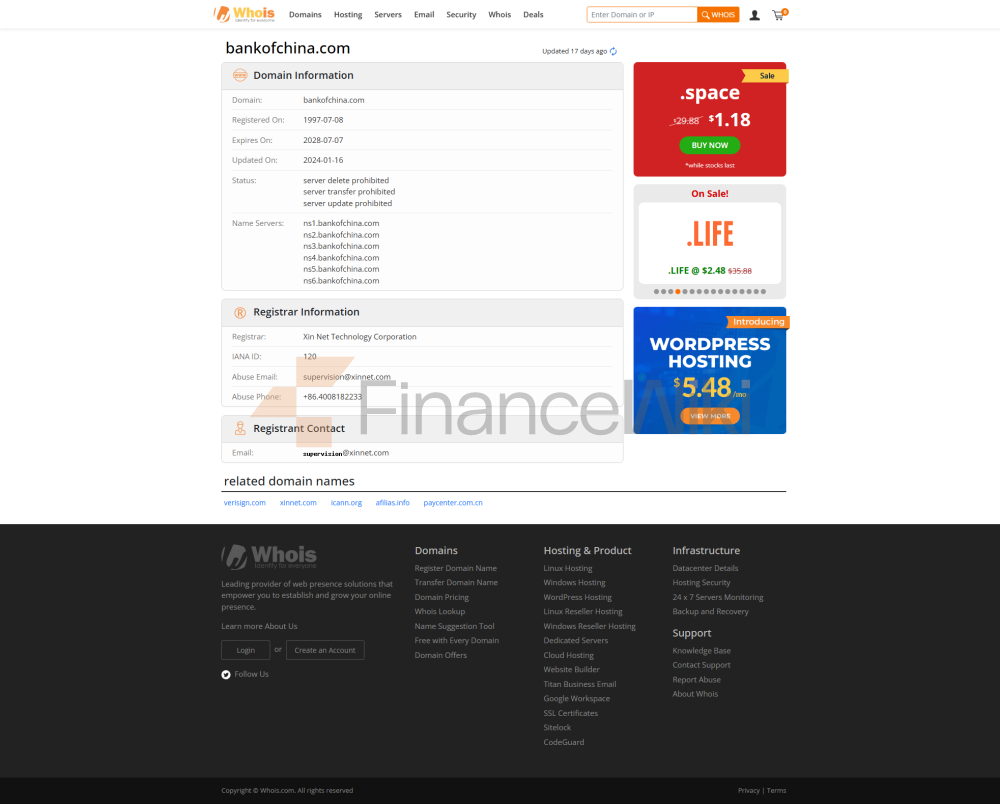

Historique Le 21 juin 1950, la Nam Tung Bank a été créée à Shin Ma Road pour gérer les activités bancaires générales telles que les envois de fonds et les prêts simples. Le président Ke Lin, le directeur général Ke Zhengping. La Nam Tung Bank a été restructurée en banque commerciale en 1974 conformément aux dispositions de la loi de Macao et de la loi bancaire de Macao, et a reçu une licence bancaire du gouvernement de Macao et du Portugal, elle a donc été rebaptisée Banco Nan Tung. La même année, Xinma Road a déménagé dans le n ° 1. En 1982, Banco Nan Tung et le secteur bancaire chinois ont formé un centre de compensation, devenant la Central Clearing Bank de Macao, et assumant également la responsabilité de la banque de compensation des billets en dollars de Hong Kong. En 1983, Banco Nan Tung a rejoint le groupe Bank of China. Le 1er septembre 1985, Nan Tung Bank Ltd. (Macao) a été créée dans la ville de Zhuhai, qui était une succursale de Banco Nan Tung dans la ville et la première banque ouverte à Zhuhai par une banque régionale de Hong Kong et de Macao. Le 1er janvier 1987, la Bank of China a acquis Banco Nan Tung et a changé son nom en Bank of China Macao Branch, devenant la neuvième succursale à l'étranger de la Bank of China. En 1992, le siège social de la Bank of China Macao Building Bank a déménagé de Ximao, avenue Sualis. Depuis le 16 octobre 1995, Banco Nacional Ultramarino est devenue la deuxième banque émettrice de billets du gouvernement de Macao. Le 28 avril 2000, la succursale de la Bank of China à Macao a signé un contrat avec le gouvernement de la RAS de Macao pour devenir l'une des banques agents de caisse du trésor public du gouvernement de Macao. Le 17 septembre de la même année, elle a été choisie par la Banque populaire de Chine comme banque de compensation commerciale personnelle en RMB à Macao ; et en novembre, elle a fourni aux clients des services commerciaux complets en RMB. En janvier 2001, elle a fourni des services bancaires en ligne aux clients des banques ; en novembre 2003, elle a créé un centre de gestion de patrimoine. En août de l'année suivante, en raison de la mise en œuvre du système d'actionnariat par la société mère Bank of China, Bank of China Macau Branch a changé son enregistrement commercial en "Bank of China Limited Macau Branch", et l'abréviation est toujours "Bank of China Macau Branch". En 2006, Morgan Stanley a acquis Nan Tung Bank Ltd. Depuis le 3 janvier 2008, elle a lancé des services bancaires par téléphone portable avec CTM - Zhida Mobile Banking Service. Le 21 novembre 2022, Bank of China a créé une filiale à 100 % "Bank of China (Macau)" dans la région administrative spéciale de Macao et a officiellement ouvert ses portes. Avant l'ouverture, diverses mises à niveau et ajustements seront effectués. Pendant cette période, les services bancaires mobiles, le paiement par code QR, le réseau électronique BOC, le retrait de cartes bancaires et les services de balayage de cartes de crédit seront suspendus.

Article principal des billets : La Banque de Chine est devenue la deuxième banque émettrice de billets à Macao le 16 octobre 1995 et a commencé à émettre des billets patacas ; et plus tard, la Banque de Chine a émis des billets pendant trois années consécutives en 1996, 1997, 1999, 2001, 2002, 2003 et 2008, respectivement, en réponse à la circulation de Macao. La proportion de billets émis et une autre banque émettrice de billets, Banco Nacional Ultramarino, représentaient 50 % de la circulation des billets patacas. Tous les billets patacas émis par la Banque de Chine sont imprimés avec la succursale de Macao de la Banque de Chine à l'arrière. D'autre part, Banco Nacional Ultramarino a émis des billets de 50 et 100 MOP en 1992 et des billets de 20 MOP en 1999 avec le bâtiment de la succursale de la Banque de Chine à Macao imprimé au verso. Depuis la création de la Nam Tung Bank, la banque a son siège au 100 Xin Ma Road ; l'année suivante, elle a déménagé à 1J et K Xin Ma Road ; et en 1961, elle a déménagé à 1 L Xin Ma Road pour poursuivre ses activités.

Entrée principale : Bank of China Building (Macao) La succursale de la Banque de Chine à Macao a maintenant son siège au Bank of China Building, Da Ma Road, Dr Soalis ; une partie de l'ancien site de l'école secondaire Lee Xiao. En 1986, après le déménagement de l'école secondaire Li Xiao, le bâtiment a été construit à la pointe sud-est de la zone et a été conçu par la Palatina Architectural and Structural Engineering Company, basée à Hong Kong. Le bâtiment a été achevé en mai 1992, avec une hauteur de 163 mètres et un total de 38 étages. C'était le plus haut bâtiment de Macao jusqu'à l'achèvement de la tour touristique de Macao. Le mur extérieur du bâtiment est pavé de murs-rideaux en granit rouge et en verre argenté, et il ressemble à une fusée.

Sous-succursale À l'heure actuelle, en plus du siège de la succursale de la Bank of China à Macao, la banque compte 32 sous-succursales à Macao ; 23 d'entre elles sont situées sur la péninsule de Macao, 3 sont situées à Taipa, 3 sont situées à Cotai City, 1 est située à Coloane, 1 est située à l'Université des sciences et technologies de Macao et 1 est située au Centre universitaire de Macao. D'autre part, la banque dispose de centres de gestion de patrimoine dans le quartier nord (Gate Gate) de la péninsule de Macao, Dynasty et Melco Shadow Exchange à Cotai City.

Macao Bank est une banque intelligente et multi-OC Bank diversifiée. L'application Apps lance plusieurs services sur le marché, notamment BOC Pay, le transfert mobile, le paiement à vie, la monnaie électronique, le gouvernement électronique, l'investissement en actions, l'assurance de gestion de patrimoine et la collecte de numéros en ligne. En février 2021, BOC Pay a rejoint le plan de méthode de paiement agrégée facilité d'utilisation de l'Autorité monétaire de Macao et a mis à niveau son paiement par code QR vers Simple Pay. Le 6 octobre 2021, elle a lancé un service de retrait interbancaire sans carte. Le 11 août 2023, il sera à nouveau mis à niveau sur la base de Simple Pay, et la fonction étendue Simple Pay + code de trajet sera ajoutée cette fois. Le transfert mobile rejoindra le service de transfert interbancaire Easy Transfer lancé par l'Autorité monétaire de Macao le 6 décembre 2021.