1. Company profile:

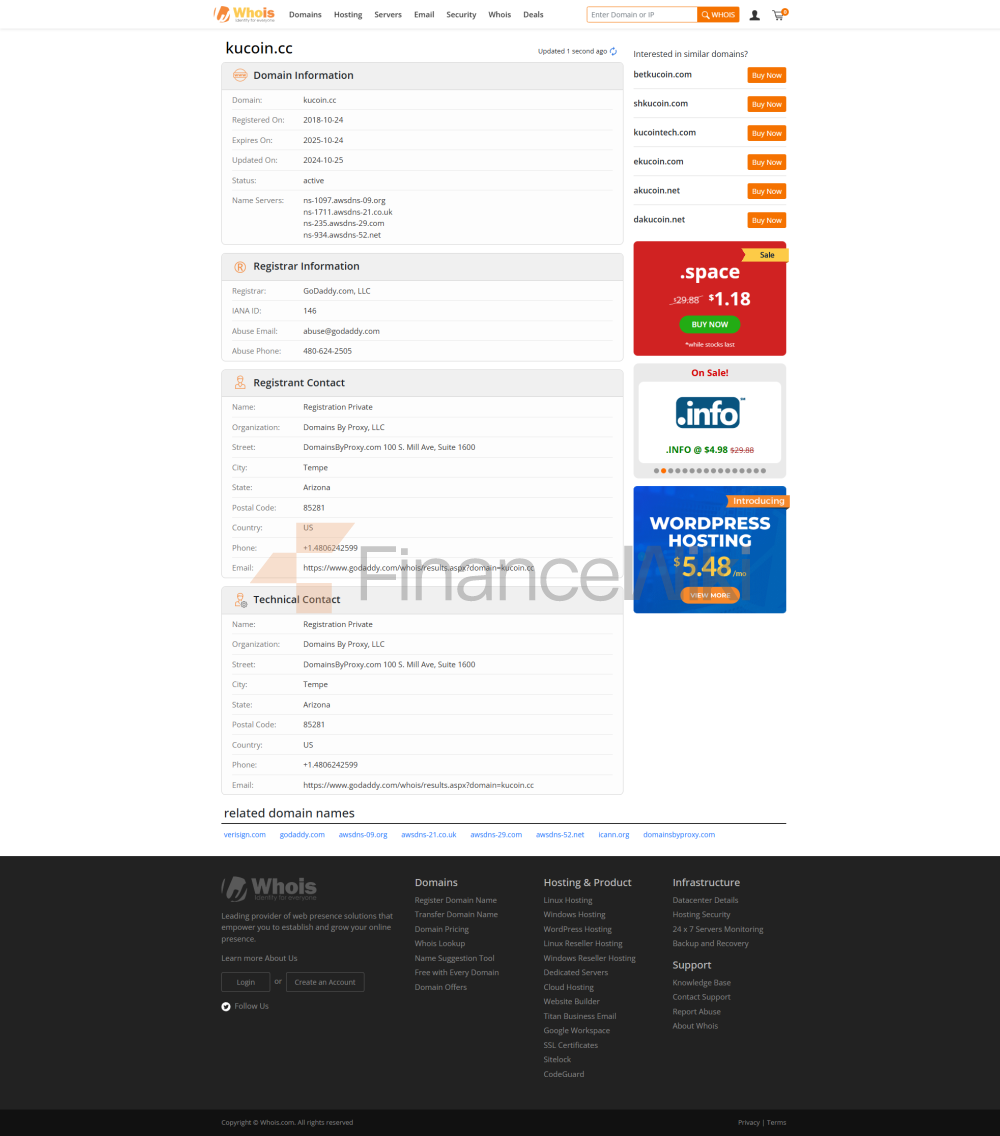

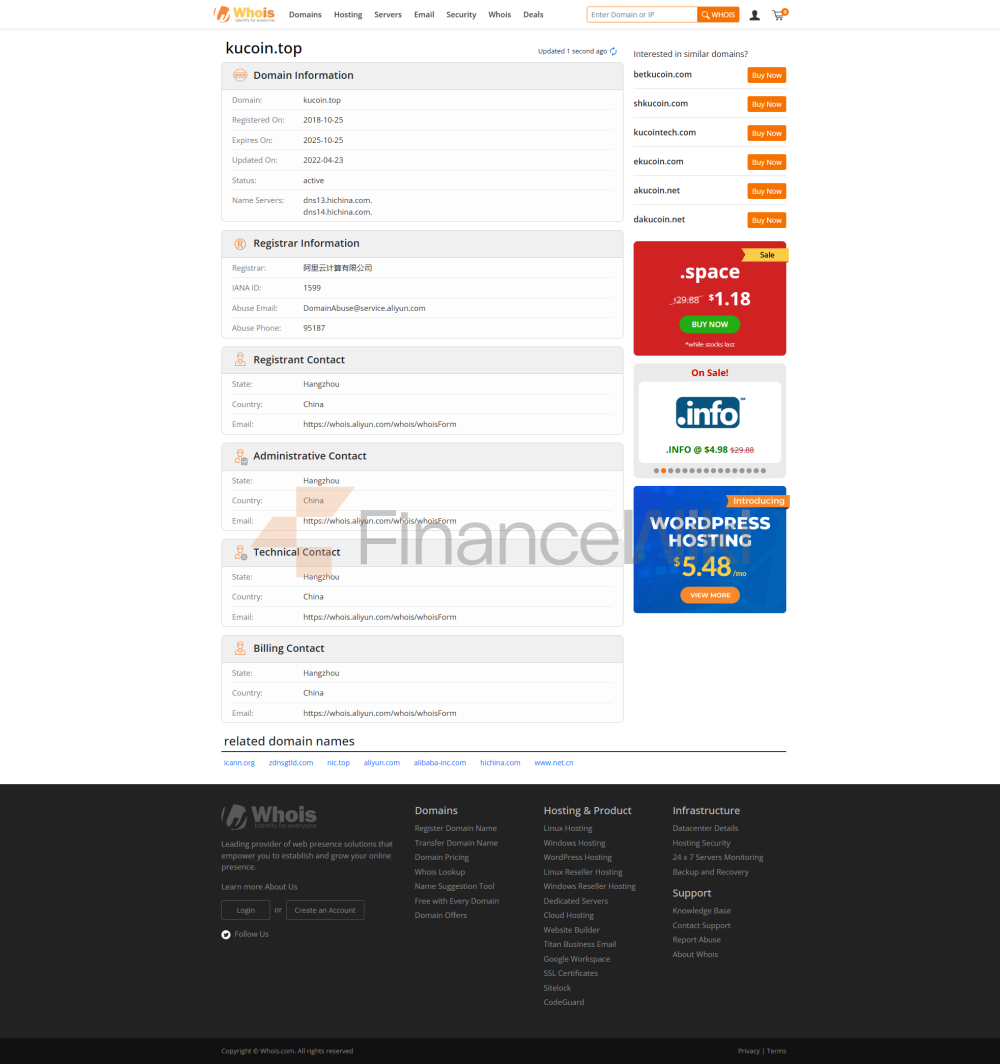

Establishment time and country

KuCoin was founded in 2017 by Chun Gan, Ke Tang, Michael Gan, and Johnny Lyu, among others. Initially headquartered in China, it was relocated to Singapore for policy reasons, and finally registered in Seychelles. Currently, KuCoin is one of the world's leading cryptocurrency trading platforms, serving more than 200 countries and regions, with more than 37 million registered users.

The company's mission and visionKuCoin's

mission is to "make cryptocurrency accessible", and is committed to providing safe, convenient and diversified digital asset trading services for users around the world. The platform calls itself a "people's exchange" and emphasizes the idea of decentralization and community drive.

2. Core Products and

ServicesSpot TradingKuCoin

provides spot trading pairs for more than 700 cryptocurrencies, supporting mainstream currencies such as BTC, ETH, USDT, etc. Users can trade through a variety of order types such as limit orders, market orders, etc., to meet the needs of different trading strategies. The KuCoin

Futures Trading

platform offers perpetual contracts and delivery contracts, supporting up to 100x leverage. Users can manage risk through a variety of order types such as stop-loss, take-profit, OCO, and more. KuCoin also provides a simulated trading function to help users become familiar with futures trading operations.

Margin Trading

allows users to borrow funds for margin trading, supports multiple currency pairs, and has flexible leverage options, which is suitable for experienced traders. KuCoin provides real-time risk warnings and liquidation warnings to ensure the safety of users' funds.

Fiat Currency Trading (P2P)

KuCoin provides a peer-to-peer (P2P) trading platform where users can directly exchange fiat currency and cryptocurrency with other users. It supports a variety of fiat currency payment methods, which is convenient for users to trade in different countries and regions.

Staking & EarnUsers

can earn fixed income through staking, and support staking services in multiple currencies. In addition, KuCoin also offers flexible and regular wealth management products with relatively high yields, which are suitable for long-term holders.

KuCoin Token (KCS)

KCS is the native token of the KuCoin platform, and holders can enjoy a variety of benefits such as transaction fee discounts, VIP benefits, and participation in platform activities. KuCoin regularly burns KCS to reduce market liquidity and increase the value of tokens.

KuCoin Labs & KuCoin Ventures

KuCoin Labs is KuCoin's incubator dedicated to supporting the early development of blockchain projects. KuCoin Ventures is its venture capital arm that invests in blockchain projects with potential and drives the construction of ecosystems.

3. Market Positioning and CompetitivenessGlobal

LayoutKuCoin

supports more than 20 languages and covers more than 200 countries and regions around the world. The platform has enhanced its competitiveness in different markets through localized operations and community building.

Product diversificationIn

addition to traditional spot trading, KuCoin also provides a variety of products such as contracts, leverage, fiat currency, staking, and wealth management to meet the needs of different users. This diversified product line gives it a strong competitive advantage in the market.

Technological

InnovationKuCoin continues to innovate in trading engines, risk control systems, security protection, etc., to improve the stability and security of the platform. For example, KuCoin provides real-time risk warnings and liquidation warnings to ensure the safety of users' funds.

Community-drivenKuCoin

emphasizes community participation and feedback, and regularly hosts AMA (Ask Me Anything) events to listen to users' opinions and suggestions. This community-driven operation model enhances user stickiness and platform activity.

4. Security and Compliance

Security MeasuresKuCoin

adopts multiple security measures such as hot and cold wallet separation, multi-signature, SSL encryption, etc., to ensure the security of user assets. The platform also has an insurance fund to deal with unexpected security incidents.

Compliance Challenges

: KuCoin has faced charges from U.S. regulators for failing to register in the U.S. and failing to implement effective anti-money laundering (AML) measures. In March 2024, KuCoin reached a settlement with U.S. authorities, paying nearly $300 million to settle the charges and agreeing to exit the U.S. market over the next two years.