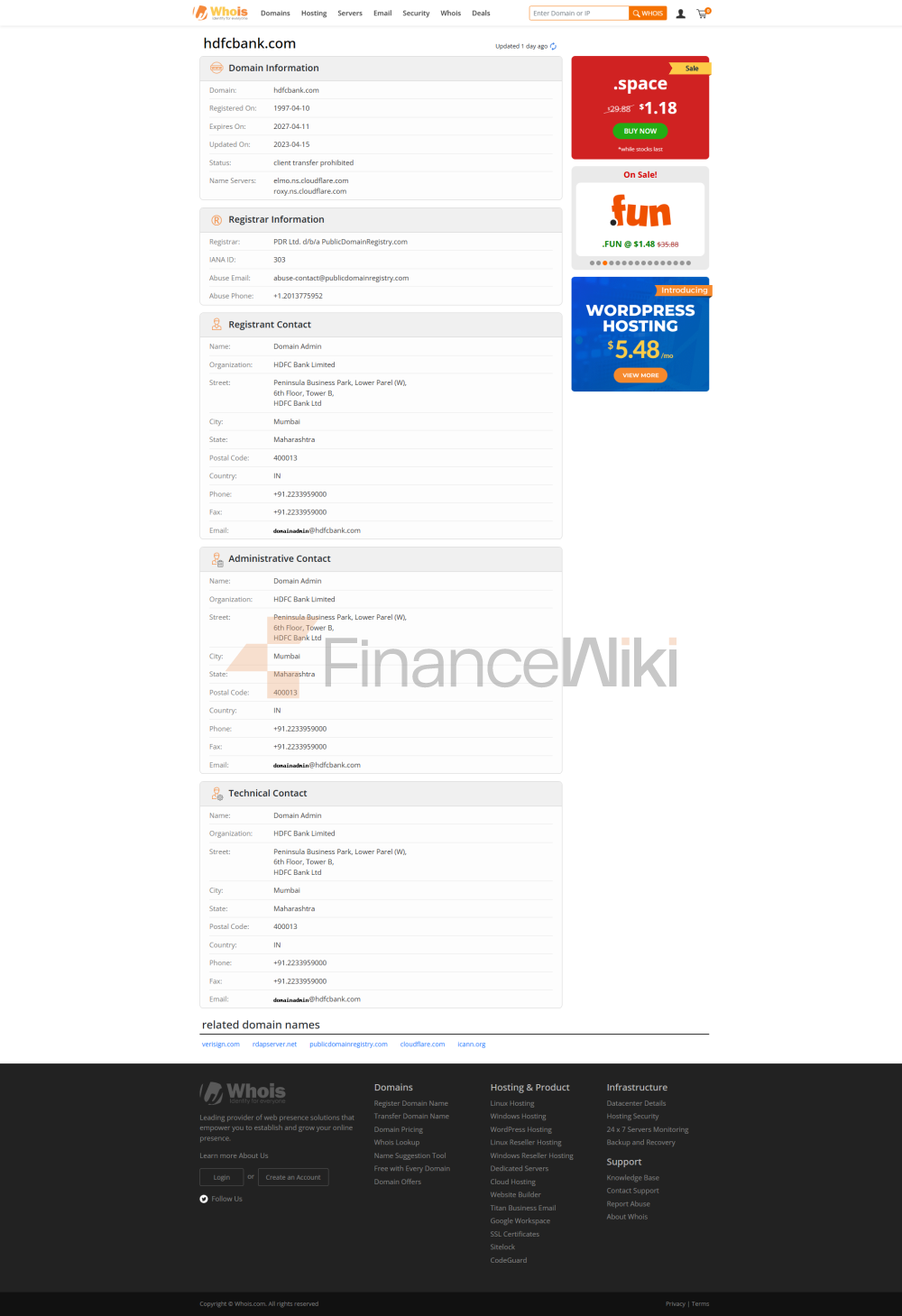

एचडीएफसी बैंक लिमिटेड (also known as HDFC) एक भारतीय बैंकिंग और वित्तीय सेवा कंपनी है जिसका मुख्यालय मुंबई में है। मई 2024 तक, यह संपत्ति द्वारा भारत में सबसे बड़ा निजी क्षेत्र का बैंक है और बाजार पूंजीकरण द्वारा दुनिया का 10 वां सबसे बड़ा बैंक है। भारतीय रिजर्व बैंक (आरबीआई) ने एचडीएफसी, भारतीय स्टेट बैंक और आईसीआईसीआई बैंक को घरेलू व्यवस्थित रूप से महत्वपूर्ण बैंकों के रूप में पहचाना है (D-SIB), जिन्हें अक्सर "असफल होने के लिए बहुत बड़ा" बैंकों के रूप में संदर्भित किया जाता है।

अप्रैल 2024 तक 145 बिलियन डॉलर के बाजार पूंजीकरण के साथ, एचडीएफसी बैंक भारतीय स्टॉक एक्सचेंज की तीसरी सबसे बड़ी कंपनी है। अपनी मूल कंपनी, एचडीएफसी, के अधिग्रहण के बाद, यह 173,000 से अधिक कर्मचारियों के साथ भारत में 16 वां सबसे बड़ा नियोक्ता भी है।

इतिहास

एचडीएफसी बैंक की स्थापना 1994 में एचडीएफसी लिमिटेड की सहायक कंपनी के रूप में हुई थी, जिसे भारतीय बैंकिंग क्षेत्र के उदारीकरण के हिस्से के रूप में निजी क्षेत्र में एक बैंक स्थापित करने के लिए भारतीय रिजर्व बैंक से "सैद्धांतिक रूप से" मंजूरी मिली थी। बैंक ने जनवरी 1995 में मुंबई में अपने पंजीकृत कार्यालय के साथ संचालन शुरू किया। वर्ली में सैंडोज़ हाउस में इसके पहले कॉर्पोरेट कार्यालय और पूर्ण-सेवा शाखा का उद्घाटन तत्कालीन केंद्रीय वित्त मंत्री मनमोहन सिंह ने किया था।

फरवरी 2000 में, टाइम बैंक का एचडीएफसी बैंक के साथ विलय हो गया, जो भारत में एक बैंक का पहला स्वैच्छिक विलय था। टाइम बैंक की स्थापना भारत के सबसे बड़े मीडिया समूह टाइम ग्रुप द्वारा की गई थी।

जुलाई 2001 में, एचडीएफसी बैंक का एडीएस न्यूयॉर्क स्टॉक एक्सचेंज में अपनी प्रारंभिक सार्वजनिक पेशकश के बाद सार्वजनिक हो गया।

2008 में, एचडीएफसी बैंक ने 95.10 बिलियन रुपये में पंजाब सेंचुरियन बैंक (सीबीओपी) का अधिग्रहण किया (2.19 billion USD), कथित तौर पर उस समय भारतीय वित्तीय क्षेत्र में सबसे बड़ा अधिग्रहण।

2021 में, बैंक ने भारतीय राष्ट्रीय भुगतान निगम के समान पैन-इंडिया खुदरा भुगतान प्रणाली के लिए एक छाता इकाई संचालित करने के लिए टाटा समूह द्वारा प्रवर्तित इकाई फेरबाइन में 9.99% हिस्सेदारी हासिल की।

लिमिटेड-एचडीएफसी बैंक विलय

22 अप्रैल 204 को, एचडीएफसी, लिमिटेड ने घोषणा की कि वह विलय और अधिग्रहण में सबसे बड़े सौदे में एचडीएफडीएफ बैंक के साथ विलय करेगा कभी भारत में। विलय के हिस्से के रूप में, एचडीएफसी लिमिटेड ने अपना होम लोन पोर्टफोलियो एचडीएफसी बैंक को हस्तांतरित कर दिया, जबकि बैंक ने एचडीएफसी लिमिटेड के जमाकर्ताओं को उस समय बैंक द्वारा पेश किए गए ब्याज दर पर अपने धन को वापस लेने या अपनी जमा राशि को नवीनीकृत करने का विकल्प प्रदान किया।

1 जुलाई, 2023 को, एचडीएफसी लिमिटेड और एचडीएफसी बैंक का विलय पूरा हो गया। नतीजतन, एचडीएफसी बैंक का बाजार पूंजीकरण $ बिलियन है, जो इसे दुनिया का सातवां सबसे मूल्यवान बैंक बनाता है। एचडीएफसी बैंक भी कुल संपत्ति से दुनिया की शीर्ष 100 बैंकिंग कंपनियों में से एक बन गया है।

विलय की गई इकाई का 120 मिलियन ग्राहक आधार है, जो जर्मनी की आबादी से बड़ा है। विलय के परिणामस्वरूप बैंक के कर्मचारियों की संख्या में उल्लेखनीय वृद्धि हुई है, जिसमें कुल 177,000 कर्मचारी हैं। विलय की गई इकाई भारतीय स्टेट बैंक के बाद संपत्ति के साथ भारत में दूसरा सबसे बड़ा बैंक बन गई है। शाखाओं की संख्या बढ़कर 8,300 हो गई है।

के शेयरों को हटा दिया गया, और शेयरधारकों को एचडीएफसी लिमिटेड के प्रत्येक 25 शेयरों के लिए एचडीएफसी बैंक के 42 शेयर प्राप्त हुए, जिसके परिणामस्वरूप एचडीएफसी बैंक की शेयर पूंजी में वृद्धि हुई।

ऑपरेशन

एचडीएफसी बैंक की हैदराबाद में शाखाएं

मार्च 2024 तक, एचडीएफसी बैंक के वितरण नेटवर्क में 8,735 शाखाएं और 20,938 एटीएम शामिल थे (कैश रीसाइक्लिंग मशीन; कैश डिपॉजिट और निकासी) 3,836 शहरों और गांवों में वितरित किए गए। एचडीएफसी लिमिटेड के वितरण नेटवर्क, जिसमें एचडीएफसी प्राइवेट सेल्स लिमिटेड के 214 कार्यालय शामिल हैं, को बैंक के नेटवर्क में एकीकृत किया गया है।

एचडीएफसी बैंक संघीय क्षेत्र पर संचालित एकमात्र निजी बैंक है। कवरती द्वीप पर एक शाखा खोलने के बाद लक्शाह द्वीप।

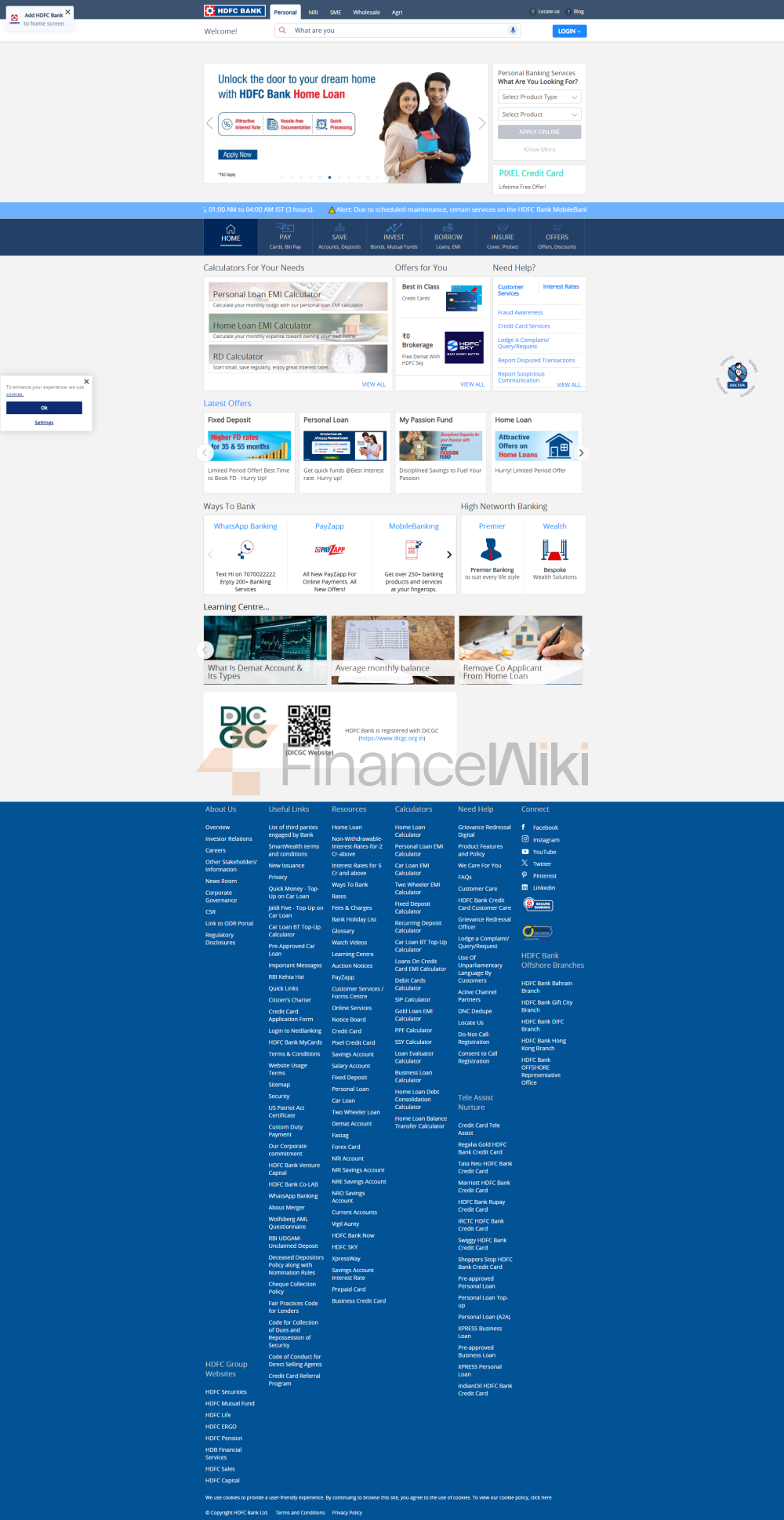

उत्पाद और सेवाएँ

एचडीएफसी बैंक थोक बैंकिंग, खुदरा बैंकिंग, ट्रेजरी, कार ऋण, दोपहिया ऋण, व्यक्तिगत ऋण, अचल संपत्ति ऋण, उपभोक्ता टिकाऊ ऋण, जीवन शैली ऋण और क्रेडिट कार्ड सहित उत्पादों और सेवाओं की एक विस्तृत श्रृंखला प्रदान करता है। इसके अलावा, विभिन्न डिजिटल उत्पाद Zapp और tBUY हैं। कंपनी ने 2024 में स्मार्ट वेल्थ ऐप भी लॉन्च किया है।

सहायक और सहयोगी

एचडीएफसी बैंक की उल्लेखनीय सहायक कंपनियों और सहयोगियों में शामिल हैं:

लिस्टिंग और शेयरहोल्डिंग

एचडीएफसी बैंक पुणे शाखा

एचडीएफसी बैंक के शेयर बॉम्बे स्टॉक एक्सचेंज और नेशनल स्टॉक एक्सचेंज ऑफ इंडिया में सूचीबद्ध हैं। इसकी अमेरिकी डिपॉजिटरी रसीदें न्यूयॉर्क स्टॉक एक्सचेंज में सूचीबद्ध हैं।

इसकी ग्लोबल डिपॉजिटरी रसीदें (GDR) लक्समबर्ग स्टॉक एक्सचेंज में सूचीबद्ध हैं, लेकिन कम ट्रेडिंग वॉल्यूम के कारण निदेशक मंडल द्वारा समाप्त कर दी गईं।

विवाद

2 दिसंबर, 2020 को, भारतीय रिजर्व बैंक (RBI) ने बैंक की ऑनलाइन बैंकिंग, मोबाइल बैंकिंग और भुगतान उपयोगिता सेवाओं में व्यवधान की घटनाओं का हवाला देते हुए बैंक की डिजिटल 2.0 योजना के तहत नए क्रेडिट कार्ड जारी करने के साथ-साथ सभी नियोजित गतिविधियों को अस्थायी रूप से रोकने का आदेश दिया।

29 जनवरी, 2020 को, भारतीय रिजर्व बैंक ने प्रारंभिक सार्वजनिक पेशकश में चल रहे परिश्रम का संचालन करने में विफलता के लिए बैंक पर जुर्माना लगाया जहां 39 चालू खाते बोली के लिए उपलब्ध थे।

एक

एचडीएफसी बैंक प्रबंधक को 59,41,000 रुपये की राशि में ओडीसा राज्य से जुड़े धोखाधड़ी के आरोपों में गिरफ्तार किया गया है।

अल्टिको कैपिटल और दुबई स्थित मशरेक बैंक ने भारतीय रिजर्व बैंक (आरबीआई) से संपर्क किया है जिसमें एचडीएफसी बैंक पर बाहरी वाणिज्यिक उधार (ईसीबी) के माध्यम से कंपनी द्वारा उठाए गए धन के हिस्से से कटौती करके नियमों का उल्लंघन करने का आरोप लगाया गया है और बैंक में पार्क किया गया है। उनका आरोप है कि खाते से धन हस्तांतरित करने के एचडीएफसी बैंक के फैसले ने आरबीआई के अंतिम उपयोग नियमों का उल्लंघन किया हो सकता है।

27 मई, 2021 को, आरबीआई ने अपने कार ऋण पोर्टफोलियो में नियामक अनुपालन में कमियों के लिए एचडीएफसी बैंक पर 100 मिलियन रुपये का जुर्माना लगाया। उपरोक्त दंड बैंकिंग विनियमन अधिनियम 1949 के कुछ प्रावधानों के उल्लंघन के लिए हैं

मार्च 2023 में, एचडीबी फाइनेंशियल सर्विसेज को उल्लंघनों का सामना करना पड़ा, जिसमें से अधिक 70 मिलियन ग्राहकों के डेटा को उजागर किया गया, जिसमें ईमेल पते, नाम, जन्म तिथि शामिल हैं। फोन नंबर, लिंग, पोस्टकोड और ग्राहकों से संबंधित ऋण की जानकारी।

पुरस्कार और सम्मान 2016 - केपीएमजी अवार्ड्स फॉर बेस्ट बैंक इन इंडिया, बैंक ऑफ द ईयर और बेस्ट डिजिटल बैंकिंग इनिशिएटिव 2016

- ब्रांडजेड रैंकिंग, तीसरे लगातार वर्ष के लिए भारत के सबसे मूल्यवान ब्रांड का नाम

- एशिया सर्वेक्षण 2015 में सर्वश्रेष्ठ कंपनी, सर्वश्रेष्ठ प्रबंधित कंपनी का नाम - भारत प्रकार स्वामित्व शेयर न्यायाधीश जीवन बीमा 50.37% एर्गोनॉमिक्स 50.52.55% एचडीएफसी म्यूचुअल फंड जनरल इंश्योरेंस कंपनी 50.55% एचडीएफसी म्यूचुअल फंड मैनेजमेंट फंड एचडीएफसी सिक्योरिटीज स्टॉकब्रोकिंग 95.48% एचडीबी फाइनेंशियल सर्विसेज कंज्यूमर फाइनेंस 94.84% एचडीएफसी कैपिटल एडवाइजर्स प्राइवेट इक्विटी रियल एस्टेट 90% एचडीएफसी क्रेडिरा एजुकेशन फाइनेंस 9.99%

- केपीएमजी अवार्ड्स फॉर बेस्ट बैंक इन इंडिया, बैंक ऑफ द ईयर और बेस्ट डिजिटल बैंकिंग इनिशिएटिव 2016

- ब्रांडजेड रैंकिंग, तीसरे लगातार वर्ष के लिए भारत के सबसे मूल्यवान ब्रांड का नाम

- एशिया सर्वेक्षण 2015 में सर्वश्रेष्ठ कंपनी, सर्वश्रेष्ठ प्रबंधित कंपनी का नाम - भारत प्रकार स्वामित्व शेयर न्यायाधीश जीवन बीमा 50.37% एर्गोनॉमिक्स 50.52.55% एचडीएफसी म्यूचुअल फंड जनरल इंश्योरेंस कंपनी 50.55% एचडीएफसी म्यूचुअल फंड मैनेजमेंट फंड एचडीएफसी सिक्योरिटीज स्टॉकब्रोकिंग 95.48% एचडीबी फाइनेंशियल सर्विसेज कंज्यूमर फाइनेंस 94.84% एचडीएफसी कैपिटल एडवाइजर्स प्राइवेट इक्विटी रियल एस्टेट 90% एचडीएफसी क्रेडिरा एजुकेशन फाइनेंस 9.99%