कॉर्पोरेट प्रोफाइल

KVB यूरोप लिमिटेड (इसके बाद "KVB" के रूप में संदर्भित) एक फिनटेक कंपनी है जिसे यूके में शामिल किया गया है 23 जून, 2024 पंजीकरण संख्या के साथ 157992 । कंपनी का मुख्यालय यूके में है और इसकी एक शाखा कोमोरोस में है। यह AO(ऑफशोर) और FCA (UK Financial Authority) द्वारा दोहरी निगरानी के अधीन है। KVB की स्थापना वैश्विक वित्तीय बाजार में अपने रणनीतिक लेआउट को चिह्नित करती है, जिसका उद्देश्य निवेशकों को विभिन्न प्रकार के व्यापारिक उत्पादों और सेवाओं के साथ प्रदान करना है। 2023Q3 तक, KVB ने रिटेल फॉरेन एक्सचेंज लाइसेंस (No.: L 15626 / KVB ) और FCA नामित प्रतिनिधि योग्यता (No.: 1017430 ) सहित कई मुख्य योग्यता प्राप्त की है। KVB की कार्यकारी टीम और सलाहकार टीम के पास व्यापक उद्योग का अनुभव है, विश्व प्रसिद्ध विश्वविद्यालयों से स्नातक किया है, और अंतर्राष्ट्रीय निवेश बैंकों और फिनटेक कंपनियों में प्रमुख पदों पर रहे हैं। कंपनी की एक स्पष्ट शेयरहोल्डिंग संरचना है और मुख्य रूप से संस्थापक टीम और संस्थागत निवेशकों द्वारा संयुक्त रूप से आयोजित की जाती है। शेयरहोल्डिंग अनुपात का सार्वजनिक रूप से खुलासा नहीं किया गया है।

नियामक सूचना

KVB एक उच्च विनियमित वित्तीय संस्थान समूह है जिसने निम्नलिखित नियामक लाइसेंस और प्रमाणपत्र प्राप्त किए हैं:

- AO(ऑफशोर) : कोमोरोस के वित्तीय नियामक के रूप में, AOने KVB को एक खुदरा विदेशी मुद्रा लाइसेंस जारी किया है (No.: L 15626 / KVB ) और यह सुनिश्चित करता है कि इसके संचालन अंतरराष्ट्रीय वित्तीय मानकों का पालन करते हैं।

- FCA (UK) : KVB यूरोप लिमिटेड को FCA द्वारा यूके में एक कानूनी वित्तीय संस्थान समूह के रूप में नामित किया गया है (Code: 1017430) और उपभोक्ता संरक्षण नियमों के अधीन है और VB

KVB

है। प्रभावी की नियामक स्थिति और निवेशकों को अतिरिक्त वित्तीय सुरक्षा प्रदान करने के लिए ऋण संरक्षण योजना पारित की है। ट्रेडिंग उत्पाद

KVB निम्नलिखित बाजार साधनों को कवर करने वाले व्यापारिक उत्पादों की एक विविध श्रृंखला प्रदान करता है:

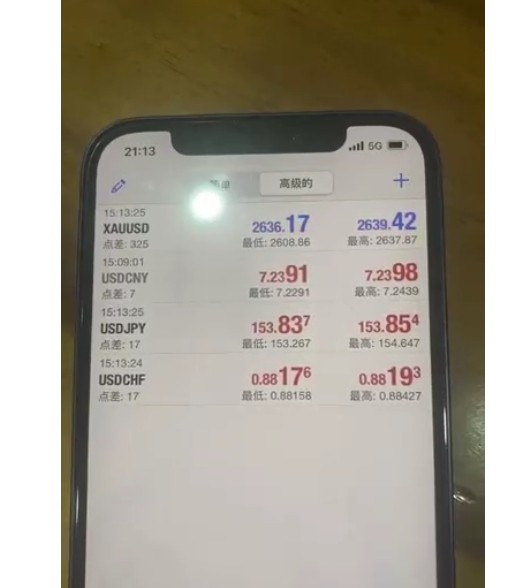

- विदेशी मुद्रा (विदेशी मुद्रा) : E/ USD, G/ USD, आदि जैसे प्रमुख वैश्विक मुद्रा जोड़े का समर्थन करता है।

- सूचकांक : डॉव जोन्स, नैस्डैक, एफटीएसई 100, आदि जैसे विश्व प्रसिद्ध सूचकांकों पर व्यापार प्रदान करता है।

- कमोडिटीज: सोना, चांदी और कच्चे तेल जैसी वस्तुओं का व्यापार शामिल है। निवेश: इक्विटी: Apple, Microsoft और जैसी विश्व स्तर पर प्रसिद्ध कंपनियों के व्यक्तिगत शेयरों का व्यापार कर सकते हैं।

- क्रिप्टोकरेंसी : बिटकॉइन (बीटीसी) और एथेरियम (ईटीएच) जैसी मुख्यधारा की क्रिप्टोकरंसीज के व्यापार का समर्थन करता है।

वर्तमान में, KVB विकल्प, फंड और ईटीएफ जैसे जटिल वित्तीय उत्पादों के व्यापार का समर्थन नहीं करता है।

ट्रेडिंग सॉफ्टवेयर

KVB विभिन्न निवेशकों की जरूरतों को पूरा करने के लिए निम्नलिखित ट्रेडिंग सॉफ्टवेयर प्रदान करता है:

- KVB ऐप : मोबाइल उपकरणों के लिए डिज़ाइन किया गया, iOS और एंड्रॉइड सिस्टम का समर्थन करता है, वास्तविक समय ट्रेडिंग फ़ंक्शन और उद्धरण प्रदान करता है। वेब आधारित और डेस्कटॉप ट्रेडिंग प्लेटफॉर्म के लिए Acts बुनियादी कवर व्यापार और उन्नत विश्लेषण।

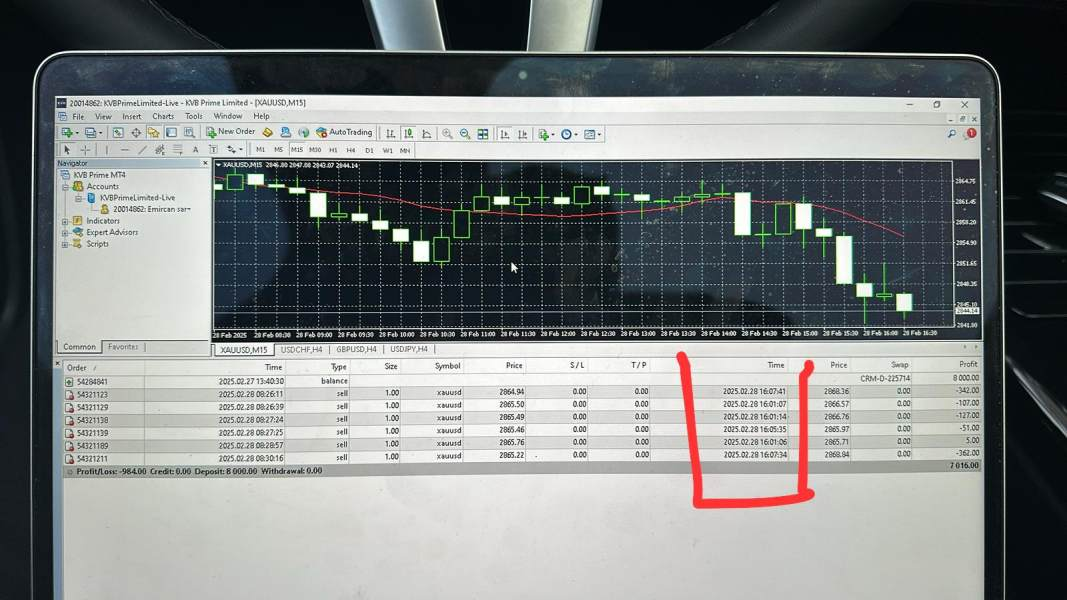

- aTr4 (MT4) : विश्व प्रसिद्ध ट्रेडिंग एंड पॉइंट, डेस्कटॉप, मोबाइल और वेब का समर्थन, शुरुआती और उन्नत व्यापारियों के लिए उपयुक्त।

KVB वर्तमान में aTr5 (MT5) का समर्थन नहीं करता है, और कुछ व्यापारिक कार्य विशिष्ट खाता प्रकारों तक सीमित हैं।

जमा और निकासी के तरीके

KVB विभिन्न प्रकार के जमा और निकासी के तरीके प्रदान करता है, और निम्नलिखित भुगतान चैनलों का समर्थन करता है:

- स्थानीय बैंक हस्तांतरण : केवल कुछ देशों और क्षेत्रों के लिए लागू होता है, प्रसंस्करण समय है, तत्काल आवश्यकता पूरी हो जाती है। Crytoli> मुद्रा: निवेशक जमा और निकासी के लिए बिटकॉइन (बीटीसी) और एथेरियम (ईटीएच) का उपयोग कर सकते हैं, और प्रसंस्करण समय तत्काल है।

वर्तमान में, कुछ जमा और निकासी के तरीके अभी तक संयुक्त राज्य अमेरिका जैसे प्रमुख बाजारों में उपलब्ध नहीं हैं।

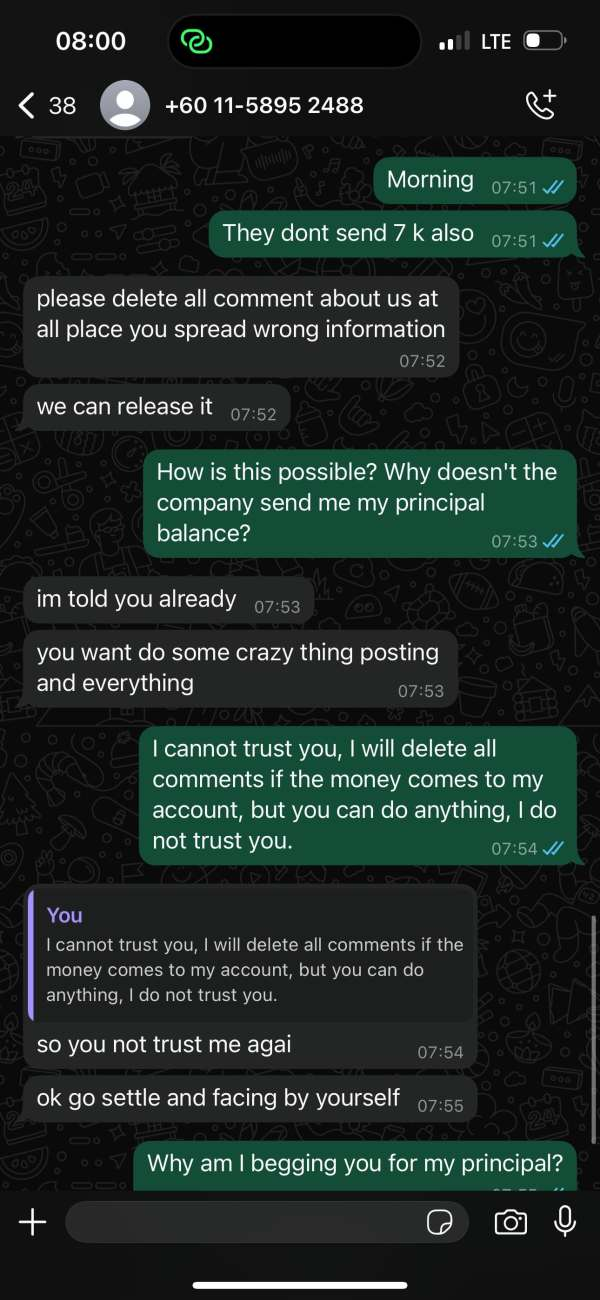

ग्राहक सहायता

केवीबी की ग्राहक सहायता टीम 24/7 उपलब्ध है और निम्नलिखित चैनलों का समर्थन करती है:

- ईमेल support@kvbplus.com सोशल मीडिया : फेसबुक, इंस्टाग्राम, लिंक्डइन और ट्विटर

कोर बिजनेस सर्विसेज और KVB के कोर ट्रेडिंग को कवर करता है, कमोडिटीज, क्रिटॉक्स, फॉरेज, स्टॉक्स और विभेदक मुद्राएं इसके फायदे हैं : - उच्च उत्तोलन लचीलापन : सट्टा व्यापारियों की उच्च-जोखिम और उच्च-वापसी की जरूरतों को पूरा करने के लिए उच्चतम 1: 1000 लाभ प्रदान करता है।

- कम फैलता है : क्लासिक खातों के लिए 1.2 पिप्स से जितना कम फैलता है और प्रीमियम खातों के लिए 0 पिप्स से जितना कम होता है

- मल्टी-प्लेटफॉर्म चयन : निवेशक अपनी व्यापारिक आदतों के अनुसार व्यापार करने के लिए KVB ऐप, Actsया 4 चुन सकते हैं।

तकनीकी बुनियादी ढांचा KVB उन्नत तकनीकी बुनियादी ढांचे का उपयोग करता है, जिसमें शामिल हैं:

T नियंत्रण प्रणाली : व्यापारिक व्यवहार की वास्तविक समय की निगरानी, असामान्य व्यापारिक संकेतों की पहचान और कृत्रिम बुद्धिमत्ता और इंटरनेट ऑफ थिंग्स तकनीक के माध्यम से प्रणालीगत जोखिम में कमी। - मल्टी-डेटा सेंटर बैकअप : ट्रेडिंग सिस्टम की स्थिरता और डेटा सुरक्षा सुनिश्चित करने के लिए दुनिया भर में कई डेटा केंद्रों की तैनाती करें।

- एपीआई एकीकरण : डेवलपर्स और संस्थागत ग्राहकों के लिए अनुकूलित समाधान प्रदान करने के लिए तीसरे पक्ष के उपकरणों का समर्थन इंटरफ़ेस एकीकरण।

अनुपालन और जोखिम नियंत्रण प्रणाली

KVB अंतरराष्ट्रीय वित्तीय नियामक मानकों का कड़ाई से पालन करता है। इसके अनुपालन और जोखिम नियंत्रण प्रणाली में शामिल हैं:

- देयता संरक्षण कार्यक्रम : निवेशकों को वित्तीय सुरक्षा और मंच विफलताओं के कारण होने वाले नुकसान से सुरक्षा प्रदान करता है।

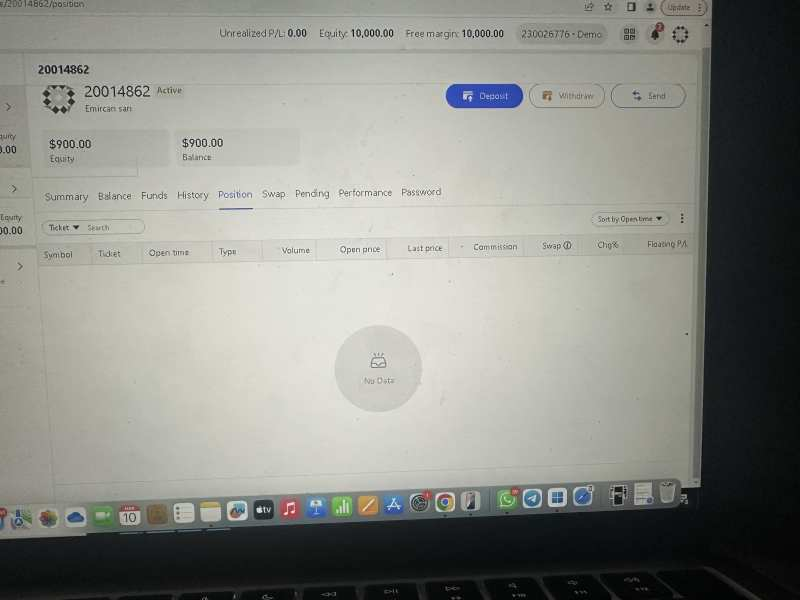

- फंड अलग खाता : निवेशक फंडों की सुरक्षा सुनिश्चित करने के लिए कंपनी के कामकाजी फंडों से ग्राहक फंड अलग से संग्रहीत किए जाते हैं।

- जोखिम प्रबंधन उपकरण : निवेशकों को व्यापारिक जोखिमों को नियंत्रित करने में मदद करने के लिए स्टॉप लॉस प्रदान करें, लाभ लें और क्रमबद्ध करना कार्यों को सीमित करें।

बाजार की स्थिति और प्रतिस्पर्धी लाभ

KVB वैश्विक मध्य से उच्च अंत निवेशक बाजार में तैनात है। इसका प्रतिस्पर्धात्मक लाभ इसमें निहित है:

- विविध व्यापारिक उत्पाद : निवेशकों की विविध जरूरतों को पूरा करने के लिए विभिन्न प्रकार के परिसंपत्ति वर्गों जैसे विदेशी मुद्रा, स्टॉक और क्रिप्टोकरेंसी को कवर करना।

- लचीली उत्तोलन सेटिंग्स : उच्च जोखिम-भूख निवेशकों के लिए उपयुक्त 1: 1000 तक का लाभ उठाने का समर्थन करता है।

- दोहरी नियामक सुरक्षा : एक ही समय में AOऔर FCA से नियामक लाइसेंस प्राप्त किया, जिससे मंच में निवेशकों का विश्वास बढ़ा।

ग्राहक सहायता और सशक्तिकरण

KVB ग्राहक शिक्षा और सशक्तिकरण पर ध्यान केंद्रित करता है, जो निम्नलिखित संसाधन प्रदान करता है: ऑनलाइन शैक्षिक संसाधन शामिल हैं: व्यापारिक रणनीतियों, बाजार विश्लेषण और जोखिम प्रबंधन पर। - सामुदायिक समर्थन : सोशल मीडिया और ट्रेडिंग प्लेटफार्मों पर सामुदायिक कार्यों के माध्यम से निवेशकों के बीच संचार और सहयोग को बढ़ावा देना।

सामाजिक जिम्मेदारी और ESG

KVB कॉर्पोरेट विकास में सामाजिक जिम्मेदारी और ESG (पर्यावरण, सामाजिक, शासन) सिद्धांतों पर केंद्रित है, जिसमें शामिल हैं:

- पर्यावरणीय प्रतिबद्धता : तकनीकी बुनियादी ढांचे का अनुकूलन करके ऊर्जा की खपत और कार्बन उत्सर्जन को कम करें।

- सामाजिक अच्छा : शिक्षा, स्वास्थ्य देखभाल और संस्कृति के क्षेत्र में सार्वजनिक अच्छी परियोजनाओं में नियमित रूप से भाग लें या प्रायोजित करें।

रणनीतिक पारिस्थितिकी सहयोग

गंभीर फिसलन

गंभीर फिसलन