Profil Perusahaan

Olive Tree Capital Markets Limited (sebelumnya Atonline Ltd) adalah perusahaan investasi berbasis Siprus yang didirikan pada tahun 2000 untuk menyediakan layanan investasi yang beragam terutama pada marekt keuangan. Perusahaan ini terdaftar di Siprus dengan modal terdaftar yang tidak diungkapkan , tetapi instrumen pasar mencakup pendapatan tetap, ekuitas, turunan, produk terstruktur, investasi alternatif dan valuta asing. Perusahaan tidak menawarkan akun demo, yang berarti pedagang pemula tidak dapat membiasakan diri dengan platform melalui perdagangan demo sebelum membuka akun secara resmi.

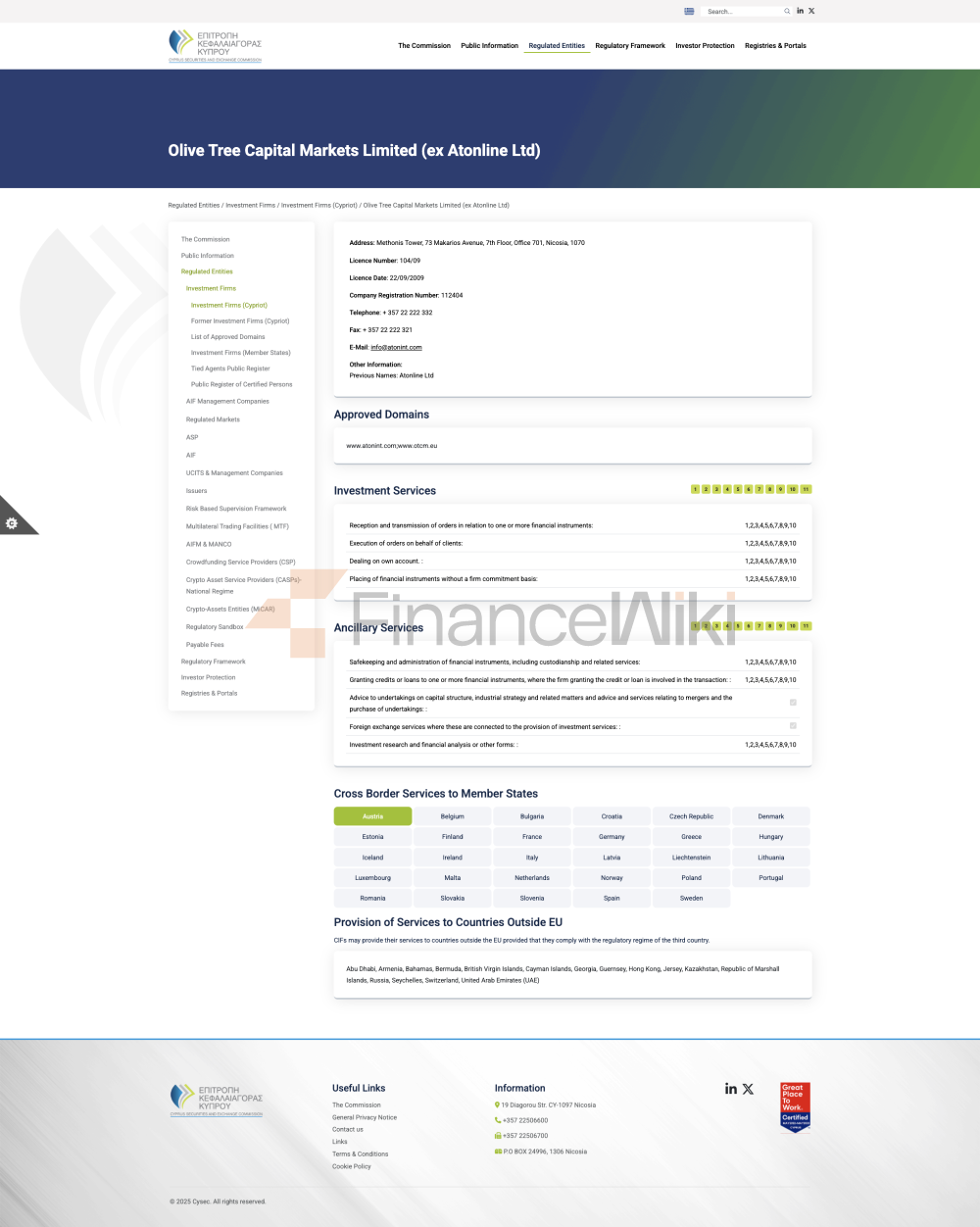

Informasi Regulasi

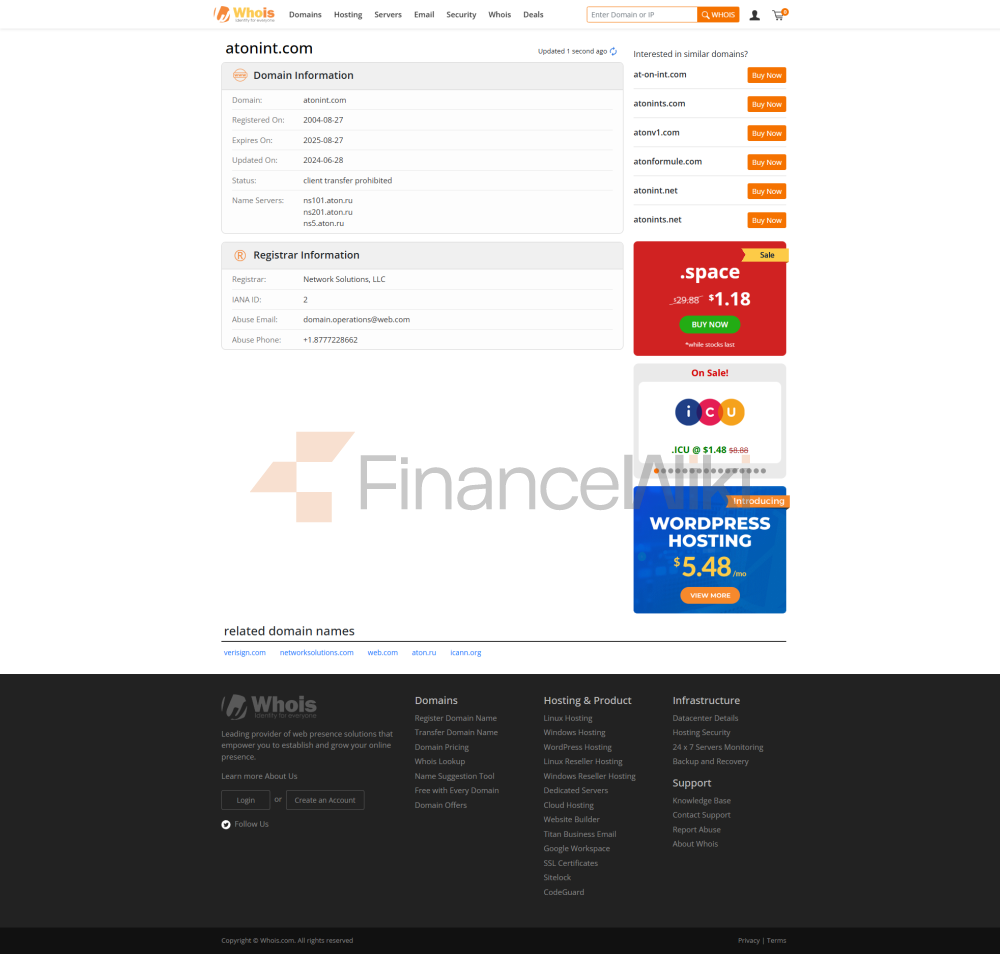

Pasar Modal Pohon Zaitun diberikan lisensi peraturan oleh Komisi Sekuritas dan Bursa Siprus (CySEC) pada 22 September 2009 dengan nomor lisensi 104 / 09 mengizinkannya untuk bertindak sebagai Pembuat Pasar (MM). Selain itu, perusahaan ini adalah anggota perdagangan Bursa Efek London, yang menunjukkan kepatuhan dan profesionalismenya. Regulasi CySEC memastikan bahwa Pasar Modal Pohon Zaitun mematuhi peraturan keuangan Uni Eropa, memberikan investor tingkat keamanan dan transparansi yang tinggi.

Produk Perdagangan

Pasar Modal Pohon Zaitun menawarkan berbagai macam produk perdagangan, termasuk:

- Pendapatan Tetap : seperti obligasi dan Harta Karun, cocok untuk investor yang mencari pengembalian yang stabil.

- Saham : Menawarkan perdagangan saham perusahaan besar yang terdaftar di seluruh dunia.

- Derivatif : seperti futures dan pilihan, memungkinkan investor untuk melakukan lindung nilai risiko atau terlibat dalam spekulasi.

- Produk Terstruktur : Instrumen keuangan yang kompleks, sering dikaitkan dengan peristiwa atau indeks pasar tertentu.

- investasi alternatif : Seperti ekuitas swasta dan dana real estate, menawarkan beragam pilihan investasi.

- Forex : Memungkinkan pedagang berspekulasi tentang fluktuasi harga pasangan mata uang.

Perangkat lunak perdagangan

Perusahaan menggunakan MetaTrader 5 (MT5) sebagai platform perdagangan utamanya. MT5 adalah platform yang dikenal luas dalam industri keuangan dengan fitur berikut:

- Alat charting canggih : Mendukung berbagai indikator teknis dan analisis grafis.

- Multi-time frame : Memungkinkan trader untuk menganalisis pasar selama periode waktu yang berbeda.

- Beberapa tipe order : Termasuk order pasar, limit order, dan stop-loss order.

- Perdagangan otomatis : Mendukung perdagangan otomatis melalui penasihat ahli (EA).

Metode deposit dan penarikan

Pasar Modal Pohon Zaitun menawarkan berbagai metode pembayaran, termasuk transfer telegraf bank dan kartu kredit / debit utama. Persyaratan untuk setoran minimum bervariasi di seluruh jenis akun: 100 dolar untuk akun mini, 500 dolar untuk akun standar, dan $1.000 untuk akun ECN. Perusahaan tidak mengenakan biaya untuk setoran, tetapi pemroses pembayaran atau bank perantara dapat mengenakan biaya tambahan. Waktu pemrosesan penarikan biasanya beberapa hari kerja , tergantung pada metode pembayaran yang dipilih.

Dukungan Pelanggan

Pasar Modal Pohon Zaitun menyediakan dukungan pelanggan multi-saluran, termasuk:

- Dukungan Telepon : + 357 22 222 332 dan + 357 222305.

- Dukungan Email : info@otcm.eu.

Bisnis dan Layanan Inti

Bisnis inti Pasar Modal Pohon Zaitun meliputi:

- Penelitian Investasi dan Analisis Keuangan : Memberikan analisis mendalam tentang tren pasar dan peluang investasi.

- Layanan Penitipan : Kelola uang tunai dan jaminan klien.

- Pembelian kembali dan Pembiayaan Margin : Menyediakan klien dengan solusi pembiayaan yang fleksibel.

- Dana Investasi : Menawarkan beragam produk dana untuk memenuhi kebutuhan investasi yang berbeda.

Infrastruktur Teknis

Pasar Modal Pohon Zaitun berfokus pada stabilitas dan keamanan dalam hal infrastruktur teknis, menggunakan server berspesifikasi tinggi dan langkah-langkah keamanan siber untuk memastikan kelancaran transaksi. Perusahaan juga telah membentuk mekanisme cadangan data yang baik untuk menangani keadaan darurat.

sistem kepatuhan dan pengendalian risiko

Perusahaan secara ketat mematuhi persyaratan peraturan dan memastikan kepatuhan melalui audit internal dan sistem manajemen risiko. Strategi manajemen risikonya mencakup penilaian dan pengendalian risiko pasar yang komprehensif, risiko kredit, dan risiko operasional.

Penentuan posisi pasar dan keunggulan kompetitif

Pasar Modal Pohon Zaitun menempati tempat di industri dengan sejarah operasi yang panjang dan status yang diatur . Namun, informasi terbatas tentang kondisi perdagangan dan kurangnya akun demo dapat memengaruhi pengalaman pengguna.

Dukungan dan pemberdayaan pelanggan

Perusahaan menyediakan saluran dukungan pelanggan termasuk telepon, email, dan alamat fisik, tetapi sumber daya pendidikannya terbatas dan kurangnya panduan pengguna dan tutorial video yang terperinci.

tanggung jawab sosial dan ESG

Pasar Modal Pohon Zaitun secara aktif memenuhi tanggung jawab sosial, berpartisipasi dalam sumbangan amal dan pelatihan karyawan, dan memperhatikan perlindungan lingkungan dan pembangunan berkelanjutan.

Ekologi Kolaborasi Strategis

Perusahaan telah menjalin kemitraan strategis dengan beberapa Grup Lembaga Keuangan dan teknologi platform untuk membentuk ekosistem yang lengkap untuk meningkatkan kehadiran pasar dan Server Klien kemampuan.

Kesehatan keuangan

Posisi keuangan Pasar Modal Pohon Zaitun masuk akal dan rasio kecukupan modalnya memenuhi persyaratan peraturan, menunjukkan kekuatan finansial dan keberlanjutan jangka panjangnya.

Peta jalan masa depan

Perusahaan berencana untuk memperluas lini produknya, meningkatkan platform teknologinya, dan memperluas pasar globalnya di masa depan untuk meningkatkan kehadiran industrinya. Alamat Fisik : Methonis Tower, 73 Makarios Avenue, Lantai 7, Kantor 701, 1070, Nicosia, Siprus.