Profil Perusahaan

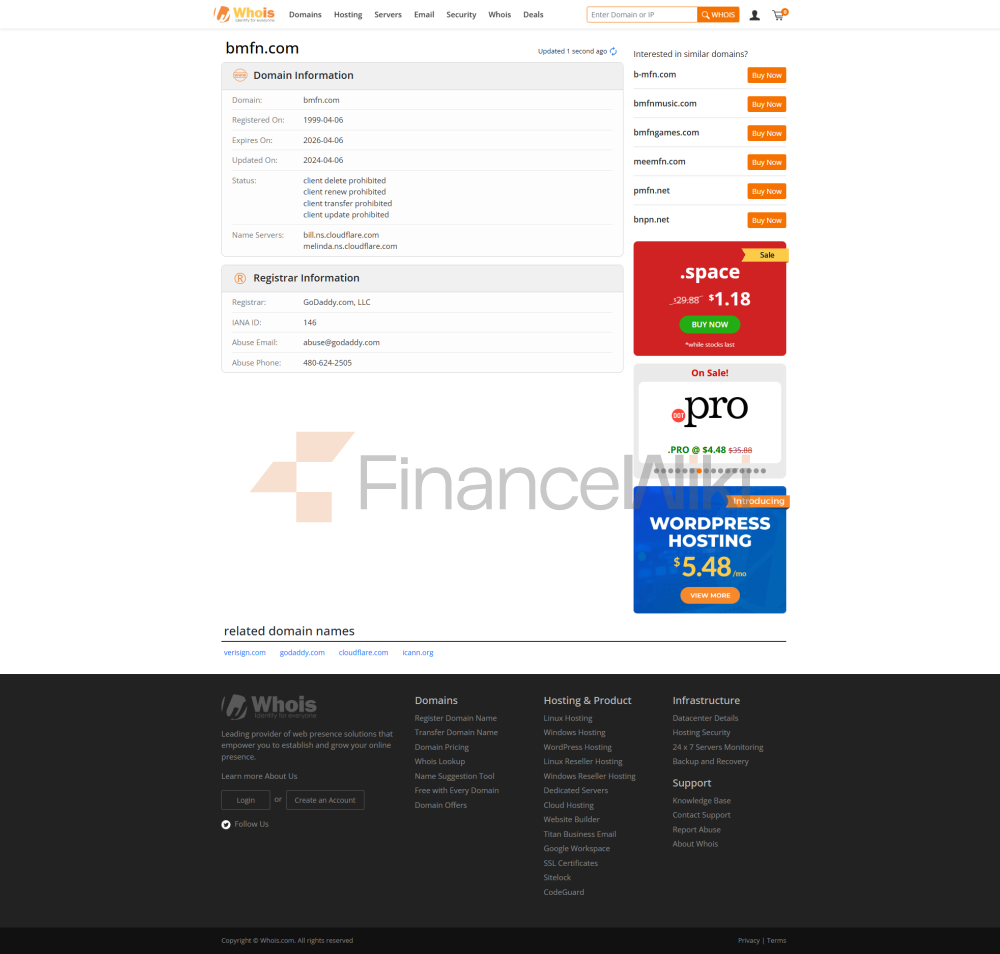

BMFN adalah broker keuangan yang berkantor pusat di Vanuatu , dengan fokus pada penyediaan layanan perdagangan multi-aset kepada pedagang global seperti valuta asing, saham, ETF, indeks dan komoditas. Perusahaan diatur oleh Vanuatu Financial Services Commission (VFSC) , tetapi perlu dicatat bahwa Vanuatu diatur di luar negeri , dan standar kepatuhan lebih rendah daripada institusi arus utama seperti FCA dan ASIC.

Regulasi dan kepatuhan (risk warning)

- Kualifikasi regulasi: Lisensi VFSC (pengawasan lepas pantai), tidak ada persyaratan wajib untuk isolasi modal, dan kurangnya jaminan untuk keamanan dana pelanggan.

- risiko laten: Keamanan dana diragukan: VFSC tidak memerlukan hak asuh independen atas dana klien, dan risiko kebangkrutan tinggi. Kesulitan penyelesaian sengketa: Mekanisme penanganan pengaduan di bawah pengawasan lepas pantai tidak transparan, dan saluran perlindungan hak terbatas.

Perdagangan produk dan instrumen

BMFN menyediakan 5 kelas aset utama , meliputi marekt keuangan arus utama:

- Forex: EUR / USD, GBP / USD dan pasangan mata uang utama / minor lainnya, dengan spread yang tidak diungkapkan.

- ETF: SPDR S & P 500 (SPY), Invesco Nasdaq (QQQ) dan dana indeks lainnya.

- Saham: Apple (AAPL), Amazon (AMZN) dan saham chip biru AS lainnya CFD.

- Indeks: S & P 500, Nasdaq 100 dan indeks saham global lainnya.

- Komoditas: Emas, minyak mentah, produk pertanian dan komoditas lainnya.

Platform perdagangan dan eksekusi

- MetaTrader4 (MT4): Fitur inti: 50 + indikator teknis, perdagangan otomatis EA, dukungan multi-bahasa (30 + bahasa). Ujung seluler: kompatibel dengan iOS / Android, dukung perdagangan kapan saja, di mana saja.

- WebTrader: Tidak ada persyaratan unduhan: Akses langsung dengan browser, pertahankan fitur inti MT4. Kutipan real-time: Konsolidasi data pasar, tetapi jangan mengungkapkan kecepatan eksekusi dan kontrol selip.

Penarikan dana dan biaya

Aturan setoran :

- Deposit minimum: $50, mendukung kartu kredit, transfer telegrafi bank.

- Biaya penanganan: Biaya setoran nol (bank pihak ketiga mungkin mengenakan biaya).

Batas penarikan :

- Waktu pemrosesan: transfer telegrafik 3-5 hari kerja, deposit kartu kredit membutuhkan waktu 30 hari untuk ditarik.

- Biaya penanganan: $50 per transfer telegrafi (rata-rata industri $10-30), biayanya tinggi.

Leverage dan pengendalian risiko

- Leverage maksimum: 1: 200 (Forex / Komoditas), perlu waspada terhadap risiko tinggi untuk memperkuat kerugian.

- Alat pengendalian risiko: Stop loss / Take profit order: fungsi pengendalian risiko dasar. Perlindungan keseimbangan negatif: tidak dinyatakan dengan jelas, platform lepas pantai sering hilang.

Dukungan pelanggan dan sumber daya pendidikan

- Saluran dukungan: Email: operations_vt@bmfn.com (waktu respons tidak jelas). Formulir online: ajukan pertanyaan di situs web resmi, kurangnya obrolan langsung dan dukungan telepon.

- Materi dasar: panduan perdagangan, analisis pasar, tidak ada kursus sistematis atau akun demo.

sistem kepatuhan dan kontrol risiko

- Manajemen dana: Mengklaim bahwa dana klien dipisahkan, tetapi VFSC tidak memiliki persyaratan audit wajib dan tidak memiliki transparansi.

- Kebijakan anti pencucian uang: Menerapkan proses KYC dan AML, tetapi pengawasannya terbatas.

Posisi pasar dan keunggulan kompetitif

- Keuntungan inti: Ambang batas rendah: mulai dari $50 untuk menarik pedagang kecil. Cakupan multi-aset: 300 + varietas dalam 5 kategori untuk memenuhi beragam kebutuhan. Dukungan MT4: Selesaikan fungsi teknis, cocok untuk perdagangan otomatis.

- Papan pendek kompetitif: Pengawasan lepas pantai: Keamanan dan kepatuhan dana lebih rendah dari platform arus utama. Biaya penarikan yang tinggi: $50 / transfer telegrafi, mengikis keuntungan kecil.

Evaluasi pengguna dan peringatan risiko

- Umpan balik positif: TraderJoe85: "Alat grafik MT4 sangat kuat, meningkatkan efisiensi perdagangan." ForexQueen123: "Layanan pelanggan merespons dengan cepat, dan proses penarikan lancar."

- Peringatan risiko: Risiko leverage tinggi: Di bawah leverage 1: 200, fluktuasi 5% dapat menyebabkan kerugian total prinsipal. Kelemahan regulasi: Pengawasan VFSC longgar, dan penyelesaian sengketa tidak dijamin.

Ringkasan dan Saran

BMFN menarik investor dengan ambang batas rendah, multi-aset dan Ekologi MT4 , tetapi sifat regulasi lepas pantai dan biaya tersembunyi yang tinggi menimbulkan risiko yang signifikan. Meskipun menyediakan varietas perdagangan arus utama, keamanan dana dan transparansi kepatuhan tidak mencukupi , disarankan untuk lebih memilih platform yang diatur oleh FCA dan ASIC . Jika Anda bersikeras menggunakannya, Anda harus mengontrol posisi secara ketat (direkomendasikan ≤ 1%), mengatur stop loss, dan secara teratur menarik keuntungan untuk mengurangi risiko.