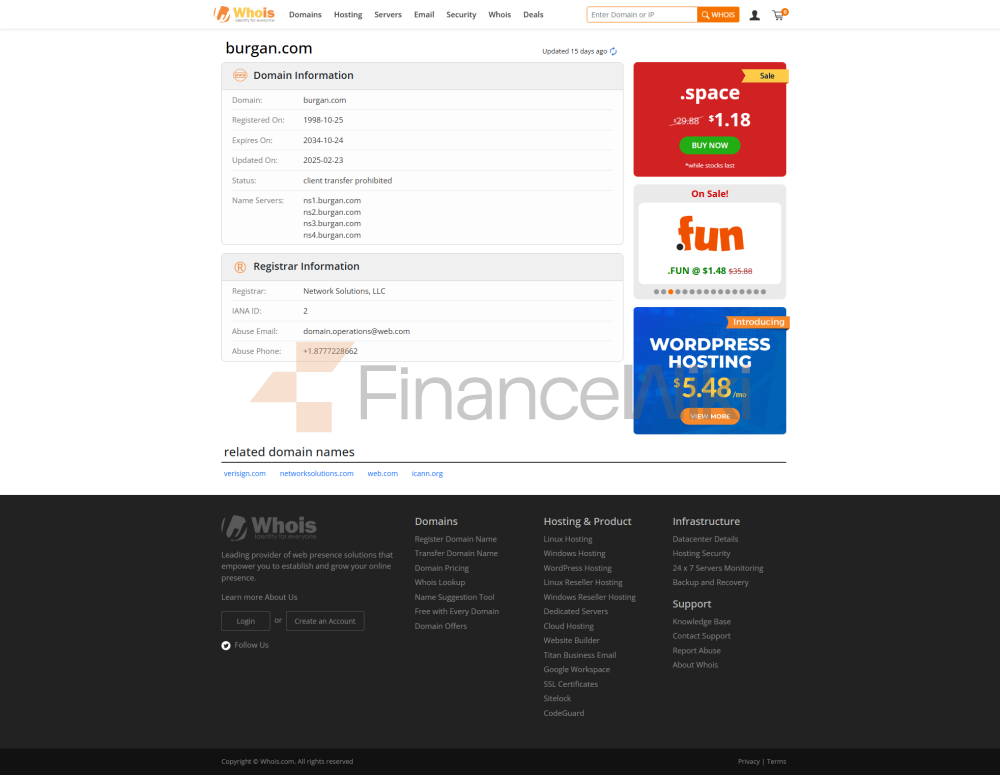

Burgan Bank didirikan pada 27 Desember 1975 dan merupakan bank Kuwait yang berkantor pusat di Kota Kuwait. Ini adalah bank tradisional terbesar kedua di Kuwait berdasarkan aset. Ini adalah anak perusahaan dari Kuwait Projects Company Holding dan mengoperasikan jaringan 24 cabang dan lebih dari 100 ATM. Pada tahun 2007, laba Burgan Bank adalah 74,80 juta dinar Kuwait, meningkat 34% dari laba tahun sebelumnya sebesar 55,70 juta dinar Kuwait.

Pada bulan Desember 2023, Burgan Bank mendapat persetujuan dari Bank Sentral Kuwait untuk menunjuk Fadel Mahmoud Abdullah sebagai CEO barunya.

Pada tanggal 23 Desember 2012, Burgan Bank memperoleh dari Eurobank 70% saham di Tekfenbank, sebuah bank Turki yang berbasis di Siprus

Didirikan pada tahun 1977, Burgan Bank adalah bank komersial termuda di Kuwait dan bank komersial terbesar kedua di Kuwait berdasarkan aset. Ini terutama berfokus pada sektor Korporat dan Lembaga Keuangan Grup dan memiliki basis pelanggan ritel dan perbankan swasta yang berkembang. Burgan Bank, anak perusahaan mayoritas di wilayah MENAT, didukung oleh salah satu jaringan cabang regional terbesar, termasuk Aljazair Gulf Bank - AGB (Aljazair), Baghdad Bank - BOB (Irak dan Lebanon), Tunisia International Bank - TIB (Tunisia) dan Burgan Bank yang sepenuhnya dimiliki - Turki (secara kolektif dikenal sebagai "Burgan Bank Group"). Selain itu, Burgan Bank beroperasi di UEA melalui kantor perusahaannya ("Burgan Financial Services Limited"), yang telah membantu bank berpartisipasi dalam berbagai peluang pendanaan di UEA. Selama bertahun-tahun, bank terus meningkatkan kinerjanya melalui struktur pendapatan yang diperluas, sumber pendanaan yang beragam, dan basis modal yang kuat. Memanfaatkan layanan dan teknologi canggih, menjadikannya trendsetter di pasar domestik dan di kawasan Timur Tengah dan Afrika Utara. Merek Burgan Bank dibangun di atas nilai-nilai asli - kepercayaan, komitmen, keunggulan, dan kemajuan untuk mengingatkan kita akan standar tinggi yang ingin kita capai. "Mengutamakan orang" adalah dasar bagi pengembangan produk dan layanannya. Bank sekali lagi menerima sertifikasi bergengsi ISO 9001: 2015, menjadikannya salah satu dari sedikit bank di GCC dan Kuwait yang telah menerima sertifikasi tersebut untuk kelima kalinya berturut-turut. Untuk kreditnya, bank adalah satu-satunya di Kuwait yang telah menerima Penghargaan Pengakuan Kualitas JPMorgan selama 12 tahun berturut-turut. Burgan Bank, anak perusahaan KIPCO (Kuwait Projects Corporation), adalah bank regional yang kuat di kawasan Timur Tengah dan Afrika Utara.