Pemahaman umum USGFX

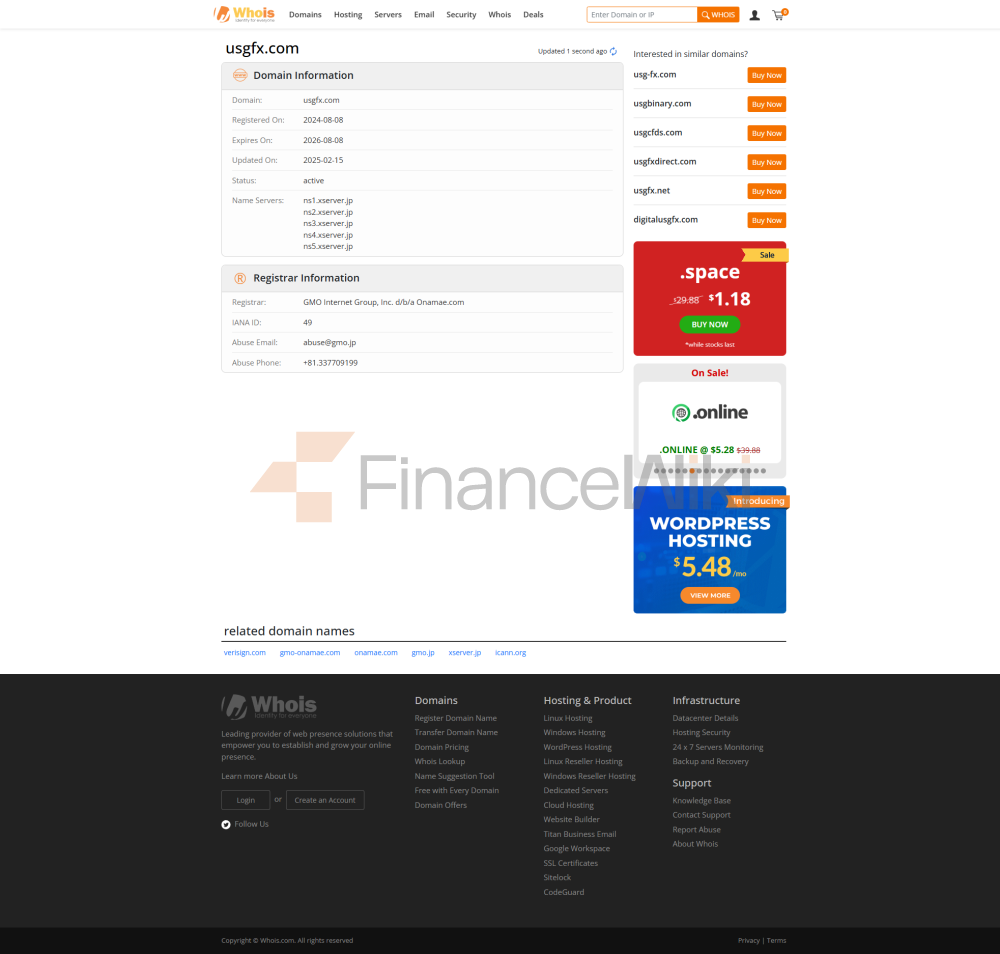

URL ini untuk sementara tidak tersedia untuk alasan yang tidak diketahui

URL adalah sebagai berikut: https://www.usgfx.com/

Union Standard Group (usg) adalah perusahaan investasi Australia dengan nama merek "Menawarkan Forex dan CFD Trading." Merek ini mulai beroperasi pada tahun 2005 dan berkantor pusat di Sydney, Australia dengan anak perusahaan di London dan Asia. Broker menawarkan berbagai instrumen keuangan termasuk Forex, Indeks, Komoditas dan Cryptocurrency dan dapat diperdagangkan pada Metatrader 4 (mt4) dan Metatrader 5 (mt5) platform perdagangan populer.

USGFX membanggakan komitmennya kepada Client Server, di mana tim dukungan pelanggan 24 / 5 tersedia untuk membantu para pedagang dengan masalah mereka. Broker juga menawarkan sumber daya pendidikan seperti webinar, b-book, dan tutorial video, serta akun demo gratis bagi para pedagang untuk mempraktikkan strategi mereka. Selain itu, USGFX menawarkan berbagai jenis akun untuk memenuhi kebutuhan pedagang yang berbeda, termasuk akun standar, akun profesional, dan akun VIP. Apakah USGFX sah atau scam?

USGFX telah menerima ulasan yang beragam, dan ada laporan tentang beberapa pedagang yang mengalami masalah dengan penarikan dan dukungan pelanggan. USGFX memiliki lisensi asic dan fsc mereka ditangguhkan dan lisensi vfsc mereka dicabut pada tahun 2020 karena kekhawatiran tentang kepatuhan mereka terhadap persyaratan peraturan, terutama yang berkaitan dengan penanganan uang klien dan prosedur manajemen risiko. Komisi Sekuritas dan Investasi Australia (ASIC) dan Komisi Layanan Keuangan Kepulauan Virgin Inggris (FSC) menangguhkan lisensi USGFX selama enam bulan, sedangkan Komisi Layanan Keuangan Vanuatu (vfsc) secara permanen mencabut lisensi mereka.

Pialang yang diatur harus mematuhi aturan dan peraturan ketat mengenai uang klien, transparansi, dan manajemen risiko. Jika terjadi perselisihan atau masalah, pedagang dapat mencari jalan lain melalui regulator. Untuk pialang yang tidak diatur, tanpa perlindungan ini, pedagang mungkin menghadapi risiko penipuan yang lebih tinggi atau perilaku tidak etis lainnya

Pro dan kontra

Di sini mari kita lihat lebih dekat hal-hal baik dan buruk tentang Federal Reserve. Sisi positifnya, mereka menawarkan berbagai instrumen keuangan untuk diperdagangkan, termasuk Forex, Komoditas, dan Indeks. Platform perdagangan mereka juga sangat ramah pengguna dan mudah dinavigasi. Pada sisi negatifnya, status peraturan mereka dipertanyakan, yang dapat menjadi tanda bahaya bagi beberapa pedagang. Plus, mereka tidak menerima klien dari negara tertentu, jadi Anda harus memastikan bahwa Anda memenuhi syarat sebelum mendaftar.

Instrumen Pasar

USGFX menawarkan berbagai instrumen keuangan untuk perdagangan, termasuk pasangan mata uang asing, komoditas, indeks, dan saham perusahaan populer. Beberapa contoh instrumen yang ditawarkan adalah:

- Pasangan mata uang forex seperti EUR / USD, GBP / USD, USD / JPY, dan AUD / USD

- Logam mulia seperti emas, perak, dan platinum

- Komoditas energi seperti minyak mentah dan gas alam

- Indeks seperti Standard & Poor 500, Nasdaq, FTSE 100, dan Nikkei 225 / li >

- Saham perusahaan populer seperti Apple, Amazon, Facebook, dan Microsoft

Jenis Akun

USGFX menawarkan empat jenis akun perdagangan yang berbeda untuk Memenuhi kebutuhan pedagang yang berbeda:

- Akun Mini: Ini adalah akun entry-level dengan persyaratan setoran minimum $100. Pedagang yang menggunakan jenis akun ini dapat memperdagangkan beberapa instrumen dengan biaya transaksi rendah, akses ke sumber daya pendidikan, dan dukungan pelanggan 24 / 5. Namun, jenis akun ini memiliki fitur terbatas, seperti leverage yang lebih rendah dan alat perdagangan terbatas.

- Akun Standar: Akun standar memerlukan setoran minimum $10.000 dan memiliki fitur tambahan, seperti leverage yang lebih tinggi, akses ke lebih banyak alat perdagangan, dan manajer akun khusus. Pedagang yang menggunakan jenis akun ini juga menikmati hosting VPS gratis dan analisis pasar reguler.

- Akun VIP: Jenis akun ini dirancang untuk pedagang volume tinggi dengan persyaratan setoran minimum $50.000. Selain fitur akun standar, pemegang akun VIP dapat menikmati strategi perdagangan khusus, dukungan pelanggan prioritas, dan wawasan pasar eksklusif.

- Akun Pro-ECN: Akun Pro-ECN dirancang untuk pedagang dan institusi berpengalaman dengan persyaratan setoran minimum $50.000. Jenis akun ini menawarkan perdagangan ECN tanpa meja, spread ultra-rendah, dan kecepatan eksekusi tinggi. Pedagang dengan jenis akun ini juga memiliki akses ke alat penelitian canggih dan likuiditas tingkat institusional.