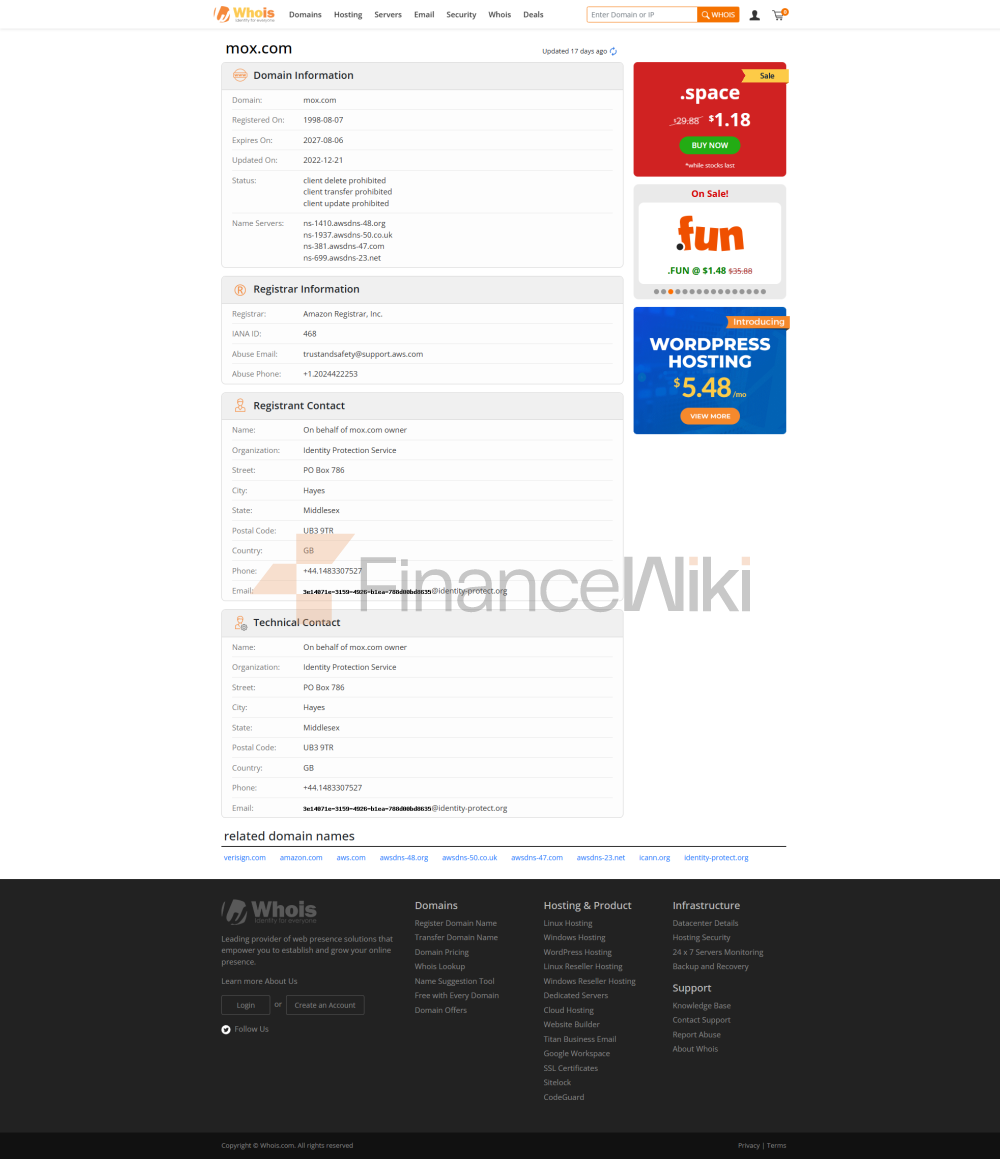

Mox (nama lengkap Mox Bank Limited) adalah bank virtual yang didirikan bersama oleh Standard Chartered Bank (Hong Kong), PCCW, HKT dan Trip.com. Chief Executive Officer adalah Hu Bosi.

Sejarah Pada bulan Maret 2019, SC Digital Solutions Limited, konsorsium Standard Chartered Bank (Hong Kong), PCCW, HKT dan Trip.com, menjadi salah satu perusahaan pertama yang memenangkan lisensi perbankan virtual di Hong Kong.

Pada Mei 2020, 3.000 pelanggan pertama yang terdaftar di Mox dapat memperoleh Kartu Mox logam edisi terbatas. Pada bulan September tahun yang sama, Mox secara resmi membuka dan mengumumkan bahwa semua pelanggan yang telah terdaftar sebelumnya dapat memperoleh Kartu Mox logam edisi terbatas.

Pada bulan Desember 2020, Mox mengumumkan bahwa mereka akan menambahkan dukungan untuk ZA Bank mulai 5 Desember, tetapi menghentikan layanan Electronic Direct Debit Authorization (eDDA) dari HSBC, Hang Seng Bank, Bank of China (Hong Kong) dan Dah Sing Bank, mencatat bahwa mereka perlu dihapus. dari daftar karena keputusan komersial yang dibuat oleh masing-masing bank.

Pada November 2021, Mox meluncurkan layanan pinjaman "pinjaman instan." Jika pelanggan meminjam 100.000 dolar Hong Kong atau lebih, periode pembayaran adalah 25 hingga 36 bulan, tingkat bunga tahunan aktual serendah 1,39%, dan biaya pemrosesan gratis.

Pada Februari 2022, Mox mengumumkan bahwa Christian Piccardi telah bergabung dengan Mox sebagai Chief Information Officer, dan David Walker, Chief Information Officer Sementara dan Chief Information Security Officer, akan mengambil peran baru sebagai Chief Data, Information Security dan Innovation Officer yang baru dibuat.

Distribusi Ekuitas

- Standard Chartered Bank (Hong Kong) 65,98%

- PCCW dan HKT bersama-sama memegang 25%

- Trip.com 9,02%

Mox adalah satu-satunya bank virtual di Hong Kong yang mayoritas dimiliki oleh perusahaan asing.

2020, beberapa pelanggan Mox menemukan bahwa nama pelanggan yang tidak dikenal muncul di pernyataan bulanan mereka untuk bulan September, dan menduga bahwa data pribadi mereka telah bocor. Mox menunjukkan bahwa ada masalah teknis, dan insiden itu tidak terkait dengan sistem Standard Chartered Bank. HKMA mengatakan bahwa telah diberitahu oleh bank, dan bahwa bank sedang menyelidiki insiden tersebut dan akan menyerahkan laporan ke HKMA.