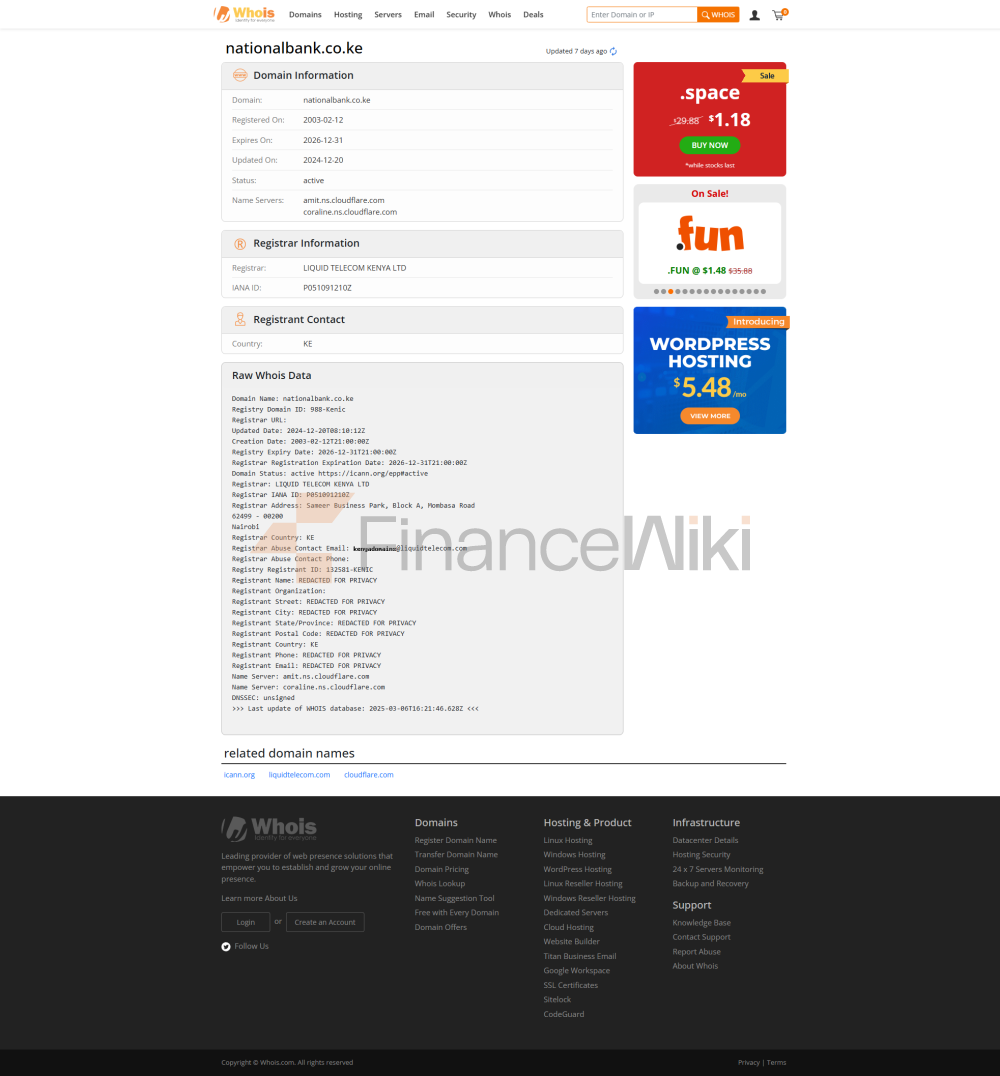

Bank Nasional Kenya (NBK), juga dikenal sebagai Bank Nasional, adalah bank komersial di Kenya, ekonomi terbesar di Komunitas Afrika Timur. Ini dilisensikan oleh Bank Sentral Kenya, Bank Sentral dan Otoritas Regulasi Perbankan Nasional. Sejak September 2019, bank telah menjadi anak perusahaan yang sepenuhnya dimiliki oleh Grup Perbankan Komersial Kenya.

Ikhtisar

NBK adalah penyedia jasa keuangan besar di Kenya, melayani individu, perusahaan dan perusahaan kecil dan menengah (UKM), serta perusahaan besar. Berkantor pusat di Nairobi, bank ini memiliki anak perusahaan: Pembina Bank Nattee dan Layanan Investasi Limited. Pada Desember 2018, nilai dasar aset Bank Nasional Kenya adalah sekitar $1,122 miliar (115,143 miliar shilling Kenya) dan nilai ekuitas pemegang saham sekitar $67,60 juta (6,936 miliar shilling Kenya).] Menyusul akuisisi saham NBK oleh KCB Group pada September 2019, saham NBK dihapus dari Bursa Efek Nairobi pada 16 September 2019.

Sejarah

Bank ini didirikan pada tahun 1968 sebagai Grup Lembaga Keuangan milik negara 100%. Pada tahun 1994, pemerintah Kenya mengurangi rasio kepemilikan sahamnya menjadi 68% dengan menjual 32% sahamnya kepada publik. Selama bertahun-tahun, pemerintah telah melakukan divestasi lebih lanjut dari NBK dan rasio kepemilikan sahamnya mencapai 22,5% pada April 2019. Setelah 12 tahun kinerja keuangan yang buruk, bank kembali menguntungkan pada 2010 dan telah membayar dividen setiap tahun sejak saat itu.

Pada April 2019, KCB Bank Kenya Limited, bank komersial terbesar di Kenya, mengumumkan niatnya untuk mengakuisisi 100% aset dan kewajiban Bank Nasional Kenya, sambil menunggu persetujuan dari pemegang saham dan regulator. Akuisisi selesai pada 16 September 2019