Dapatkan gambaran umum tentang KGI FUTURES

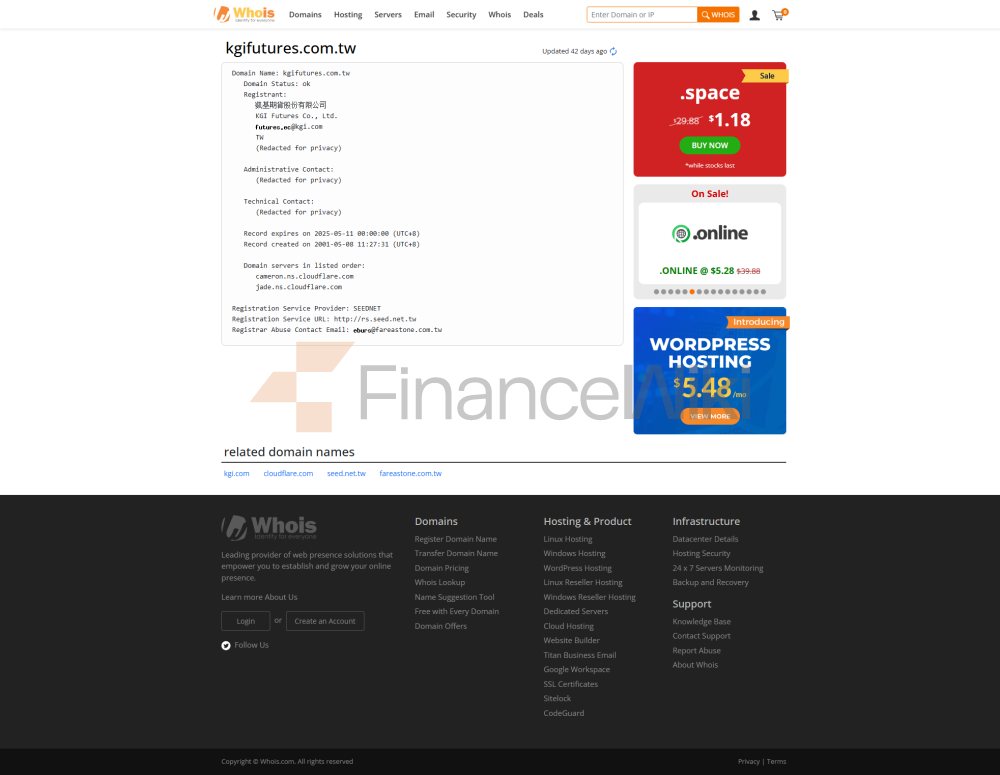

Berkantor pusat di Taiwan, KGI FUTURES telah menjadi pemain yang diatur dalam industri berjangka sejak didirikan pada tahun 1985. Perusahaan ini memiliki reputasi yang sangat baik untuk menyediakan akses ke berbagai pasar berjangka, melayani pemegang akun individu dan perusahaan. Pedagang dapat memanfaatkan leverage hingga 1: 30, memungkinkan mereka untuk menjelajahi berbagai peluang perdagangan.

Platform perdagangan portabel KGI yang ramah pengguna menyederhanakan pengalaman perdagangan, sementara metode deposit dan penarikan yang fleksibel, termasuk transfer perbankan online dan pengiriman uang yang dijual bebas, menambah kenyamanan. Selain itu, klien dapat memperoleh manfaat dari tim Client Server yang responsif yang dapat dihubungi melalui telepon, email, dan dukungan di tempat selama jam layanan yang ditentukan. KGI FUTURES menyediakan pintu gerbang yang komprehensif dan andal ke dunia perdagangan berjangka.

Keuntungan:

- Berbagai instrumen: KGI FUTURES menawarkan berbagai instrumen berjangka seperti indeks saham berjangka, saham berjangka, komoditas berjangka, mata uang berjangka, dll., menyediakan peluang perdagangan yang cukup.

- Aplikasi perdagangan yang mudah digunakan: Aplikasi KGI go SHENQI memiliki antarmuka yang sederhana dan intuitif yang mengurangi kompleksitas yang biasanya dikaitkan dengan platform perdagangan berjangka.

- Eksekusi Order Cepat: Eksekusi order secepat kilat adalah keuntungan yang signifikan, memastikan bahwa pedagang dapat dengan cepat masuk dan keluar posisi di pasar berjangka yang serba cepat.

- Opsi Pendanaan Ganda: KGI FUTURES mendukung beberapa metode deposit dan penarikan, meningkatkan fleksibilitas dan kenyamanan kliennya.

- Akses ke Pasar Domestik dan Internasional: Pedagang dapat mengakses pasar berjangka lokal dan internasional, memperluas cakupan dan diversifikasi investasi mereka.

Kekurangan:

- Navigasi Bagan Kompleks: Antarmuka bagan analisis teknis mungkin tidak intuitif untuk beberapa pengguna dan perlu ditingkatkan untuk meningkatkan pengalaman pengguna.

- Sumber Daya Pendidikan Terbatas: Aplikasi ini mungkin kekurangan materi pendidikan yang komprehensif dan mungkin mengharuskan pedagang (terutama pemula) untuk mencari sumber daya eksternal untuk pembelajaran dan pengembangan keterampilan.

- Komisi Variabel: Komisi dan biaya perdagangan dapat bervariasi berdasarkan volume dan faktor lainnya. Pedagang harus hati-hati mengevaluasi struktur biaya untuk memahami dampaknya terhadap profitabilitas.

Alat Pasar

KGI FUTURES menawarkan berbagai instrumen berjangka dan merupakan pilihan yang menarik bagi pedagang yang mencari kelas aset yang berbeda.

Kontrak berjangka yang menonjol termasuk Taiwan Index Futures, Gold Futures, Crude Oil Futures, Copper Futures, Corn Futures, Natural Gas Futures, dan lain-lain. Rangkaian produk yang luas ini memungkinkan pedagang untuk mendiversifikasi portofolio mereka dan menjaga investasi mereka sesuai dengan tren pasar.

Jenis Akun

KGI FUTURES umumnya menawarkan berbagai jenis akun yang disesuaikan dengan kebutuhan spesifik pedagang. Ini mungkin termasuk akun perdagangan individu dan akun perusahaan dengan fitur dan keunggulan yang berbeda.

Untuk informasi spesifik tentang jenis akun dan atribut uniknya, klien potensial disarankan untuk mengunjungi situs web resmi KGI FUTURES atau menghubungi dukungan pelanggan mereka untuk pertanyaan terperinci terkait akun mereka. Keragaman jenis akun memastikan bahwa pedagang dapat memilih jenis akun yang paling sesuai dengan tujuan dan preferensi perdagangan mereka.

Leverage

Leverage maksimum yang ditawarkan oleh KGI FUTURES adalah 1: 30, yang berarti bahwa untuk setiap $1 di akun perdagangan, pedagang dapat mengontrol posisi senilai hingga $30 di pasar berjangka. Leverage ini memungkinkan pedagang untuk memperkuat potensi perdagangan mereka, yang dapat meningkatkan keuntungan dan kerugian.

Pedagang harus berhati-hati dan sepenuhnya memahami risiko yang terkait dengan perdagangan leverage, karena leverage yang lebih tinggi memperkuat keuntungan dan potensi kerugian. Dengan memberikan leverage ini, KGI FUTURES menawarkan pedagang kesempatan untuk mengambil posisi yang lebih besar di pasar berjangka, sambil tetap menjadikan manajemen risiko sebagai prioritas utama.

Spread dan Komisi

Spread dan Komisi untuk KGI FUTURES dapat bervariasi tergantung pada sejumlah faktor, termasuk kontrak berjangka, volume, dan jenis akun tertentu. Biasanya, komisi biaya perdagangan berjangka KGI FUTURES, dan struktur biaya dapat berubah sesuai dengan itu.

Sementara jadwal biaya yang tepat dapat berubah, pedagang disarankan untuk memeriksa informasi terbaru dan terlengkap tentang spread dan komisi di situs resmi platform FUTURES KGI. Memahami struktur biaya sangat penting bagi pedagang untuk mengelola biaya perdagangan secara efektif dan membuat keputusan yang tepat.

Platform perdagangan

Platform perdagangan KGI FUTURES kgi Portable menyediakan antarmuka yang sederhana dan intuitif bagi para pedagang. Ini memiliki desain yang bersih dan rapi yang memudahkan pengguna untuk menavigasi dan melaksanakan perdagangan. Platform ini memiliki empat fungsi utama: kutipan, pesanan, akun, dan pengaturan.

Pedagang terutama melakukan aktivitas perdagangan berjangka di bagian "Kutipan," di mana mereka dapat memperoleh data pasar waktu nyata dan melakukan perdagangan dengan cepat. Bagian "Pesanan" dan "Akun" memberi pengguna informasi berharga tentang aktivitas perdagangan dan status keuangan mereka. Salah satu fitur yang menonjol adalah fitur "Pesanan Petir," yang memfasilitasi penempatan pesanan cepat, yang sangat penting di pasar berjangka yang berubah dengan cepat.