Profil Perusahaan

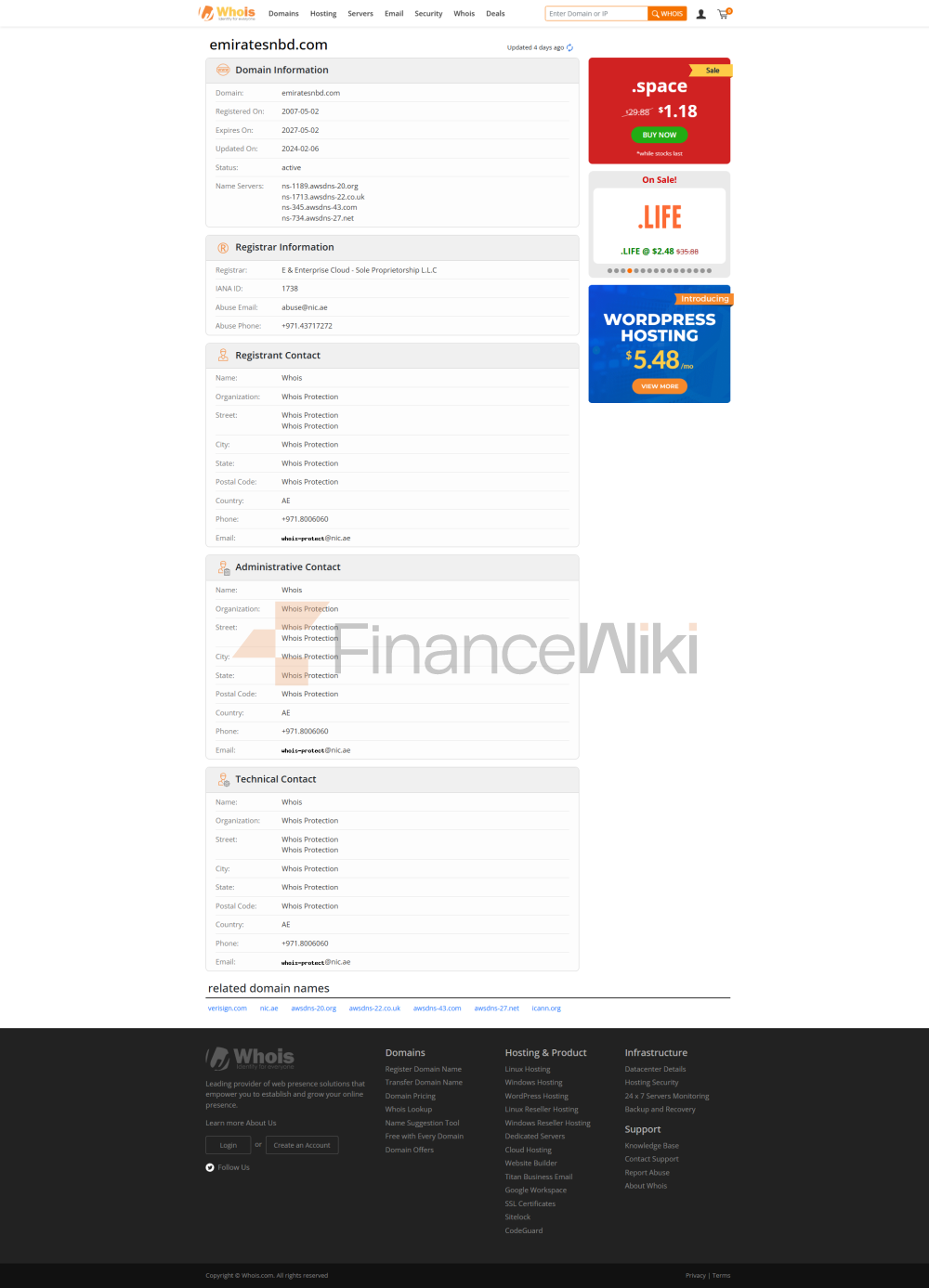

Emirates NBD Bank PJSC (selanjutnya disebut "Emirates NBD") adalah bank milik negara di Uni Emirat Arab yang berkantor pusat di Dubai. Sebagai salah satu grup perbankan terbesar di Timur Tengah berdasarkan aset, Emirates NBD berkomitmen untuk menyediakan layanan keuangan yang komprehensif kepada klien individu, korporat dan institusional. Bank ini didirikan pada 6 Maret 2007 dengan penggabungan National Bank of Dubai (NBD) dan Emirates International Bank (EBI) . Per 31 Desember 2020, total asetnya adalah 698 miliar dirham, ukuran depositnya adalah 464 miliar dirham, total pendapatan mencapai 23,21 miliar dirham, dan laba bersihnya adalah 7 miliar dirham. Saat ini, bank tersebut memiliki lebih dari 9.000 karyawan di 70 negara di seluruh dunia, dan memiliki kantor perwakilan di China, Indonesia, dan tempat lain, yang semakin memperluas pengaruh internasionalnya.

Informasi Regulasi

Emirates NBD adalah Financial Institution Group di bawah pengawasan Bank Sentral Uni Emirat Arab (CBUAE) dan memegang lisensi perbankan yang komprehensif. Sebagai bank milik negara, operasinya diatur secara ketat untuk memastikan stabilitas dan kepatuhan keuangan. Meskipun Emirates NBD tidak terlibat langsung dalam layanan perantara, fungsi perbankannya diawasi dan diarahkan oleh Bank Sentral UEA, memastikan bahwa layanan keuangannya memenuhi standar internasional.

Bisnis & Layanan Inti

Emirates NBD Bisnis inti mencakup bidang-bidang berikut:

1. Personal Banking

- Rekening Tabungan & Cek : Menawarkan berbagai jenis akun untuk memenuhi kebutuhan pelanggan yang berbeda.

- Pinjaman Pribadi : Termasuk pinjaman konsumen, pinjaman mobil, dan pinjaman kredit pribadi.

- Kartu Kredit : Berbagai pilihan, termasuk poin hadiah, penawaran perjalanan, dan uang kembali.

2. Corporate Banking

- Pinjaman Bisnis : Menyediakan solusi pembiayaan untuk UKM dan perusahaan besar.

- Layanan Manajemen Tunai : Membantu bisnis mengoptimalkan arus kas dan keuangan sehari-hari.

- Trade Finance : Mendukung kebutuhan perdagangan internasional, termasuk surat kredit dan jaminan.

3. Layanan Investasi

- Manajemen Aset : Menyediakan manajemen portofolio dan layanan manajemen kekayaan.

- Produk Investasi : Meliputi reksa dana, investasi saham dan obligasi.

4. Layanan Perbankan Digital

- Perbankan Online : Menyediakan layanan manajemen akun yang nyaman.

- Aplikasi Perbankan Seluler : Mendukung transaksi perbankan kapan saja, di mana saja.

5. Layanan Valuta Asing

- Transfer Uang Internasional : Menyediakan transfer lintas batas yang cepat melalui layanan seperti DirectRemit, transfer telegrafi, dan Western Union.

- Kartu Uang Perjalanan : Kartu GlobalCash yang mendukung 15 mata uang, dirancang untuk perjalanan internasional.

Infrastruktur Teknis

Emirates NBD telah mengadopsi sistem kontrol risiko AIoT canggih, yang menggabungkan kecerdasan buatan dan teknologi IoT untuk memantau risiko transaksi secara real time dan memastikan keamanan dana pelanggan. Infrastruktur teknisnya juga mencakup teknologi blockchain untuk mengoptimalkan transfer lintas batas dan pelaksanaan kontrak pintar. Selain itu, platform digital bank mendukung otentikasi biometrik untuk meningkatkan keamanan otentikasi pelanggan.

sistem kepatuhan dan pengendalian risiko

Emirates NBD secara ketat mematuhi persyaratan peraturan Bank Sentral UEA dan telah membentuk sistem kepatuhan dan pengendalian risiko yang komprehensif. Pernyataan kepatuhannya menekankan kontrol ketat pada anti pencucian uang (AML), pembiayaan kontra-terorisme (CFT) dan privasi data. Selain itu, bank memastikan efektivitas kerangka manajemen risikonya melalui audit reguler dan pengujian stres.

Pemosisian Pasar dan Keuntungan Kompetitif

Sebagai Grup Institusi Keuangan terkemuka di Timur Tengah, Emirates NBD menonjol dalam persaingan ketat dengan keunggulan berikut:

- Cakupan Global : Dengan jaringan bisnis internasional yang luas, layanan tersedia di UEA, Mesir, India, dan negara lain.

- Nilai Tukar Kompetitif : Menyediakan nilai tukar jual dan beli real-time mata uang utama untuk memenuhi beragam kebutuhan devisa.

- Dukungan pelanggan yang cepat dan responsif : layanan 24 / 7 melalui telepon, email, WhatsApp, dan platform online.

Dukungan dan pemberdayaan pelanggan

Emirates NBD menawarkan beragam saluran dukungan kepada pelanggannya:

- Dukungan telepon : Layanan multi-bahasa tersedia, dan pelanggan dapat menghubungi nomor lokal atau internasional untuk pertanyaan.

- Dukungan online : Kirim pertanyaan melalui situs web resmi dan aplikasi seluler, dan berharap untuk menerima balasan dalam waktu 24 jam.

- WhatsApp Bank : Nikmati pertanyaan akun respons cepat dan dukungan transaksi dengan berlangganan layanan di + 971 540000.

tanggung jawab sosial dan ESG

Emirates NBD secara aktif terlibat dalam proyek tanggung jawab sosial untuk mendukung pendidikan, perlindungan lingkungan dan pengembangan masyarakat. Melalui inisiatif "Go Green" , bank berkomitmen untuk mengurangi emisi karbon dan mempromosikan praktik keuangan yang berkelanjutan. Selain itu, bank mendukung kebutuhan pendidikan siswa muda melalui program beasiswa , yang selanjutnya memenuhi tanggung jawab kewarganegaraan perusahaannya. Emirates NBD telah menjalin kemitraan jangka panjang dengan beberapa kelompok lembaga keuangan di seluruh dunia, termasuk Standard Chartered, HSBC dan Citibank. Melalui kemitraan ini, bank telah lebih memperluas jaringan globalnya dan mengoptimalkan layanan keuangan lintas batas. Selain itu, bank telah bermitra dengan Reserve Bank of India (RBI) untuk lebih memperluas kehadirannya di India.

Kesehatan keuangan

Pada 31 Desember 2020 , Emirates NBD memiliki total aset 698 miliar dirham dan rasio kecukupan modal bersih 18,4% , jauh di atas persyaratan minimum Bank Sentral UEA. Struktur modalnya meliputi inti Modal Tier 1 (87,70 miliar dirham) dan Modal Tier 2 (20,30 miliar dirham), memastikan kesehatan keuangannya.

Peta Jalan Masa Depan

Rencana pengembangan NBD Emirates di masa depan mencakup bidang-bidang utama berikut:

- Keuangan Berkelanjutan : Mempromosikan produk keuangan hijau dan mendukung transisi ke ekonomi rendah karbon. Emirates NBD telah menjadi pemain kunci dalam marekting keuangan di Timur Tengah dan global dengan layanan keuangannya yang komprehensif, infrastruktur teknologi canggih, dan posisi pasar yang kuat. Komitmennya terhadap dukungan pelanggan dan tanggung jawab sosial semakin memperkuat reputasinya sebagai Grup Lembaga Keuangan yang bertanggung jawab.