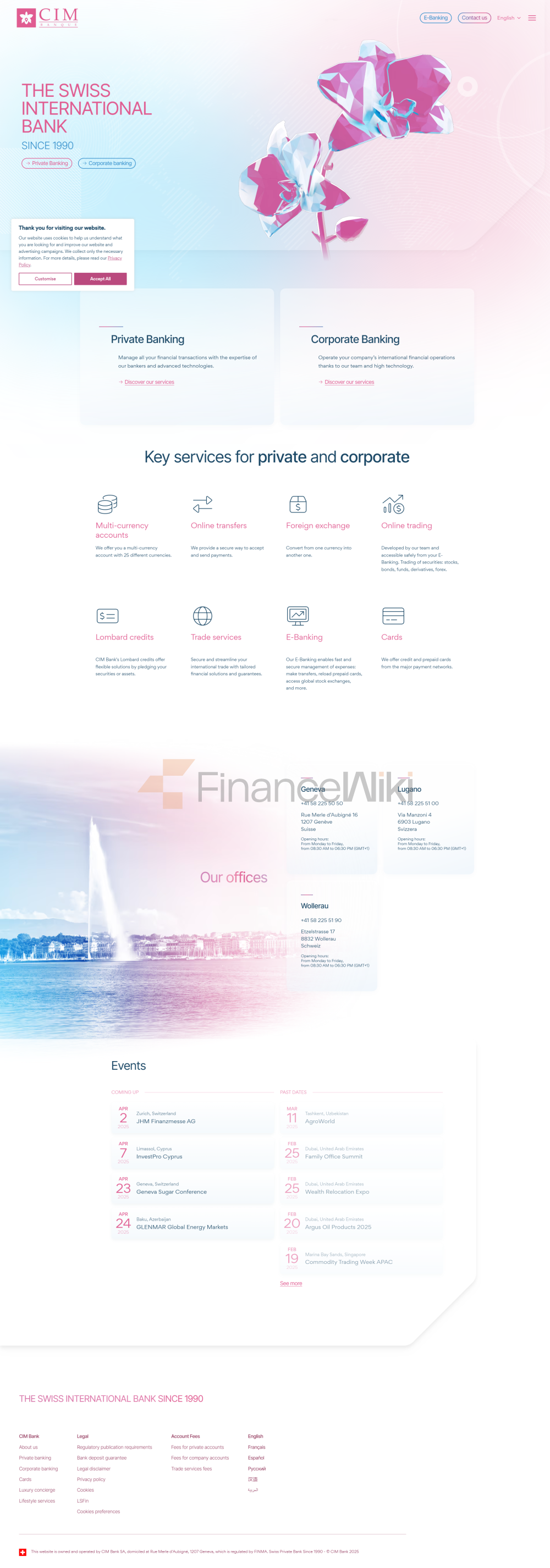

Diverifikasi: CIM Bank adalah bank swasta yang didirikan pada tahun 1990 dan berkantor pusat di Swiss.

Dengan kantor di Jenewa, Wallerau dan Lugano, CIM Bank mengklaim memberikan layanan perbankan kepada klien swasta dan banyak perusahaan di seluruh dunia.

Didirikan di Swiss di bawah hukum Swiss, CIM Bank adalah anggota Bursa Efek Swiss dan Asosiasi Bankir Swiss (SBA).

Sekarang di bawah pengawasan FINMA di Swiss, perhatikan bahwa pengawasan belum tentu aman, dan investasi berisiko. Harap pertimbangkan diri Anda dan pilih dengan hati-hati untuk mencegah kerusakan dana Anda.

CIM menawarkan manajemen kepercayaan, penasihat ahli, perdagangan seluler, perdagangan otomatis, analisis harian, akun demo, perdagangan 24 / 5, scalping, hedging, dan layanan lainnya.

Ukuran posisi minimum: 0,01

Jenis spread: Tetap

Menyebar pada mata uang utama: 1.65-2

Leverage maksimum: 100

Akun standar: $100

Metode pembayaran populer: Transfer bank, kartu bank, WebMoney

Mata uang akun: EUR, USD

Aset yang tersedia: Obligasi, Dana, Saham, Komoditas

Platform perdagangan: Metaer4, Stasiun Perdagangan, Pemilih Sistem Forex

Nilai Bank Swiss

Untuk Setiap klien adalah unik dalam hal CIM Bank. Kami berkomitmen untuk membantu klien kami dalam berbagai situasi sehari-hari untuk membantu mereka memaksimalkan nilai investasi mereka. Kerahasiaan dan rasa hormat terhadap privasi pribadi adalah nilai dasar Swiss dan merupakan bagian dari DNA CIM Bank. Kekuatan bank kami terletak pada keragaman bankir swasta. Tim kami berbicara lebih dari selusin bahasa dan menggunakan keahliannya untuk memberikan solusi hubungan dan keuangan pribadi yang dipersonalisasi kepada klien swasta dan institusional.

Swiss Online Banking

CIM Bank berkomitmen untuk menyediakan solusi digital inovatif kepada pelanggannya yang memberi mereka akses siap ke semua informasi yang mereka butuhkan. 100% Pembukaan Akun Online. Kami telah mendigitalkan seluruh proses pembukaan akun, dari identifikasi hingga tanda tangan; semuanya, online!

Perbankan Elektronik

Kelola pengeluaran harian Anda, lakukan transfer internasional, isi ulang kartu prabayar Anda, dan banyak lagi.

Layanan Profesional

Forex

Obligasi

Ekuitas

Opsi

Dana

Derivatif

Produk TerstrukturKeuntungan

Pedagang di CIM Bank memiliki pengetahuan yang luas dan mendalam tentang pasar pendapatan tetap perusahaan dan pemerintah.

Harga terbaik waktu nyata

Komisi kompetitif

anggota SIX

Tugas manajemen

Mandat obligasi. Mandat manajemen obligasi memungkinkan Anda untuk berinvestasi di pasar obligasi dengan memilih mata uang referensi mandat, kematangan maksimum obligasi dalam portofolio Anda dan peringkat minimumnya.

Mandat saham. Investasikan di pasar saham dalam mata uang referensi pilihan Anda dan beri tahu kami preferensi pribadi Anda untuk kelas aset.

Mandat seimbang. Mandat seimbang memungkinkan Anda menginvestasikan sebagian modal Anda di saham dan sisanya di obligasi. Anda dapat memilih mata uang referensi komisi, rasio saham, kematangan maksimum obligasi dan peringkat minimumnya.

Dukungan Pelanggan

Dukungan 24 jam

Situs web: https://www.cimbanque.com/

Alamat: Rue Merle-d 'Aubigné 16, 1207 Jenewa, Swiss

Telp: + 41 58 225 50